Commercial PV

Capital Expenditures (CAPEX)

Definition: Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year. For commercial PV, this is modeled for only a host-owned business model with access to debt.

For the 2020 ATB, and based on EIA (2016b) and the NREL Solar-PV Cost Model (Feldman et al. Forthcoming) (Barbose and Darghouth 2018), the distributed solar PV plant envelope is defined to include items noted in the table above.

Base Year: In the chart below, reported historical commercial-scale PV installation CAPEX (Barbose and Darghouth 2018) is shown in box-and-whiskers format for comparison to historical commercial-scale PV benchmark overnight capital cost and ATB future CAPEX projections. The data in Barbose and Darghouth (2018) represent 81% of all U.S. residential PV and commercial PV capacity installed through 2018 and 76% of capacity installed in 2018.

The difference in each year's price between the market and benchmark data reflects differences in methodologies. Reported and benchmark prices can differ for a variety of reasons, as enumerated by Barbose and Darghouth (2018) and Bolinger, Seel, and Robson (2018), including:

- Timing-related issues: For instance, the time between contract completion and project placement in service may vary.

- Variations over time in the size, technology, installer margin, and design of systems installed in a given year

- Which cost categories are included in CAPEX (e.g., financing costs and initial O&M expenses).

Federal investment tax credits provide an incentive to include costs in the upfront CAPEX to receive a higher tax credit, and these included costs may have otherwise been reported as operating costs. The bottom-up benchmarks are more reflective of an overnight capital cost, which is in line with the ATB methodology of inputting overnight capital cost and calculating construction financing to derive CAPEX.

Commercial PV pricing and capacities are quoted in kWDC (i.e., module rated capacity) unlike other generation technologies (including utility-scale PV), which are quoted in kWAC. For commercial PV, this would correspond to the combined rated capacity of all inverters. This is because kWDC is the unit that the majority of the PV industry uses. Although costs are reported in kWDC, the total CAPEX includes the cost of the inverter, which has a capacity measured in kWAC.

CAPEX estimates for 2019 reflect continued rapid decline in pricing supported by analysis of recent system pricing for projects that became operational in 2019 (Feldman et al. Forthcoming).

The historical chart above shows the range in historical CAPEX that reflects the heterogeneous composition of the commercial PV market in the United States.

The chart also includes a representative commercial-scale PV installation. Although commercial PV systems vary dramatically in size and application, typical installation costs are represented with a single estimate per innovations scenario. Additionally, commercial PV CAPEX does not correlate well with solar resource.

Although the technology market share may shift over time with new developments, the typical installation cost is represented with the projections above.

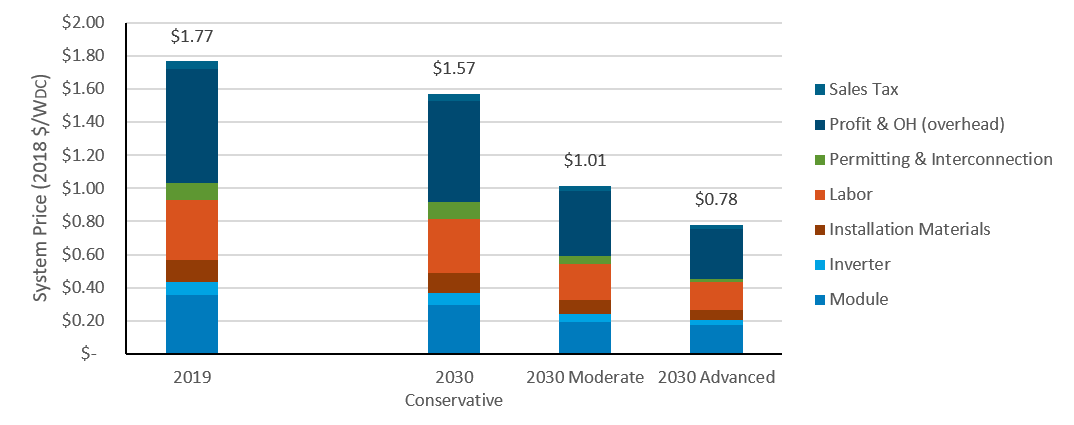

System prices of $2.00/WDC in 2018 and $1.77/WDC in 2019 are based on bottom-up benchmark analysis reported in U.S. Solar Photovoltaic System Cost Benchmark Q1 2019 (Feldman et al. Forthcoming), adjusted for inflation. The 2018 and 2019 bottom-up benchmarks are reflective of an overnight capital cost, which is in line with the ATB methodology of inputting overnight capital cost and calculating construction financing to derive CAPEX.

The Base Year CAPEX estimates should tend toward the low end of observed cost because no regional impacts are included. These effects are represented in the historical market data.

Future Years: Projections of 2030 commercial PV plant CAPEX are based on bottom-up cost modeling, with a straight-line change in price in the intermediate years between 2019 and 2030. A summary of the system design and price changes made in the models are described in the Summary of Technology Innovations by Scenario table. See below for the details of changes to components of system price in the different ATB scenarios.

We assume each scenario's 2050 CAPEX is the equivalent of the 2030 CAPEX of the scenario but one degree more aggressive, with a straight-line change in price in the intermediate years between 2030 and 2050. Asterisks indicate corresponding cells, where scenarios use the same values but shifted in time. We also developed and modeled a scenario one degree more aggressive than the Advanced Scenario to estimate its 2050 CAPEX. The 2050 Advances Scenario assumes: a module efficiency of 30%, achieved through double-junction cells (perovskite on top of c-Si); further inverter simplification and manufacturing automation; 50% labor cost improvements through automation and pre-assembly efficiencies; and that low-cost carbon fiber cuts material costs in half.

Year | Advanced (Increased level of R&D) | Moderate (Current level of R&D) | Conservative (Decreased level of R&D) |

2030 | **Commercial PV CAPEX: $0.78/WDC | ***Commercial PV CAPEX: $1.01/WDC | Commercial PV CAPEX: $1.57/WDC |

2050 | *$0.57/WDC | **$0.78/WDC | ***$1.01/WDC |

We compared the CAPEX scenarios over time to four analysts' projections, adjusted for inflation (see chart below). The 2020 ATB CAPEX projections are fairly in-line with other analysts' projections through 2030, with the exception of the analysts' maximum projection, which starts at a much higher CAPEX. Two of the four analyst projections do not go beyond 2030, so there are limited datapoints to compare the ATB projections, however the Advanced Scenario is in-line with the minimum analyst projection.

Use the following table to view the components of CAPEX.

References

The following references are specific to this page; for all references in this ATB, see References.

Barbose, Galen, & Dargouth, Naïm. (2018). Tracking the Sun XI: The Installed Price of Residential and Non-Residential Photovoltaic Systems in the United States. (No. LBNL-2001062). Lawrence Berkeley National Laboratory. https://eta-publications.lbl.gov/sites/default/files/tracking_the_sun_2018_edition_final.pdf

BNEF (2019). 2H 2019 US PV Market Outlook. BNEF (Bloomberg New Energy Finance).

BNEF (2019). New Energy Outlook 2019. https://about.bnef.com/new-energy-outlook/

Bolinger, Mark, & Seel, Joachim. (2018). Utility-Scale Solar: An Empirical Trends in Project Technology, Cost, Performance, and PPA Pricing in the United States (2018 Edition). Lawrence Berkeley National Laboratory. https://emp.lbl.gov/sites/default/files/lbnl_utility_scale_solar_2018_edition_report.pdf

EIA (2016). Capital Cost Estimates for Utility Scale Electricity Generating Plants. U.S. Energy Information Administration. https://www.eia.gov/analysis/studies/powerplants/capitalcost/pdf/capcost_assumption.pdf

EIA (2020). Annual Energy Outlook 2020 with Projections to 2050. (No. AEO2020). U.S. Energy Information Administration. https://www.eia.gov/outlooks/aeo/pdf/AEO2020.pdf

Feldman, David, Vignesh Ramasamy, Ran Fu, Ashwin Ramdas, Jal Desai, and Robert Margolis. (Forthcoming). U.S. Solar Photovoltaic System and Energy Storage Cost Benchmark: Q1 2020. Golden, CO: National Renewable Energy Laboratory.

Fu, Ran, Feldman, David, & Margolis, Robert. (2018). U.S. Solar Photovoltaic System Cost Benchmark: Q1 2018. National Renewable Energy Laboratory. https://www.nrel.gov/docs/fy19osti/72399.pdf

Wood Mackenzie (2019). U.S. PV System Pricing H2 2019: System Pricing, Breakdowns and Forecasts. https://www.woodmac.com/reports/power-markets-us-solar-pv-system-pricing-h2-2019-361390

Developed with funding from the U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy.