Project Finance Impact on LCOE

Levelized cost of energy (LCOE) is a simple metric that combines the primary technology cost and performance parameters, CAPEX, O&M, and CF. It is included in the ATB for illustrative purposes. The focus of the ATB is to define the primary cost and performance parameters for use in electric sector modeling or other analysis where more sophisticated comparisons among technologies are made. LCOE captures the energy component of electric system planning and operation, but the electric system also requires capacity and flexibility services to operate reliably. Electricity generation technologies have different capabilities to provide such services. For example, wind and PV are primarily energy service providers while the other electricity generation technologies provide capacity and flexibility services in addition to energy. These capacity and flexibility services are difficult to value and depend strongly on the system in which a new generation plant is introduced. These services are represented in electric sector models such as the ReEDS model and corresponding analysis results such as the Standard Scenarios.

To estimate LCOE, assumptions about the cost of capital to finance electricity generation projects and the period over which that investment is recovered are required. The sensitivity of LCOE to these values is shown below. The equations and variables used to estimate LCOE are defined on the equations and variables page. For LCOE estimates for High, Mid, and Low scenarios for all technologies, see 2017 ATB Cost and Performance Summary.

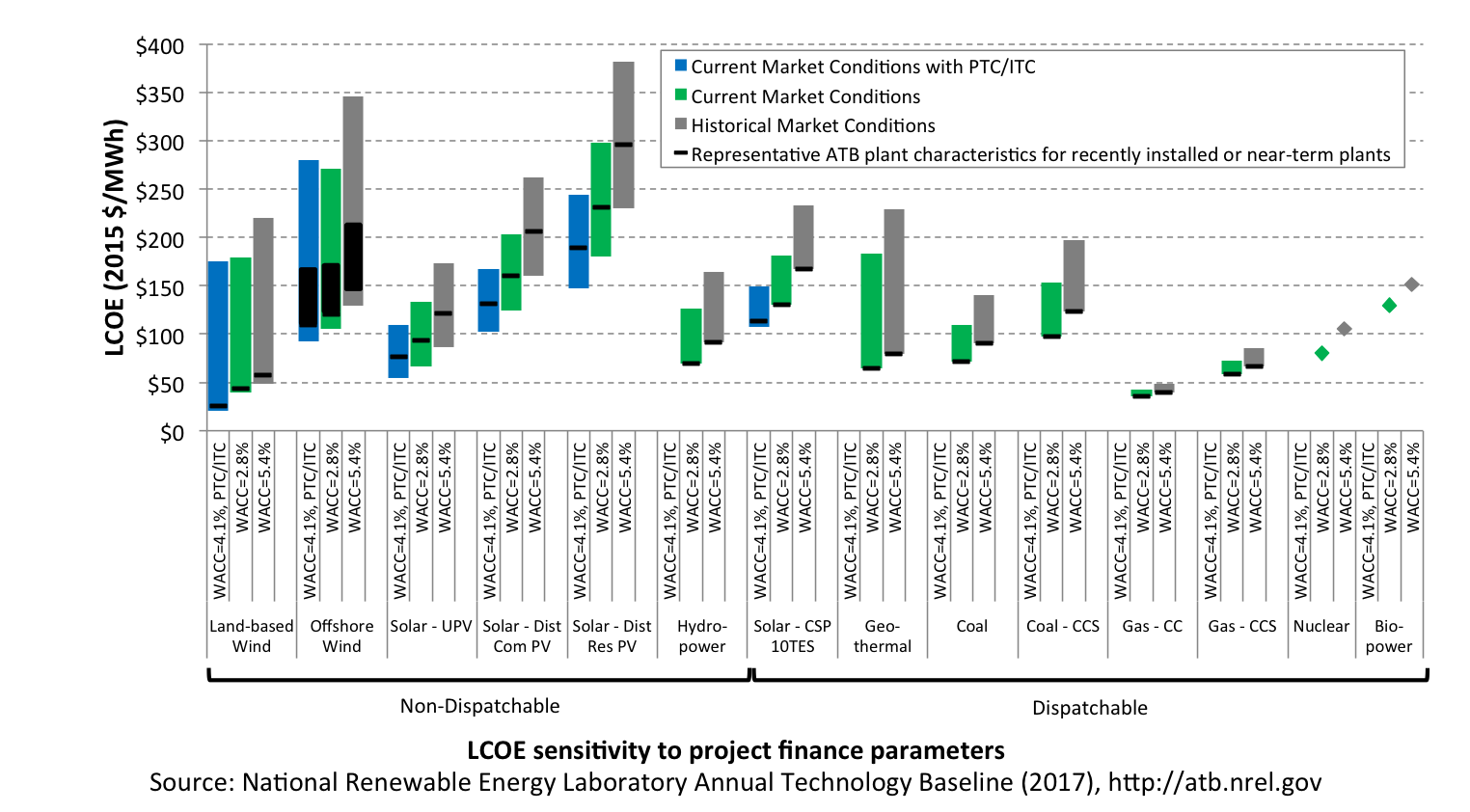

Sensitivity to Project Finance Parameters

In the 2017 ATB, two options representing market conditions for project finance are available. Current market conditions are based on macroeconomic indicators from AEO (2017) for the year 2017 as a source for debt and equity rates of return. Long-term historic conditions are based on debt and equity rates of return that are typical in electric sector modeling analysis using the ReEDS model.

The following figure illustrates the sensitivity of Base Year LCOE values to changes in the combination of debt interest rate, return on equity rate, and debt fraction in three ways:

- Current Market Conditions, PTC/ITC: For wind and solar plants that are eligible to receive the production tax credit (PTC) or investment tax credit (ITC) at present, debt fractions tend to be lower than other electricity generation technologies because tax equity investors are significant project sponsors. This scenario reflects debt interest and return on equity rates observed in today's market, a debt fraction of 40%, and the effect of the PTC or ITC for wind and solar LCOE estimates only. These assumptions are not included in the ATB spreadsheet.

- Current Market Conditions: The values of the PTC and ITC are ramping down by 2020, at which time wind and solar projects may be financed with debt fractions similar to other technologies. This scenario reflects debt interest (4.4% nominal, 1.9% real) and return on equity rates (9.5% nominal, 6.8% real) to represent 2017 market conditions (AEO 2017) and a debt fraction of 60% for all electricity generation technologies. An economic life, or period over which the initial capital investment is recovered, of 20 years is assumed for all technologies. These assumptions are one of the project finance options in the ATB spreadsheet.

- Long-Term Historical Market Conditions: Historically, debt interest and return on equity were represented with higher values. This scenario reflects debt interest (8% nominal, 5.4% real) and return on equity rates (13% nominal, 10.2% real) implemented in the ReEDS model and reflected in prior versions of ATB and Standard Scenarios model results. A debt fraction of 60% for all electricity generation technologies is assumed. An economic life, or period over which the initial capital investment is recovered, of 20 years is assumed for all technologies. These assumptions are one of the project finance options in the ATB spreadsheet.

The range of LCOE for renewable technologies reflects the range of available resource conditions. The range of LCOE for coal and natural gas plants reflects the two capacity factor values implemented in the ATB.

This figure is intended to illustrate the impact that financial assumptions have on LCOE estimates. It is not intended to predict future market conditions.

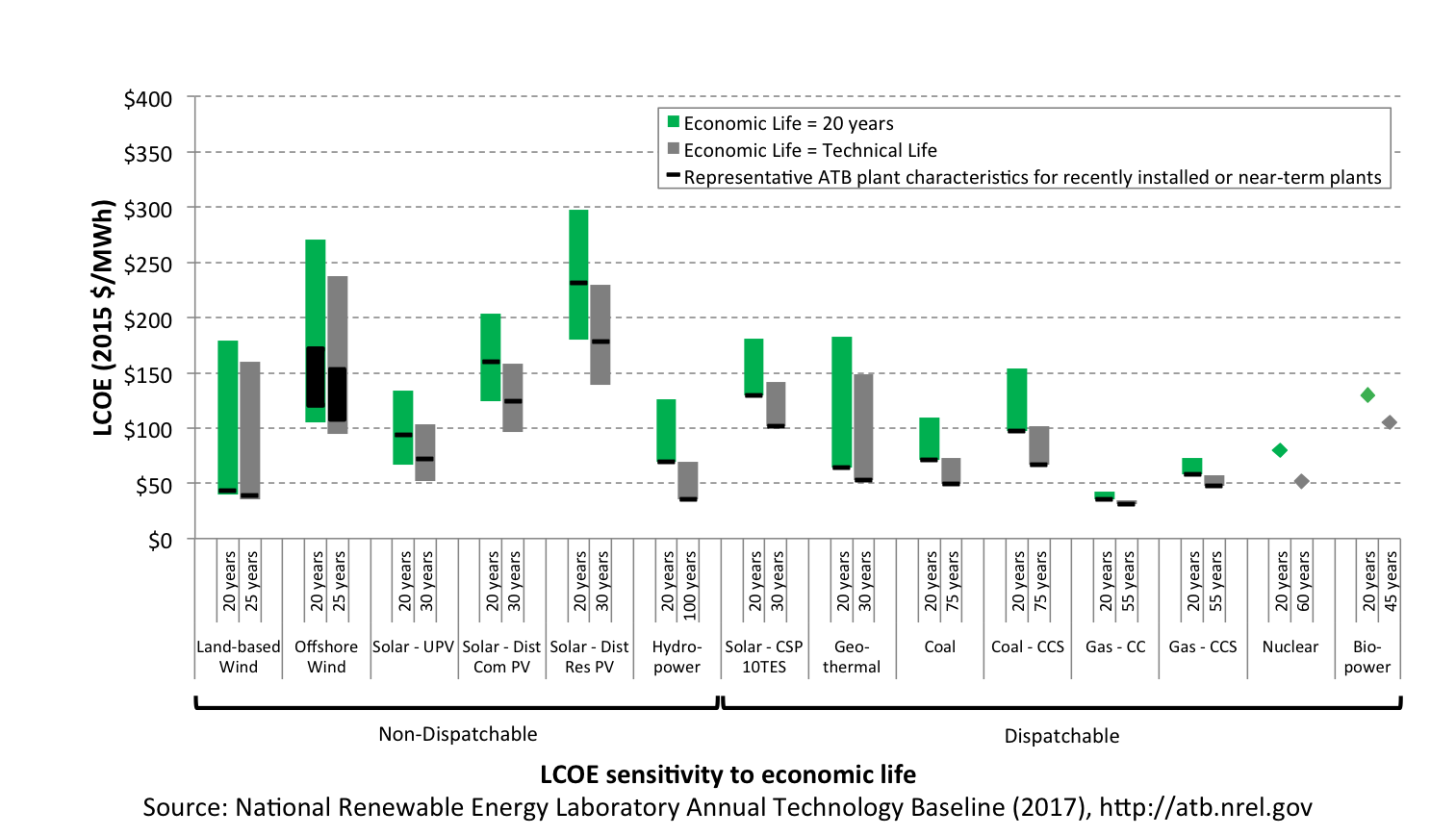

Sensitivity to Economic Life

An important assumption for computing LCOE is the period over which the electricity generation plant cost and performance are levelized. In the ATB, this period is defined as the economic life, and it represents the period over which the initial capital investment to build a plant is recovered.

The following figure illustrates the sensitivity of Base Year LCOE values to changes in the economic life in two ways:

- Economic life is 20 years for all technologies. This approach reflects the perspective of a hypothetical investor that evaluates each technology investment over a common capital recovery time horizon independent of the technology.

- Economic life is equal to technical life. This approach reflects a capital recovery period that extends over the technical life of the electricity generation plant that is unique to each technology option.

The range of LCOE for renewable technologies reflects the range of available resource conditions. The range of LCOE for coal and natural gas plants reflects the two capacity factor values implemented in the ATB.

The technical life for each technology is consistent with that implemented in the ReEDS model and reflected in prior versions of ATB and Standard Scenarios model results.

This sensitivity analysis is based on changing the period over which capital investment is recovered. To understand the sensitivity of technical life on LCOE estimates, a more complicated analysis is required. Assumptions about the residual value of the plant over time, major component replacement or repair time schedules, and contractual or regulatory renewal schedules (e.g., licenses or leases) would affect the period over which a plant may operate. In general, economic life will be less than or equal to technical life so that capital investments are recovered before the plant is no longer technically viable.