Utility-Scale PV

Capital Expenditures (CAPEX)

Definitions: For a PV system, the rated capacity in the denominator is reported in terms of the aggregated capacity of either (1) all its modules or (2) all its inverters. PV modules are rated using standard test conditions and produce direct current (DC) energy; inverters convert DC energy/power to alternating current (AC) energy/power. Therefore, the capacity of a PV system is rated either in MWDC via the aggregation of all modules' rated capacities or in MWAC via the aggregation of all inverters' rated capacities. The ratio of these two capacities is referred to as the inverter loading ratio (ILR). The 2020 ATB assumes current estimates and future projections use an inverter loading ratio of 1.34.

The PV industry typically refers to PV CAPEX in units of $/MWDC based on the aggregated module capacity. The electric utility industry typically refers to PV CAPEX in units of $/MWAC based on the aggregated inverter capacity; for the 2020 ATB, we have switched to using $/MWAC for utility-scale PV.

Plant costs are represented with a single estimate per innovations scenario, because CAPEX does not correlate well with solar resource.

For the 2020 ATB, and based on EIA (2016a) and the NREL Solar PV Cost Model (Feldman et al. Forthcoming), the utility-scale solar PV plant envelope is defined to include items noted in the table above.

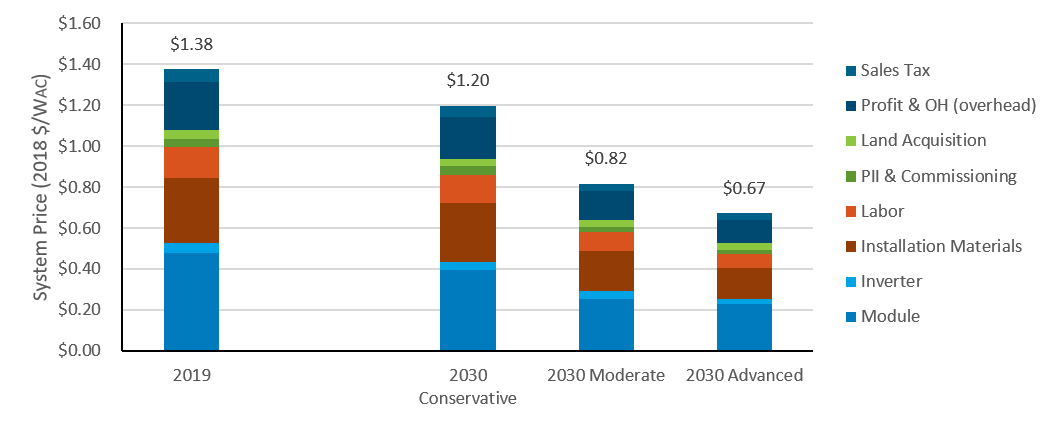

Base Year: A system price of $1.57/WAC in 2018 is based on modeled pricing for a 100-MWDC, one-axis tracking systems quoted in Q1 2018 as reported by, adjusted from $/WDC to $/WAC by an ILR of 1.34. The $1.38/WAC price in 2020 is based on modeled pricing for a 100-MWDC, one-axis tracking systems quoted in Q1 2019 as reported by Feldman et al. (2018).

We focus on larger systems for the 2018 and 2019 values to better align with the current trends in utility-scale installations. (EIA 2020) reported 92 PV installations (greater than 5 MWAC in capacity) totaling 4.4 GWAC were placed in service in 2019 in the United States. While this represents an average of approximately 48 MWAC, 76% of the installed capacity in 2018 came from systems greater than 50 MWAC, and 39% came from systems greater than 100 MWAC.

In the historical data chart below, reported historical utility-scale PV plant CAPEX (Bolinger and Seel 2018) is shown in box-and-whiskers format for comparison to the historical benchmarked utility-scale PV plant overnight capital cost and future CAPEX projections. Bolinger, Seel, and Robson (2018) provide statistical representation of CAPEX for 93% of all utility-scale PV capacity.

The difference in each year's price between the market and benchmark data reflects differences in methodologies. Reported and benchmark prices can differ for a variety of reasons, as enumerated by Barbose and Darghouth (2018) and Bolinger, Seel, and Robson (2018), including:

- Timing-related issues: For instance, the time between PPA contract completion and project placement in service may vary, and a system can be reported as installed in separate sections over time or when an entire complex is complete. For example, in 2014, the reported capacity-weighted average system price was higher than 80% of system prices in 2014 due to very large systems with multiyear construction schedules being installed in that year. Developers of these large systems negotiated contracts and installed portions of their systems when module and other costs were higher.

- Variations over time in the size, technology, installer margin, and design of systems installed in a given year

- Which cost categories are included in CAPEX (e.g., financing costs and initial O&M expenses).

Federal investment tax credits provide an incentive to include costs in the upfront CAPEX to receive a higher tax credit, and these included costs may have otherwise been reported as operating costs. The bottom-up benchmarks are more reflective of an overnight capital cost, which is in line with the ATB methodology of inputting overnight capital cost and calculating construction financing to derive CAPEX.

Future Years

Projections of 2030 utility-scale PV plant CAPEX are based on bottom-up cost modeling, with a straight-line change in price in the intermediate years between 2019 and 2030. ILR is assumed to remain at a constant 1.34 over time. A summary of the system design and price changes made in the models are described in the Summary of Technology Innovations by Scenario table. See below for the details of changes to components of system price in the different ATB scenarios.

We assume each scenario's 2050 CAPEX is the equivalent of the 2030 CAPEX of the scenario but one degree more aggressive, with a straight-line change in price in the intermediate years between 2030 and 2050. Asterisks indicate corresponding cells, where scenarios use the same values but shifted in time. We also developed and modeled a scenario one degree more aggressive than the Advanced Scenario to estimate its 2050 CAPEX. The 2050 Advances Scenario assumes: a module efficiency of 30%, achieved through double-junction cells (perovskite on top of c-Si); further inverter simplification and manufacturing automation; 50% labor cost improvements through automation and pre-assembly efficiencies; and that low-cost carbon fiber cuts material costs in half.

Year | Advanced (Increased level of R&D) | Moderate (Current level of R&D) | Conservative (Decreased level of R&D) |

2030 | **Utility-scale CAPEX: $0.67/WAC | ***Utility-scale CAPEX: $0.82/WAC | Utility-scale CAPEX: $1.20/WAC |

2050 | $0.51/WAC | **$0.67/WAC | ***$0.82/WAC |

However, it is important to keep in mind that analyst projections represent analyst expected outcomes, while the Advanced Scenario represents NREL's estimate of an unlikely outcome (20%-50% likelihood). We compared the CAPEX scenarios over time to five analysts' projections, adjusted for inflation and ILR. The 2030 CAPEX Conservative, Moderate, and Advanced Scenarios line up fairly well with the maximum, median, and minimum analyst projections (see chart below). The 2050 CAPEX Conservative and Moderate Scenarios exceed all analysts' other projections; however, it is important to keep in mind that analysts' projections represent analyst expected outcomes, while the Conservative and Moderate Scenarios represent NREL's estimate of an outcome which will likely be exceeded.

References

The following references are specific to this page; for all references in this ATB, see References.

Barbose, Galen, & Dargouth, Naïm. (2018). Tracking the Sun XI: The Installed Price of Residential and Non-Residential Photovoltaic Systems in the United States. (No. LBNL-2001062). Lawrence Berkeley National Laboratory. https://eta-publications.lbl.gov/sites/default/files/tracking_the_sun_2018_edition_final.pdf

BNEF (2019). 2H 2019 US PV Market Outlook. BNEF (Bloomberg New Energy Finance).

BNEF (2019). New Energy Outlook 2019. https://about.bnef.com/new-energy-outlook/

Bolinger, Mark, & Seel, Joachim. (2018). Utility-Scale Solar: An Empirical Trends in Project Technology, Cost, Performance, and PPA Pricing in the United States (2018 Edition). Lawrence Berkeley National Laboratory. https://emp.lbl.gov/sites/default/files/lbnl_utility_scale_solar_2018_edition_report.pdf

EIA (2016). Annual Energy Outlook 2016 Early Release: Annotated Summary of Two Cases. (No. AEO2016). U.S. Energy Information Administration. https://www.eia.gov/outlooks/archive/aeo16/er/

EIA (2019). Annual Energy Outlook 2019 with Projections to 2050. (No. AEO2019). U.S. Energy Information Administration. https://www.eia.gov/outlooks/aeo/pdf/AEO2019.pdf

EIA (2020). Annual Energy Outlook 2020 with Projections to 2050. (No. AEO2020). U.S. Energy Information Administration. https://www.eia.gov/outlooks/aeo/pdf/AEO2020.pdf

Feldman, David, Vignesh Ramasamy, Ran Fu, Ashwin Ramdas, Jal Desai, and Robert Margolis. (Forthcoming). U.S. Solar Photovoltaic System and Energy Storage Cost Benchmark: Q1 2020. Golden, CO: National Renewable Energy Laboratory.

Fu, Ran, Feldman, David, & Margolis, Robert. (2018). U.S. Solar Photovoltaic System Cost Benchmark: Q1 2018. National Renewable Energy Laboratory. https://www.nrel.gov/docs/fy19osti/72399.pdf

Wood Mackenzie (2019). U.S. PV System Pricing H2 2019: System Pricing, Breakdowns and Forecasts. https://www.woodmac.com/reports/power-markets-us-solar-pv-system-pricing-h2-2019-361390

Developed with funding from the U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy.