Annual Technology Baseline 2017

National Renewable Energy Laboratory

Recommended Citation:

NREL (National Renewable Energy Laboratory). 2017. 2017 Annual Technology Baseline. Golden, CO: National Renewable Energy Laboratory. http://atb.nrel.gov/.

Please consult Guidelines for Using ATB Data:

https://atb.nrel.gov/electricity/user-guidance.html

2017 ATB

For each electricity generation technology in the ATB, this website provides:

- Capital expenditures (CAPEX): the definition of CAPEX used in the ATB and the historical trends, current estimates, and future projections of CAPEX used in the ATB

- Operations and maintenance (O&M) costs: the definition of O&M and the current estimates and future projections of O&M used in the ATB

- Capacity factor (CF): the definition of CF and the historical trends, current estimates, and future projections of CF used in the ATB

- Future cost and performance methods: an outline of the methodology used to make the projections of future cost and performance in the ATB for High, Mid, and Low cost cases

- Levelized cost of energy (LCOE): metric that combines CAPEX, O&M, CF, and projections for High-, Mid-, Low-cost cases for illustration of the combined effect of the primary cost and performance components and discussion of technology advances that yield future projections.

Electricity generation technologies are selected on the left side of the screen, and the topics highlighted above can be selected using the drop-down menu at the top-right of the screen.

Guidelines for using and interpreting ATB content are provided. LCOE captures the energy component of electric system planning and operation, but the electric system also requires capacity and flexibility services to operate reliably. These services are represented in electric sector models such as the Regional Energy Deployment Systems (ReEDS) model and corresponding analysis results such as the NREL Standard Scenarios.

The NREL Standard Scenarios, a companion product to the ATB, provides a suite of electric sector scenarios and associated assumptions—including technology cost and performance assumptions from the ATB.

ATB data sources and references are also provided for each technology. All dollar values are presented in 2015 U.S. dollars, unless noted otherwise.

Additional information about the 2017 ATB—available via links in the ATB website footer below—includes:

Hydropower

Note: Pumped-storage hydropower is considered a storage technology in the ATB and will be addressed in future years. It and other storage technologies are represented in Standard Scenarios Model Results from the ReEDS model.

Upgrades to Existing Facilities

Representative Technology

Hydropower technologies have produced electricity in the United States for over a century. Many of these infrastructure investments have potential to continue providing electricity in the future through upgrades of existing facilities (DOE 2016). At individual facilities, investments can be made to improve the efficiency of existing generating units through overhauls, generator rewinds, or turbine replacements. Such investments are known collectively as "upgrades," and they are reflected as increases to plant capacity. As plants reach a license renewal period, upgrades to existing facilities to increase capacity or energy output are typically considered. While the smallest projects in the United States can be as small as 10-100 kW, the bulk of upgrade potential is from large, multi-megawatt facilities.

Resource Potential

The estimated total upgrade potential of 6.9 GW/24 TWh (at about 1,800 facilities) is based on generalizable information drawn from a series of case studies or owner-specific assessments (DOE 2016). Information available to inform the representation of improvements to the existing fleet includes:.

- A systematic, full-fleet assessment of expansion potential at Reclamation projects performed under the Reclamation Hydropower Modernization Initiative (see U.S. Bureau of Reclamation, "Hydropower Resource Assessment at Existing Reclamation Facilities")

- Case study reports from the U.S. Army Corps of Engineers (Corps) performed under its Hydropower Modernization Initiative (Montgomery, Watson, and Harza 2009)

- Case study reports combining assessments of upgrade and unit and plant optimization potential from the U.S. Department of Energy/Oak Ridge National Laboratory Hydropower Advancement Project.

Renewable energy technical potential, as defined by Lopez et al. (2012), represents the achievable energy generation of a particular technology given system performance, topographic limitations, and environmental and land-use constraints. The primary benefit of assessing technical potential is that it establishes an upper-boundary estimate of development potential. It is important to understand that there are multiple types of potential - resource, technical, economic, and market (Lopez et al. 2012; NREL, "Renewable Energy Technical Potential").

Base Year and Future Year Projections Overview

Upgrades are often among the lowest-cost new capacity resource, with the modeled costs for individual projects ranging from $800/kW to nearly $20,000/kW. This differential results from significant economies of scale from project size, wherein larger capacity plants are less expensive to upgrade on a dollar-per-kilowatt basis than smaller projects are. The average cost of the upgrade resource is approximately $1,500/kW.

CAPEX for each existing facility is based on direct estimates (DOI 2010) where available. Costs at non-reclamation plants were developed using Hall et al. (2003).

Cost= (277 × ExpansionMW-0.3) + (2230 × ExpansionMW-0.19)

The capacity factor is based on actual 10-year average energy production reported in EIA 923 forms. Some hydropower facilities lack flexibility and only produce electricity when river flows are adequate. Others with storage capabilities are operated to meet a balance between electric system, reservoir management, and environmental needs using their dispatch capability.

No future cost and performance projections for hydropower upgrades are assumed.

Upgrade cost and performance are not illustrated in this documentation of the ATB for the sake of simplicity.

Standard Scenarios Model Results

The ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for High, Mid, and Low projections are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

The ReEDS model times upgrade potential availability with the relicensing date, plant age (50 years), or both.

Powering Non-Powered Dams

Representative Technology

Non-powered dams (NPD) are classified by energy potential in terms of head. Low-head facilities have design heads below 20 m and typically exhibit the following characteristics (DOE 2016):

- 1MW to 10 MW

- New/rehabilitated intake structure

- Little, if any, new penstock

- Axial-flow or Kaplan turbines (2-4 units)

- New powerhouse (indoor)

- New/rehabilitated tailrace

- Minimal new transmission (<5 miles, if required)

- Capacity factor of 35% to 60%.

High-head facilities have design heads above 20 m and typically exhibit the following characteristics (DOE 2016):

- 5 MW to 30 MW

- New/rehabilitated intake structure

- New penstock (typically <500 feet of steel penstock, if required)

- Francis turbines (1–3 units)

- New powerhouse (indoor)

- New/rehabilitated tailrace

- Minimal new transmission line (up to 15 mw, if required)

- Capacity factor of 35% to 60%.

Resource Potential

Up to 12 GW of technical potential exists to add power to U.S. NPD. However, when economic decision-making approximating seen in recent development activity is taken into account, the economic potential of NPD may be approximately 5.6 GW at over 54,000 dams in the contiguous United States. The majority of this potential (5 GW or 90% of resource capacity) is associated with less than 700 dams (DOE 2016). These resource considerations are discussed below:

- According to the National Inventory of Dams, more than 80,000 dams exist that do not produce power. This data set was filtered to remove dams with erroneous flow and geographic data and dams whose data could not be resolved to a satisfactory level of detail (Hadjerioua, Wei, and Kao 2012). This initial assessment of 54,391 dams resulted in 12 GW of capacity.

- A new methodology for sizing potential hydropower facilities that was developed for the new-stream reach development resource (Kao et al. 2014) was applied to non-powered dams. This resource potential was estimated to be 5.6 GW at over 54,000 dams. In the development of the Hydropower Vision, the NPD resource available to the ReEDS model was adjusted based on recent development activity and limited to only those projects with power potential of 500 kW or more. As the ATB uses the Hydropower Vision supply curves, this results in a final resource potential of 5 GW/29 TWh from 671 dams.

- For each facility, a design capacity, average monthly flow rate over a 20-year period, and a design flow rate exceedance level of 30% are assumed. The exceedance level represents the fraction of time that the design flow is exceeded. This parameter can be varied and results in different capacity and energy generation for a given site. The value of 30% was chosen based on industry rules of thumb. The capacity factor for a given facility is determined by these design criteria.

- Design capacity and flow rate dictate capacity and energy generation potential. All facilities are assumed sized for 30% exceedance of flow rate based on long-term, average monthly flow rates.

Renewable energy technical potential, as defined by Lopez et al. (2012), represents the achievable energy generation of a particular technology given system performance, topographic limitations, and environmental and land-use constraints. The primary benefit of assessing technical potential is that it establishes an upper-boundary estimate of development potential. It is important to understand that there are multiple types of potential - resource, technical, economic, and market (Lopez at al. 2012; NREL, "Renewable Energy Technical Potential").

Base Year and Future Projections Overview

Site-specific CAPEX, O&M, and capacity factor estimates are made for each site in the available resource potential. CAPEX and O&M estimates are made based on statistical analysis of historical plant data from 1980 to 2015 (O'Connor et al. 2015a). Capacity factors are estimated based on historical flow rates. For presentation in the ATB, a subset of resource potential is aggregated into four representative NPD plants that span a range of realistic conditions for future hydropower deployment.

Projections developed for the Hydropower Vision study (DOE 2016) using technological learning assumptions and bottom-up analysis of process and/or technology improvements provide a range of future cost outcomes. Three different projections were developed for scenario modeling as bounding levels:

- High cost: no change in CAPEX, O&M, or capacity factor from 2015 to 2050; consistent across all renewable energy technologies in the ATB

- Mid cost: incremental technology learning, consistent with Reference in Hydropower Vision (DOE 2016); CAPEX reductions for new stream-reach development (NSD) only

- Low cost: gains that are achievable when pushing to the limits of potential new technologies, such as modularity (in both civil structures and power train design), advanced manufacturing techniques, and materials, consistent with Advanced Technology in Hydropower Vision (DOE 2016); both CAPEX and O&M cost reductions implemented.

Standard Scenarios Model Results

ATB CAPEX, O&M and capacity factor assumptions for Base Year and future projections through 2050 for Low, Mid, and High projections are used to develop Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

ReEDS Version 2017.1 standard scenario model results restrict the resource potential to sites greater than 500 kW consistent with the Hydropower Vision, which results in 5 GW/29 TWh at 671 dams.

New Stream-Reach Development

Representative Technology

Greenfield or new stream-reach development (NSD) sites are defined as new hydropower developments along previously undeveloped waterways and typically exhibit the following characteristics (DOE 2016):

- 1 MW to 100 MW

- New diversion/intake structure

- New penstock

- Steel with length being head/terrain dependent

- Various turbine selections

- Impulse/Francis are common for recently completed projects

- New powerhouse (indoor)

- New tailrace

- New transmission line (up to 15 miles for new projects)

- Capacity factor of 30% to 80%.

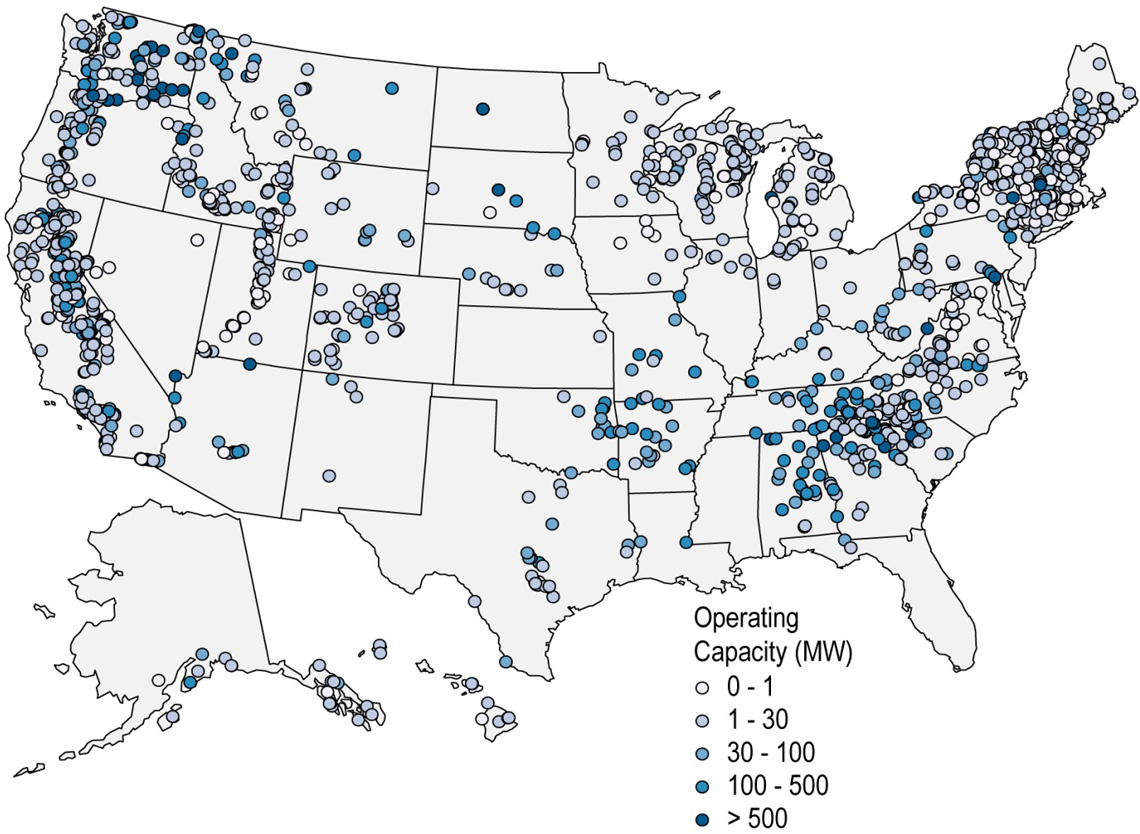

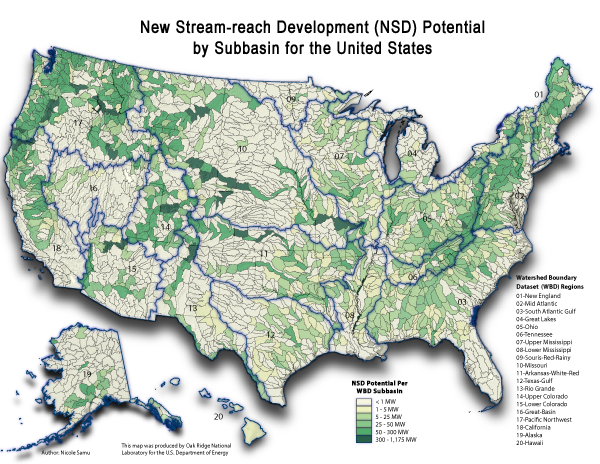

Resource Potential

The resource potential is estimated to be 53.2 GW/301 TWh at nearly 230,000 individual sites (Kao et al. 2014) after accounting for locations statutorily excluded from hydropower development such as national parks, wild and scenic rivers, and wilderness areas.

- About 8,500 stream reaches were evaluated to assess resource potential (i.e., capacity) and energy generation potential (i.e., capacity factor). For each stream reach, a design capacity, average monthly flow rate over a 20-year period, and design flow rate exceedance level of 30% are assumed. The exceedance level represents the fraction of time that the design flow is exceeded. This parameter can be varied and results in different capacity and energy generation for a given site. The value of 30% was chosen based on industry rules of thumb. The capacity factor for a given facility is determined by these design criteria. Plant sizes range from kilowatt-scale to multi-megawatt scale (Kao et al. 2014).

- The resource assessment approach is designed to minimize the footprint of a hydropower facility by restricting inundation area to the FEMA 100-year floodplain.

- New hydropower facilities are assumed to apply run-of-river operation strategies. Run-of-river operation means that the flow rate into a reservoir is equal to the flow rate out of the facility. These facilities do not have dispatch capability.

- Design capacity and flow rate dictate capacity and energy generation potential. All facilities are assumed sized for 30% exceedance of flow rate based on long-term, average monthly flow rates.

Renewable energy technical potential, as defined by Lopez et al. (2012), represents the achievable energy generation of a particular technology given system performance, topographic limitations, and environmental and land-use constraints. The primary benefit of assessing technical potential is that it establishes an upper-boundary estimate of development potential. It is important to understand that there are multiple types of potential - resource, technical, economic, and market (Lopez et al. 2012; NREL, "Renewable Energy Technical Potential").

Base Year and Future Year Projections Overview

Site-specific CAPEX, O&M, and capacity factor estimates are made for each site in the available resource potential. CAPEX and O&M estimates are made based on statistical analysis of historical plant data from 1980 to 2015 (O'Connor et al. 2015a). Capacity factors are estimated based on historical flow rates. For presentation in the ATB, a subset of resource potential is aggregated into four representative NSD plants that span a range of realistic conditions for future hydropower deployment.

Projections developed for the Hydropower Vision study (DOE 2016) using technological learning assumptions and bottom-up analysis of process and/or technology improvements provide a range of future cost outcomes. Three different projections were developed for scenario modeling as bounding levels:

- High cost: no change in CAPEX, O&M, or capacity factor from 2015 to 2050; consistent across all renewable energy technologies in the ATB

- Mid cost: incremental technology learning, consistent with Reference in Hydropower Vision (DOE 2016); CAPEX reductions for NSD only

- Low cost: gains that are achievable when pushing to the limits of potential new technologies, such as modularity (in both civil structures and power train design), advanced manufacturing techniques, and materials, consistent with Advanced Technology in Hydropower Vision (DOE 2016); both CAPEX and O&M cost reductions implemented.

Standard Scenarios Model Results

ATB CAPEX, O&M and capacity factor assumptions for Base Year and future projections through 2050 for Low, Mid, and High projections are used to develop Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

ReEDS Version 2017.1 standard scenario model results restrict the resource potential to sites greater than 1 MW, which results in 30.1 GW/176 TWh on nearly 8,000 reaches.

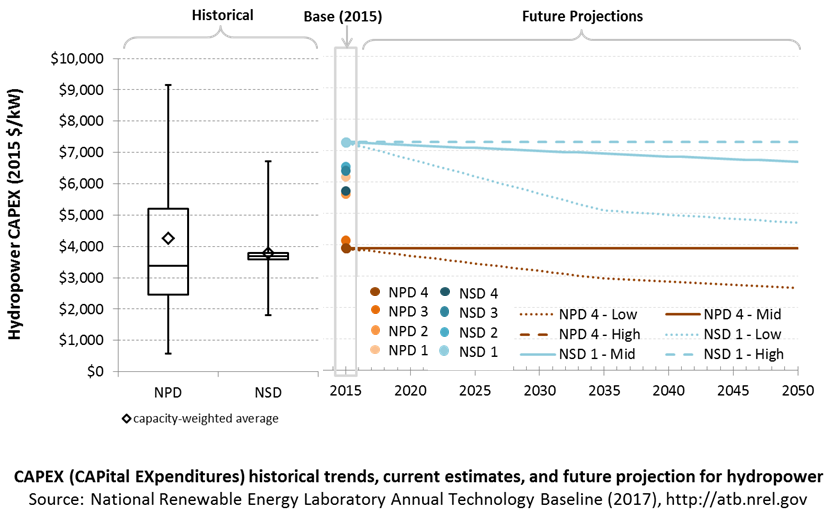

CAPital EXpenditures (CAPEX): Historical Trends, Current Estimates, and Future Projections

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year. These expenditures include the hydropower generation plant, the balance of system (e.g., site preparation, installation, and electrical infrastructure), and financial costs (e.g., development costs, onsite electrical equipment, and interest during construction) and are detailed in CAPEX Definition. In the ATB, CAPEX reflects typical plants and does not include differences in regional costs associated with labor or materials. The range of CAPEX demonstrates variation with resource in the contiguous United States.

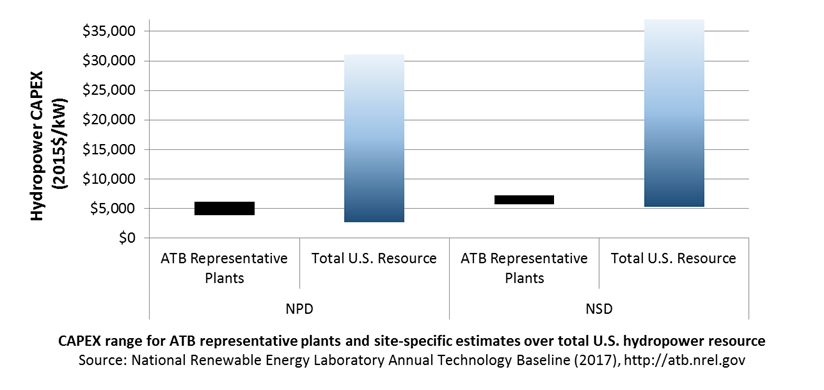

The following figure shows the Base Year estimate and future year projections for CAPEX costs. Three cost reduction scenarios are represented: High, Mid, and Low. Historical data from actual and proposed non-powered dam (NPD) and new stream-reach development (NSD) plants installed in the United States from 1981 to 2014 are shown for comparison to the ATB Base Year. The estimate for a given year represents CAPEX of a new plant that reaches commercial operation in that year.

Recent Trends

Actual and proposed NPD and NSD CAPEX from 1981 to 2014 (from O'Connor et al. 2015a) are shown in box-and-whiskers format for comparison to the ATB current CAPEX estimates and future projections.

The higher-cost ATB sites generally reflect small-capacity, low-head sites that are not comparable to the historical data sample's generally larger-capacity and higher-head facilities. These characteristics lead to higher ATB Base Year CAPEX estimates than past data suggest. For example, the NSD projects that became commercially operational in this period are dominated by a few high-head projects in the mountains of the Pacific Northwest or Alaska.

The Base Year estimates of CAPEX for NPDs in the ATB range from $3,800/kW to $6,000/kW. These estimates reflect facilities with 3 feet of head to over 60 feet head and from 0.5 MW to more than 30 MW of capacity. In general, the higher-cost sites reflect much smaller-capacity (<10 MW), low-head (<30 ft.) sites that have fewer analogues in the historical data, but these characteristics result in higher CAPEX.

The Base Year estimates of CAPEX for NSD range from $5,500/kW to $7,900/kW. The estimates reflect potential sites with 3 feet of head to over 60 feet head and from 1 MW to more than 30 MW of capacity. In general, NSD potential represents smaller-capacity facilities with lower head than most historical data represents. These characteristics lead to higher CAPEX estimates than past data suggests as many of the larger, higher-head sites in the United States have been previously developed.

Base Year Estimates

For illustration in the ATB, all potential NPD and NSD sites were first binned by both head and capacity. Analysis of these bins provided groupings that represent the most realistic conditions for future hydropower deployment. The design values of these four reference NPD and four reference NSD plants are shown below. The full range of resource and design characteristics is summarized in the ATB data spreadsheet.

| Plants | Resource Characteristics Ranges | Weighted Average Values | Calculated Plant Values | ||||

|---|---|---|---|---|---|---|---|

| Plants | Head (feet) | Capacity (MW) | Head (feet) | Capacity (MW) | Capacity Factor | ICC (2015$/kW) | O&M (2015$/kW) |

| NPD 1 | 3-30 | 0.5-10 | 15.4 | 4.8 | 0.62 | $6,169 | $112 |

| NPD 2 | 3-30 | 10+ | 15.9 | 82.2 | 0.64 | $5,615 | $31 |

| NPD 3 | 30+ | 0.5-10 | 89.6 | 4.2 | 0.60 | $4,131 | $119 |

| NPD 4 | 30+ | 10+ | 81.3 | 44.7 | 0.60 | $3,895 | $41 |

| NSD 1 | 3-30 | 1-10 | 15.7 | 3.7 | 0.66 | $7,270 | $125 |

| NSD 2 | 3-30 | 10+ | 19.6 | 44.1 | 0.66 | $6,490 | $41 |

| NSD 3 | 30+ | 1-10 | 46.8 | 4.3 | 0.62 | $6,357 | $118 |

| NSD 4 | 30+ | 10+ | 45.3 | 94.0 | 0.66 | $5,722 | $29 |

The reference plants shown above were developed using the average characteristics (weighted by capacity) of the resource plants within each set of ranges. For example, NPD 1 is constructed from the capacity-weighted average values of NPD sites with 3-330 feet of head and 0.5-30 MW of capacity.

The weighted-average values were used as input to the cost formulas (O'Connor et al. 2015a) in order to calculate site CAPEX and O&M costs.

CAPEX for each plant is based on statistical analysis of historical plant data from 1980 to 2015 as a function of key design parameters, plant capacity, and hydraulic head (O'Connor et al. 2015a).

NPD CAPEX = (11,489,245 × P0.976 × H-0.24) + (310,000 × P0.7)

NSD CAPEX = (9,605,710 × P0.977 × H-0.126) + (610,000 × P0.7)

Where P is capacity in megawatts, and H is head in feet. The first term represents the initial capital costs, while the second represents licensing.

Future Projections

Projections developed for the Hydropower Vision study (DOE 2016) using technological learning assumptions and bottom-up analysis of process and/or technology improvements provide a range of future cost outcomes. Three different CAPEX projections were developed for scenario modeling as bounding levels:

- High cost:

- NPD and NSD CAPEX unchanged from the Base Year; consistent across all renewable energy technologies in the ATB

- Mid cost: consistent with Reference in Hydropower Vision:

- NSD CAPEX reduced 5% in 2035 and 8.6% in 2050

- NPD CAPEX unchanged from the Base Year

- Low cost: consistent with Advanced Technology in Hydropower Vision:

- Low head NPD/All NSD CAPEX reduced 30% in 2035 and 35.3% in 2050. Low Head NPD is NPD-1 and NPD-2.

- High head NPD CAPEX reduced 25% in 2035 and 32.7% in 2050. High head NPD is NPD-3 and NPD-4.

Detailed description of the methodology for developing Future Year Projections is found in Projections Methodology.

Technology innovations that could impact future CAPEX costs are summarized in LCOE Projections.

Standard Scenarios Model Results

ATB CAPEX, O&M and capacity factor assumptions for Base Year and future projections through 2050 for Low, Mid, and High projections are used to develop Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

ReEDS Version 2017.1 standard scenario model results use resource/cost supply curves representing estimates at each individual facility (~700 NPD and ~8,000 NSD).

The ReEDS model represents cost and performance for NPD and NSD potential in 5 bins for each of 134 geographic regions, which results in CAPEX ranges of $2,750/kW-$9,000/kW for NPD resource and $5,200/kW-$15,600/kW for NSD.

The ReEDS model represents cost and performance for NPD and NSD potential in 5 bins for each of 134 geographic regions, which results in capacity factor ranges of 38%-80% for NPD resource and 53%-81% for NSD.

CAPEX Definition

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year.

For the ATB - and based on EIA (2016a) and the System Cost Breakdown Structure described by O'Connor et al. (2015b) - the hydropower plant envelope is defined to include:

- Hydropower generation plant

- Civil works, such as site preparation, dams and reservoirs, water conveyances, and powerhouse structures

- Equipment, such as the powertrain and ancillary plant electrical and mechanical systems

- Balance of system

- Installation and O&M infrastructure

- Electrical infrastructure, such as transformers, switchgear, and electrical system connecting turbines to each other and to the control center

- Project indirect costs, including costs related to environmental mitigation and regulatory compliance, engineering, distributable labor and materials, construction management start up and commissioning, and contractor overhead costs, fees, and profit

- Financial costs

- Owner's costs, such as development costs, preliminary feasibility and engineering studies, environmental studies and permitting, legal fees, insurance costs, and property taxes during construction

- Electrical interconnection and onsite electrical equipment (e.g., switchyard), a nominal-distance spur line (<1 mile), and necessary upgrades at a transmission substation; distance-based spur line cost (GCC) not included in the ATB

- Interest during construction estimated based on three-year duration accumulated 10%/10%/80% at half-year intervals and an 8% interest rate (ConFinFactor).

CAPEX can be determined for a plant in a specific geographic location as follows:

CAPEX = ConFinFactor*(OCC*CapRegMult+GCC).

(See the Financial Definitions tab in the ATB data spreadsheet.)

Regional cost variations and geographically specific grid connection costs are not included in the ATB (CapRegMult = 1; GCC = 0). In the ATB, the input value is overnight capital cost (OCC) and details to calculate interest during construction (ConFinFactor).

In the ATB, CAPEX is shown for four representative non-powered dam plants and four representative new stream-reach development plants. CAPEX estimates for all identified hydropower potential (~700 NPD and ~8,000 NSD) results in a CAPEX range that is much broader than that shown in the ATB. It is unlikely that all of the resource potential will be developed due to the very high costs for some sites. Regional cost effects and distance-based spur line costs are not estimated.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for High, Mid, and Low projections are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

CAPEX in ATB do not represent regional variants (CapRegMult) associated with labor rates, material costs, etc., and neither does ReEDS.

CAPEX in ATB do not include geographically determined spur line (GCC) from plant to transmission grid, and neither does ReEDS.

Operation and Maintenance (O&M) Costs

Operations and maintenance (O&M) costs represent average annual fixed expenditures (and depend on rated capacity) required to operate and maintain a hydropower plant over its technical lifetime of 50 years (the distinction between economic life and technical life is described here), including:

- Insurance, taxes, land lease payments, and other fixed costs

- Present value and annualized large component overhaul or replacement costs over technical life (e.g., rewind stator, patch cavitation damage, and replace bearings)

- Scheduled and unscheduled maintenance of hydropower plant components, including turbines, generators, etc. over the technical lifetime of the plant.

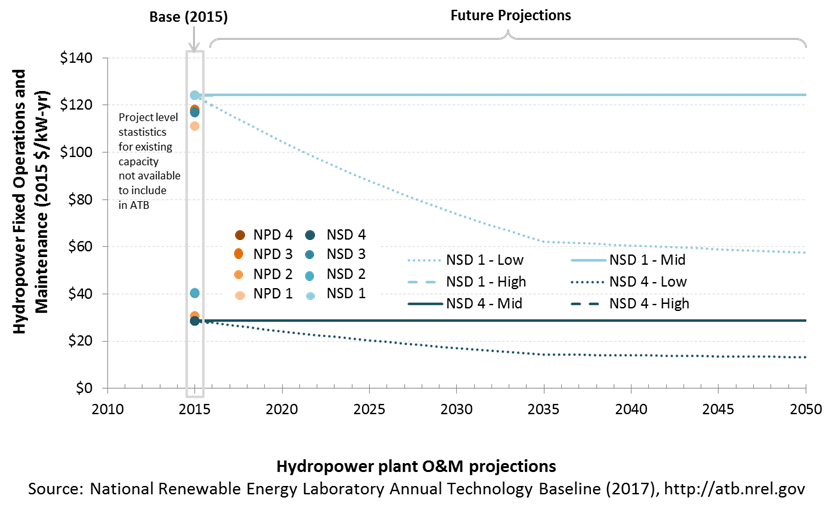

The following figure shows the Base Year estimate and future year projections for fixed O&M (FOM) costs. Three cost reduction scenarios are represented. The estimate for a given year represents annual average FOM costs expected over the technical lifetime of a new plant that reaches commercial operation in that year.

Base Year Estimates

A statistical analysis of long-term plant operation costs from FERC Form-1 resulted in a relationship between annual, FOM costs, and plant capacity (updated to 2015$ from O'Connor et al. 2015a).

Lesser of (Annual O&M (in 2015$)=227,000xP0.547) or (2.5% of CAPEX)

Future Year Projections

Projections developed for the Hydropower Vision study (DOE 2016) using technological learning assumptions and bottom-up analysis of process and/or technology improvements provide a range of future cost outcomes. Three different O&M projections were developed for scenario modeling as bounding levels:

- High cost: FOM costs unchanged from the Base Year to 2050; consistent with all ATB technologies

- Mid cost: FOM costs for both NPD and NSD plants are unchanged from 2015 to 2050; consistent with Reference in Hydropower Vision

- Low cost: FOM costs for both NPD and NSD plants are reduced by 50% in 2035 and 54% in 2050, consistent with Advanced Technology in Hydropower Vision.

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

Capacity Factor: Expected Annual Average Energy Production Over Lifetime

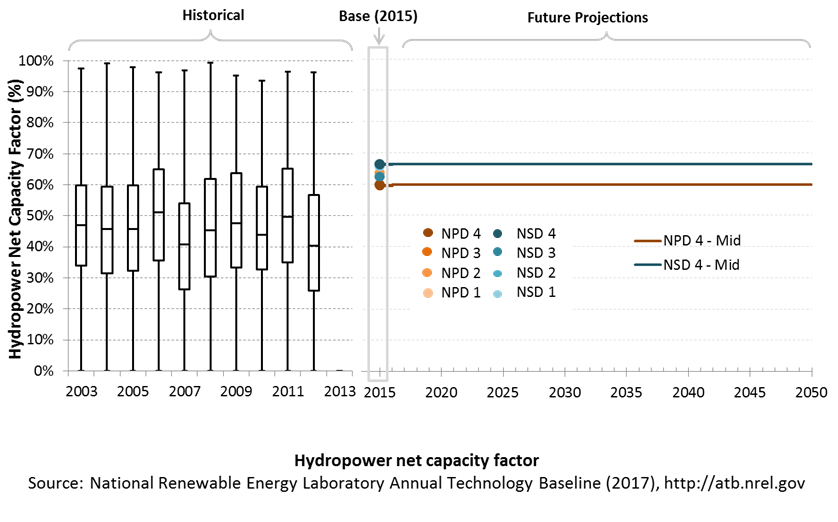

The capacity factor represents the expected annual average energy production divided by the annual energy production, assuming the plant operates at rated capacity for every hour of the year. It is intended to represent a long-term average over the technical lifetime of the plant (the distinction between economic life and technical life is described here). It does not represent interannual variation in energy production. Future year estimates represent the estimated annual average capacity factor over the technical lifetime of a new plant installed in a given year.

The capacity factor is influenced by site hydrology, design factors (e.g., exceedance level), and operation characteristics (e.g., dispatch or run of river). Capacity factors for all potential NPD sites and NSDs are estimated based on design criteria, long-term monthly flow rate records, and run-of-river operation.

The following figure shows a range of capacity factors based on variation in the resource for hydropower plants in the contiguous United States. Historical data from run of river hydropower plants operating in the United States from 2003 through 2012 are shown for comparison with the Base Year estimates. The range of the Base Year estimates illustrates the effect of resource variation. Future projections for High, Mid and Low cost scenarios are unchanged from the Base Year. Technology improvements are focused on CAPEX and O&M cost elements.

Recent Trends

Actual energy production from about 200 run-of-river plants operating in the United States from 2003 to 2012 (EIA 2016a) is shown in box-and-whiskers format for comparison with current estimates and future projections. This sample includes some very old plants that may have lower availability and efficiency losses. It also includes plants that have been relicensed and may no longer be optimally designed for current operating regime (e.g., a peaking unit now operating as run of river). This contributes to the broad range, particularly on the low end.

Interannual variation of hydropower plant output for run-of-river plants may be significant due to hydrological changes such as drought. This impact may be exacerbated by climate change over the long term.

Current and future estimates for new hydropower plants are within the range of observed plant performance. These potential hydropower plants would be designed for specific site conditions, which would indicate operation toward the high end of the range.

Base Year Estimates

For illustration in the ATB, all potential NPD and NSD sites are represented with four reference plants, each as described below.

| Plants | Resource Characteristics Ranges | Weighted Average Values | Calculated Plant Values | ||||

|---|---|---|---|---|---|---|---|

| Plants | Head (feet) | Capacity (MW) | Head (feet) | Capacity (MW) | Capacity Factor | ICC (2014$/kW) | O&M (2014$/kW) |

| NPD 1 | 3-30 | 0.5-10 | 15.4 | 4.8 | 0.62 | $6,169 | $112 |

| NPD 2 | 3-30 | 10+ | 15.9 | 82.2 | 0.64 | $5,615 | $31 |

| NPD 3 | 30+ | 0.5-10 | 89.6 | 4.2 | 0.60 | $4,131 | $119 |

| NPD 4 | 30+ | 10+ | 81.3 | 44.7 | 0.60 | $3,895 | $41 |

| NSD 1 | 3-30 | 1-10 | 15.7 | 3.7 | 0.66 | $7,270 | $125 |

| NSD 2 | 3-30 | 10+ | 19.6 | 44.1 | 0.66 | $6,490 | $41 |

| NSD 3 | 30+ | 1-10 | 46.8 | 4.3 | 0.62 | $6,357 | $118 |

| NSD 4 | 30+ | 10+ | 45.3 | 94.0 | 0.66 | $5,722 | $29 |

Future Year Projections

The capacity factor remains unchanged from the Base Year through 2050. Technology improvements are focused on CAPEX and O&M costs.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for High, Mid, and Low projections are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

ReEDS Version 2017.1 standard scenario model results use resource/cost supply curves representing estimates at each individual facility (~700 NPD and ~8,000 NSD).

The ReEDS model represents cost and performance for NPD and NSD potential in 5 bins for each of 134 geographic regions, which results in capacity factor ranges of 38%-80% for the NPD resources and 53%-81% for NSD.

Existing hydropower facilities in the ReEDS model provide dispatch capability such that their annual energy production is determined by the electric system needs by dispatching generators to accommodate diurnal and seasonal load variations and output from variable generation sources (e.g., wind and solar PV).

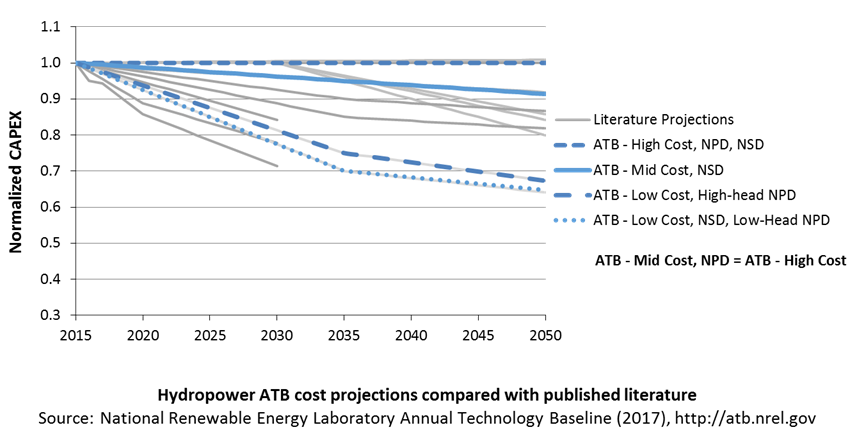

Plant Cost and Performance Projections Methodology

Projections developed for the Hydropower Vision study (DOE 2016) using technological learning assumptions and bottom-up analysis of process and/or technology improvements provide a range of future cost outcomes. Three different projections were developed for scenario modeling as bounding levels:

- High cost: no change in CAPEX or OPEX from 2015 to 2050; consistent across all renewable energy technologies in the ATB

- Mid cost: incremental learning, consistent with Reference in the Hydropower Vision study (DOE 2016); CAPEX reductions for NSD only

- Low cost: gains that are achievable when pushing to the limits of potential new technologies, such as modularity (in both civil structures and power train design), advanced manufacturing techniques, and materials, consistent with Advanced Technology in Hydropower Vision (DOE 2016); both CAPEX and O&M cost reductions implemented.

The Mid and Low cost cases use a mix of inputs based on EIA technological learning assumptions, input from a technical team of Oak Ridge National Laboratory researchers, and the experience of expert hydropower consultants. Estimated 2035 cost levels are intended to provide magnitude of order cost reductions deemed to be at least conceptually possible, and they are meant to stimulate a broader discussion with the hydropower industry and its stakeholders that will be necessary to the future of cost reduction in the industry. Cost projections were derived independently for NPD and NSD technologies.

For context, ATB cost projections are compared to the literature, which represents 7 independent published studies and 11 cost projection scenarios within these studies. Cost reduction literature for hydropower is limited with several studies projecting no change through 2050. It is unclear whether (1) this represents a deliberate estimate of no future change in cost or (2) no estimate has been made.

Hydropower investment costs are very site specific and vary with type of technology. Literature was reviewed to attempt to isolate perceived CAPEX reduction for resources of similar characteristics over time (e.g., estimated cost to develop the same site in 2015, 2030, and 2050 based on different technology, installation, and other technical aspects). Some studies reflect increasing CAPEX over time. These studies were excluded from the ATB based on the interpretation that rising costs reflect a transition to less attractive sites as the better sites are used earlier.

Literature estimates generally reflect hydropower facilities of sizes similar to those represented in U.S. resource potential (i.e., they exclude estimates for very large facilities). Due to limited sample size, all projections are analyzed together without distinction between types of technology. Note that although declines are shown on a percentage basis, the reduction is likely to vary with initial capital cost. Large reductions for moderately expensive sites may not scale to more expensive sites or to less expensive sites. Projections derived for the Hydropower Vision study for different technologies (Low Head NPD, High Head NPD, and NSD) address this simplification somewhat.

Levelized Cost of Energy (LCOE) Projections

Levelized cost of energy (LCOE) is a simple metric that combines the primary technology cost and performance parameters, CAPEX, O&M, and capacity factor. It is included in the ATB for illustrative purposes. The focus of the ATB is to define the primary cost and performance parameters for use in electric sector modeling or other analysis where more sophisticated comparisons among technologies are made. LCOE captures the energy component of electric system planning and operation, but the electric system also requires capacity and flexibility services to operate reliably. Electricity generation technologies have different capabilities to provide such services. For example, wind and PV are primarily energy service providers, while the other electricity generation technologies provide capacity and flexibility services in addition to energy. These capacity and flexibility services are difficult to value and depend strongly on the system in which a new generation plant is introduced. These services are represented in electric sector models such as the ReEDS model and corresponding analysis results such as the Standard Scenarios.

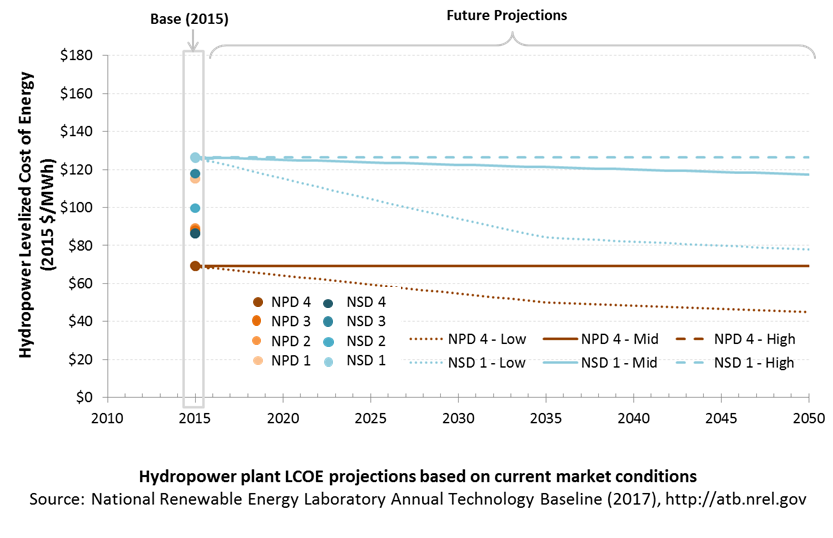

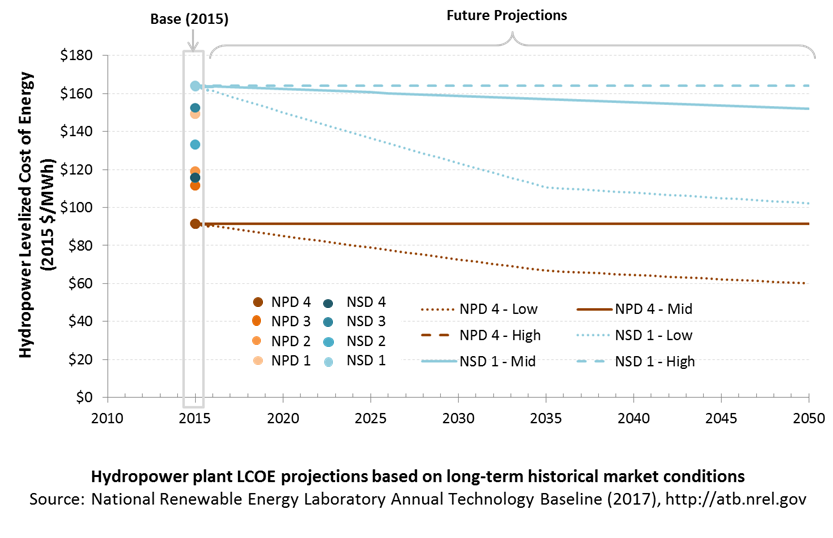

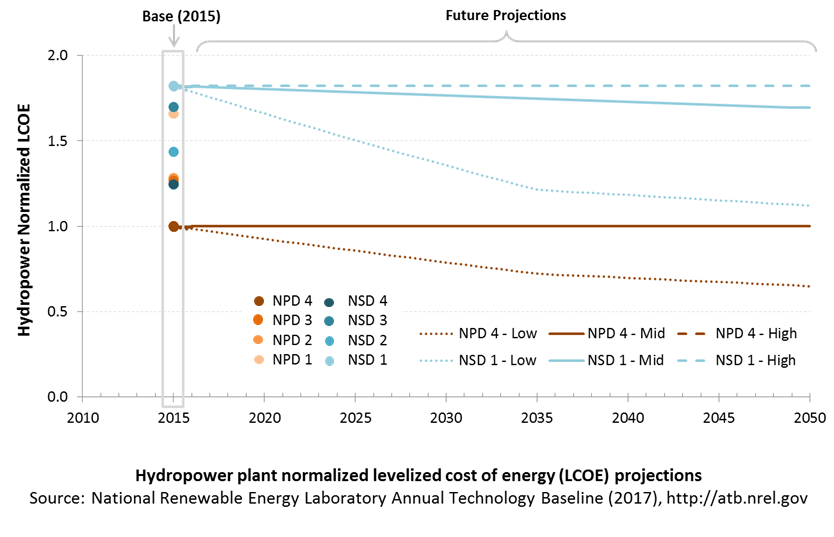

The following three figures illustrate the combined impact of CAPEX, O&M, and capacity factor projections across the range of resources present in the contiguous United States. The Current Market Conditions LCOE demonstrates the range of LCOE based on macroeconomic conditions similar to the present. The Historical Market Conditions LCOE presents the range of LCOE based on macroeconomic conditions consistent with prior ATB editions and Standard Scenarios model results. The Normalized LCOE (all LCOE estimates are normalized with the lowest Base Year LCOE value) emphasizes the effect of resource quality and the relative differences in the three future pathways independent of project finance assumptions. The ATB representative plant characteristics that best align with recently installed or anticipated near-term hydropower plants are associated with NPD 4. Data for all the resource categories can be found in the ATB data spreadsheet.

The methodology for representing the CAPEX, O&M, and capacity factor assumptions behind each pathway is discussed in Projections Methodology. The three pathways are generally defined as:

- High = Base Year (or near-term estimates of projects under construction) equivalent through 2050 maintains current relative technology cost differences

- Mid = technology advances through continued industry growth, public and private R&D investments, and market conditions relative to current levels that may be characterized as "likely" or "not surprising"

- Low = Technology advances that may occur with breakthroughs, increased public and private R&D investments, and/or other market conditions that lead to cost and performance levels that may be characterized as the "limit of surprise" but not necessarily the absolute low bound.

To estimate LCOE, assumptions about the cost of capital to finance electricity generation projects are required. For comparison in the ATB, two project finance structures are represented.

- Current Market Conditions: The values of the production tax credit (PTC) and investment tax credit (ITC) are ramping down by 2020, at which time wind and solar projects may be financed with debt fractions similar to other technologies. This scenario reflects debt interest (4.4% nominal, 1.9% real) and return on equity rates (9.5% nominal, 6.8% real) to represent 2017 market conditions (AEO 2017) and a debt fraction of 60% for all electricity generation technologies. An economic life, or period over which the initial capital investment is recovered, of 20 years is assumed for all technologies. These assumptions are one of the project finance options in the ATB spreadsheet.

- Long-Term Historical Market Conditions: Historically, debt interest and return on equity were represented with higher values. This scenario reflects debt interest (8% nominal, 5.4% real) and return on equity rates (13% nominal, 10.2% real) implemented in the ReEDS model and reflected in prior versions of the ATB and Standard Scenarios model results. A debt fraction of 60% for all electricity generation technologies is assumed. An economic life, or period over which the initial capital investment is recovered, of 20 years is assumed for all technologies. These assumptions are one of the project finance options in the ATB spreadsheet.

These parameters are held constant for estimates representing the Base Year through 2050. No incentives such as the PTC or ITC are included. The equations and variables used to estimate LCOE are defined on the equations and variables page. For illustration of the impact of changing financial structures such as WACC and economic life, see Project Finance Impact on LCOE. For LCOE estimates for High, Mid, and Low scenarios for all technologies, see 2017 ATB Cost and Performance Summary.

Areas identified as having potential cost reduction opportunities associated with the Low cost projection include:

- Widespread implementation of value engineering and design/construction best practices

- Modular "drop-in" systems that minimize civil works and maximize ease of manufacture reduce both capital investment and O&M expenditures

- Use of alternative materials in place of steel for water diversion (e.g., penstocks)

- Implementation of standardized "smart" automation and remote monitoring systems to optimize scheduling of maintenance

- Research and development on environmentally enhanced turbines to improve performance of the existing hydropower fleet

- Efficient, certain, permitting, licensing, and approval procedures.

The Hydropower Vision study (DOE 2016) includes roadmap actions that result in lower-cost technology.

Natural Gas Plants

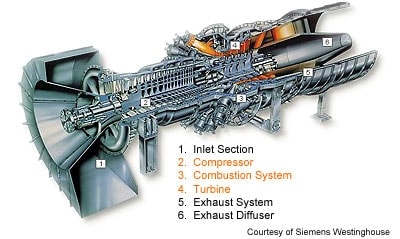

A gas-fired combustion turbine involves:

- An air compressor compresses air and feeds it into the combustion chamber at hundreds of miles per hour.

- In a combustion system, a ring of fuel injectors inject fuel into combustion chambers where it mixes with the air and is combusted. The resulting high-temperature, high-pressure gas stream enters and expands through the turbine.

- A turbine has alternate stationary and rotating airfoil-section blades that are driven by expanding hot combustion gas. The rotating blades drive the compressor and spin a generator to produce electricity.

Simple-cycle gas turbines can achieve 20%-35% energy conversion efficiency depending on the type and design of the system. Aeroderivative turbines are typically more flexible but more expensive than their industrial gas turbine counterparts. Combined-cycle natural gas plants include a heat recovery steam generator that uses the hot exhaust from the combustion turbine to generate steam. That steam can then be used to generate additional electricity using a steam turbine. Combined-cycle natural gas plants typically have efficiencies ranging from 50%-60%, and R&D targets have been set to achieve even higher efficiencies. Combined-cycle plants can be built using a variety of configurations, such as a single combustion turbine and steam turbine connected to a single generator (1x1) or two combustion turbines coupled with one steam turbine (2x1) (DOE "How Gas Turbine Power Plants Work").

Renewable energy technical potential, as defined by Lopez et al. (2012), represents the achievable energy generation of a particular technology given system performance, topographic limitations, and environmental and land-use constraints. Technical resource potential corresponds most closely to fossil reserves, as both can be characterized by the prospect of commercial feasibility and depend strongly on available technology at the time of the resource assessment. Natural gas reserves in the United States are assessed by the United States Geological Survey (USGS, "National Oil and Gas Assessment").

This section focuses on large, utility-scale natural gas plants. Distributed-scale turbines may be included in a future version of the ATB.

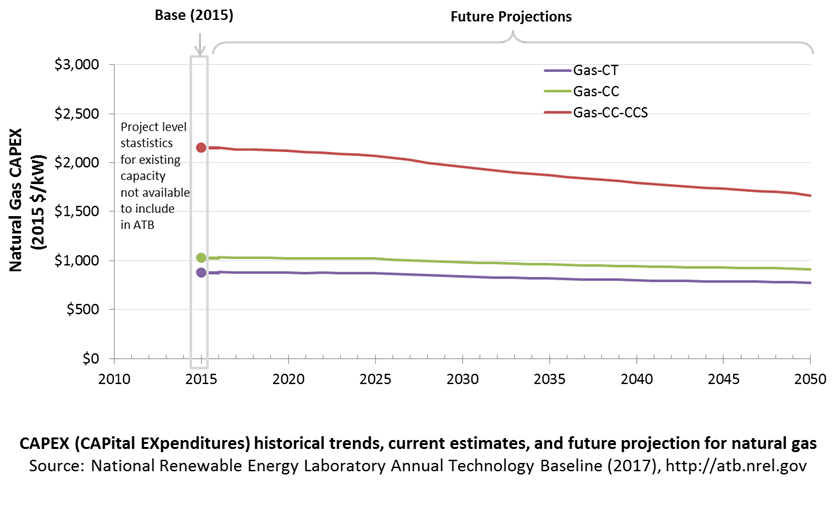

CAPital EXpenditures (CAPEX): Historical Trends, Current Estimates, and Future Projections

Because natural gas plants are well-known and perform close to their optimal performance, the EIA capital expenditures (CAPEX) projections decline at the minimum learning rate for the gas-fired technologies, resulting in incremental improvement over time that progresses slightly more quickly than inflation.

The one exception is natural gas combined cycle (CC) with carbon capture and storage (CCS). The DOE Office of Fossil Energy and the National Energy Technology Laboratory conduct research on reducing the costs and increasing the performance of CCS technology, and costs are expected to decline over time at a higher learning rate than the more mature gas-CT and gas-CC technologies.

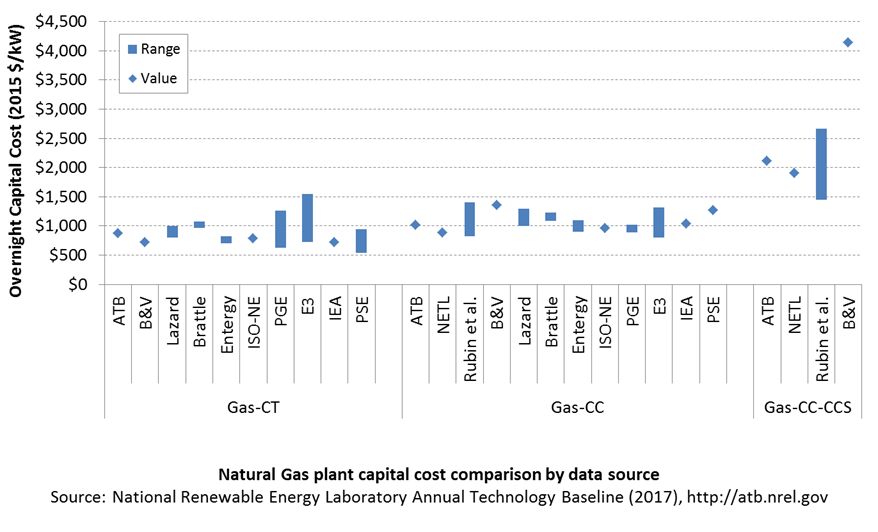

Comparison with Other Sources

Costs vary due to differences in configuration (e.g., 2x1 versus 1x1), turbine class, and methodology. All costs were converted to the same dollar year.

CAPEX Definition

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year.

Overnight capital costs are modified from EIA (2017). Capital costs include overnight capital cost plus defined transmission cost, and it removes a material price index.

Fuel costs are taken from EIA (2017). EIA reports two types of gas-CT and gas-CC technologies in the Annual Energy Outlook: advanced (H-class for gas-CC, F-class for gas-CT) and conventional (F-class for gas-CC, LM-6000 for gas-CT). Because we represent a single gas-CT and gas-CC technology in the ATB, the characteristics for the ATB plants are taken to be the average of the advanced and conventional systems as reported by EIA. For example, the OCC for the gas-CC technology in the ATB is the average of the capital cost of the advanced and conventional combined cycle technologies from the EIA's Annual Energy Outlook. Future work aims to improve the representation of the various natural gas technologies in the ATB. The CCS plant configuration includes only the cost of capturing and compressing the CO2. It does not include CO2 delivery and storage.

| Overnight Capital Cost ($/kW) | Construction Financing Factor (ConFinFactor) | CAPEX ($/kW) | |

|---|---|---|---|

| Gas-CT: Conventional combustion turbine | $864 | 1.021 | $882 |

| Gas-CC: Conventional combined cycle | $1,010 | 1.021 | $1,032 |

| Gas-CC-CCS: Combined cycle with carbon capture sequestration | $2,109 | 1.021 | $2,154 |

CAPEX can be determined for a plant in a specific geographic location as follows:

CAPEX = ConFinFactor × (OCC×CapRegMult+GCC).

(See the Financial Definitions tab in the ATB data spreadsheet.)

Regional cost variations and geographically specific grid connection costs are not included in the ATB (CapRegMult=1; GCC=0). In the ATB, the input value is overnight capital cost (OCC) and details to calculate interest during construction (ConFinFactor).

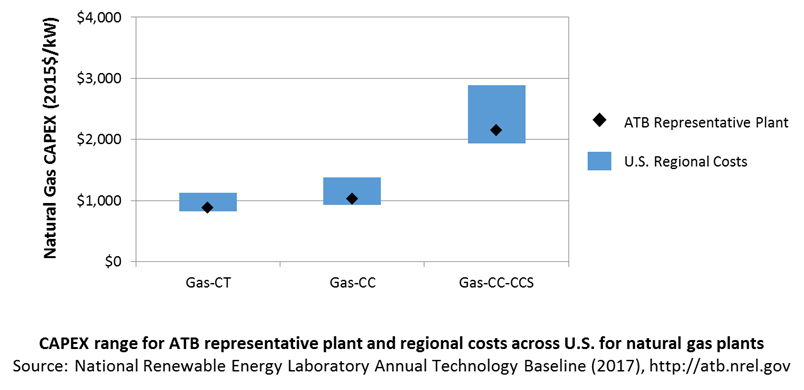

In the ATB, CAPEX represents each type of gas plant with a unique value. Regional cost effects associated with labor rates, material costs, and other regional effects as defined by EIA (2016a) expand the range of CAPEX. Unique land-based spur line costs based on distance and transmission line costs are not estimated. The following figure illustrates the ATB representative plant relative to the range of CAPEX including regional costs across the contiguous United States. The ATB representative plants are associated with a regional multiplier of 1.0.

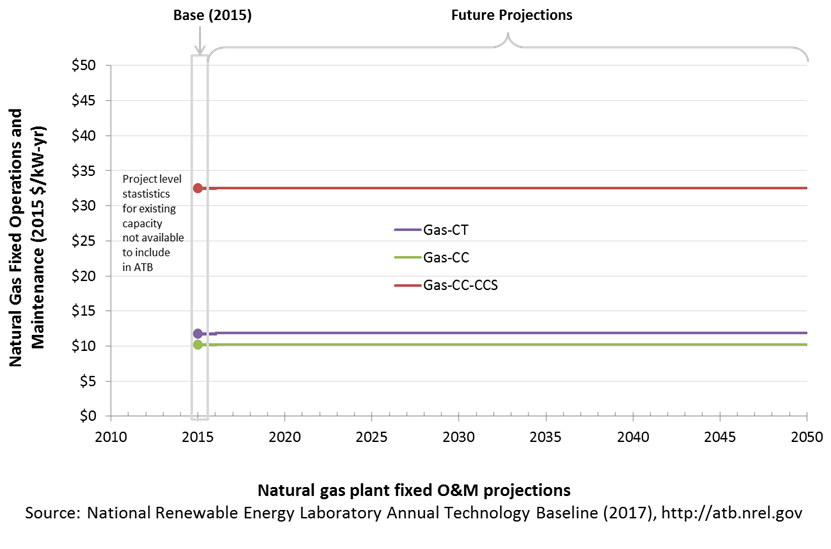

Operation and Maintenance (O&M) Costs

Operations and maintenance (O&M) costs represent the annual expenditures required to operate and maintain a plant over its technical lifetime (the distinction between economic life and technical life is described here), including:

- Insurance, taxes, land lease payments, and other fixed costs

- Present value and annualized large component replacement costs over technical life

- Scheduled and unscheduled maintenance of power plants, transformers, and other components over the technical lifetime of the plant.

Market data for comparison are limited and generally inconsistent in the range of costs covered and the length of the historical record.

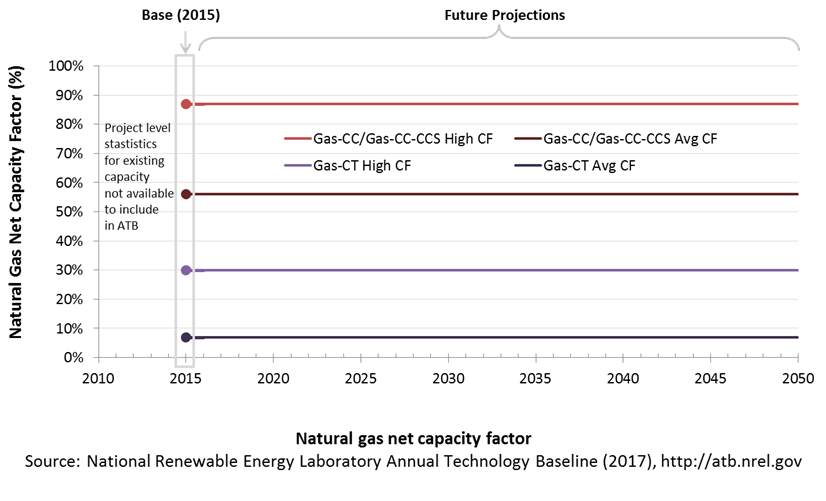

Capacity Factor: Expected Annual Average Energy Production Over Lifetime

The capacity factor represents the assumed annual energy production divided by the total possible annual energy production, assuming the plant operates at rated capacity for every hour of the year. For natural gas plants, the capacity factor is typically lower (and, in the case of combustion turbines, much lower) than their availability factor. Natural gas plants have availability factors approaching 100%.

The capacity factors of dispatchable units is typically a function of the unit's marginal costs and local grid needs (e.g., need for voltage support or limits due to transmission congestion). The average capacity factor is the average fleet-wide capacity factor for these plant types in 2015. The high capacity factor is taken from EIA (2016c, Table 1a) for a new power plant and represents a high bound of operation for a plant of this type.

Gas-CT power plants are less efficient than gas-CC power plants, and they tend to run as intermediate or peaker plants.

Gas-CC with CCS has not yet been built. It is expected to be a baseload unit.

Levelized Cost of Energy (LCOE) Projections

Levelized cost of energy (LCOE) is a simple metric that combines the primary technology cost and performance parameters, CAPEX, O&M, and capacity factor. It is included in the ATB for illustrative purposes. The focus of the ATB is to define the primary cost and performance parameters for use in electric sector modeling or other analysis where more sophisticated comparisons among technologies are made. LCOE captures the energy component of electric system planning and operation, but the electric system also requires capacity and flexibility services to operate reliably. Electricity generation technologies have different capabilities to provide such services. For example, wind and PV are primarily energy service providers, while the other electricity generation technologies provide capacity and flexibility services in addition to energy. These capacity and flexibility services are difficult to value and depend strongly on the system in which a new generation plant is introduced. These services are represented in electric sector models such as the ReEDS model and corresponding analysis results such as the Standard Scenarios.

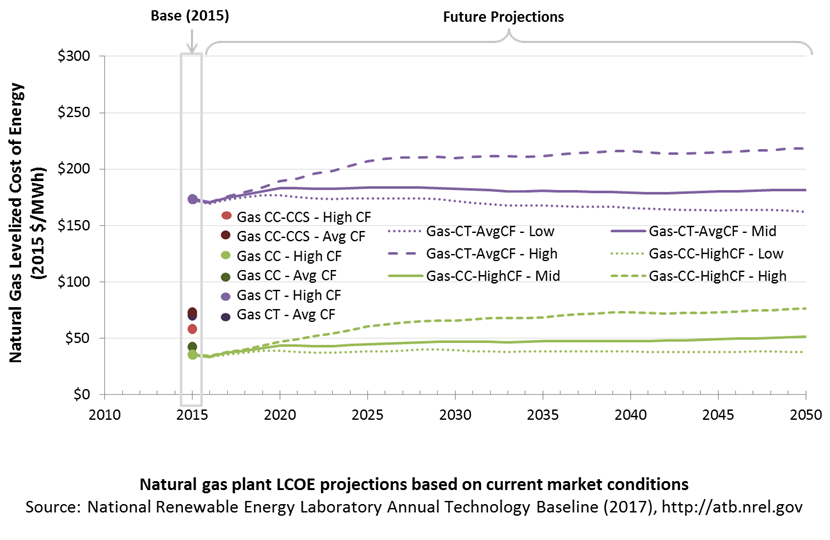

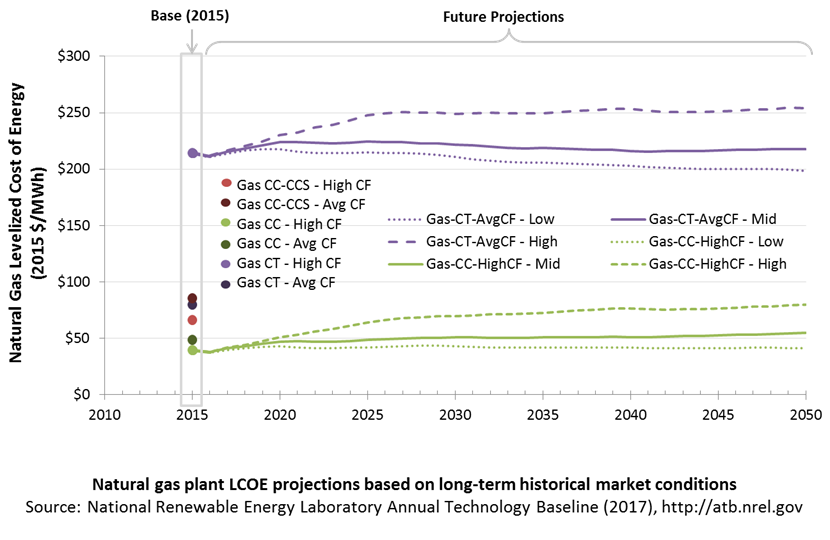

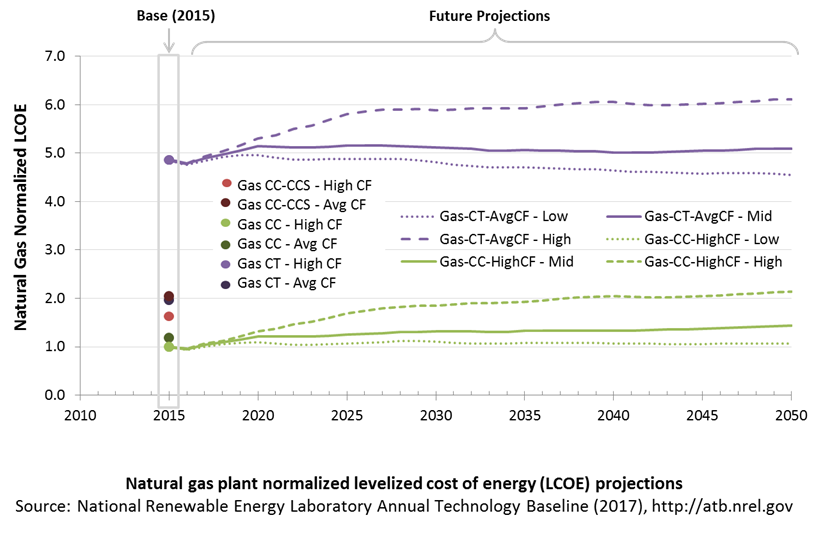

The following three figures illustrate the combined impact of CAPEX, O&M, and capacity factor projections across the range of resources present in the contiguous United States. The Current Market Conditions LCOE demonstrates the range of LCOE based on macroeconomic conditions similar to the present. The Historical Market Conditions LCOE presents the range of LCOE based on macroeconomic conditions consistent with prior ATB editions and Standard Scenarios model results. The Normalized LCOE (all LCOE estimates are normalized with the lowest Base Year LCOE value) emphasizes the relative effect of fuel price and heat rate independent of project finance assumptions. The ATB representative plant characteristics that best align with recently installed or anticipated near-term natural gas plants are associated with Gas-CC-HighCF. Data for all the resource categories can be found in the ATB data spreadsheet.

The LCOE of natural gas plants is directly impacted by the price of the natural gas fuel, so we include low, median, and high natural gas price trajectories. The LCOE is also impacted by variations in the heat rate and O&M costs. Because the reference and high natural gas price projections from AEO 2017 are rising over time, the LCOE of new natural gas plants can actually increase over time if the gas prices rise faster than the capital costs decline. For a given year, the LCOE assumes that the fuel prices from that year continue throughout the lifetime of the plant.

These projections do not include any cost of carbon, which would influence the LCOE of fossil units. Also, for CCS plants, the potential revenue from selling the captured carbon is not included (e.g., enhanced oil recovery operation may purchase CO2 from a CCS plant).

Fuel prices are based on the EIA's Annual Energy Outlook 2017 (EIA 2017).

To estimate LCOE, assumptions about the cost of capital to finance electricity generation projects are required. For comparison in the ATB, two project finance structures are represented.

- Current Market Conditions: The values of the production tax credit (PTC) and investment tax credit (ITC) are ramping down by 2020, at which time wind and solar projects may be financed with debt fractions similar to other technologies. This scenario reflects debt interest (4.4% nominal, 1.9% real) and return on equity rates (9.5% nominal, 6.8% real) to represent 2017 market conditions (AEO 2017) and a debt fraction of 60% for all electricity generation technologies. An economic life, or period over which the initial capital investment is recovered, of 20 years is assumed for all technologies. These assumptions are one of the project finance options in the ATB spreadsheet.

- Long-Term Historical Market Conditions: Historically, debt interest and return on equity were represented with higher values. This scenario reflects debt interest (8% nominal, 5.4% real) and return on equity rates (13% nominal, 10.2% real) implemented in the ReEDS model and reflected in prior versions of the ATB and Standard Scenarios model results. A debt fraction of 60% for all electricity generation technologies is assumed. An economic life, or period over which the initial capital investment is recovered, of 20 years is assumed for all technologies. These assumptions are one of the project finance options in the ATB spreadsheet.

These parameters are held constant for estimates representing the Base Year through 2050. No incentives such as the PTC or ITC are included. The equations and variables used to estimate LCOE are defined on the equations and variables page. For illustration of the impact of changing financial structures such as WACC and economic life, see Project Finance Impact on LCOE. For LCOE estimates for High, Mid, and Low scenarios for all technologies, see 2017 ATB Cost and Performance Summary.

Coal

In a coal power plant:

- Heat is created: Coal is pulverized, mixed with hot air, and burned in suspension.

- Water turns to steam: The heat turns purified water into steam, which is piped to the turbine.

- Steam turns the turbine: The pressure of the steam pushes the turbine blade, turns the shaft in the generator, and creates power.

- Steam is turned back into water: Cool water is drawn into a condenser where the steam turns back into water that can be used over again in the plant.

The process outlined above is adapted from Duke Energy ("How Energy Works"). Coal plant emissions and performance are also impacted by the kind of coal (coal rank) that the plant burns. Lignite, subbituminous, bituminous, and anthracite coal are all of varying quality. The amount of moisture, sulfur, and ash in a particular type of coal can have significant influence on coal plant operation, design, and cost.

(soon to be set up for cofiring biomass)

Renewable energy technical potential, as defined by Lopez et al. (2012), represents the achievable energy generation of a particular technology given system performance, topographic limitations, and environmental and land-use constraints. Technical resource potential corresponds most closely to fossil reserves, as both can be characterized by the prospect of commercial feasibility and depend strongly on available technology at the time of the resource assessment. Coal reserves in the United States are assessed by the United States Geological Survey (USGS, "Coal Assessments").

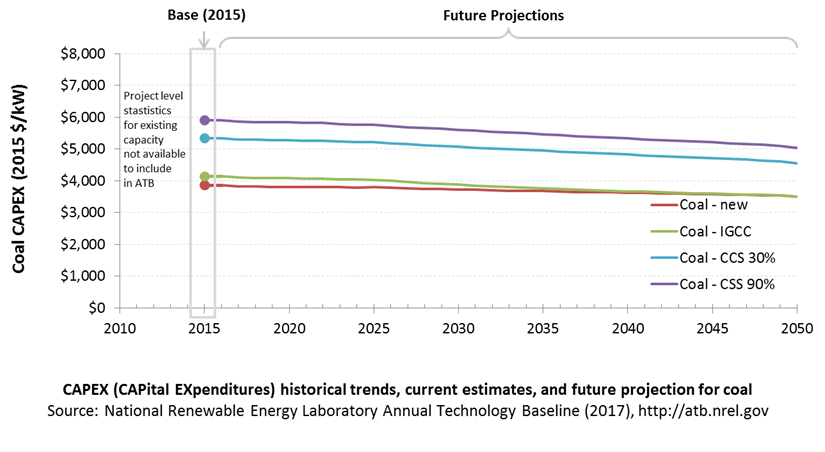

CAPital EXpenditures (CAPEX): Historical Trends, Current Estimates, and Future Projections

Technology cost and performance projections are taken the EIA Annual Energy Outlook Reference Scenario (EIA 2017). Because little-to-no coal is built in the Reference Scenario, coal capital expenditures (CAPEX) decline according to the minimum learning rate. Pulverized coal is a relatively mature technology, and therefore has a low minimum learning rate. Integrated gasification combined cycle (IGCC) technology, where the coal is gasified and then fed into a combined cycle turbine, is less mature and is assumed to have a slightly higher minimum learning rate. Coal with carbon capture and storage (CCS) is also a newer technology with a higher minimum learning rate.

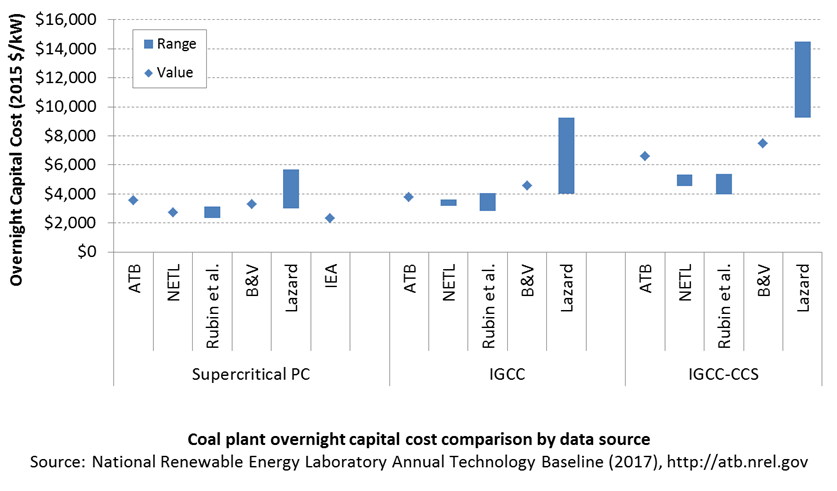

Comparison with Other Sources

Lazard (2016) does not explicitly define their ranges with and without CCS; thus, the high end of their pulverized coal and IGCC ranges and the low end of their IGCC-CCS range are assumed to be the middle of the full reported range. All sources have been normalized to the same dollar year. Costs vary due to differences in system design (e.g., coal rank), methodology, and plant cost definitions.

CAPEX Definition

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year.

For coal power plants, CAPEX equals interest during construction (ConFinFactor) times the overnight capital cost (OCC).

Overnight capital costs are modified from EIA (2017). Capital costs include overnight capital cost plus defined transmission cost, and it removes a material price index.

Fuel costs, which are just passed through to end user, are taken from EIA (2017).

For the ATB, coal-CCS technology is ultra-supercritical pulverized coal technology fitted with CCS. Both 30% capture and 90% capture options are included for the coal-CCS technology. The CCS plant configuration includes only the cost of capturing and compressing the CO2. It does not include CO2 delivery and storage.

| Overnight Capital Cost ($/kW) | Construction Financing Factor (ConFinFactor) | CAPEX ($/kW) | |

|---|---|---|---|

| Coal-new: Ultra-supercritical pulverized coal with SO2 and NOx controls | $3,559 | 1.084 | $3,859 |

| Coal-IGCC: Integrated gasification combined cycle (IGCC) | $3,819 | 1.084 | $4,141 |

| Coal-CCS: Ultra-supercritical pulverized coal with carbon capture and sequestration (CCS) options (30% / 90% capture) | $4,927 / $5,448 | 1.084 | $5,341 / $5,906 |

CAPEX can be determined for a plant in a specific geographic location as follows:

CAPEX = ConFinFactor × (OCC×CapRegMult+GCC).

(See the Financial Definitions tab in the ATB data spreadsheet.)

Regional cost variations and geographically specific grid connection costs are not included in the ATB (CapRegMult=1; GCC=0). In the ATB, the input value is overnight capital cost (OCC) and details to calculate interest during construction (ConFinFactor).

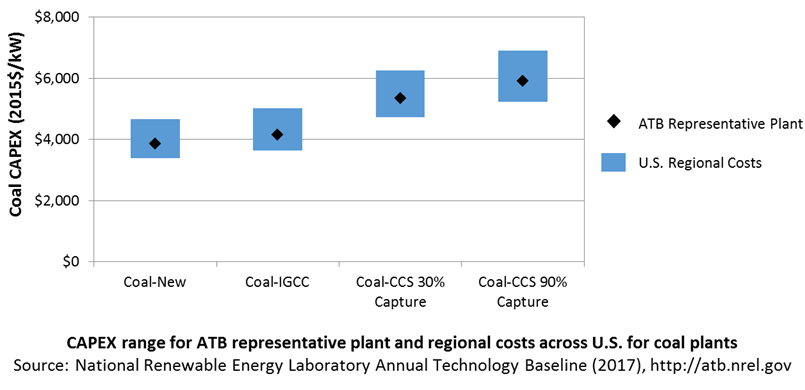

In the ATB, CAPEX represents each type of a coal plant with a unique value. Regional cost effects associated with labor rates, material costs, and other regional effects as defined by EIA (2016a) expand the range of CAPEX. Unique land-based spur line costs based on distance and transmission line costs are not estimated. The following figure illustrates the ATB representative plant relative to the range of CAPEX including regional costs across the contiguous United States. The ATB representative plants are associated with a regional multiplier of 1.0.

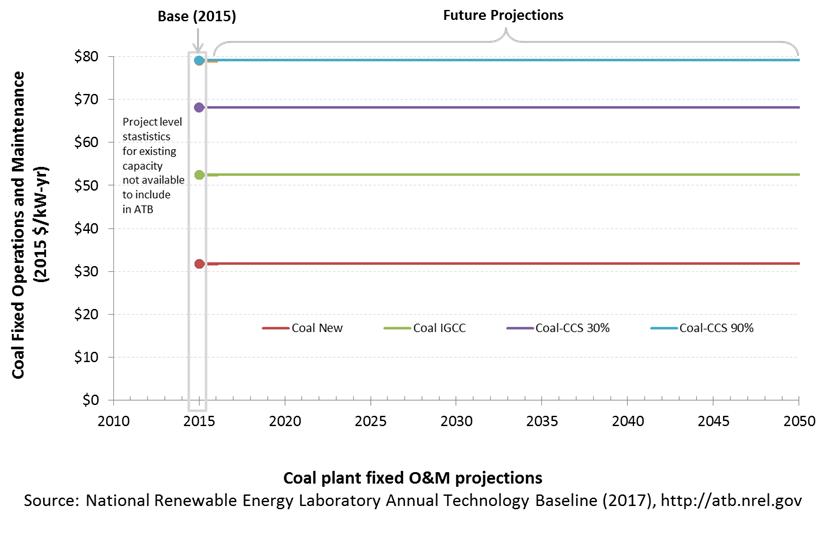

Operation and Maintenance (O&M) Costs

Operations and maintenance (O&M) costs represent the annual expenditures required to operate and maintain a plant over its technical lifetime (the distinction between economic life and technical life is described here), including:

- Insurance, taxes, land lease payments, and other fixed costs

- Present value and annualized large component replacement costs over technical life

- Scheduled and unscheduled maintenance of power plants, transformers, and other components over the technical lifetime of the plant.

Market data for comparison are limited and generally inconsistent in the range of costs covered and the length of the historical record.

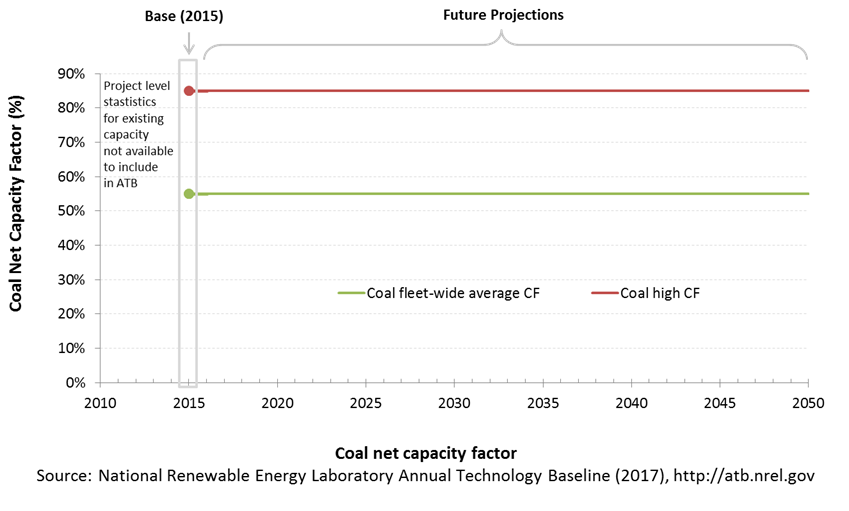

Capacity Factor: Expected Annual Average Energy Production Over Lifetime

The capacity factor represents the assumed annual energy production divided by the total possible annual energy production, assuming the plant operates at rated capacity for every hour of the year. For coal plants, the capacity factors are typically lower than their availability factors. Coal plant availability factors have a wide range depending on system design and maintenance schedules.

The capacity factor of dispatchable units is typically a function of the unit's marginal costs and local grid needs (e.g., need for voltage support or limits due to transmission congestion).

Coal power plants have typically been operated as baseload units, although that has changed in many locations due to low natural gas prices and increased penetration of variable renewable technologies. The average capacity factor used in the ATB is the fleet-wide average reported by EIA for 2015. The high capacity factor represents a new plant that would operate as a baseload unit.

Even though IGCC and coal with CCS have experienced limited deployment in the United States, it is expected that their performance characteristics would be similar to new coal power plants.

Levelized Cost of Energy (LCOE) Projections

Levelized cost of energy (LCOE) is a simple metric that combines the primary technology cost and performance parameters, CAPEX, O&M, and capacity factor. It is included in the ATB for illustrative purposes. The focus of the ATB is to define the primary cost and performance parameters for use in electric sector modeling or other analysis where more sophisticated comparisons among technologies are made. LCOE captures the energy component of electric system planning and operation, but the electric system also requires capacity and flexibility services to operate reliably. Electricity generation technologies have different capabilities to provide such services. For example, wind and PV are primarily energy service providers, while the other electricity generation technologies provide capacity and flexibility services in addition to energy. These capacity and flexibility services are difficult to value and depend strongly on the system in which a new generation plant is introduced. These services are represented in electric sector models such as the ReEDS model and corresponding analysis results such as the Standard Scenarios.

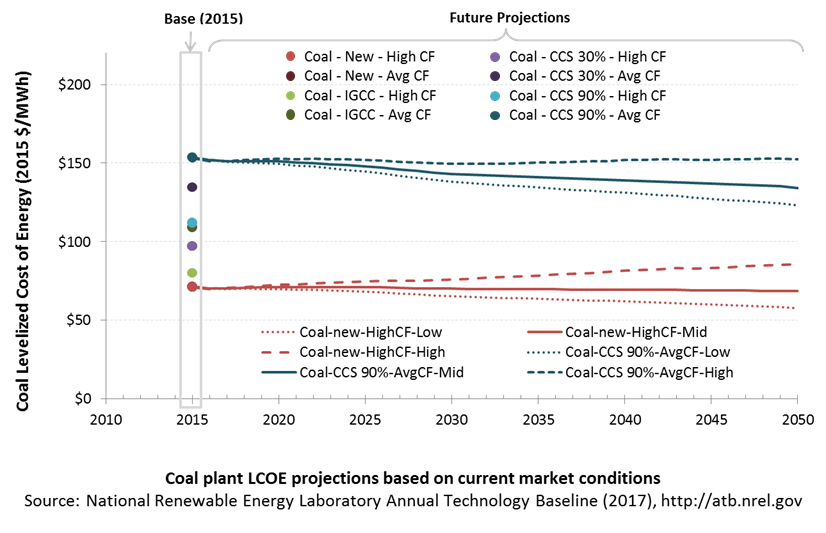

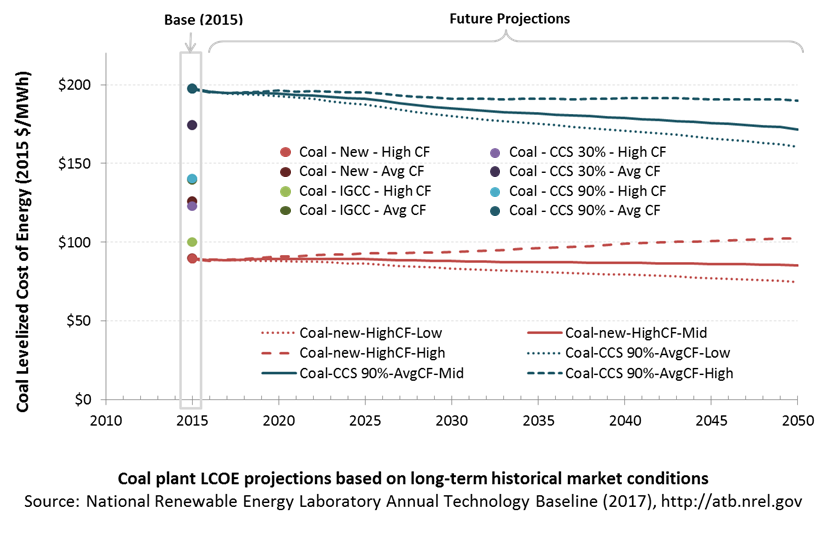

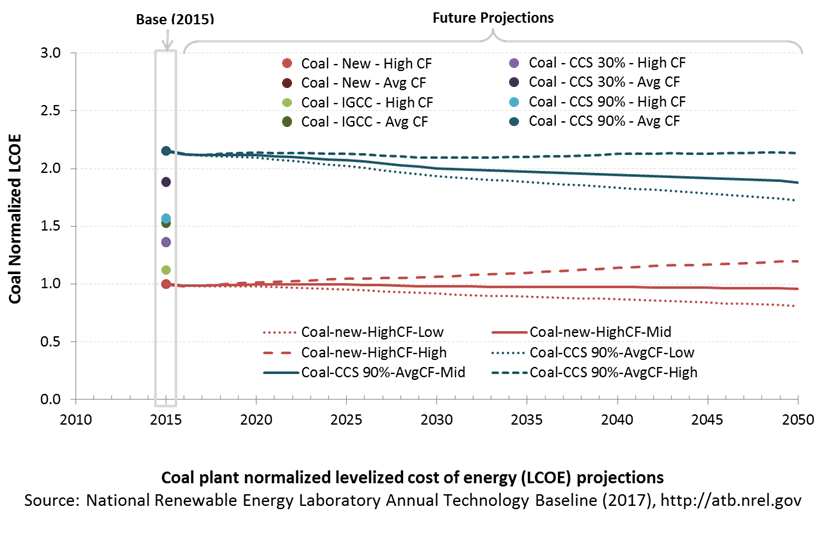

The following three figures illustrate the combined impact of CAPEX, O&M, and capacity factor projections across the range of resources present in the contiguous United States. The Current Market Conditions LCOE demonstrates the range of LCOE based on macroeconomic conditions similar to the present. The Historical Market Conditions LCOE presents the range of LCOE based on macroeconomic conditions consistent with prior ATB editions and Standard Scenarios model results. The Normalized LCOE (all LCOE estimates are normalized with the lowest Base Year LCOE value) emphasizes the relative effect of fuel price and heat rate independent of project finance assumptions. The ATB representative plant characteristics that best align with recently installed or anticipated near-term coal plants are associated with Coal-New-HighCF. Data for all the resource categories can be found in the ATB data spreadsheet.

The LCOE of coal power plants is directly impacted by multiple coal fuel cost scenarios. It is also impacted by variations in the heat rate, O&M costs, and assumed capacity factor. For a given year, the LCOE assumes that the fuel prices from that year continue throughout the lifetime of the plant.

The projections do not include any cost of carbon, which would influence the LCOE of fossil units. Also, for CCS plants, the potential revenue from selling the captured carbon is not included (e.g., enhanced oil recovery operation may purchase CO2 from a CCS plant).

To estimate LCOE, assumptions about the cost of capital to finance electricity generation projects are required. For comparison in the ATB, two project finance structures are represented.

- Current Market Conditions: The values of the production tax credit (PTC) and investment tax credit (ITC) are ramping down by 2020, at which time wind and solar projects may be financed with debt fractions similar to other technologies. This scenario reflects debt interest (4.4% nominal, 1.9% real) and return on equity rates (9.5% nominal, 6.8% real) to represent 2017 market conditions (AEO 2017) and a debt fraction of 60% for all electricity generation technologies. An economic life, or period over which the initial capital investment is recovered, of 20 years is assumed for all technologies. These assumptions are one of the project finance options in the ATB spreadsheet.

- Long-Term Historical Market Conditions: Historically, debt interest and return on equity were represented with higher values. This scenario reflects debt interest (8% nominal, 5.4% real) and return on equity rates (13% nominal, 10.2% real) implemented in the ReEDS model and reflected in prior versions of the ATB and Standard Scenarios model results. A debt fraction of 60% for all electricity generation technologies is assumed. An economic life, or period over which the initial capital investment is recovered, of 20 years is assumed for all technologies. These assumptions are one of the project finance options in the ATB spreadsheet.

These parameters are held constant for estimates representing the Base Year through 2050. No incentives such as the PTC or ITC are included. The equations and variables used to estimate LCOE are defined on the equations and variables page. For illustration of the impact of changing financial structures such as WACC and economic life, see Project Finance Impact on LCOE. For LCOE estimates for High, Mid, and Low scenarios for all technologies, see 2017 ATB Cost and Performance Summary.

Nuclear

Nuclear power contributed about 20% of U.S. electricity generation over the past two decades (DOE "Light Water Reactor Sustainability Program").

Nuclear power plants generate electricity in the same way as any other steam-electric power plant. Water is heated, and steam from the boiling water turns turbines and generates electricity. The main difference is that heat from a self-sustaining chain reaction boils the water in a nuclear power plant, as opposed to burning fuels in fossil fuel plants (DOE Office of Nuclear Energy "History").

Renewable energy technical potential, as defined by Lopez et al. (2012), represents the achievable energy generation of a particular technology given system performance, topographic limitations, and environmental and land-use constraints. Technical resource potential corresponds most closely to fossil reserves, as both can be characterized by the prospect of commercial feasibility and depend strongly on available technology at the time of the resource assessment. Uranium reserves in the United States are assessed by the United States Geological Survey (USGS, "Uranium Resources and Environmental Investigations").

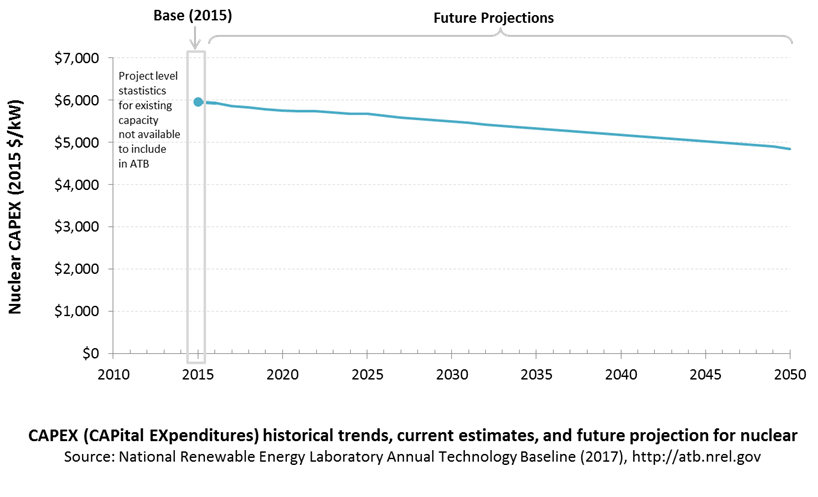

CAPital EXpenditures (CAPEX): Historical Trends, Current Estimates, and Future Projections

Because nuclear plants are well-known and perform close to their optimal performance, EIA expects capital expenditures (CAPEX) will incrementally improve over time and slightly more quickly than inflation.

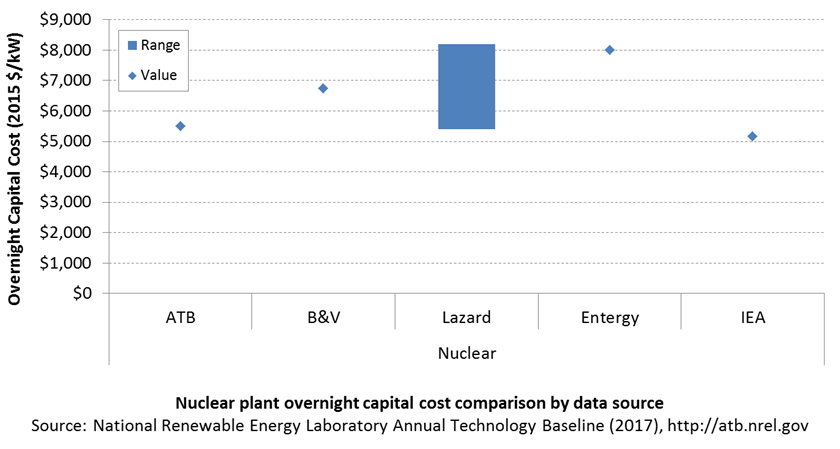

Comparison with Other Sources

CAPEX Definition

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year.

Overnight capital costs are modified from EIA (2017). Capital costs include overnight capital cost plus defined transmission cost, and it removes a material price index.

| Overnight Capital Cost ($/kW) | Construction Financing Factor (ConFinFactor) | CAPEX ($/kW) | |

|---|---|---|---|

| Nuclear: Advanced nuclear power generation | $5,515 | 1.084 | $5,979 |

CAPEX can be determined for a plant in a specific geographic location as follows:

CAPEX = ConFinFactor*(OCC*CapRegMult+GCC).

(See the Financial Definitions tab in the ATB data spreadsheet.)

Regional cost variations and geographically specific grid connection costs are not included in the ATB (CapRegMult = 1; GCC = 0). In the ATB, the input value is overnight capital cost (OCC) and details to calculate interest during construction (ConFinFactor).

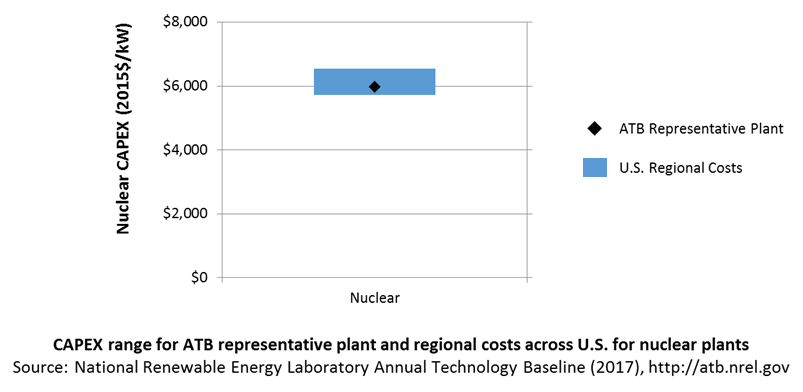

In the ATB, CAPEX represents each type of nuclear plant with a unique value. Regional cost effects associated with labor rates, material costs, and other regional effects as defined by EIA (2016a) expand the range of CAPEX (Plant*Region). Unique land-based spur line costs based on distance and transmission line costs are not estimated. The following figure illustrates the ATB representative plant relative to the range of CAPEX including regional costs across the contiguous United States. The ATB representative plants are associated with a regional multiplier of 1.0.

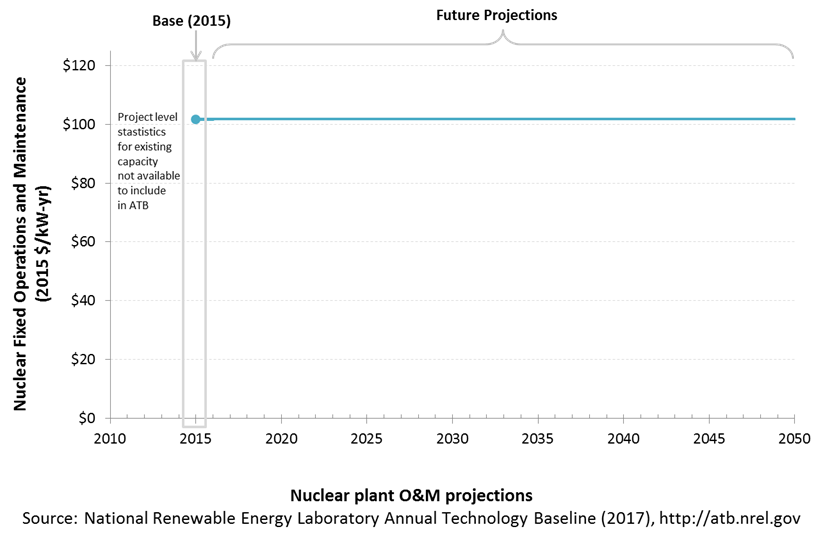

Operation and Maintenance (O&M) Costs

Operations and maintenance (O&M) costs represent the annual expenditures required to operate and maintain a plant over its technical lifetime (the distinction between economic life and technical life is described here), including:

- Insurance, taxes, land lease payments, and other fixed costs

- Present value and annualized large component replacement costs over technical life

- Scheduled and unscheduled maintenance of power plants, transformers, and other components over the technical lifetime of the plant.

Market data for comparison are limited and generally inconsistent in the range of costs covered and the length of the historical record.

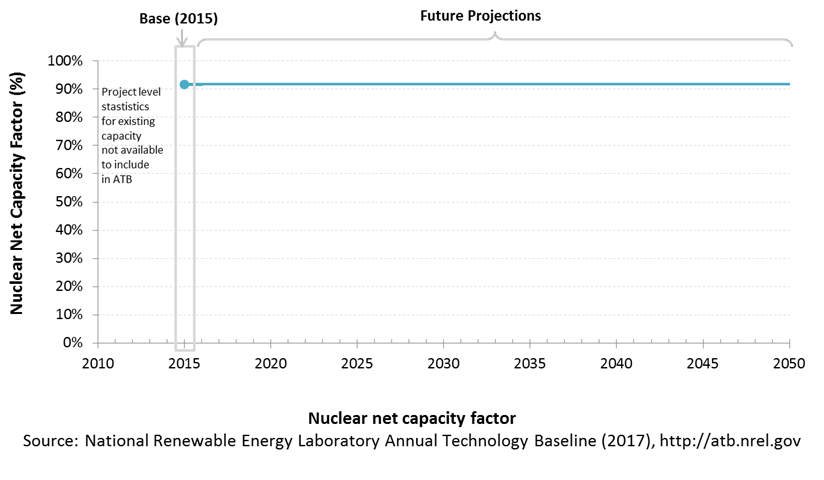

Capacity Factor: Expected Annual Average Energy Production Over Lifetime

The capacity factor represents the assumed annual energy production divided by the total possible annual energy production, assuming the plant operates at rated capacity for every hour of the year. For nuclear plants, the capacity factor is typically the same as (or very close to) their availability factor.

The capacity factor of nuclear units is generally very high (>85%) as they are typically always online except when undergoing maintenance or refueling (NEI "US Nuclear Capacity Factors").

In the United States, nuclear power plants are baseload plants with steady capacity factors. They need to change out their uranium fuel rods about every 24 months. After 18-36 months, the used fuel is removed from the reactor (World Nuclear Association "The Nuclear Fuel Cycle"). The average fueling outage duration in 2013 was 41 days; from 1990 to 1997, the refueling days ranged from 66 to 106, so improvements have helped capacity factors (NEI, "US Nuclear Refueling Outage Days"). See also NEI ("US Nuclear Power Plants: General U.S. Nuclear Info").

Levelized Cost of Energy (LCOE) Projections

Levelized cost of energy (LCOE) is a simple metric that combines the primary technology cost and performance parameters, CAPEX, O&M, and capacity factor. It is included in the ATB for illustrative purposes. The focus of the ATB is to define the primary cost and performance parameters for use in electric sector modeling or other analysis where more sophisticated comparisons among technologies are made. LCOE captures the energy component of electric system planning and operation, but the electric system also requires capacity and flexibility services to operate reliably. Electricity generation technologies have different capabilities to provide such services. For example, wind and PV are primarily energy service providers, while the other electricity generation technologies provide capacity and flexibility services in addition to energy. These capacity and flexibility services are difficult to value and depend strongly on the system in which a new generation plant is introduced. These services are represented in electric sector models such as the ReEDS model and corresponding analysis results such as the Standard Scenarios.

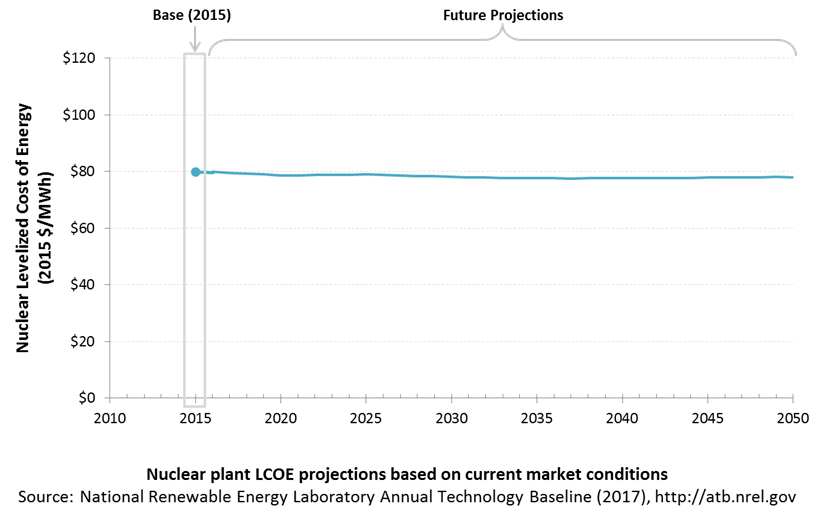

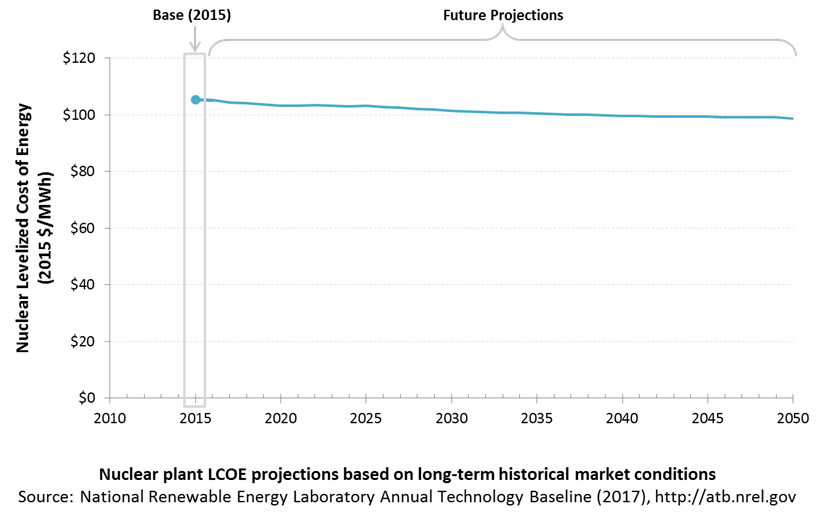

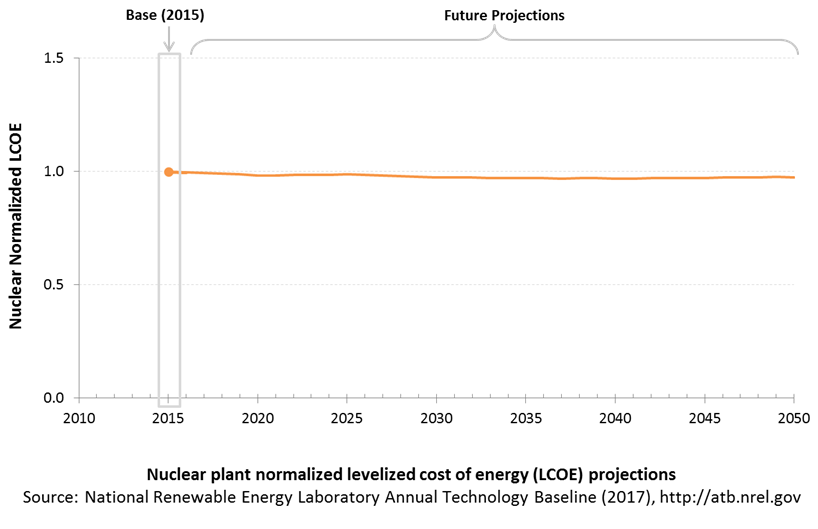

The following three figures illustrate the combined impact of CAPEX, O&M, and capacity factor projections across the range of resources present in the contiguous United States. The Current Market Conditions LCOE demonstrates the range of LCOE based on macroeconomic conditions similar to the present. The Historical Market Conditions LCOE presents the range of LCOE based on macroeconomic conditions consistent with prior ATB editions and Standard Scenarios model results. The Normalized LCOE (all LCOE estimates are normalized with the lowest Base Year LCOE value) emphasizes the relative effect of fuel price and heat rate independent of project finance assumptions.

The LCOE of nuclear power plants is directly impacted by the cost of uranium, variations in the heat rate, and O&M costs, but the biggest factor is the capital cost (including financing costs) of the plant. The LCOE can also be impacted by the amount of downtime from refueling or maintenance. For a given year, the LCOE assumes that the fuel prices from that year continue throughout the lifetime of the plant.

Fuel prices are based on the EIA's Annual Energy Outlook 2017 (EIA 2017).

To estimate LCOE, assumptions about the cost of capital to finance electricity generation projects are required. For comparison in the ATB, two project finance structures are represented.

- Current Market Conditions: The values of the production tax credit (PTC) and investment tax credit (ITC) are ramping down by 2020, at which time wind and solar projects may be financed with debt fractions similar to other technologies. This scenario reflects debt interest (4.4% nominal, 1.9% real) and return on equity rates (9.5% nominal, 6.8% real) to represent 2017 market conditions (AEO 2017) and a debt fraction of 60% for all electricity generation technologies. An economic life, or period over which the initial capital investment is recovered, of 20 years is assumed for all technologies. These assumptions are one of the project finance options in the ATB spreadsheet.

- Long-Term Historical Market Conditions: Historically, debt interest and return on equity were represented with higher values. This scenario reflects debt interest (8% nominal, 5.4% real) and return on equity rates (13% nominal, 10.2% real) implemented in the ReEDS model and reflected in prior versions of the ATB and Standard Scenarios model results. A debt fraction of 60% for all electricity generation technologies is assumed. An economic life, or period over which the initial capital investment is recovered, of 20 years is assumed for all technologies. These assumptions are one of the project finance options in the ATB spreadsheet.

These parameters are held constant for estimates representing the Base Year through 2050. No incentives such as the PTC or ITC are included. The equations and variables used to estimate LCOE are defined on the equations and variables page. For illustration of the impact of changing financial structures such as WACC and economic life, see Project Finance Impact on LCOE. For LCOE estimates for High, Mid, and Low scenarios for all technologies, see 2017 ATB Cost and Performance Summary.

References

B&V (Black & Veatch). 2012. Cost and Performance Data for Power Generation Technologies. Black & Veatch Corporation. February 2012. http://bv.com/docs/reports-studies/nrel-cost-report.pdf.

Brattle Group (Samuel A. Newell, J. Michael Hagerty, Kathleen Spees, Johannes P. Pfeifenberger, Quincy Liao, Christopher D. Ungate, and John Wroble). 2014. Cost of New Entry Estimates for Combustion Turbine and Combined Cycle Plants in PJM. The Brattle Group. http://www.brattle.com/system/publications/pdfs/000/005/010/original/Cost_of_New_Entry_Estimates_for_Combustion_Turbine_and_Combined_Cycle_Plants_in_PJM.pdf.

DOE (U.S. Department of Energy). 2016. Hydropower Vision: A New Chapter for America's Renewable Electricity Source. Washington, D.C.: U.S. Department of Energy. DOE/GO-102016-4869. July 2016. https://energy.gov/sites/prod/files/2016/10/f33/Hydropower-Vision-10262016_0.pdf.

DOI (U.S. Department of the Interior, Bureau of Reclamation). 2010. Assessment of Potential Capacity Increases at Existing Hydropower Plants: Hydropower Modernization Initiative. Sacramento, CA: U.S. Department of the Interior. October 2010. https://www.usbr.gov/power/AssessmentReport/USBRHMICapacityAdditionFinalReportOctober2010.pdf.

E3 (Energy and Environmental Economics). 2014. Capital Cost Review of Power Generation Technologies: Recommendations for WECC's 10- and 20-Year Studies. Prepared for the Western Electric Coordinating Council. https://www.wecc.biz/Reliability/2014_TEPPC_Generation_CapCost_Report_E3.pdf.

EIA (U.S. Energy Information Administration). 2015. Annual Energy Outlook with Projections to 2040. Washington, D.C.: U.S. Department of Energy. DOE/EIA-0383(2015). April 2015. http://www.eia.gov/outlooks/aeo/pdf/0383(2015).pdf.

EIA (U.S. Energy Information Administration). 2016a. Capital Cost Estimates for Utility Scale Electricity Generating Plants. Washington, D.C.: U.S. Department of Energy. November 2016. https://www.eia.gov/analysis/studies/powerplants/capitalcost/pdf/capcost_assumption.pdf.