Land-Based Wind

The 2019 ATB characterization for land-based wind updates the Base Year and future wind technology cost and performance estimates from years past to align with current expectations for wind energy costs over the coming decades. This year's ATB characterization for land-based wind relies on a new bottoms-up engineering approach for 2030 turbine and plant technology that is used to inform cost and performance characterizations through 2030. This new approach was developed based on persistent feedback since the release of the Wind Vision report (DOE & NREL, 2015) and the System Management of Atmospheric Resource through Technology (SMART) strategies wind plant analysis (Dykes et al., 2017) , from the wind industry original equipment manufacturer (OEM) and stakeholder community that noted the wind ATB mid case assumptions to be overly conservative. Based on this feedback and observations of substantial technology gains in recently commercialized turbine offerings an array of industry experts now anticipate wind energy LCOEs of 2-2.5 cent/kWh by the mid-2020s, depending on specific financing terms and conditions. In terms of technology gains, the most noteworthy has been the substantial and rapid scaling of wind turbines from the 2-MW to 4-MW with increases in rotor size from approximately 100 m to 150 m. These gains in scale are allowing modern technology to capture turbine level economies of scale and balance of plant efficiencies while placing the turbine in better resource regimes at greater heights above ground level.

To better align with the OEM and industry stakeholder cost reduction expectations NREL redefined the methodology used for estimating future energy costs. Specifically, for this year's ATB NREL used expert input to define one of many potential turbine technology pathways for a Mid and Low scenario in 2030. Bottom-up engineering cost and performance analysis were then executed to obtain the future cost reduction trajectories (Stehly, Beiter, Heimiller, & Scott, 2020) . Although this method has resulted in a cost reduction pathway that maintains and could even accelerate recent significant cost reduction gains, these results are believed to be more in line with wind industry analyst and OEM expectations. There is substantial focus throughout the global wind industry on driving down costs and increasing performance due to fierce competition from within as well as among several power generation technologies including solar PV and natural gas-fired generation.

Representative Technology

Representative technologies for land-based wind for the base year (2017) and 2030 assume a 50-MW to 100-MW facility, consistent with current project sizes (Wiser & Bolinger, 2018) . Our base year characterization is extracted from wind turbines installed in the United States in 2017 which were, on average, 2.3-MW turbines with rotor diameters of 113 m and hub heights of 86 m (Wiser & Bolinger, 2018) . Our 2030 representative technology assumes a 4.5-MW turbine with a rotor diameter of 167 m and a hub height of 110 m. Notably turbines that are nearly of this scale (i.e., 4-MW, 150 m rotor and 80-m to 110-m hub height are commercially available today and expected to be installed in facilities in the U.S. in the early 2020s.

Resource Potential

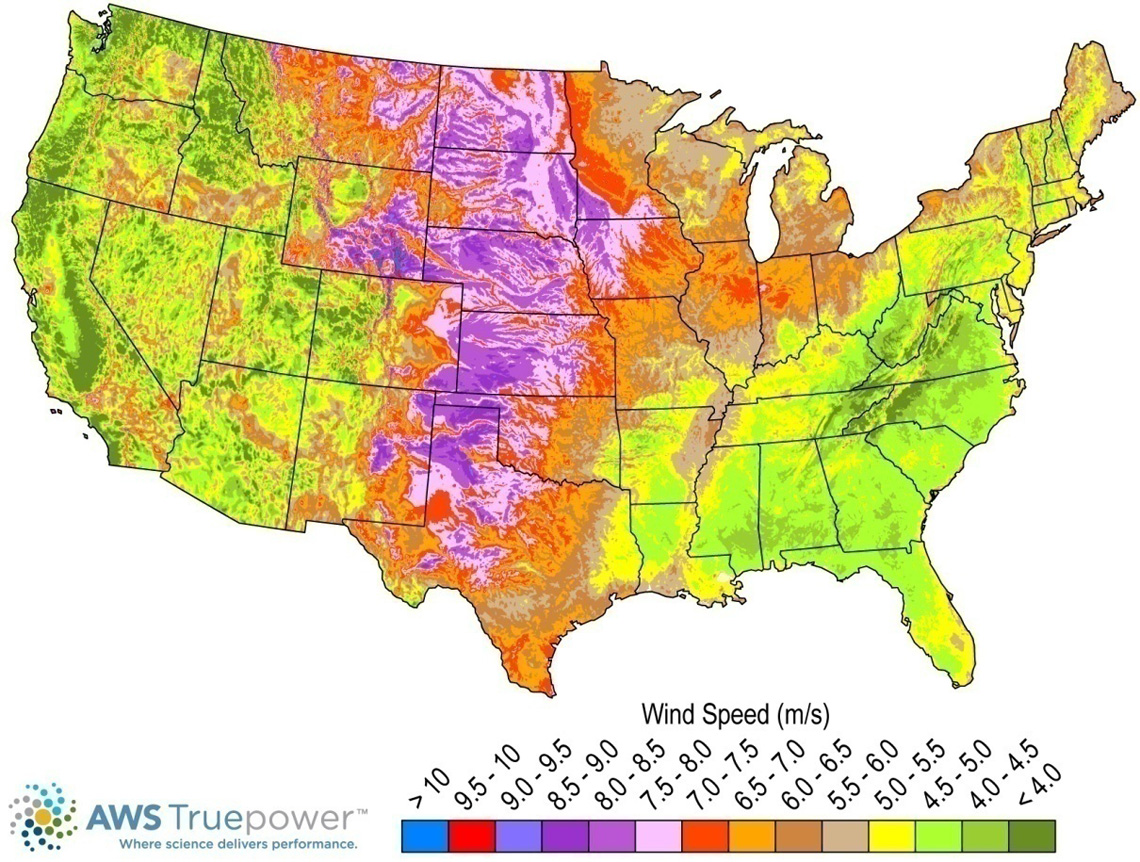

Wind resource is prevalent throughout the United States but is concentrated in the central states. Total land-based wind technical potential exceeds 10,000 GW (almost tenfold current total U.S. electricity generation capacity), which would use the wind resource on 3.5 million km2 of land area but would disrupt or exclude other uses from a fraction of that area. This technical potential does not include standard exclusions-lands such as federally protected areas, urban areas, and water. Resource potential has been expanded from approximately 6,000 GW (DOE & NREL, 2015) by including locations with lower wind speeds to provide more comprehensive coverage of U.S. land areas where future technology may improve economic potential.

Renewable energy technical potential, as defined by Lopez et al. (2012) , represents the achievable energy generation of a particular technology given system performance, topographic limitations and environmental and land-use constraints. The primary benefit of assessing technical potential is that it establishes an upper-boundary estimate of development potential. It is important to understand that there are multiple types of potential, including resource, technical, economic, and market potential (see NREL: "Renewable Energy Technical Potential").

The resource potential is calculated by using more than 130,000 distinct areas for wind plant deployment that cover more than 3.5 million km2. The potential capacity is estimated to total more than 10,000 GW if a power density of 3 MW/km2 is assumed.

Base Year and Future Year Projections Overview

For each of the 130,000 distinct areas, an LCOE is estimated taking into consideration site-specific hourly wind profiles. Representative wind turbines derived from annual installation statistics are associated with a range of average annual wind speed based on actual historical wind plant installations. This method is described by Moné (2017) and summarized below:

- Capital expenditures (CAPEX) associated with wind plants installed in the interior of the country are used to characterize CAPEX for hypothetical wind plants with average annual wind speeds that correspond with the median conditions for recently installed wind facilities.

- Capacity factor is determined for each unique location using the site-specific hourly wind profile and a power curve that corresponds with the representative wind turbine defined to represent the annual average wind speed for each site.

- Average annual operations and maintenance (O&M) costs are assumed to be equivalent at all geographic locations.

- LCOE is calculated for each area based on the CAPEX and capacity factor estimated for each area.

For representation in the ATB, the full resource potential, reflecting the 130,000 individual areas, was divided into 10 techno-resource groups (TRGs). The capacity-weighted average CAPEX, O&M, and capacity factor for each group is presented in the ATB. ATB Base Year costs for land-based wind are calibrated to NREL's 2017 Cost of Wind Energy Review (Stehly, Beiter, Heimiller, & Scott, 2018).

Focusing on future costs, this year's ATB characterization represents an update relative to years past in order to realign with current expectations for costs over the next decade. Three different projections were developed for scenario modeling as bounding levels:

- Constant Technology Cost Scenario: no change in CAPEX, O&M, or capacity factor from 2017 to 2050; consistent across all renewable energy technologies in the ATB

- Mid Technology Cost Scenario: 2030 cost estimates for the Mid scenario are estimated (1) using NREL's Cost and Scaling Model (CSM) and inputs from analyst-predicted turbine and plant technology in 2030 specific to the Mid case (Stehly et al., 2020) and (2) applying technology-specific cost adjustments for factors such as construction contingencies and transportation. Beyond 2030, costs and performance were derived from an estimated change in LCOE from 2030 to 2050 based on historical land-based wind LCOE and single-factor learning rates ranging from 10.5% to 18.6%, meaning LCOE declines by this amount for each doubling of global cumulative wind capacity (Wiser et al., 2016) . NREL's Cost and Scaling applies component level scaling relationships (e.g., for the blades, hub, generator, and tower) that reflect the component-specific and often nonlinear relationship between size and cost (Christopher Moné et al., 2017) .

- Low Technology Cost Scenario: 2030 cost estimates for the Low scenario are estimated using NREL's CSM and inputs from the analyst-predicted turbine technology in 2030 specific to the Low case (Stehly et al., 2020) and applying technology-specific cost adjustments; beyond 2030, the costs were derived using the same learning rate methodology as for the Mid case but assuming an increase in global cumulative capacity.

In last year's ATB, the mid case cost projections were informed by the expert survey that reported expected LCOE changes in percentage terms relative to 2014 baseline values (Wiser et al., 2016) . Prior mid case projections were estimated using the entire sample size from the survey work (163 experts) which included strategic, system-level thought leaders with wind technology, costs, and/or market expertise. However, the survey also identified a smaller group – deemed "leading experts" through a deliberative process by a core group of International Energy Agency (IEA) Wind Task 26 members. This leading experts group (22 leading experts) generally expected more aggressive wind energy cost reductions. Recent wind industry data focused on price points more than 3-5 years into the future indicate that costs are falling more quickly than the full sample predicted and more in line with the leading Experts predictions. This year's ATB mid case is informed both by this leading group of experts' predictions as well as the expert input and bottom-up engineering pathways analysis referenced previously.

The Low case is primarily informed by the wind program's Atmosphere to Electrons (A2e) applied research initiative that advances the fundamental science necessary to drive innovation and the realization of the SMART wind power plant of the future (Dykes et al., 2017) . This research in addition to ongoing Wind Energy Technologies Office (WETO) projects including Big Adaptive Rotors (DOE, 2018) , Lightweight Drivetrains (DOE EERE, 2019) , and Tall Towers (2019 Wind Energy Technologies Office Funding Opportunity Announcement, 2019) support the wind industry's ongoing scaling activities and manufacturing improvements and were combined to assess additional potential pathways and related projected cost impacts for each LCOE component.

As done in the expert survey work (Wiser et al., 2016) historical LCOE estimates were compared to the LCOE projections of the Mid and Low scenarios. The LCOE projections were found to require continued sizable cost reductions consistent with and potentially somewhat greater than the historical LCOE trends. Possible justifications for maintaining recent rates of high cost reduction and potentially even going beyond long-term historical LCOE learning include stiff competition from around the globe as well as a highly capitalized industry with annual expenditures on the order of $100 billion. Accordingly, the revised Mid scenario is now considered representative of the reference case for land-based wind. The Low cost scenario projections are derived from the same methodology as the Mid case but applying additional cost reduction potentials from a collection of intelligent and novel technologies that comprise next-generation wind turbine and plant technology and characterized as System Management of Atmospheric Resource through Technology, or SMART strategies (Dykes et al., 2017) . In both scenarios, the overall LCOE reductions resulting from these analyses were used as the basis for the ATB projections. Accordingly, all three cost elements – CAPEX, O&M, and capacity factor – should be considered together; individual cost element projections are derived.

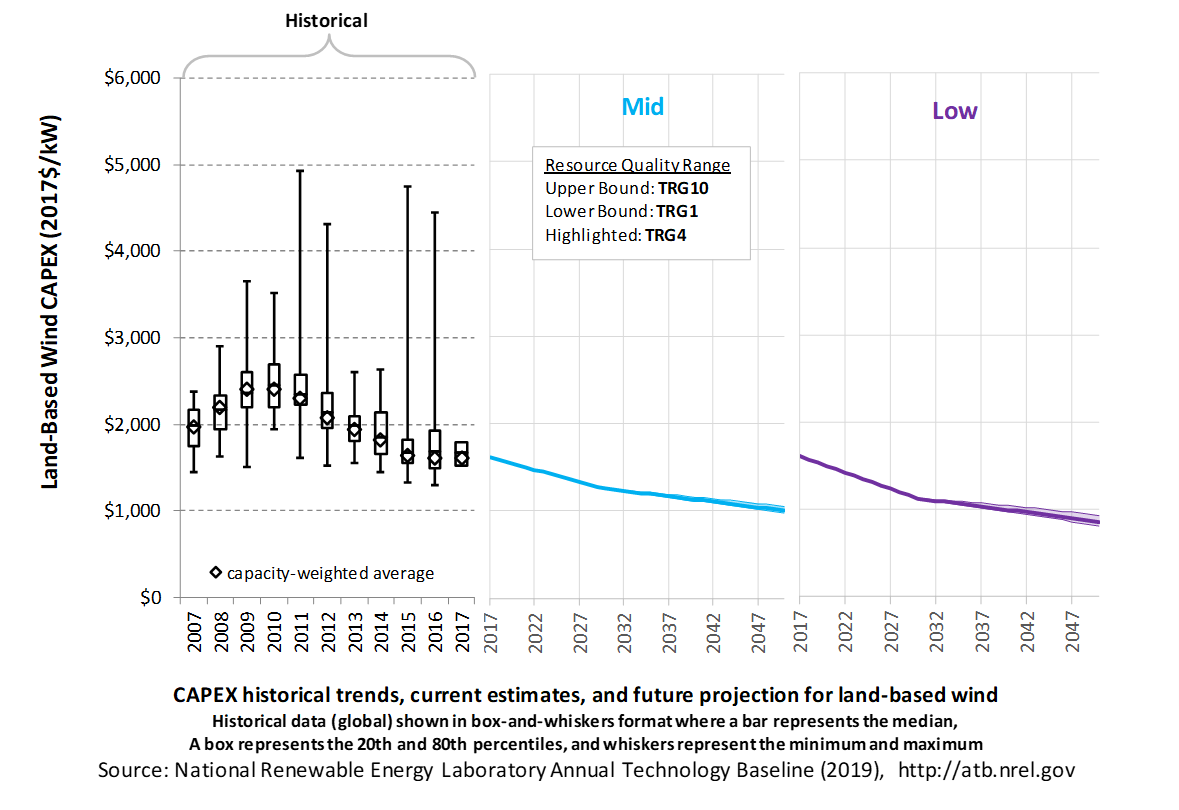

Capital Expenditures (CAPEX): Historical Trends, Current Estimates, and Future Projections

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year. These expenditures include the wind turbine, the balance of system (e.g., site preparation, installation, and electrical infrastructure), and financial costs (e.g., development costs, onsite electrical equipment, and interest during construction) and are detailed in CAPEX Definition. In the ATB, CAPEX reflects typical plants and does not include differences in regional costs associated with labor, materials, taxes, or system requirements. The related Standard Scenarios product uses Regional CAPEX Adjustments. The range of CAPEX demonstrates variation with wind resource in the contiguous United States.

The CAPEX improvements for future land-based wind projects may be realized through many technology pathways to achieve LCOE reductions. It is also important to note that CAPEX improvements are not the only pathway to LCOE reductions as LCOE is also influenced by capacity factor, financing, O&M, and project life. For the purpose of reducing the vast combinations of future pathways NREL analysts defined a single future turbine configuration in 2030 to conduct the bottom-up cost analysis for the Mid and Low scenarios. The specific 2030 turbine configuration for the Mid scenario assumes a nameplate capacity of 4.5 MW with a rotor diameter of 167 m placed on a 110 m tower. Additional turbine configurations explored that resulted in LCOEs that were within 10% (or less) of the current Mid scenario included turbines with nameplate capacity ratings of 3-MW and 4-MW, rotor diameters down to 150 m, and hub heights up to 140 m. The relatively low sensitivity of LCOE to these changes in turbine configuration is indicative of the array potential pathways and solutions to the LCOE values estimated in this year's ATB.

The defined turbine characteristics were then used to estimate the total system CAPEX of a theoretical commercial scale (e.g., 100-MW) project. Although the relatively low observed sensitivity to significantly different turbine configurations for a single reference site indicate some uncertainty need for and value of wind turbine tailoring for varied site conditions, it is generally expected that over the long-term wind turbine designs will be optimized for a specific plant's site conditions. In this year's ATB, this site-specific design optimization process which is often reflected in different CAPEX values across TRGs was not included. Instead we assumed the single turbine configuration across all 10 TRGs. This simplification was applied due to limited resources and lack of necessary data to robustly characterize CAPEX variation across the 10 TRGs. Nevertheless, the ability to assess and tailor turbine configurations and CAPEX estimates for each TRG is expected to be reimplemented in future iterations of the ATB.

CAPEX Definition

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year.

For the ATB, and based on a capital cost estimates report from EIA (2016) and the System Cost Breakdown Structure defined by Moné et al. (2015), the wind plant envelope is defined to include:

- Wind turbine supply

- Balance of system (BOS)

- Turbine installation, substructure supply, and installation

- Site preparation, installation of underground utilities, access roads, and buildings for operations and maintenance

- Electrical infrastructure, such as transformers, switchgear, and electrical system connecting turbines to each other and to the control center

- Project-related indirect costs, including engineering, distributable labor and materials, construction management start up and commissioning, and contractor overhead costs, fees, and profit.

- Financial costs

- Owners' costs, such as development costs, preliminary feasibility and engineering studies, environmental studies and permitting, legal fees, insurance costs, and property taxes during construction

- Onsite electrical equipment (e.g., switchyard), a nominal-distance spur line (< 1 mile), and necessary upgrades at a transmission substation; distance-based spur line cost (GCC) not included in the ATB

- Interest during construction estimated based on three-year duration accumulated 10%/10%/80% at half-year intervals and an 8% interest rate (ConFinFactor).

CAPEX can be determined for a plant in a specific geographic location as follows:

Regional cost variations and geographically specific grid connection costs are not included in the ATB (CapRegMult = 1; GCC = 0). In the ATB, the input value is overnight capital cost (OCC) and details to calculate interest during construction (ConFinFactor).

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

CAPEX in the ATB does not represent regional variants (CapRegMult) associated with labor rates, material costs, etc., but the ReEDS model does include 134 regional multipliers (EIA, 2016).

The ReEDS model determines the land-based spur line (GCC) uniquely for each of the 130,000 areas based on distance and transmission line cost.

Operation and Maintenance (O&M) Costs

Operations and maintenance (O&M) costs depend on capacity and represent the annual fixed expenditures required to operate and maintain a wind plant, including:

- Insurance, taxes, land lease payments, and other fixed costs

- Present value and annualized large component replacement costs over technical life (e.g., blades, gearboxes, and generators)

- Scheduled and unscheduled maintenance of wind plant components, including turbines and transformers, over the technical lifetime of the plant.

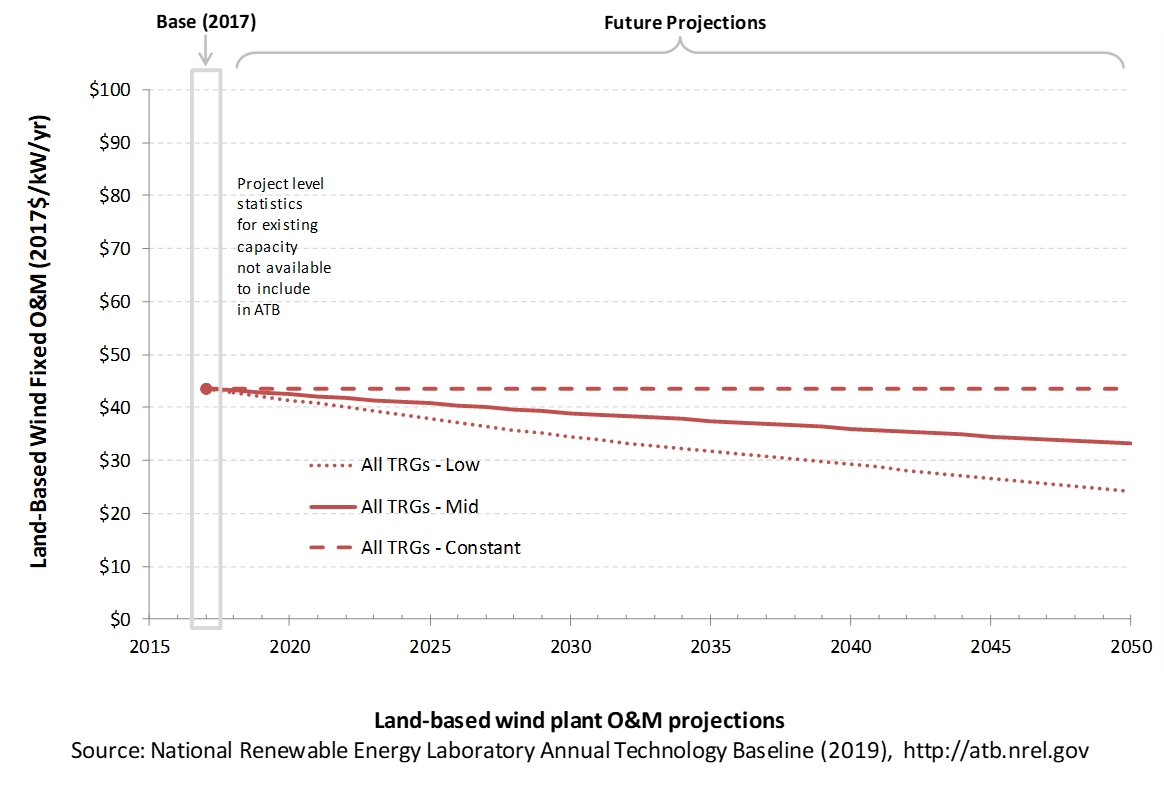

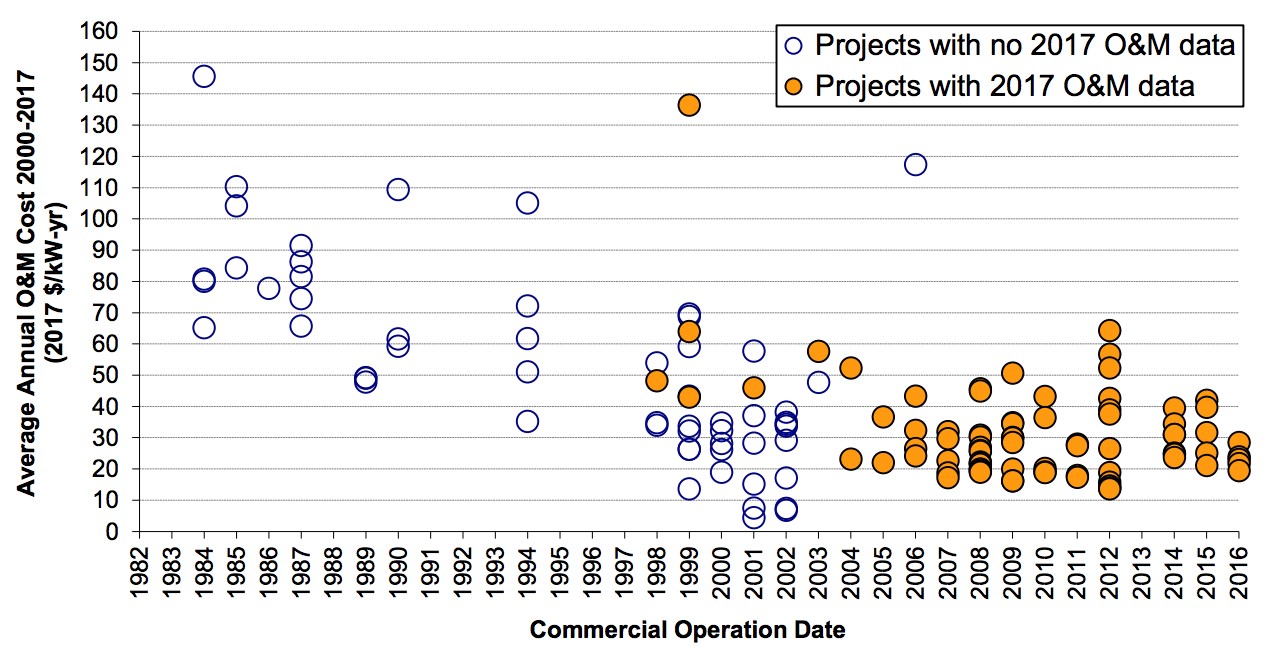

The following figure shows the Base Year estimate and future year projections for fixed O&M (FOM) costs. Three cost scenarios are represented. The estimate for a given year represents annual average FOM costs expected over the technical lifetime of a new plant that reaches commercial operation in that year.

Base Year Estimates

The FOM of $44/kW-yr in the Base Year was estimated in the 2017 Cost of Wind Energy Review (Stehly, Beiter, Heimiller, & Scott, 2018); no variation of FOM with TRG (or wind speed) was assumed. The following chart shows sample historical data for reference.

Future Year Projections

Future FOM is assumed to decline by approximately 25% by 2050 in the Mid case and 45% in the Low case. These values are informed by recent work benchmarking work for wind power operating costs in the United States (Wiser, Bolinger, & Lantz, 2019).

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

Capacity Factor: Expected Annual Average Energy Production Over Lifetime

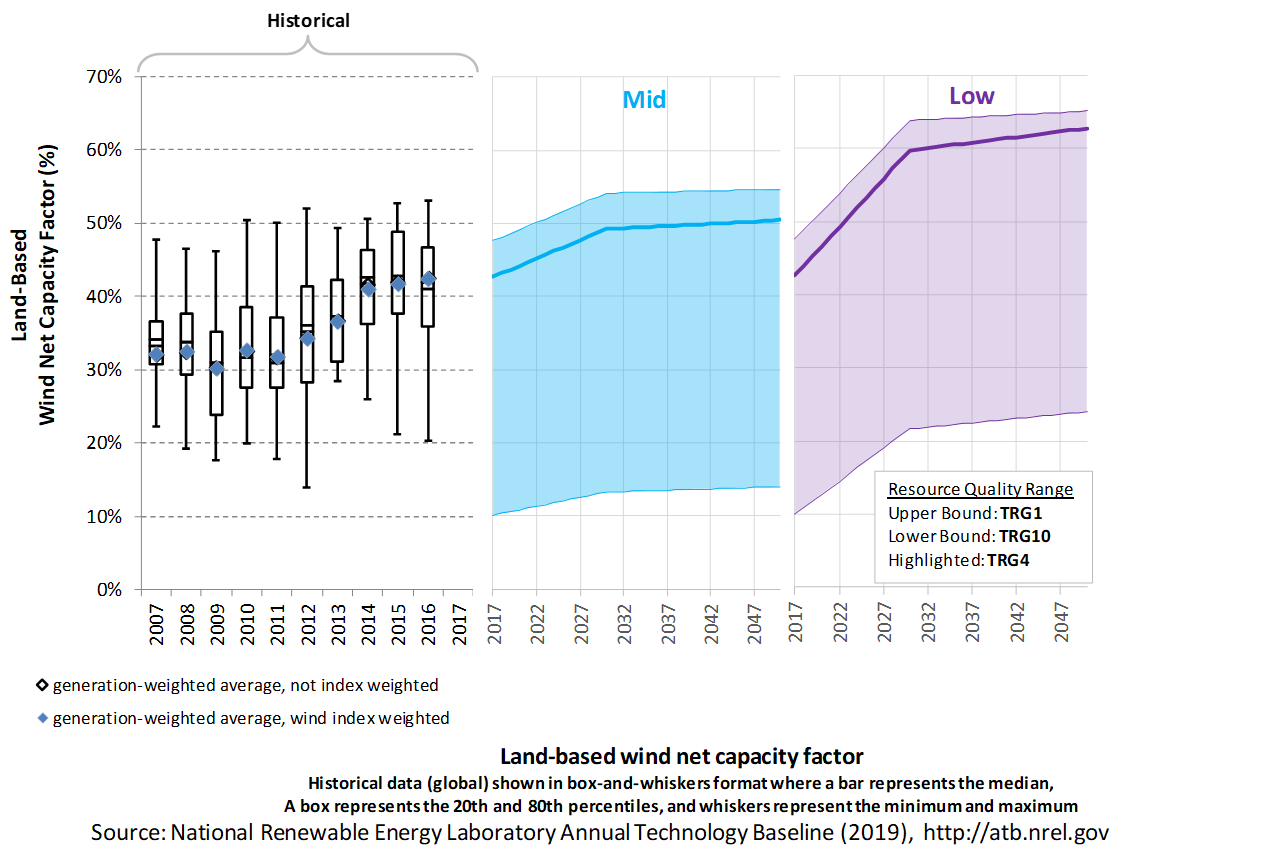

The capacity factor represents the expected annual average energy production divided by the annual energy production, assuming the plant operates at rated capacity for every hour of the year. It is intended to represent a long-term average over the lifetime of the plant. It does not represent interannual variation in energy production. Future year estimates represent the estimated annual average capacity factor over the technical lifetime of a new plant installed in a given year.

The capacity factor is influenced by hourly wind profile, expected downtime, and energy losses within the wind plant. The specific power (ratio of machine rating to rotor swept area) and hub height are design choices that influence the capacity factor.

The following figure shows a range of capacity factors based on variation in the resource for wind plants in the contiguous United States. Historical data from wind plants operating in the United States in 2015, according to the year in which plants were installed, is shown for comparison to the ATB Base Year estimates. The range of Base Year estimates illustrate the effect of locating a wind plant in sites with high wind speeds (TRG 1) or low wind speeds (TRG 10). Future projections are shown for Constant, Mid, and Low technology cost scenarios.

Recent Trends

Actual energy production from about 90% of wind plants operating in the United States since 2007 is shown in box-and-whiskers format for comparison with the ATB current estimates and future projections. The historical data illustrate capacity factor for projects operating in 2017, shown by year of commercial online date. As reported in the 2017 DOE Wind Technologies Market Report (Wiser & Bolinger, 2018).

Base Year Estimates

Most installed U.S. wind plants generally align with ATB estimates for performance in TRGs 5-7. High wind resource sites associated with TRGs 1 and 2 as well as very low wind resource sites associated with TRGs 8-10 are not as common in the historical data, but the range of observed data encompasses ATB estimates.

To calculate the Base Year capacity factors the 2017 turbine characteristics (Wiser & Bolinger, 2018) are input into the System Advisor Model, or SAM and run for each of the weighted average wind speeds in each TRG.

The capacity factor is referenced to an 80-m, above-ground-level, long-term average hourly wind resource data from AWS Truepower (2012).

Future Year Projections

Projections for capacity factors implicitly reflect technology innovations such as larger rotors and taller towers that will increase energy capture at the same location (without specifying precise tower height or rotor diameter changes). Improvements in plant performance through lower losses and increased availability are also included implicitly. In practice future turbine designs will be optimized for a specific site with attempts to maximize capacity factor. This optimization is not captured in this analysis since one turbine configuration is defined for each of the TRGs. Analysts hope to enhance the ability to define site-specific turbine configurations for each TRG in future iteration of the ATB.

- Mid: The projected capacity factors in 2030 are calculated in SAM using the inputs of the predicted turbine technology in 2030 that are specific to the Mid scenario (Stehly et al., 2020) for each of the TRGs; additional wind plant performance and availability are also applied through technology innovations assessed in the SMART wind power plant of the future work (Dykes et al., 2017); beyond 2030, analysts predict generally modest improvements in wind plant performance through 2050 for the resource-rich site (i.e., TRGs 1 and 2) and increasing slightly for the less favorable resource sites (i.e., TRGs 8-10).

- Low: The projected capacity factors in 2030 are calculated in SAM using the inputs of the predicted turbine technology in 2030 that are specific to the Low scenario (Stehly et al., 2020) for each of the TRGs; additional wind plant performance and availability are also applied through technology innovations assessed in the SMART wind power plant of the future work (Dykes et al., 2017), but they assume further reduction in losses than in the Mid case; beyond 2030, analysts predict slightly higher improvements in wind plant performance than in the Mid case through 2050 for the resource-rich site (i.e., TRGs 1 and 2) and increasing slightly for the less favorable resource sites (i.e., TRGs 8-10).

Increased energy capture through turbine scaling and wind plant optimization are the two primary factors influencing wind plant capacity factor. The introduction of novel control mechanisms will continue to increase energy capture with more-precise control of the flow through the entire wind plant. These technology advancements are expected to increase capacity factor for all TRGs, with a more rapid rate of increases in capacity factor through 2030 and a slower rate of increase through 2050. This analysis is illustrative of one of many capacity factor improvement pathways for LCOE reduction. Of course, as was the case for CAPEX there are many different pathways to a given capacity factor. Turbine rotor diameter, specific power, and hub height can each be traded off to achieve a given capacity factor, depending on site conditions and relative costs for pursuing one approach or the other; plant layout and operational strategies that impact losses are additional levers that may be used to achieve a given capacity factor.

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

The ReEDS model output capacity factors for wind and solar PV can be lower than input capacity factors due to endogenously estimated curtailments determined by scenario constraints.

Plant Cost and Performance Projections Methodology

ATB projections were derived from two different sources for the Mid and Low cases:

- Mid Technology Cost Scenario: 2030 cost estimates for the Mid scenario are estimated (1) using CSM and inputs from analyst-predicted turbine technology in 2030 that are specific to the Mid case (Stehly et al., 2020) and (2) applying technology-specific cost adjustments; beyond 2030, the costs are derived from estimated change in LCOE from 2030 to 2050 based on historical land-based wind LCOE and single-factor learning rates ranging from 10.5% to 18.6%, meaning LCOE declines by this amount for each doubling of global cumulative wind capacity (Wiser et al., 2016). Future FOM is assumed to decline by approximately 25% by 2050 in the Mid case. These values are informed by recent work benchmarking work for wind power operating costs in the United States (Wiser et al., 2019). The projected capacity factors in 2030 are calculated in SAM using the inputs of the predicted turbine technology in 2030 that are specific to the Mid case (Stehly et al., 2020) for each of the TRGs; additional wind plant performance and availability are also applied through technology innovations assessed in the SMART wind power plant of the future work (Dykes et al., 2017); beyond 2030, analysts predict generally modest improvements in wind plant performance through 2050 for the resource-rich site (i.e., TRGs 1 and 2) and increasing slightly for the less favorable resource sites (i.e., TRGs 8-10).

- Low Technology Cost Scenario: 2030 cost estimates for the Low scenario are estimated (1) using NREL's CSM and inputs from the analyst-predicted turbine technology in 2030 that are specific to the Low case (Stehly et al., 2020) and (2) applying technology-specific cost adjustments; beyond 2030, the costs are derived using the same learning rate methodology as for the Mid case but assuming an increase in global cumulative capacity. Future FOM is assumed to decline by approximately 45% in the Low case. These values are informed by recent work benchmarking work for wind power operating costs in the United States (Wiser et al., forthcoming). The projected capacity factors in 2030 are calculated in SAM using the inputs of the predicted turbine technology in 2030 that are specific to the Low case (Stehly et al., 2020) for each of the TRGs; additional wind plant performance and availability are also applied through technology innovations assessed in the SMART wind power plant of the future work (Dykes et al., 2017), but they assume further reduction in losses than in the Mid case; beyond 2030, analysts predict slightly higher improvements in wind plant performance than in the Mid case through 2050 for the resource-rich site (i.e., TRGs 1 and 2) and increasing slightly for the less favorable resource sites (i.e., TRGs 8-10).

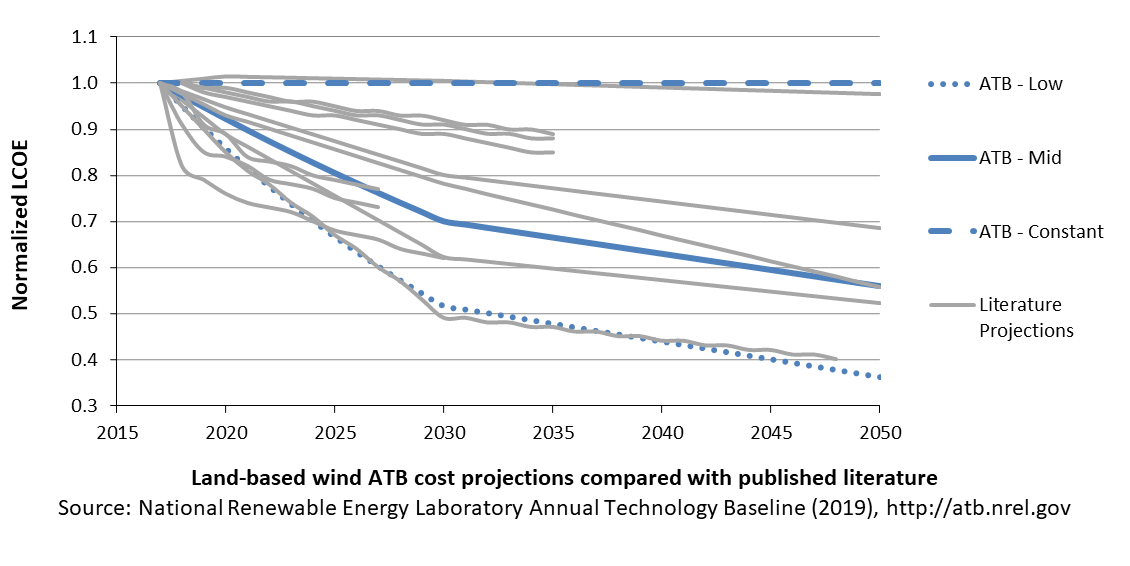

Projections of the cost of wind energy from the literature provide context for the ATB Constant, Mid, and Low technology cost projections. The ATB Mid cost projection results in LCOE reductions that are higher than other scenarios that are in median range of the literature ((Shreve, 2018), (BNEF, 2018)), and lower than ((Kost, Shammugam, Julch, Huyen-Tran, & Schlegl, 2018), (Wiser et al., 2016)). The ATB Low cost projection, which corresponds to the NREL bottom-up cost analysis, is relatively in line with the leading experts prediction (Wiser et al., 2016).

- Mid case projection institutions: Bloomberg New Energy Finance, Wood Mackenzie, Global Wind Energy Council.

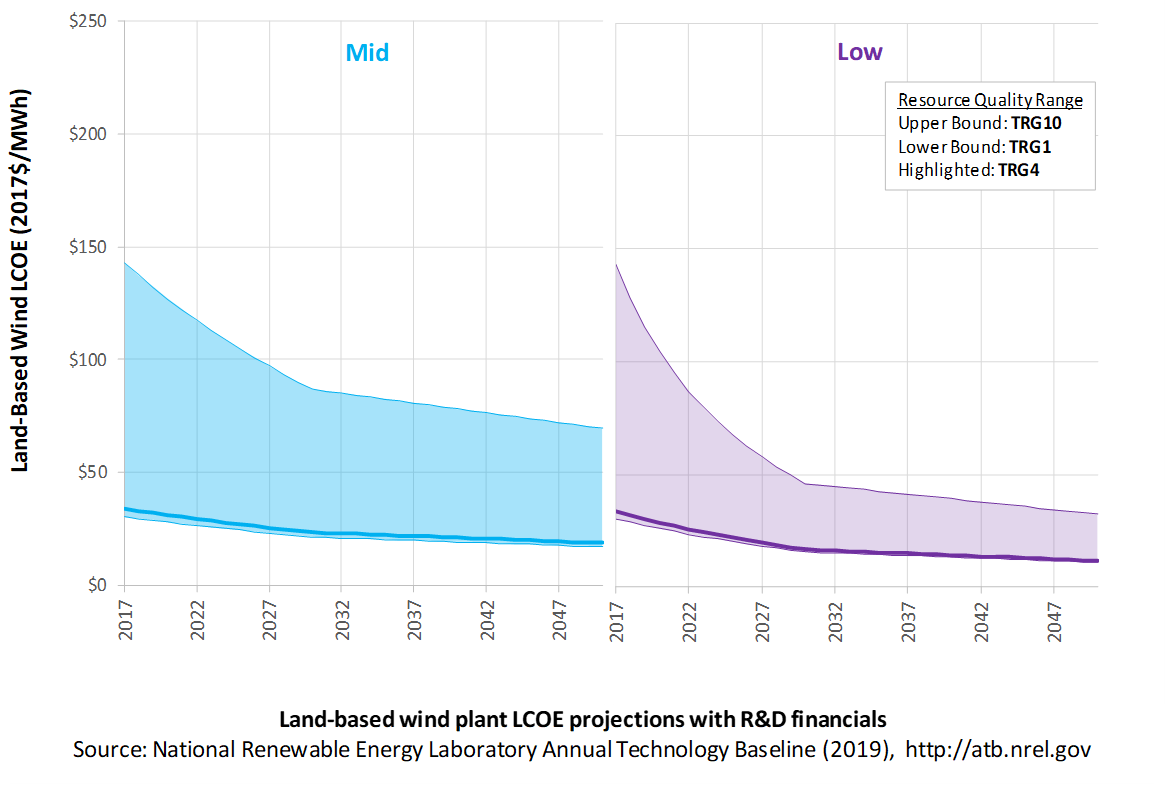

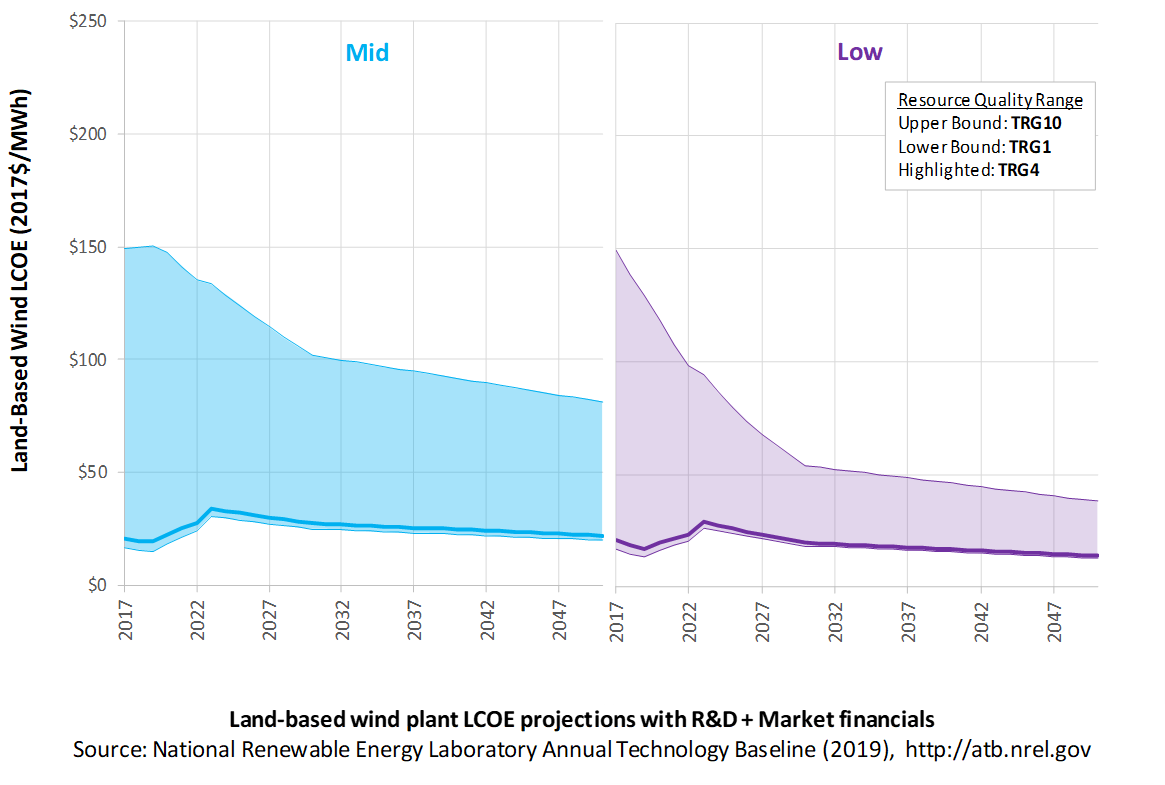

Levelized Cost of Energy (LCOE) Projections

Levelized cost of energy (LCOE) is a summary metric that combines the primary technology cost and performance parameters: CAPEX, O&M, and capacity factor. It is included in the ATB for illustrative purposes. The ATB focuses on defining the primary cost and performance parameters for use in electric sector modeling or other analysis where more sophisticated comparisons among technologies are made. The LCOE accounts for the energy component of electric system planning and operation. The LCOE uses an annual average capacity factor when spreading costs over the anticipated energy generation. This annual capacity factor ignores specific operating behavior such as ramping, start-up, and shutdown that could be relevant for more detailed evaluations of generator cost and value. Electricity generation technologies have different capabilities to provide such services. For example, wind and PV are primarily energy service providers, while the other electricity generation technologies provide capacity and flexibility services in addition to energy. These capacity and flexibility services are difficult to value and depend strongly on the system in which a new generation plant is introduced. These services are represented in electric sector models such as the ReEDS model and corresponding analysis results such as the Standard Scenarios.

The following three figures illustrate LCOE, which includes the combined impact of CAPEX, O&M, and capacity factor projections for land-based wind across the range of resources present in the contiguous United States. For the purposes of the ATB, the costs associated with technology and project risk in the U.S. market are represented in the financing costs but not in the upfront capital costs (e.g., developer fees and contingencies). An individual technology may receive more favorable financing terms outside the United States, due to less technology and project risk, caused by more project development experience (e.g., offshore wind in Europe) or more government or market guarantees. The R&D Only LCOE sensitivity cases present the range of LCOE based on financial conditions that are held constant over time unless R&D affects them, and they reflect different levels of technology risk. This case excludes effects of tax reform and tax credits, and changing interest rates over time. The R&D + Market LCOE case adds to these financial assumptions: (1) the changes over time consistent with projections in the Annual Energy Outlook and (2) the effects of tax reform and tax credits. The ATB representative plant characteristics that best align with those of recently installed or anticipated near-term land-based wind plants are associated with TRG 4. Data for all the resource categories can be found in the ATB Data spreadsheet; for simplicity, not all resource categories are shown in the figures.

R&D Only | R&D + Market

The methodology for representing the CAPEX, O&M, and capacity factor assumptions behind each pathway is discussed in Projections Methodology. In general, the degree of adoption of technology innovation distinguishes the Constant, Mid, and Low technology cost scenarios. These projections represent trends that reduce CAPEX and improve performance. Development of these scenarios involves technology-specific application of the following general definitions:

- Constant Technology: Base Year (or near-term estimates of projects under construction) equivalent through 2050 maintains current relative technology cost differences

- Mid Technology Cost Scenario: Technology advances through continued industry growth, public and private R&D investments, and market conditions relative to current levels that may be characterized as "likely" or "not surprising"

- Low Technology Cost Scenario: Technology advances that may occur with breakthroughs, increased public and private R&D investments, and/or other market conditions that lead to cost and performance levels that may be characterized as the " limit of surprise" but not necessarily the absolute low bound.

To estimate LCOE, assumptions about the cost of capital to finance electricity generation projects are required, and the LCOE calculations are sensitive to these financial assumptions. Two project finance structures are used within the ATB:

- R&D Only Financial Assumptions: This sensitivity case allows technology-specific changes to debt interest rates, return on equity rates, and debt fraction to reflect effects of R&D on technological risk perception, but it holds background rates constant at 2017 values from AEO2019 (EIA, 2019) and excludes effects of tax reform and tax credits.

- R&D Only + Market Financial Assumptions: This sensitivity case retains the technology-specific changes to debt interest, return on equity rates, and debt fraction from the R&D Only case and adds in the variation over time consistent with AEO2019 (EIA, 2019) as well as effects of tax reform and tax credits. For a detailed discussion of these assumptions, see Project Finance Impact on LCOE.

A constant cost recovery period – or period over which the initial capital investment is recovered – of 30 years is assumed for all technologies throughout this website, and it can be varied in the ATB data spreadsheet.

The equations and variables used to estimate LCOE are defined on the Equations and Variables page. For illustration of the impact of changing financial structures such as WACC, see Project Finance Impact on LCOE. For LCOE estimates for the Constant, Mid, and Low technology cost scenarios for all technologies, see 2019 ATB Cost and Performance Summary.

In general, differences among the technology cost cases reflect different levels of adoption of innovations. Reductions in technology costs reflect the cost reduction opportunities that are listed below.

- Continued turbine scaling to larger-megawatt turbines with larger rotors such that the swept area/megawatt capacity decreases, resulting in higher capacity factors for a given location

- Continued diversification of turbine technology whereby the largest rotor diameter turbines tend to be located in lower wind speed sites, but the number of turbine options for higher wind speed sites increases

- Taller towers that result in higher capacity factors for a given site due to the wind speed increase with elevation above ground level

- Improved plant siting and operation to reduce plant-level energy losses, resulting in higher capacity factors

- Wind turbine technology and plants that are increasingly tailored to and optimized for local site-specific conditions

- More efficient O&M procedures combined with more reliable components to reduce annual average FOM costs

- Continued manufacturing and design efficiencies such that capital cost/kilowatt decreases with larger turbine components

- Adoption of a wide range of innovative control, design, and material concepts that facilitate the above high-level trends.

Geothermal

Geothermal technology cost and performance projections have been updated with analysis and results from the GeoVision: Harnessing the Heat Beneath our Feet report (DOE, 2019). The GeoVision report is a collaborative multiyear effort with contributors from industry, academia, national laboratories, and federal agencies. The analysis in the report updates resource potential estimates as well as current and projected capital and O&M costs based on rigorous, bottom-up modeling.

Representative Technology

Hydrothermal geothermal technologies encompass technologies for exploring for the resource, drilling to access the resource, and building power plants to convert geothermal energy to electricity. Technology costs depend heavily on the hydrothermal resource temperature and well productivity and depth, so much so that project costs are site-specific and applying a "typical" cost to any given site would be inaccurate. The 2019 ATB uses scenarios developed by the DOE Geothermal Technology Office (Mines, 2013) for representative binary and flash hydrothermal power plant technologies. The first scenario assumes a 175°C resource at a depth of 1.5 km with wells producing an average of 110 kg/s of geothermal brine supplied to a 30-MWe binary (organic Rankine cycle) power plant. The second scenario assumes a 225°C resource at a depth of 2.5 km with wells producing 80 kg/s of geothermal brine supplied to a 40-MWe dual-flash plant. These are mid-grade or "typical" temperatures and depths for binary and flash hydrothermal projects. The ReEDS model uses the full hydrothermal supply curve. The 2019 ATB representative technologies fall in the middle or near the end of the hydrothermal resources typically deployed in ReEDS model runs.

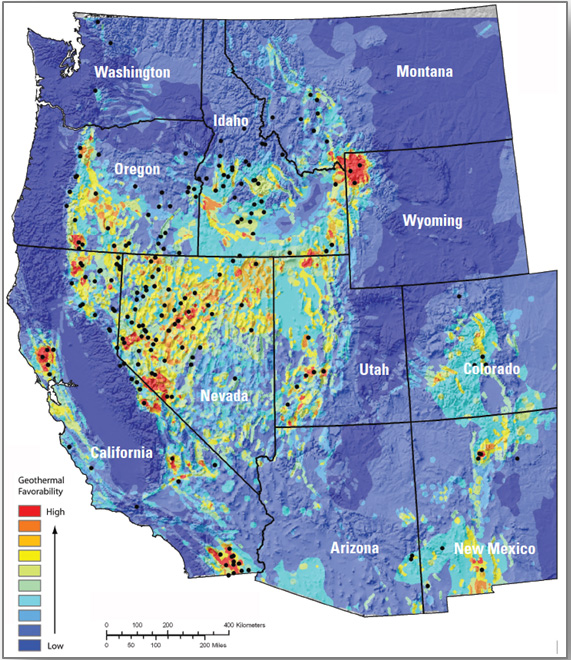

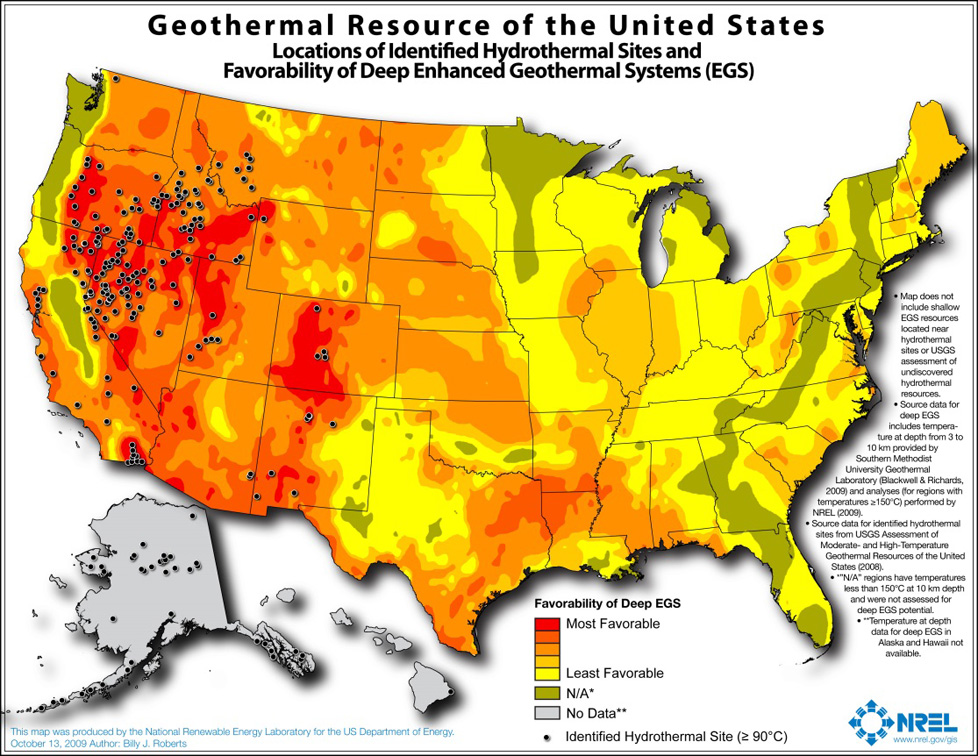

Resource Potential

The hydrothermal geothermal resource is concentrated in the western United States. The total mean potential is 39,090 MW: 9,057 MW identified and 30,033 MW undiscovered (USGS, 2008). The resource potential identified by the U.S. Geological Survey (USGS, 2008) at each site is based on available reservoir thermal energy information from studies conducted at the site. The undiscovered hydrothermal technical potential estimate is based on a series of GIS statistical models for the spatial correlation of geological factors that facilitate the formation of geothermal systems.

The U.S. Geological Survey resource potential estimates for hydrothermal were used with the following modifications:

- Installed capacity of about 3 GW in 2016 is excluded from the resource potential.

- Resources on federally protected and U.S. Department of Defense (DOD) lands, where development is highly restricted are excluded from the resource potential, as are resources on lands where significant barriers that prevent or inhibit development of geothermal projects were identified by Augustine, Ho, and Blair (2019).

Renewable energy technical potential, as defined by Lopez et al. (2012), represents the achievable energy generation of a particular technology given system performance, topographic limitations, and environmental and land-use constraints. The primary benefit of assessing technical potential is that it establishes an upper-boundary estimate of development potential. It is important to understand that there are multiple types of potential-resource, technical, economic, and market (see NREL: "Renewable Energy Technical Potential").

Base Year and Future Year Projections Overview

The Base Year cost and performance estimates are calculated using Geothermal Electricity Technology Evaluation Model (GETEM), a bottom-up cost analysis tool that accounts for each phase of development of a geothermal plant (DOE "Geothermal Electricity Technology Evaluation Model").

- Cost and performance data for hydrothermal generation plants are estimated for each potential site using GETEM. Model results are based on resource attributes (e.g., estimated reservoir temperature, depth, and potential) of each site. GETEM inputs are derived from the Business-as-Usual (BAU) scenario from GeoVision ( (DOE, 2019), (Augustine, Ho, & Blair, 2019)).

- Site attribute values are from (USGS, 2008) for identified resource potential and from capacity-weighted averages of site attribute values of nearby identified resources for undiscovered resource potential.

- GETEM is used to estimate CAPEX, O&M, and parasitic plant losses that affect net energy production.

Capacity factor and O&M costs for plants installed in future years are unchanged from the Base Year. Projections for hydrothermal and EGS technologies are equivalent.

- Constant Technology Cost Scenario: no change in CAPEX, O&M, or capacity factor from 2015 to 2050; consistent across all renewable energy technologies in the ATB

- Mid Technology Cost Scenario: CAPEX cost reduction based on assumed minimum learning as implemented in AEO (EIA, 2015): 10% by 2035; this corresponds to a 0.5% annual improvement in CAPEX, which is assumed to continue on through 2050

- Low Technology Cost Scenario: CAPEX based on the Technology Improvement scenario from GeoVision Study ( (DOE, 2019); (Augustine, Ho, & Blair, 2019)); cost and technology improvements change linearly from present values and are fully achieved by 2030.

Representative Technology

As with cost for projects that use hydrothermal resources, EGS resource project costs depend so heavily on the hydrothermal resource temperature and well productivity and depth that project costs are site-specific. The 2019 ATB uses scenarios developed by the DOE Geothermal Technology Office (Mines, 2013) for representative binary and flash EGS power plants assuming current (immature) EGS technology performance metrics. The first scenario assumes a 175°C resource at a depth of 3 km with wells producing an average of 40 kg/s of geothermal brine supplied to a 25-MWe binary (organic Rankine cycle) power plant. The second scenario assumes a 250°C resource at a depth of 3.5 km with wells producing 40 kg/s of geothermal brine supplied to a 30-MWe dual-flash plant. These temperatures and depths are at the low-cost end of the EGS supply curve and would be some of the first developed. The ReEDS model uses the full EGS supply curve. Neither of these technologies is typically used.

Resource Potential

The enhanced geothermal system (EGS) resource is concentrated in the western United States. The total potential is greater than 100,000 MW: 1,493 MW of near-hydrothermal field EGS (NF-EGS) and the remaining potential comes from deep EGS.

Renewable energy technical potential as defined by Lopez et al. (2012) represents the achievable energy generation of a particular technology given system performance, topographic limitations, environmental, and land-use constraints. The primary benefit of assessing technical potential is that it establishes an upper-boundary estimate of development potential. It is important to understand there are multiple types of potential-resource, technical, economic, and market (see NREL: "Renewable Energy Technical Potential").

Base Year and Future Year Projections Overview

The Base Year cost and performance estimates are calculated using the Geothermal Electricity Technology Evaluation Model (GETEM), a bottom-up cost analysis tool that accounts for each phase of development of a geothermal plant (DOE "Geothermal Electricity Technology Evaluation Model").

- Cost and performance data for EGS generation plants are estimated for each potential site using GETEM. Model results based on resource attributes (e.g., estimated reservoir temperature, depth, and potential) of each site. GETEM inputs are derived from the GeoVision BAU scenario ( (DOE, 2019), (Augustine, Ho, & Blair, 2019)).

- Approaches to restrict resource potential to about 500 GW based on USGS analysis may be implemented in the future.

- GETEM is used to estimate CAPEX and O&M and parasitic plant losses that affect net energy production.

Capacity factor and O&M costs for plants installed in future years are unchanged from the Base Year. Projections for hydrothermal and enhanced geothermal system technologies are equivalent.

- Constant Technology Cost Scenario: no change in CAPEX, O&M, or capacity factor from 2015 to 2050, consistent across all renewable energy technologies in the ATB

- Mid Technology Cost Scenario: CAPEX cost reduction based on assumed minimum learning as implemented in AEO (EIA, 2015): 10% by 2035; this corresponds to a 0.5% annual improvement in CAPEX, which is assumed to continue on through 2050.

- Low Technology Cost Scenario: CAPEX based on the GeoVision Technology Improvement scenario ( (DOE, 2019), (Augustine, Ho, & Blair, 2019)). Cost and technology improvements decrease linearly from present values and are fully achieved by 2030.

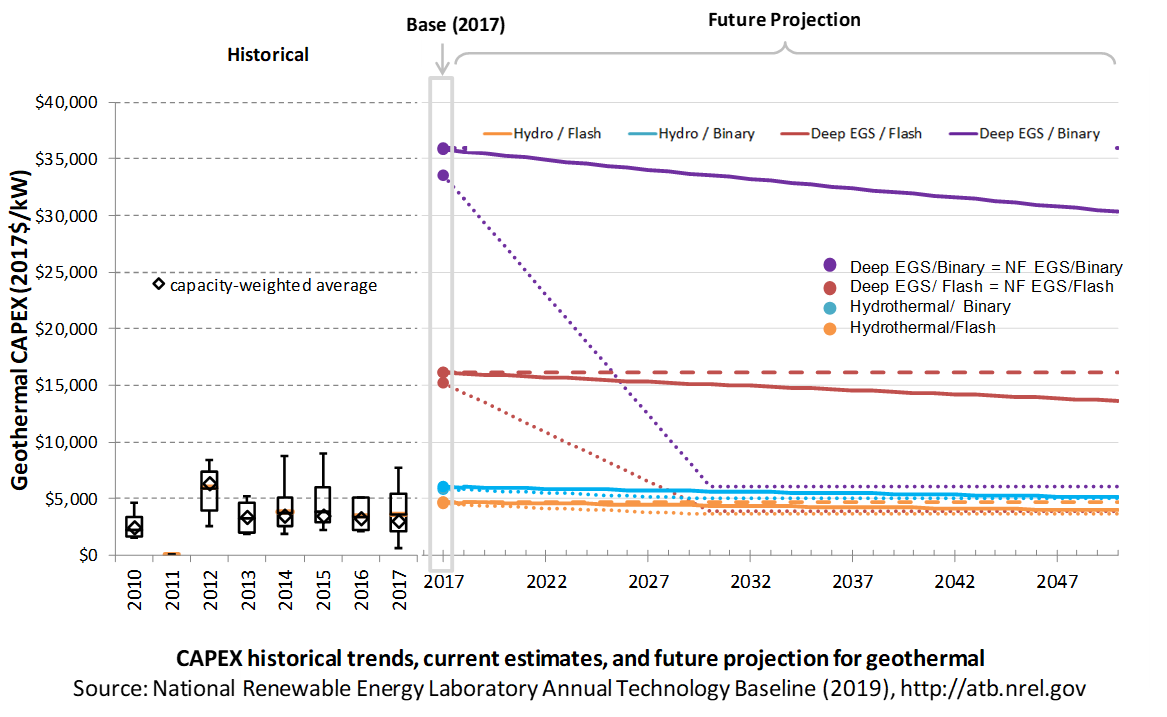

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year. These expenditures include the geothermal generation plant, the balance of system (e.g., site preparation, installation, and electrical infrastructure), and financial costs (e.g., development costs, onsite electrical equipment, and interest during construction) and are detailed in CAPEX Definition. In the ATB, CAPEX reflects typical plants and does not include differences in regional costs associated with labor, materials, taxes, or system requirements. The related Standard Scenarios product uses Regional CAPEX Adjustments. The range of CAPEX demonstrates variation with resource in the contiguous United States.

The following figure shows the Base Year estimate and future year projections for CAPEX costs. Three cost scenarios are represented: Constant, Mid, and Low technology cost. The estimate for a given year represents CAPEX of a new plant that reaches commercial operation in that year.

Base Year Estimates

For illustration in the ATB, six representative geothermal plants are shown. Two energy conversion processes are common: binary organic Rankine cycle and flash.

- Binary plants use a heat exchanger to transfer geothermal energy to an organic Rankine cycle. This technology generally applies to lower-temperature systems. These systems have higher CAPEX than flash systems because of the increased number of components, their lower-temperature operation, and a general requirement that a number of wells be drilled for a given power output.

- Flash plants create steam directly from the thermal fluid through a pressure change. This technology generally applies to higher-temperature systems. Due to the reduced number of components and higher-temperature operation, these systems generally produce more power per well, thus reducing drilling costs. These systems generally have lower CAPEX than binary systems.

Examples using each of these plant types in each of the three resource types (hydrothermal, NF-EGS, and deep EGS) are shown in the ATB.

Costs are for new or greenfield hydrothermal projects, not for re-drilling or additional development/capacity additions at an existing site.

Characteristics for the six examples of plants representing current technology were developed based on discussion with industry stakeholders. The CAPEX estimates were generated using GETEM. CAPEX for NF-EGS and EGS are equivalent.

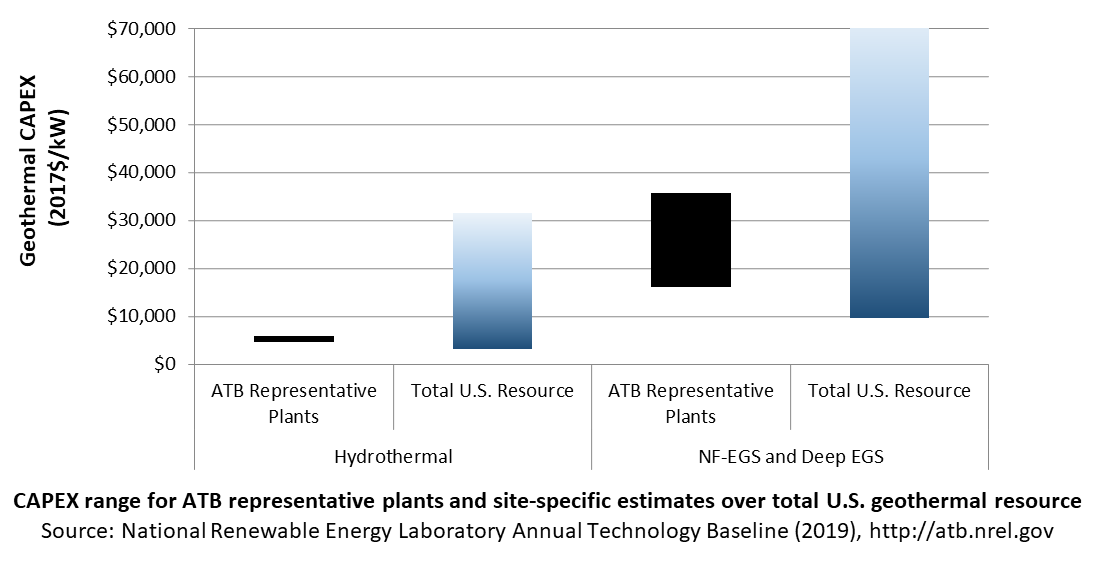

The following table shows the range of OCC associated with the resource characteristics for potential sites throughout the United States.

| Temp (°C) | >=200C | 150-200 | 135-150 | <135 | |

| Hydrothermal | Number of identified sites | 21 | 23 | 17 | 59 |

| Total capacity (MW) | 15,338 | 2,991 | 820 | 4,632 | |

| Average OCC ($/kW) | 3,906 | 7,720 | 8,794 | 16,248 | |

| Min OCC ($/kW) | 3,000 | 4,140 | 7,004 | 10,950 | |

| Max OCC ($/kW) | 5,491 | 29,135 | 11,027 | 21,349 | |

| Example of plant OCC ($/kW) | 4,229 | 5,455 | |||

| NF-EGS | Number of sites | 12 | 20 | ||

| Total capacity (MW) | 787 | 596 | |||

| Average OCC ($/kW) | 11,041 | 26,077 | |||

| Min OCC ($/kW) | 8,778 | 18,172 | |||

| Max OCC ($/kW) | 18,009 | 39,987 | |||

| Example of plant OCC ($/kW) | 14,512 | 32,268 | |||

| Deep EGS (3-6 km) | Number of sites | n/a | n/a | ||

| Total capacity (MW) | 100,000+ | ||||

| Average OCC ($/kW) | 28,418 | 60,170 | |||

| Min OCC ($/kW) | 18,320 | 39,329 | |||

| Max OCC ($/kW) | 54,047 | 77,983 | |||

| Example of plant OCC ($/kW) | 14,512 | 32,268 | |||

Future Year Projections

Projection of future geothermal plant CAPEX for the Low case is based on the GeoVision Technology Improvement scenario (DOE, 2019).

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

CAPEX Definition

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year.

For the ATB – and based on (EIA, 2016) and GETEM component cost calculations – the geothermal plant envelope is defined to include:

- Geothermal generation plant

- Exploration, confirmation drilling, well field development, reservoir stimulation (EGS), plant equipment, and plant construction

- Power plant equipment, well-field equipment, and components for wells (including dry/non-commercial wells)

- Balance of system (BOS)

- Installation and electrical infrastructure, such as transformers, switchgear, and electrical system connecting turbines to each other and to the control center

- Project indirect costs, including costs related to engineering, distributable labor and materials, construction management start up and commissioning, and contractor overhead costs, fees, and profit

- Financial costs

- Owners' costs, such as development costs, preliminary feasibility and engineering studies, environmental studies and permitting, legal fees, insurance costs, and property taxes during construction

- Electrical interconnection and onsite electrical equipment (e.g., switchyard), a nominal-distance spur line (<1 mile), and necessary upgrades at a transmission substation; distance-based spur line cost (GCC) not included in the ATB

- Interest during construction estimated based on four-year and five-year duration for hydrothermal and EGS respectively (for the low scenario) and an eight-year duration and ten-year duration for hydrothermal and EGS respectively (for the mid- and constant-scenario) accumulated at different intervals for hydro and EGS based on scheduled at outlined by the GeoVision Study (ConFinFactor).

CAPEX can be determined for a plant in a specific geographic location as follows:

Regional cost variations and geographically specific grid connection costs are not included in the ATB (CapRegMult = 1; GCC = 0). In the ATB, the input value is overnight capital cost (OCC) and details to calculate interest during construction (ConFinFactor).

In the ATB, CAPEX is shown for six representative plants. Examples of CAPEX for binary organic Rankine cycle and flash energy conversion processes in each of three geothermal resource types are presented. CAPEX estimates for all hydrothermal NF-EGS potential results in a CAPEX range that is much broader than that shown in the ATB. It is unlikely that all the resource potential will be developed due to the high costs for some sites. Regional cost effects and distance-based spur line costs are not estimated.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

The ReEDS model represents cost and performance for hydrothermal, NF-EGS, and EGS potential in 5 bins for each of 134 geographic regions, resulting in a greater CAPEX range in the reference supply curve than what is shown in examples in the ATB.

CAPEX in the ATB does not represent regional variants (CapRegMult) associated with labor rates, material costs, etc., and neither does the ReEDS model.

CAPEX in the ATB does not include geographically determined spur line (GCC) from plant to transmission grid, and neither does the ReEDS model.

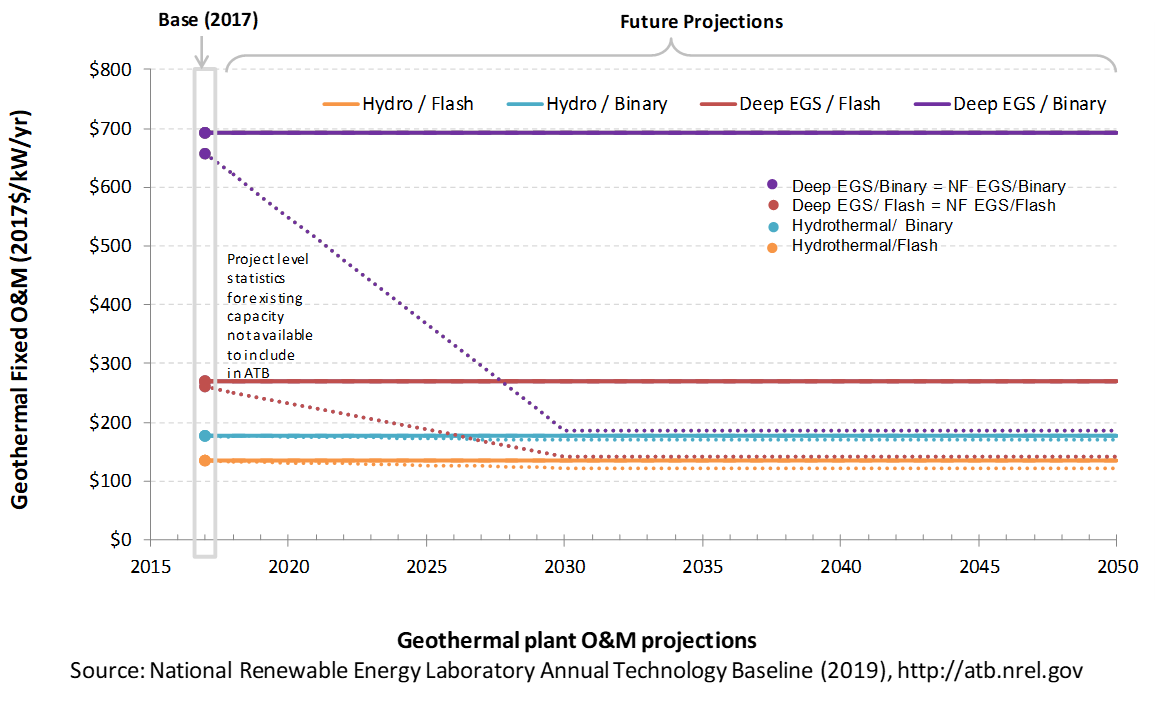

Operations and maintenance (O&M) costs represent average annual fixed expenditures (and depend on rated capacity) required to operate and maintain a hydrothermal plant over its lifetime of 30 years (plant and reservoir), including:

- Insurance, taxes, land lease payments, and other fixed costs

- Present value and annualized large component overhaul or replacement costs over technical life (e.g., downhole pumps)

- Scheduled and unscheduled maintenance of geothermal plant components and well field components over the technical lifetime of the plant and reservoir.

The following figure shows the Base Year estimate and future year projections for fixed O&M (FOM) costs. Three cost scenarios are represented. The estimate for a given year represents annual average FOM costs expected over the technical lifetime of a new plant that reaches commercial operation in that year.

Base Year Estimates

FOM is estimated for each example of a plant based on technical characteristics.

GETEM is used to estimate FOM for each of the six representative plants. FOM for NF-EGS and EGS are equivalent.

Future Year Projections

Future FOM cost reductions are based on results from the GeoVision scenario (DOE, 2019) and are described in detail in Augustine, Ho, and Blair (2019).

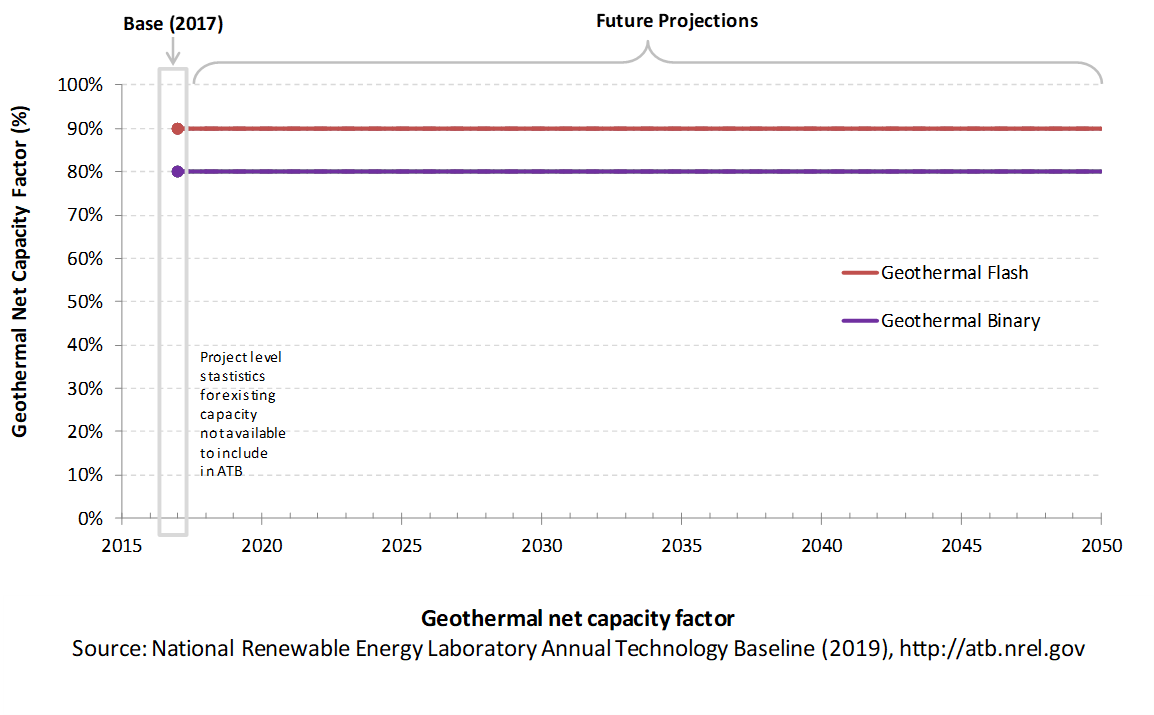

Capacity Factor: Expected Annual Average Energy Production Over Lifetime

The capacity factor represents the expected annual average energy production divided by the annual energy production, assuming the plant operates at rated capacity for every hour of the year. It is intended to represent a long-term average over the technical lifetime of the plant. It does not represent interannual variation in energy production. Future year estimates represent the estimated annual average capacity factor over the technical lifetime of a new plant installed in a given year.

Geothermal plant capacity factor is influenced by diurnal and seasonal air temperature variation (for air-cooled plants), technology (e.g., binary or flash), downtime, and internal plant energy losses.

The following figure shows a range of capacity factors based on variation in the resource for plants in the contiguous United States. The range of the Base Year estimates illustrates Binary or Flash geothermal plants. Future year projections for the Constant, Mid, and Low technology cost scenarios are unchanged from the Base Year. Technology improvements are focused on CAPEX cost elements.

Base Year Estimate

The capacity factor estimates are developed using GETEM at typical design air temperature and based on design plant capacity net losses. An additional reduction is applied to approximate potential variability due to seasonal temperature effects.

Some geothermal plants have experienced year-on-year reductions in energy production, but this is not consistent across all plants. No approximation of long-term degradation of energy output is assumed.

Ongoing work at NREL and the Idaho National Laboratory is helping improve capacity factor estimates for geothermal plants. As this work progresses, it will be incorporated into future versions of the ATB.

Future Year Projections

Capacity factors remain unchanged from the Base Year through 2050. Technology improvements are focused on CAPEX costs. Estimates of capacity factor for geothermal plants in the ATB represent typical operation. The dispatch characteristics of these systems are valuable to the electric system to manage changes in net electricity demand. Actual capacity factors will be influenced by the degree to which system operators call on geothermal plants to manage grid services.

Plant Cost and Performance Projections Methodology

The site-specific nature of geothermal plant cost, the relative maturity of hydrothermal plant technology, and the very early stage development of EGS technologies make cost projections difficult. No thorough literature reviews have been conducted for cost reduction of hydrothermal geothermal technologies or EGS technologies. However, the GeoVision BAU scenario is based on a bottom-up analysis of costs and performance improvements. The inputs for the BAU scenario were developed by the national laboratories as part of the GeoVision effort, and it was reviewed by industry experts.

Projection of future geothermal plant CAPEX for the Low cost case is based on the GeoVision Technology Improvement scenario. It assumes that cost and technology improvements are achieved by 2030 and that costs decrease linearly from present values to the 2030 projected values. The Mid cost case is based on minimum learning rates as implemented in AEO (EIA, 2015): 10% by 2035. This corresponds to a 0.5% annual improvement in CAPEX, which is assumed to continue on through 2050. The Constant technology cost scenario retains all cost and performance assumptions equivalent to the Base Year through 2050.

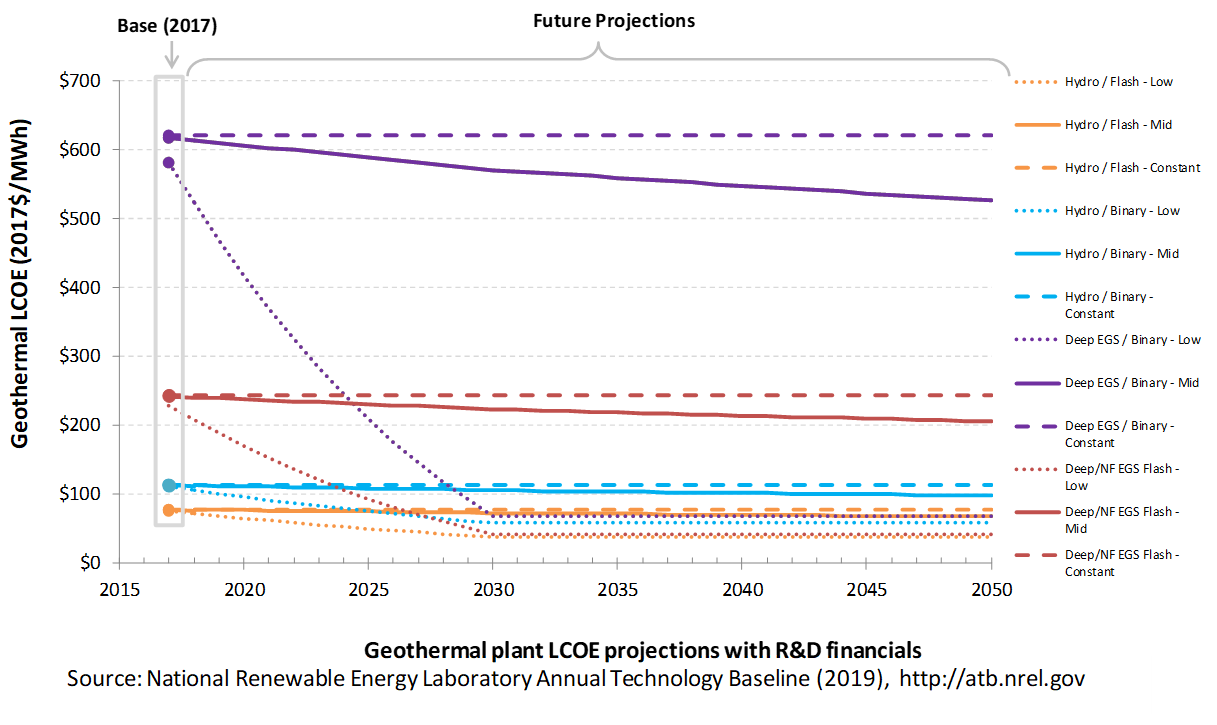

Levelized Cost of Energy (LCOE) Projections

Levelized cost of energy (LCOE) is a simple metric that combines the primary technology cost and performance parameters: CAPEX, O&M, and capacity factor. It is included in the ATB for illustrative purposes. The ATB focuses on defining the primary cost and performance parameters for use in electric sector modeling or other analysis where more sophisticated comparisons among technologies are made. The LCOE accounts for the energy component of electric system planning and operation. The LCOE uses an annual average capacity factor when spreading costs over the anticipated energy generation. This annual capacity factor ignores specific operating behavior such as ramping, start-up, and shutdown that could be relevant for more detailed evaluations of generator cost and value. Electricity generation technologies have different capabilities to provide such services. For example, wind and PV are primarily energy service providers, while the other electricity generation technologies such as geothermal, can provide capacity and flexibility services in addition to energy. These capacity and flexibility services are difficult to value and depend strongly on the system in which a new generation plant is introduced. These services are represented in electric sector models such as the ReEDS model and corresponding analysis results such as the Standard Scenarios.

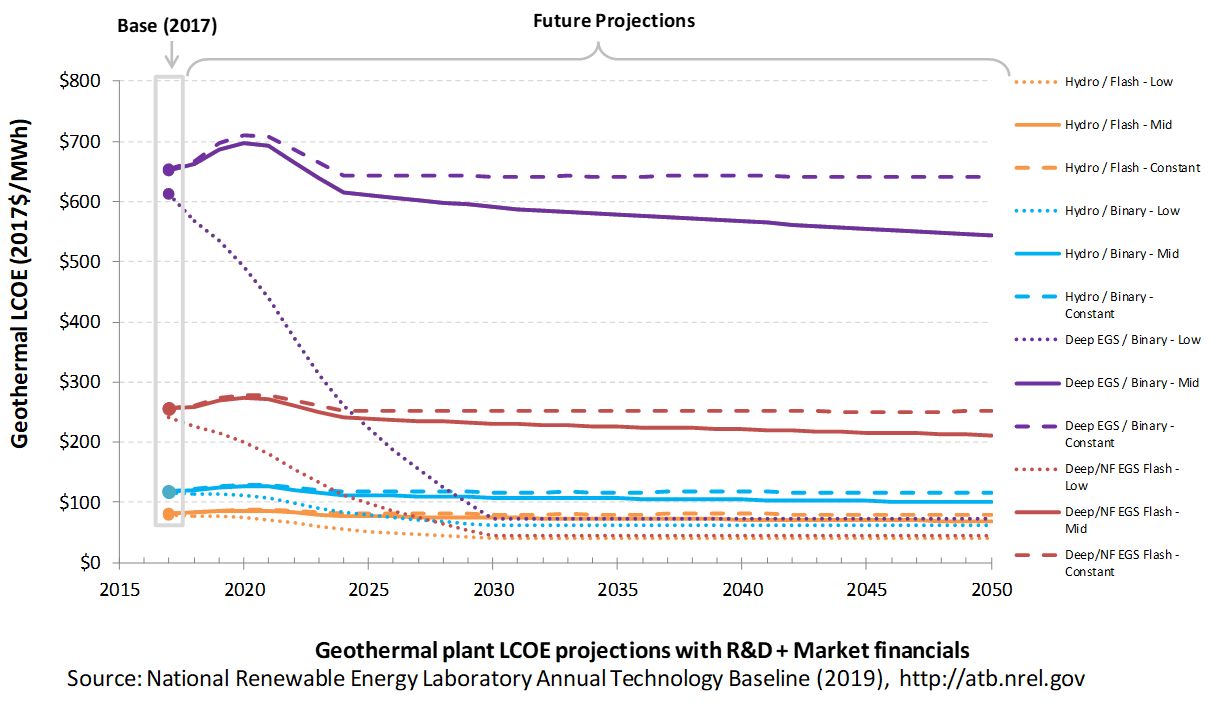

The following three figures illustrate LCOE, which includes the combined impact of CAPEX, O&M, and capacity factor projections for geothermal across the range of resources present in the contiguous United States. For the purposes of the ATB, the costs associated with technology and project risk in the U.S. market are represented in the financing costs but not in the upfront capital costs (e.g., developer fees and contingencies). An individual technology may receive more favorable financing terms outside the United States, due to less technology and project risk, caused by more project development experience (e.g., offshore wind in Europe) or more government or market guarantees. The R&D Only LCOE sensitivity cases present the range of LCOE based on financial conditions that are held constant over time unless R&D affects them, and they reflect different levels of technology risk. This case excludes effects of tax reform, tax credits, technology-specific tariffs, and changing interest rates over time. The R&D + Market LCOE case adds to these financial assumptions: (1) the changes over time consistent with projections in the Annual Energy Outlook and (2) the effects of tax reform, tax credits, and tariffs. The ATB representative plant characteristics that best align with those of recently installed or anticipated near-term geothermal plants are associated with Hydrothermal/Flash. Data for all the resource categories can be found in the ATB Data spreadsheet; for simplicity, not all resource categories are shown in the figures.

R&D Only | R&D + Market

The methodology for representing the CAPEX, O&M, and capacity factor assumptions behind each pathway is discussed in Projections Methodology. In general, the degree of adoption of technology innovation distinguishes the Constant, Mid, and Low technology cost scenarios. These projections represent trends that reduce CAPEX and improve performance. Development of these scenarios involves technology-specific application of the following general definitions:

- Constant Technology: Base Year (or near-term estimates of projects under construction) equivalent through 2050 maintains current relative technology cost differences

- Mid Technology Cost Scenario: Technology advances through continued industry growth, public and private R&D investments, and market conditions relative to current levels that may be characterized as "likely" or "not surprising"

- Low Technology Cost Scenario: Technology advances that may occur with breakthroughs, increased public and private R&D investments, and/or other market conditions that lead to cost and performance levels that may be characterized as the " limit of surprise" but not necessarily the absolute low bound.

To estimate LCOE, assumptions about the cost of capital to finance electricity generation projects are required, and the LCOE calculations are sensitive to these financial assumptions. Two project finance structures are used within the ATB:

- R&D Only Financial Assumptions: This sensitivity case allows technology-specific changes to debt interest rates, return on equity rates, and debt fraction to reflect effects of R&D on technological risk perception, but it holds background rates constant at 2017 values from AEO2019 (EIA, 2019) and excludes effects of tax reform, tax credits, and tariffs.

- R&D Only + Market Financial Assumptions: This sensitivity case retains the technology-specific changes to debt interest, return on equity rates, and debt fraction from the R&D Only case and adds in the variation over time consistent with AEO2018, as well as effects of tax reform, tax credits, and technology-specific tariffs. For a detailed discussion of these assumptions, see Changes from 2018 ATB to 2019 ATB.

A constant cost recovery period – over which the initial capital investment is recovered – of 30 years is assumed for all technologies throughout this website, and can be varied in the ATB data spreadsheet.

The equations and variables used to estimate LCOE are defined on the Equations and Variables page. For illustration of the impact of changing financial structures such as WACC, see Project Finance Impact on LCOE. For LCOE estimates for the Constant, Mid, and Low technology cost scenarios for all technologies, see 2019 ATB Cost and Performance Summary.

In general, differences among the technology cost cases reflect different levels of adoption of innovations. Reductions in technology costs reflect the cost reduction opportunities that are listed below.

- Development of exploration and reservoir characterization tools that reduce well-field costs through risk reduction by locating and characterizing low- and moderate-temperature hydrothermal systems prior to drilling

- High-temperature tools and electronics for geothermal subsurface operations

- Development of reservoir engineering techniques and technologies that enable EGS

- More efficient drilling practices and advanced drilling systems such as using flames or lasers to drill through rock; drilling steering technology; and other technologies to reduce drilling costs.

References

The following references are specific to this page; for all references in this ATB, see References.2019 Wind Energy Technologies Office Funding Opportunity Announcement. (2019, April). U.S. Department of Energy, EERE.

Augustine, Chad, Ho, J., & Blair, N. (2019). GeoVision Analysis Supporting Task Force Report: Electric Sector Potential to Penetration (No. NREL/ TP-6A20-71833). Retrieved from National Renewable Energy Laboratory website: https://www.nrel.gov/docs/fy19osti/71833.pdf

Augustine, Chad. (2016). Updates to Enhanced Geothermal System Resource Potential Estimate. GRC Transactions, 40, 673–677. Retrieved from http://pubs.geothermal-library.org/lib/grc/1032382.pdf

AWS. (2012). Wind Resource of the United States: Mean Annual Wind Speed at 200m Resolution. Retrieved from https://aws-dewi.ul.com/assets/Wind-Resource-Map-UNITED-STATES-11x171.pdf

BNEF. (2018b). BloombergNEF - EPVAL Wind Inputs 2H 2018 - US - Onshore. BNEF.

DOE EERE. (2019, February). Advanced Next-Generation High Efficiency Lightweight Wind Turbine Generator. U.S. Department of Energy, EERE.

DOE, & NREL. (2015). Wind Vision: A New Era for Wind Power in the United States (Technical Report No. DOE/GO-102015-4557). Retrieved from U.S. Department of Energy website: https://www.nrel.gov/docs/fy15osti/63197-2.pdf

DOE. (2018, May 8). Pathways to Success for Next-Generation Supersized Wind Turbine Blades. U.S. Department of Energy, EERE.

DOE. (2019). GeoVision: Harnessing the Heat Beneath Our Feet (No. DOE/EE-1306). Retrieved from U.S. Department of Energy website: https://www.energy.gov/eere/geothermal/geovision

Dykes, K., Hand, M., Stehly, T., Veers, P., Robinson, M., Lantz, E., & Tusing, R. (2017). Enabling the SMART Wind Power Plant of the Future Through Science-Based Innovation (No. NREL/TP-5000-68123). https://doi.org/10.2172/1378902

EIA. (2015). Annual Energy Outlook 2015 with Projections to 2040 (No. AEO2015). Retrieved from U.S. Energy Information Administration website: https://www.eia.gov/outlooks/aeo/pdf/0383(2015).pdf

EIA. (2016b). Capital Cost Estimates for Utility Scale Electricity Generating Plants. Retrieved from U.S. Energy Information Administration website: https://www.eia.gov/analysis/studies/powerplants/capitalcost/pdf/capcost_assumption.pdf

EIA. (2019a). Annual Energy Outlook 2019 with Projections to 2050. Retrieved from U.S. Energy Information Administration website: https://www.eia.gov/outlooks/aeo/pdf/AEO2019.pdf

Kost, C., Shammugam, S., Julch, V., Huyen-Tran, N., & Schlegl, T. (2018). Levelized Cost of Electricity Renewable Energy Technologies. Retrieved from Fraunhofer website: https://www.ise.fraunhofer.de/content/dam/ise/en/documents/publications/studies/EN2018_Fraunhofer-ISE_LCOE_Renewable_Energy_Technologies.pdf

Lopez, A., Roberts, B., Heimiller, D., Blair, N., & Porro, G. (2012). U.S. Renewable Energy Technical Potentials: A GIS-Based Analysis (Technical Report No. NREL/TP-6A20-51946). https://doi.org/10.2172/1219777

Mines, G. (2013, April). Geothermal Electricity Technology Evaluation Model (GETEM). Presented at the Geothermal Technologies Office 2013 Peer Review, Washington, D.C. Retrieved from https://energy.gov/sites/prod/files/2014/02/f7/mines_getem_peer2013.pdf

Moné, C., Smith, A., Maples, B., & Hand, M. (2015). 2013 Cost of Wind Energy Review (No. NREL/TP-5000-63267). https://doi.org/10.2172/1172936

Moné, Christopher, Hand, M., Bolinger, M., Rand, J., Heimiller, D., & Ho, J. (2017). 2015 Cost of Wind Energy Review (No. NREL/TP-6A20-66861). https://doi.org/10.2172/1351062

Roberts, B. J. (2009). Geothermal Resource of the United States: Locations of Identified Hydrothermal Sites and Favorability of Deep Enhanced Geothermal Systems (EGS). Retrieved from https://www.nrel.gov/gis/images/geothermal_resource2009-final.jpg

Shreve, D. (2018). United States Wind Energy Market Outlook. Wood Mackenzie.

Stehly, T., Beiter, P., Heimiller, D., & Scott, G. (2018). 2017 Cost of Wind Energy Review (Technical Report No. NREL/TP-6A20-72167). Retrieved from National Renewable Energy Laboratory website: www.nrel.gov/docs/fy18osti/72167.pdf

Stehly, T., Beiter, P., Heimiller, D., & Scott, G. (2020). 2018 Cost of Wind Energy Review (Technical Report No. NREL/TP-5000-74598). Retrieved from National Renewable Energy Laboratory website: https://www.nrel.gov/docs/fy20osti/74598.pdf

Tester, J. W., & et al. (2006). The Future of Geothermal Energy: Impact of Enhanced Geothermal Systems (EGS) on the United States in the 21st Century. Cambridge, MA: Massachusetts Institute of Technology.

USGS. (2008). Assessment of Moderate- and High-Temperature Geothermal Resources of the United States (No. Fact Sheet 2008-3082). Retrieved from U.S. Geological Survey website: https://pubs.usgs.gov/fs/2008/3082/pdf/fs2008-3082.pdf

Wiser, R., & Bolinger, M. (2018). 2017 Wind Technologies Market Report (No. DOE/EE-1798). https://doi.org/10.2172/1471044

Wiser, R., Bolinger, M., & Lantz, E. (2019). Assessing Wind Power Operating Costs in the United States: Results from a Survey of Wind Industry Experts. Renewable Energy Focus.

Wiser, R., Jenni, K., Seel, J., Baker, E., Hand, M., Lantz, E., & Smith, A. (2016). Forecasting Wind Energy Costs and Cost Drivers: The Views of the World's Leading Experts (No. LBNL-1005717; p. 87 pp.). Retrieved from Lawrence Berkeley National Laboratory website: https://emp.lbl.gov/publications/forecasting-wind-energy-costs-and