Offshore Wind

Representative Technology

In 2016, the first offshore wind plant (30 MW) commenced commercial operation in the United States near Block Island (Rhode Island). In 2018, Vineyard Wind LLC and Massachusetts electric distribution companies submitted a 20-year power purchase agreement (PPA) for 800 MW of offshore wind generation and renewable energy certificates to the Massachusetts Department of Public Utilities for review and approval. In the ATB, cost and performance estimates are made for commercial-scale projects with 600 MW in capacity. The ATB Base Year offshore wind plant technology reflects a machine rating of 6 MW with a rotor diameter of 155 m and hub height of 100 m, which is typical of European projects installed in 2016 and 2017 and the turbine rating installed at the Block Island Wind Farm (GE Haliade 150-6MW).

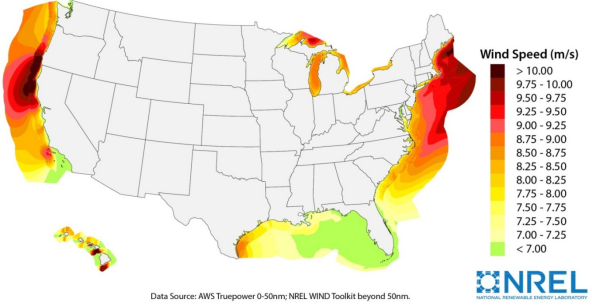

Resource Potential

Wind resource is prevalent throughout major U.S. coastal areas, including the Great Lakes. The resource potential exceeds 2,000 GW, excluding Alaska, based on domain boundaries from 50 nautical miles (nm) to 200 nm, turbine hub heights of 100 m (previously 90 m), and a capacity array power density of 3 MW/km2(Walt Musial et al. 2016). A range of technology exclusions were applied based on maximum water depth for deployment, minimum wind speed, and limits to floating technology in freshwater surface ice. Resource potential was represented by more than 7,000 areas for offshore wind plant deployment after accounting for competing use and environmental exclusions, such as marine protected areas, shipping lanes, pipelines, and others.

Base Year and Future Year Projections Overview

Based on a resource assessment (Walt Musial et al. 2016), LCOE was estimated at more than 7,000 areas (with a total capacity of approximately 2,000 GW). Using an updated version of NREL's Offshore Regional Cost Analyzer (ORCA) (Beiter et al. 2016), a variety of spatial parameters were considered, such as wind speeds, water depth, distance from shore, distance to ports, and wave height. CAPEX, O&M, and capacity factor are calculated for each geographic location using engineering models, hourly wind resource profiles, and representative sea states. ORCA was calibrated to the latest cost and technology trends observed in the U.S. and European offshore wind markets, including:

- Turbine CAPEX: $1,300/kW were assumed for the Base Year to account for decreases in Turbine CAPEX that were observed in global offshore wind markets.

- Turbine Rating: A turbine technology trend of 6 MW (Base Year), 8 MW (2022 commercial operation date [COD]), 10 MW (2027 COD), and 10 MW (2032 COD) was assumed to correspond to recent technology trends. While higher turbine ratings may be commercially available during this period (e.g., up to 15-MW turbine ratings are expected to be commercially available by the early 2030s), the selected turbine ratings are intended to reflect the average turbine rating of the operating U.S. offshore wind fleet.

- Export System Cable Costs: A reduction of 25% in comparison to an earlier version of ORCA (Beiter et al. 2016) was assumed for the Base Year to account for increased competition within the supply chain in recent years and for changes in material use and commodity prices.

- Cost Reduction Trajectory: Recent literature was surveyed to identify the most up-to-date cost reduction trends expected for U.S. and European offshore wind projects; the version of ORCA used to estimate cost reduction trajectories are derived from Valpy et al. (2017)(fixed bottom) and Hundleby et al. (2017)(floating).

- Contingency Levels: A markup of 25% above of European contingency levels was assumed to account for the higher risk of installing and operating early offshore wind farms in the United States.

- Lease Area Price: This cost to projects was included to account for the recent increase in the tendered U.S. lease area prices.

The spatial LCOE assessment served as the basis for estimating the ATB baseline LCOE in the Base Year 2017, weighted by the available capacity, for fixed-bottom and floating offshore wind technology. Only sites that exceed a distance to cable landfall of 20 kilometers (km) and a water depth of 10 meters (m) were included in the spatial assessment for the ATB to represent those sites only that are likely to be developed in the near-to-medium term. Long-term average hourly wind profiles are assumed and estimated LCOE reflects the least-cost choice among four substructure types (Beiter et al. 2016):

- Monopile (fixed-bottom)

- Jacket (fixed-bottom)

- Semi-submersible (floating)

- Spar (floating).

The representative offshore wind plant size is assumed to be 600 MW (Beiter et al. 2016). For illustration in the ATB, the full resource potential, represented by 7,000 areas, was divided into 15 techno-resource groups (TRGs), of which TRGs 1-5 are representative of fixed-bottom wind technology and TRGs 6-15 are representative of floating offshore wind technology. The capacity-weighted average CAPEX, O&M, grid connection costs, and capacity factor for each group are presented in the ATB.

For illustration in the ATB, all potential offshore wind plant areas were represented in 15 TRGs with TRGs 1-5 representing fixed-bottom offshore technology and TRGs 6-15 representing floating offshore wind technology. These were defined by resource potential (GW) and have higher resolution on the least-cost TRGs, as these are the most likely sites to be deployed, based on their economics. The following table summarizes the capacity-weighted average water depth, distance to cable landfall, and cost and performance parameters for each TRG. The table includes the relative resource potential. Typical offshore wind installations in 2017 that have spatial and economic conditions that may lend themselves well to near-term deployment are associated with TRG 3.

TRG Definitions for Offshore Wind

| TRG | Weighted Water Depth (m) | Weighted Distance Site to Cable Landfall (km) | Weighted Average CAPEX ($/kW) | Weighted Average OPEX ($/kW/yr) | Weighted Average Net CF (%) | Potential Wind Plant Capacity of Fixed-Bottom/Floating Total (%) | |

| Fixed-Bottom | TRG 1 | 18 | 27 | 3,361 | 105 | 45 | 2 |

| TRG 2 | 22 | 29 | 3,475 | 106 | 44 | 3 | |

| TRG 3 | 24 | 33 | 3,660 | 109 | 44 | 7 | |

| TRG 4 | 29 | 57 | 4,001 | 112 | 41 | 44 | |

| TRG 5 | 31 | 65 | 4,633 | 107 | 30 | 44 | |

| Floating | TRG 6 | 144 | 38 | 4,602 | 77 | 52 | 1 |

| TRG 7 | 159 | 45 | 4,661 | 78 | 51 | 2 | |

| TRG 8 | 157 | 46 | 4,710 | 78 | 49 | 4 | |

| TRG 9 | 148 | 64 | 4,936 | 84 | 49 | 8 | |

| TRG 10 | 107 | 101 | 5,209 | 91 | 47 | 15 | |

| TRG 11 | 375 | 116 | 5,320 | 98 | 43 | 15 | |

| TRG 12 | 467 | 116 | 5,331 | 97 | 36 | 15 | |

| TRG 13 | 663 | 166 | 5,785 | 92 | 34 | 15 | |

| TRG 14 | 432 | 147 | 6,145 | 87 | 30 | 15 | |

| TRG 15 | 468 | 133 | 6,599 | 83 | 28 | 11 | |

Future year projections for CAPEX, O&M, and capacity factor in the "Mid Technology Cost" Scenario are derived from the estimated cost reduction potential for offshore wind technologies based on assessments by BVG Associates ((Valpy et al. 2017), (Hundleby et al. 2017)) for 2017-2032. Based on the modeled data between 2017-2032, an (exponential) trend fit is derived for CAPEX, O&M in the "Mid Technology Cost" Scenario, and capacity factor to extrapolate ATB data for years 2033-2050. The specific scenarios are:

- Constant Technology Cost Scenario: no change in CAPEX, O&M, or capacity factor from 2015 to 2050; consistent across all renewable energy technologies in the ATB.

- Mid Technology Cost Scenario: LCOE percentage reduction estimated from BVG ((Valpy et al. 2017), (Hundleby et al. 2017)) from the Base Year, which is intended to correspond to a 50% probability of exceedance.

- Low Technology Cost Scenario: LCOE deviation from the Mid Technology Cost Scenario in CAPEX, O&M, or capacity factor from 2017 to 2050 informed by analysts' bottom-up technology and cost modeling. This scenario is intended to correspond to a 10%-30% probability of exceedance.

Capital Expenditures (CAPEX): Historical Trends, Current Estimates, and Future Projections

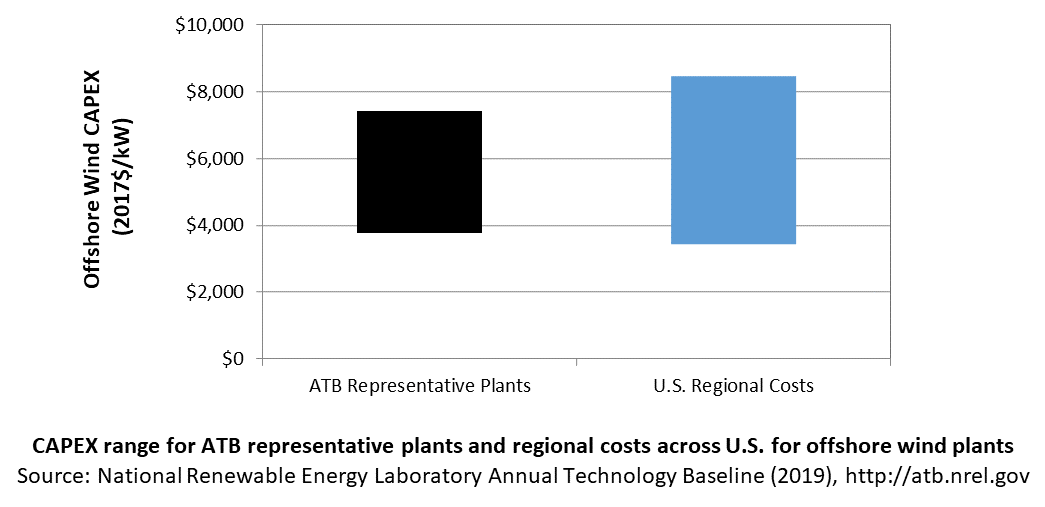

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year. These expenditures include the wind turbine, the balance of system (e.g., site preparation, installation, and electrical infrastructure), and financial costs (e.g., development costs, onsite electrical equipment, and interest during construction) and are detailed in CAPEX Definition. In the ATB, CAPEX reflects typical plants and does not include differences in regional costs associated with labor, materials, taxes, or system requirements. The related Standard Scenarios product uses Regional CAPEX Adjustments. The range of CAPEX demonstrates variation with spatial site parameters in the contiguous United States.

CAPEX Definition

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year.

Based on Moné at al. (2015) and Beiter et al. (2016), the System Cost Breakdown Structure of the ATB for the wind plant envelope is defined to include:

- Wind turbine supply

- Balance of system (BOS)

- Turbine installation, substructure supply and installation

- Site preparation, port and staging area support for delivery, storage, handling, and installation of underground utilities

- Electrical infrastructure, such as transformers, switchgear, and electrical system connecting turbines to each other (array cable system costs) and to the cable landfall (export cable system costs)

- Development and project management

- Financial costs

- Owners' costs, such as development costs, preliminary feasibility and engineering studies, environmental studies and permitting, legal fees, insurance costs, and property taxes during construction

- Interest during construction estimated based on three-year duration accumulated 40%/40%/20% at half-year intervals and an 8% interest rate (ConFinFactor).

CAPEX can be determined for a plant in a specific geographic location as follows:

Regional cost variations are not included in the ATB (CapRegMult = 1). In the ATB, the input value is overnight capital cost (OCC) and details to calculate interest during construction (ConFinFactor). Because transmission infrastructure between an offshore wind plant and the point at which a grid connection is made onshore is a significant component of the offshore wind plant cost, an offshore spur line cost (OffSpurCost) for each TRG is included in the CAPEX estimate. The offshore spur line cost reflects a capacity-weighted average of all potential wind plant areas within a TRG, similar to OCC.

In the ATB, CAPEX represents the capacity-weighted average values of all potential wind plant areas within a TRG and varies with water depth and distance from shore. Regional cost effects associated with labor rates, material costs, and other regional effects as defined by DOE and NREL (2015) expand the range of CAPEX. Unique land-based spur line costs for each of the 7,000 areas based on distance and transmission line costs expand the range of CAPEX even further. The following figure illustrates the ATB representative plants relative to the range of CAPEX including regional costs across the contiguous United States. The ATB representative plants are associated with a regional multiplier of 1.0.

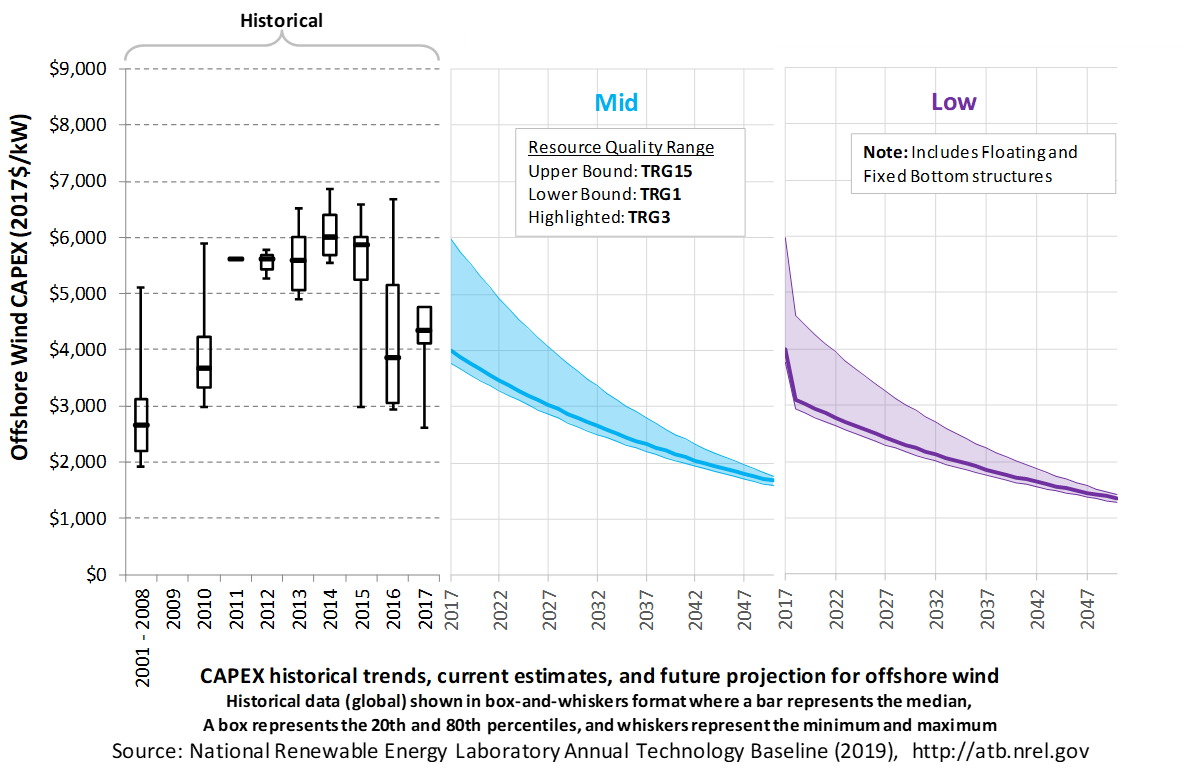

The following figure shows the Base Year estimate and future year projections for CAPEX costs. Mid and Low technology cost scenarios are shown. Historical data from offshore wind plants installed globally are shown for comparison to the ATB Base Year estimates. The estimate for a given year represents CAPEX of a new plant that reaches commercial operation in that year.

Recent Trends

Actual global offshore wind plant CAPEX is shown in box-and-whiskers format for comparison to the ATB current CAPEX estimates and future projections. CAPEX estimates for 2017 correspond well with market data for plants installed in 2017. Projections reflect a continuation of the downward trend observed in the recent past and are anticipated to continue based on preliminary data for 2017 projects.

Base Year Estimates

Base Year estimates for CAPEX were derived using an updated version of NREL's Offshore Regional Cost Analyzer (ORCA) (Beiter et al. 2016). A variety of spatial parameters were considered, such as water depth, distance from shore, distance to ports, and wave height to estimate CAPEX. CAPEX estimates were calibrated to correspond to the latest cost and technology trends observed in the U.S. and European offshore wind markets, including:

- Turbine CAPEX: $1,300/kW were assumed for the Base Year to account for decreases in Turbine CAPEX that were observed in global offshore wind markets.

- Turbine Rating: A turbine technology trend of 6 MW (Base Year), 8 MW (2022 commercial operation date [COD]), 10 MW (2027 COD), and 10 MW (2032 COD) was assumed to correspond to recent technology trends. While higher turbine ratings may be commercially available during this period (e.g., up to 15-MW turbine ratings are expected to be commercially available by the early 2030s), the selected turbine ratings are intended to reflect the average turbine rating of the operating U.S. offshore wind fleet.

- Export System Cable Costs: A reduction of 25% in comparison to an earlier version of ORCA (Beiter et al. 2016) was assumed for the Base Year to account for increased competition within the supply chain in recent years and for changes in material use and commodity prices.

- Cost Reduction Trajectory: Recent literature was surveyed to identify the most up-to-date cost reduction trends expected for U.S. and European offshore wind projects; the version of ORCA used to estimate cost reduction trajectories are derived from Valpy et al. (2017)(fixed bottom) and Hundleby et al. (2017) (floating).

- Contingency Levels: A markup of 25% on top of European contingency levels was assumed to account for the higher risk of installing and operating early offshore wind farms in the United States.

- Lease Area Price: This cost to projects was included to account for the recent increase in the tendered U.S. lease area prices.

Future Year Projections

- Mid Technology Cost Scenario: CAPEX percentage reduction estimated from BVG ((Valpy et al. 2017) for fixed-bottom and (Hundleby et al. 2017)) from the Base Year, which is intended to correspond to a 50% probability of exceedance.

- Low Technology Cost Scenario: CAPEX deviation from the Mid Technology Cost Scenario in CAPEX, O&M, or capacity factor from 2017 to 2050 informed by analysts' bottom-up technology and cost modeling. This scenario is intended to correspond to a 10%-30% probability of exceedance.

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

CAPEX in the ATB does not represent regional variants (CapRegMult) associated with labor rates, material costs, etc., but the ReEDS model does include 134 regional multipliers (EIA 2013).

The ReEDS model determines offshore spur line and land-based spur line (GCC) uniquely for each of the 7,000 areas based on distance and transmission line cost.

Operation and Maintenance (O&M) Costs

Operations and maintenance (O&M) costs represent the annual fixed expenditures required to operate and maintain a wind plant over its lifetime, including:

- Insurance, taxes, land lease payments and other fixed costs (e.g., project management and administration, weather forecasting, and condition monitoring)

- Present value and annualized large component replacement costs over technical life (e.g., blades, gearboxes, and generators)

- Scheduled and unscheduled maintenance of wind plant components, including turbines and transformers, over the technical lifetime of the plant.

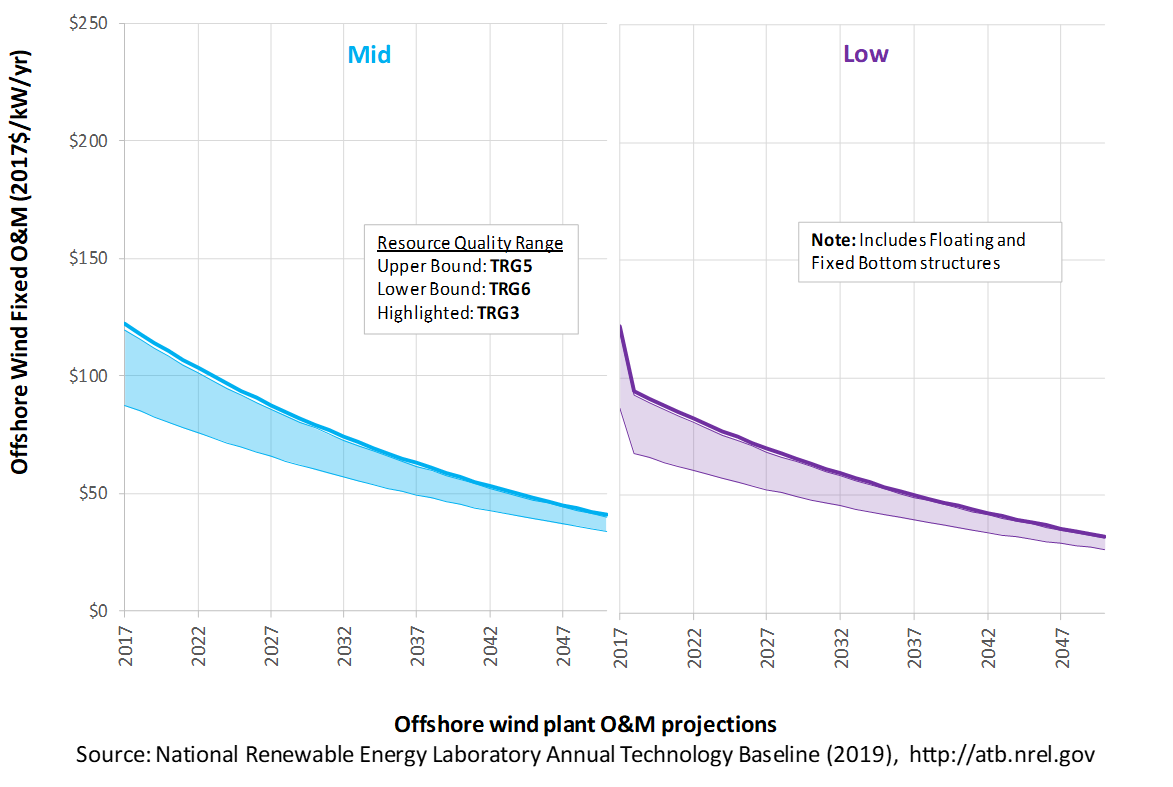

The following figure shows the Base Year estimate and future year projections for fixed and floating O&M (FOM) costs. Mid and Low technology cost scenarios are shown. The estimate for a given year represents annual average FOM costs expected over the technical lifetime of a new plant that reaches commercial operation in that year. The range of Base Year O&M estimates reflect the variation in spatial parameters such as distance from shore and metocean conditions.

Base Year Estimates

FOM costs vary by distance from shore and metocean conditions. As a result, O&M costs in the "Mid Technology Cost Scenario" vary from $87/kW-year (TRG 6) to $127/kW-year (TRG 4) in 2017. The average in the ATB "Mid Technology Cost Scenario" for fixed-bottom offshore technology (TRGs 1-5) is $121/kW-year; the corresponding value for floating offshore wind technology (TRGs 6-15) is $97/kW-year.

Future Year Projections

Future fixed-bottom offshore wind technology O&M is estimated to decline 66% by 2050 in the Mid cost case.

Future floating offshore wind technology O&M is estimated to decline 61% by 2050 in the Mid cost case.

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

Capacity Factor: Expected Annual Average Energy Production Over Lifetime

The capacity factor represents the expected annual average energy production divided by the annual energy production, assuming the plant operates at rated capacity for every hour of the year. It is intended to represent a long-term average over the lifetime of the plant. It does not represent interannual variation in energy production. Future year estimates represent the estimated annual average capacity factor over the technical lifetime of a new plant installed in a given year.

The capacity factor is influenced by the rotor swept area/generator capacity, hub height, hourly wind profile, expected downtime, and energy losses within the wind plant. It is referenced to 100-m above-water-surface, long-term average hourly wind resource data from Musial et al. (2016).

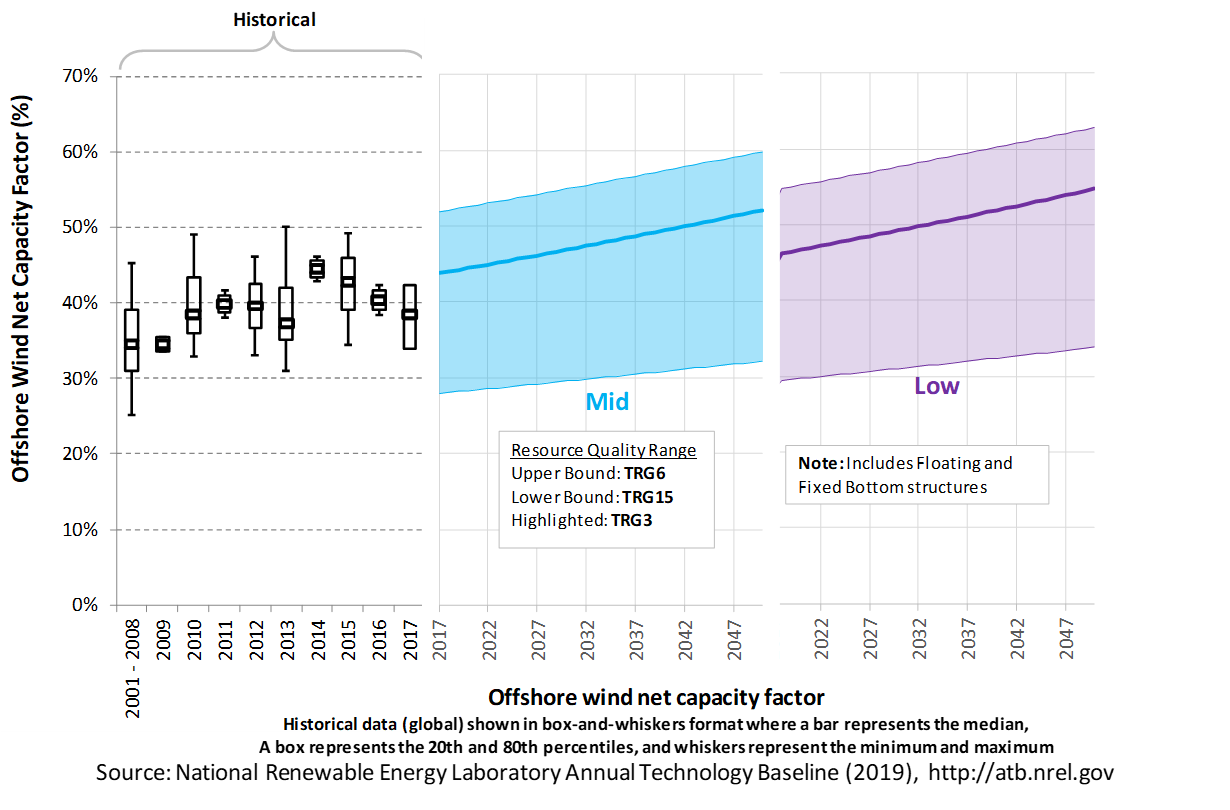

The following figure shows a range of capacity factors based on variation in the wind resource for offshore wind plants in the contiguous United States. Preconstruction estimates for offshore wind plants operating globally in 2015, according to the year in which plants were installed, is shown for comparison to the ATB Base Year estimates. The range of Base Year estimates illustrates the effect of locating an offshore wind plant in a variety of wind resource (TRGs 1-5 are fixed-bottom offshore wind plants and TRGs 6-15 are floating offshore wind plants). Future projections are shown for Mid and Low technology cost scenarios.

Recent Trends

Preconstruction annual energy estimates from publicly available global operating wind capacity in 2017 (Walter Musial et al. forthcoming) are shown in a box-and-whiskers format for comparison with the ATB current estimates and future projections. The historical data illustrate preconstruction estimated capacity factors for projects by year of commercial online date. The figure shows the comparison between the range of capacity factors defined by the ATB TRGs and the reported capacity factors for projects installed in 2017.

Base Year Estimates

The capacity factor is determined using a representative power curve for a generic NREL-modeled 6-MW offshore wind turbine (Beiter et al. 2016) and includes geospatial estimates of gross capacity factors for the entire resource area (Walt Musial et al. 2016). The net capacity factor considers spatial variation in wake losses, electrical losses, turbine availability, and other system losses. For illustration in the ATB, all 7,000 wind plant areas are represented in 15 TRGs.

Future Year Projections

Projections of capacity factors for plants installed in future years were determined based on estimates obtained from BVG ((Valpy et al. 2017), (Hundleby et al. 2017)) for both fixed-bottom and floating offshore wind technologies. Projections for capacity factors implicitly reflect technology innovations such as larger rotors and taller towers that will increase energy capture at the same geographic location without explicitly specifying tower height and rotor diameter changes.

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

The ReEDS model output capacity factors for offshore wind can be lower than input capacity factors due to endogenously estimated curtailments determined by scenario constraints.

Plant Cost and Performance Projections Methodology

ATB projections between the Base Year and 2032 (COD) were derived from an expert elicitation conducted by BVG Associates ((Valpy et al. 2017), (Hundleby et al. 2017)). The expert elicitation assesses the impact of more than 50 technology innovations on various cost components of European offshore wind farms up to 2032 (COD). The cost impact from technology innovations was assessed by soliciting industry experts about the maximum cost impact from a technology innovation in combination with an assessment of an innovation's commercial readiness and market share in a given year.

For the ATB, three different technology cost scenarios were adapted from the expert survey results for scenario modeling as bounding levels:

- Constant Technology Cost Scenario: no change in CAPEX, O&M, or capacity factor from 2015 to 2050; consistent across all renewable energy technologies in the ATB.

- Mid Technology Cost Scenario: LCOE percentage reduction estimated from BVG ((Valpy et al. 2017), (Hundleby et al. 2017)) from the Base Year, intended to correspond to a 50% probability of exceedance.

- Low Technology Cost Scenario: LCOE deviation from the Mid Technology Cost Scenario in CAPEX, O&M, or capacity factor from 2017 to 2050 informed by analysts' bottom-up technology and cost modeling. This scenario is intended to correspond to a 10%-30% probability of exceedance.

Expert survey estimates from BVG Associates were normalized to the ATB Base Year starting point and applied to overnight capital costs (OCC), FOM, and annual energy production in 2022 (COD), 2027 (COD), and 2032 (COD). These serve as the ATB Mid projection between 2017-2032 (COD). The ATB Mid scenario is intended to represent a cluster of technology innovations that change the manufacturing, installation, operation, and performance of a wind farm consistent with historical cost reduction rates. The ATB Low scenario is intended to represent a cluster of technology innovations that fundamentally change the manufacturing, installation, operation and performance of a wind farm resulting in considerably higher cost reductions than the ATB Mid scenario. The ATB Low scenario is represented by cost reductions that are twice the rate achieved in the ATB Mid scenario. The percentage reduction in LCOE was applied equally across all TRGs. The cost reductions for ATB Mid and ATB Low scenarios between 2032 and 2050 were extrapolated (i.e., exponentially fit) based on the estimated trend between 2017 and 2032 (COD).

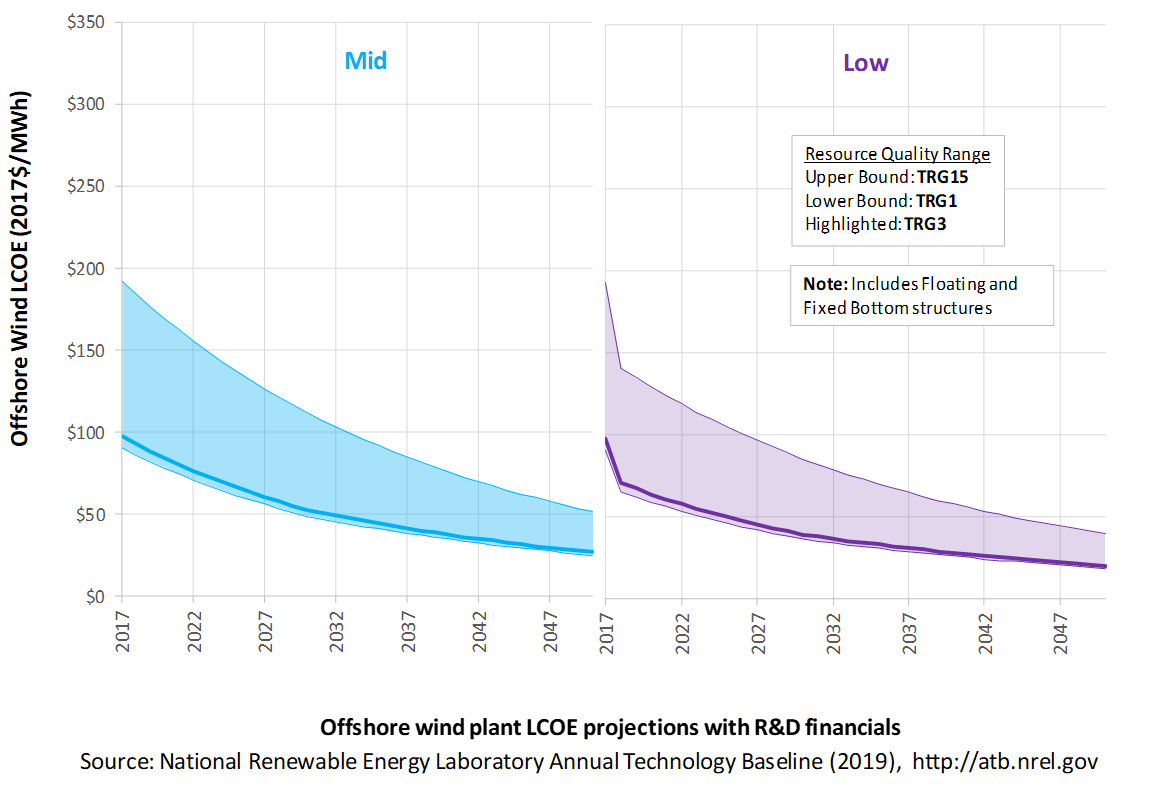

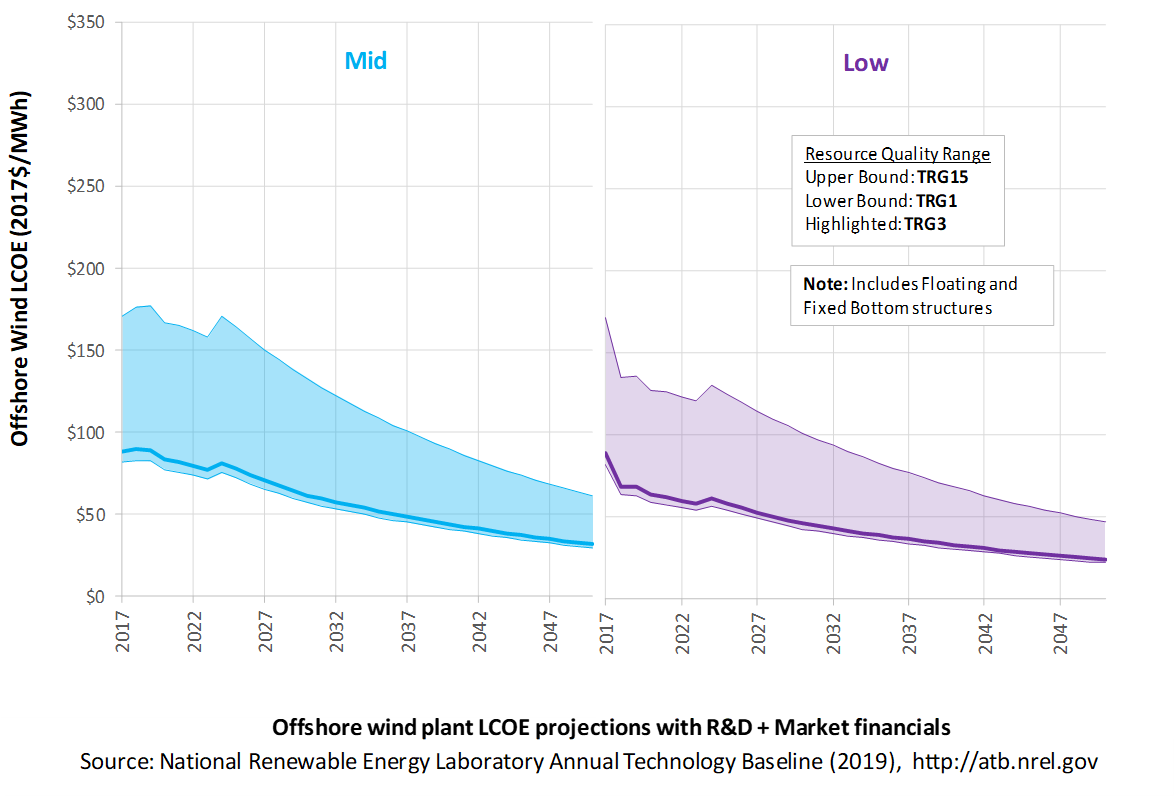

Levelized Cost of Energy (LCOE) Projections

Levelized cost of energy (LCOE) is a summary metric that combines the primary technology cost and performance parameters: CAPEX, O&M, and capacity factor. It is included in the ATB for illustrative purposes. The ATB focuses on defining the primary cost and performance parameters for use in electric sector modeling or other analysis where more sophisticated comparisons among technologies are made. The LCOE accounts for the energy component of electric system planning and operation. The LCOE uses an annual average capacity factor when spreading costs over the anticipated energy generation. This annual capacity factor ignores specific operating behavior such as ramping, start-up, and shutdown that could be relevant for more detailed evaluations of generator cost and value. Electricity generation technologies have different capabilities to provide such services. For example, wind and PV are primarily energy service providers, while the other electricity generation technologies provide capacity and flexibility services in addition to energy. These capacity and flexibility services are difficult to value and depend strongly on the system in which a new generation plant is introduced. These services are represented in electric sector models such as the ReEDS model and corresponding analysis results such as the Standard Scenarios.

The following three figures illustrate LCOE, which includes the combined impact of CAPEX, O&M, and capacity factor projections for offshore wind across the range of resources present in the contiguous United States. The R&D Only LCOE sensitivity cases present the range of LCOE based on financial conditions that are held constant over time unless R&D affects them, and they reflect different levels of technology risk. This case excludes effects of tax reform, tax credits, and changing interest rates over time. The R&D + Market LCOE case adds to these financial assumptions: (1) the changes over time consistent with projections in the Annual Energy Outlook and (2) the effects of tax reform and tax credits. The ATB representative plant characteristics that best align with those of recently installed or anticipated near-term offshore wind plants are associated with TRG 3. Data for all the resource categories can be found in the ATB Data spreadsheet; for simplicity, not all resource categories are shown in the figures.

R&D Only | R&D + Market

The methodology for representing the CAPEX, O&M, and capacity factor assumptions behind each pathway is discussed in Projections Methodology. In general, the degree of adoption of technology innovation distinguishes the Constant, Mid, and Low technology cost scenarios. These projections represent trends that reduce CAPEX and improve performance. Development of these scenarios involves technology-specific application of the following general definitions:

- Constant Technology: Base Year (or near-term estimates of projects under construction) equivalent through 2050 maintains current relative technology cost differences

- Mid Technology Cost Scenario: Technology advances through continued industry growth, public and private R&D investments, and market conditions relative to current levels that may be characterized as "likely" or "not surprising"

- Low Technology Cost Scenario: Technology advances that may occur with breakthroughs, increased public and private R&D investments, and/or other market conditions that lead to cost and performance levels that may be characterized as the " limit of surprise" but not necessarily the absolute low bound.

To estimate LCOE, assumptions about the cost of capital to finance electricity generation projects are required, and the LCOE calculations are sensitive to these financial assumptions. Two project finance structures are used within the ATB:

- R&D Only Financial Assumptions: This sensitivity case allows technology-specific changes to debt interest rates, return on equity rates, and debt fraction to reflect effects of R&D on technological risk perception, but it holds background rates constant at 2017 values from AEO2019 (EIA 2019) and excludes effects of tax reform and tax credits.

- R&D Only + Market Financial Assumptions: This sensitivity case retains the technology-specific changes to debt interest, return on equity rates, and debt fraction from the R&D Only case and adds in the variation over time consistent with AEO2019 (EIA 2019) as well as effects of tax reform and tax credits. For a detailed discussion of these assumptions, see Project Finance Impact on LCOE.

A constant cost recovery period-over which the initial capital investment is recovered-of 30 years is assumed for all technologies throughout this website, and can be varied in the ATB data spreadsheet.

The equations and variables used to estimate LCOE are defined on the Equations and Variables page. For illustration of the impact of changing financial structures such as WACC, see Project Finance Impact on LCOE. For LCOE estimates for the Constant, Mid, and Low technology cost scenarios for all technologies, see 2019 ATB Cost and Performance Summary.

In general, differences among the technology cost cases reflect different levels of adoption of innovations. Reductions in technology costs reflect the cost reduction opportunities that are listed below:

- The financing conditions assumed for the ATB are applicable to commercial-scale offshore wind projects only. Commercial-scale fixed-bottom offshore wind projects are expected to be installed starting in the early 2020s (Walter Musial et al. forthcoming). Offshore wind projects using floating technology are in a pre-commercial phase currently (i.e., multi-turbine arrays between 12-50 MW in size) for which the ATB financial assumptions are likely too favorable. Once floating technology is deployed at commercial scale, the ATB financial assumptions are expected to appropriately reflect the terms of financing. The use of floating technology for commercial-scale projects is expected by the mid-2020s. Continued turbine scaling to larger-megawatt turbines with larger rotors such that swept area/megawatt capacity decreases resulting in higher capacity factors for a given location

- Greater market competition in the production of primary components (e.g., turbines, support structure), and installation services

- Economy-of-scale and productivity improvements in manufacturing, including mass production of substructure component and optimized installation strategies

- Improved plant siting and operation to reduce plant-level energy losses, resulting in higher capacity factors

- More efficient O&M procedures combined with more reliable components to reduce annual average FOM costs

- Adoption of a wide range of innovative control, design, and material concepts that facilitate the high-level trends described above.

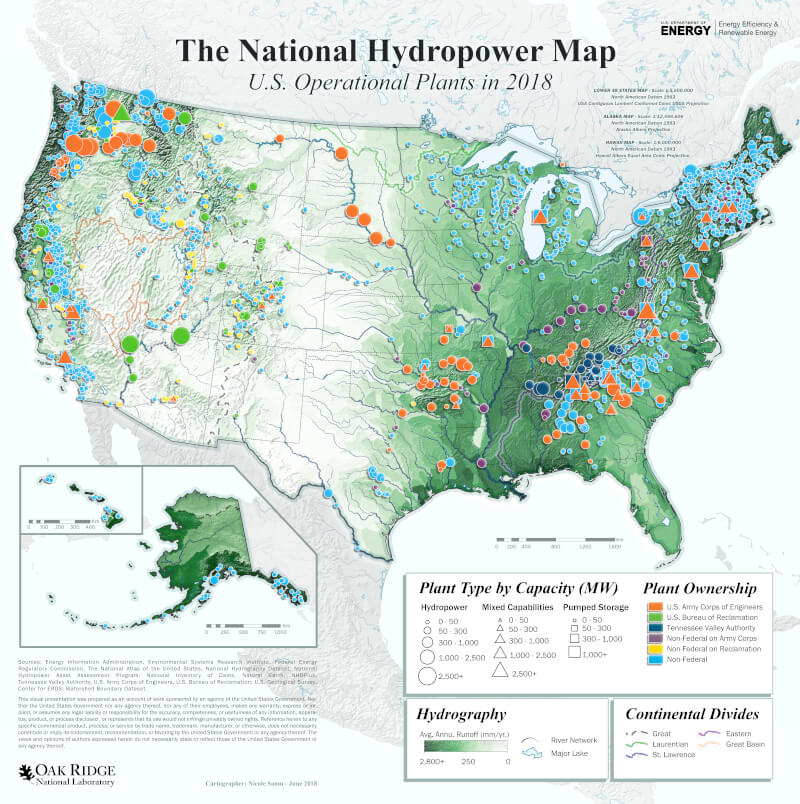

Hydropower

Renewable energy technical potential, as defined by Lopez et al. (2012) , represents the achievable energy generation of a particular technology given system performance, topographic limitations, and environmental and land-use constraints. The primary benefit of assessing technical potential is that it establishes an upper-boundary estimate of development potential. It is important to understand that there are multiple types of potential-resource, technical, economic, and market (see NREL: "Renewable Energy Technical Potential").

Note: Pumped-storage hydropower is considered a storage technology in the ATB and will be addressed in future years. It and other storage technologies are represented in Standard Scenarios Model Results from the ReEDS model, and battery storage technologies are shown in the associated portion of the ATB.

Representative Technology

Hydropower technologies have produced electricity in the United States for over a century. Many of these infrastructure investments have potential to continue providing electricity in the future through upgrades of existing facilities (DOE, 2016) . At individual facilities, investments can be made to improve the efficiency of existing generating units through overhauls, generator rewinds, or turbine replacements. Such investments are known collectively as "upgrades," and they are reflected as increases to plant capacity. As plants reach a license renewal period, upgrades to existing facilities to increase capacity or energy output are typically considered. While the smallest projects in the United States can be as small as 10-100 kW, the bulk of upgrade potential is from large, multi-megawatt facilities.

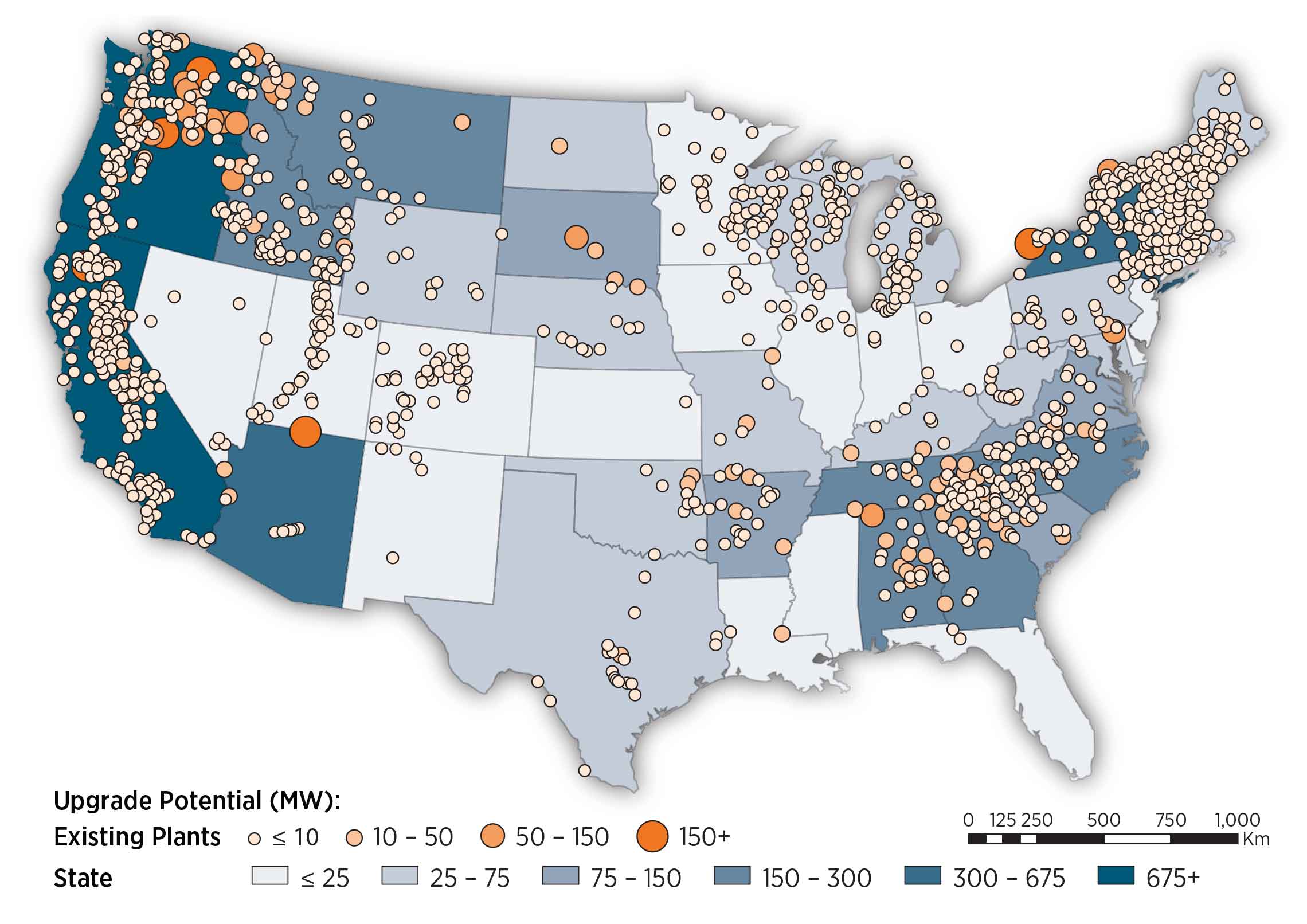

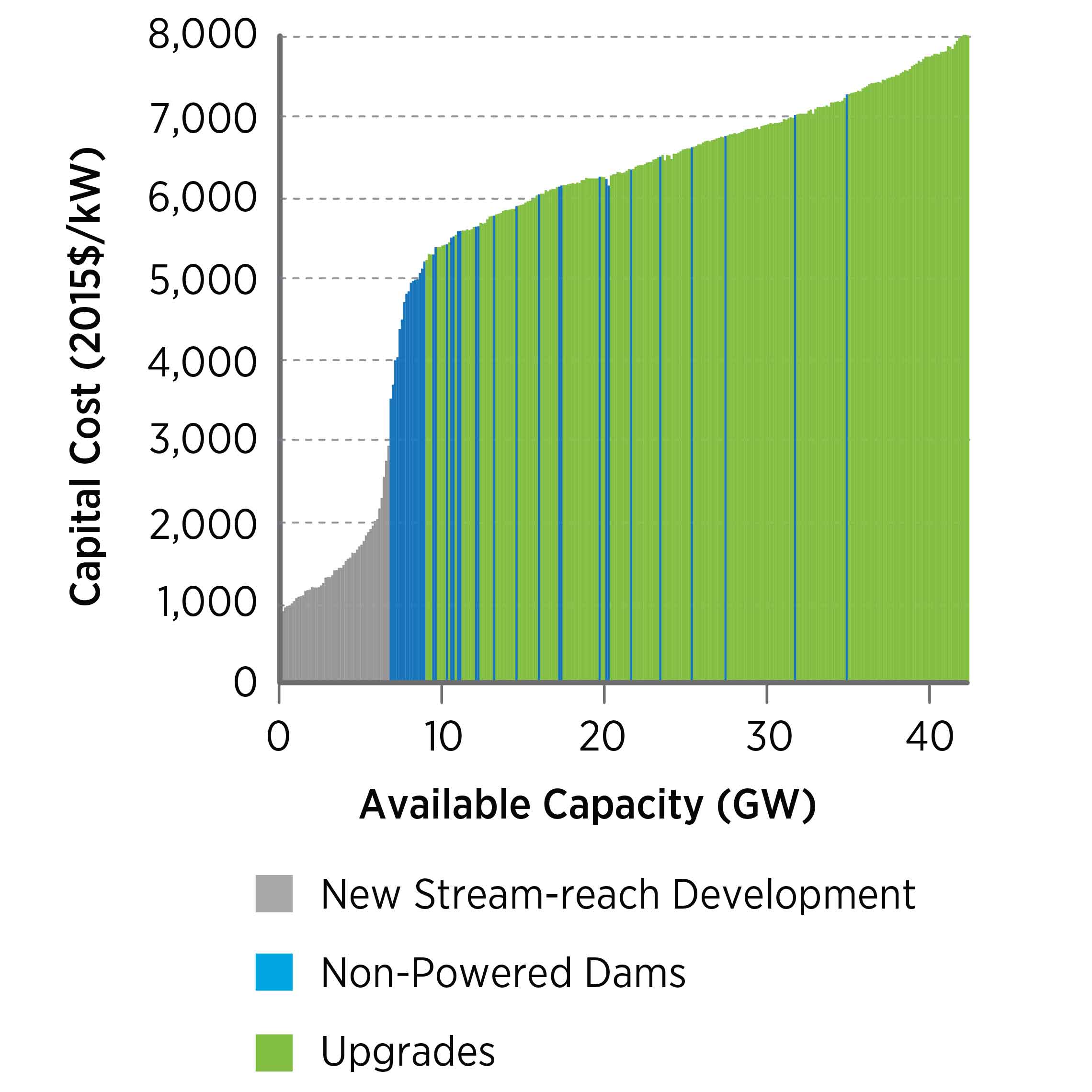

Resource Potential

The estimated total upgrade potential of 6.9 GW/24 terawattt-hours (TWh) (at about 1,800 facilities) is based on generalizable information drawn from a series of case studies or owner-specific assessments (DOE, 2016) . Information available to inform the representation of improvements to the existing fleet includes:

- A systematic, full-fleet assessment of expansion potential at Reclamation projects performed under the Reclamation Hydropower Modernization Initiative (see U.S. Bureau of Reclamation, "Hydropower Resource Assessment at Existing Reclamation Facilities")

- Case study reports from the U.S. Army Corps of Engineers (Corps) performed under its Hydropower Modernization Initiative (MWH, Watson, & Harza, 2009)

- Case study reports combining assessments of upgrade and unit and plant optimization potential from the U.S. Department of Energy/Oak Ridge National Laboratory Hydropower Advancement Project.

Base Year and Future Year Projections Overview

Upgrades are often among the lowest-cost new capacity resource, with the modeled costs for individual projects ranging from $800/kW to nearly $20,000/kW. This differential results from significant economies of scale from project size, wherein larger capacity plants are less expensive to upgrade on a dollar-per-kilowatt basis than smaller projects are. The average cost of the upgrade resource is approximately $1,500/kW.

CAPEX for each existing facility is based on direct estimates

The capacity factor is based on actual 10-year average energy production reported in EIA 923 forms. Some hydropower facilities lack flexibility and only produce electricity when river flows are adequate. Others with storage capabilities are operated to meet a balance between electric system, reservoir management, and environmental needs using their dispatch capability.

No future cost and performance projections for hydropower upgrades are assumed.

Upgrade cost and performance are not illustrated in this documentation of the ATB for the sake of simplicity.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

Upgrade potential becomes available in the ReEDS model at the relicensing date, end of plant life (50 years), or both.

Representative Technology

Non-powered dams (NPD) are classified by energy potential in terms of head. Low head facilities have design heads below 20 m and typically exhibit the following characteristics (DOE, 2016) :

- 1 MW to 10 MW

- New/rehabilitated intake structure

- Little, if any, new penstock

- Axial-flow or Kaplan turbines (2-4 units)

- New powerhouse (indoor)

- New/rehabilitated tailrace

- Minimal new transmission (< 5 miles, if required)

- Capacity factor of 35% to 60%.

High head facilities have design heads above 20 m and typically exhibit the following characteristics (DOE, 2016) :

- 5 MW to 30 MW

- New/rehabilitated intake structure

- New penstock (typically < 500 feet of steel penstock, if required)

- Francis turbines (1-3 units)

- New powerhouse (indoor)

- New/rehabilitated tailrace

- Minimal new transmission line (up to 15 MW, if required)

- Capacity factor of 35% to 60%.

Resource Potential

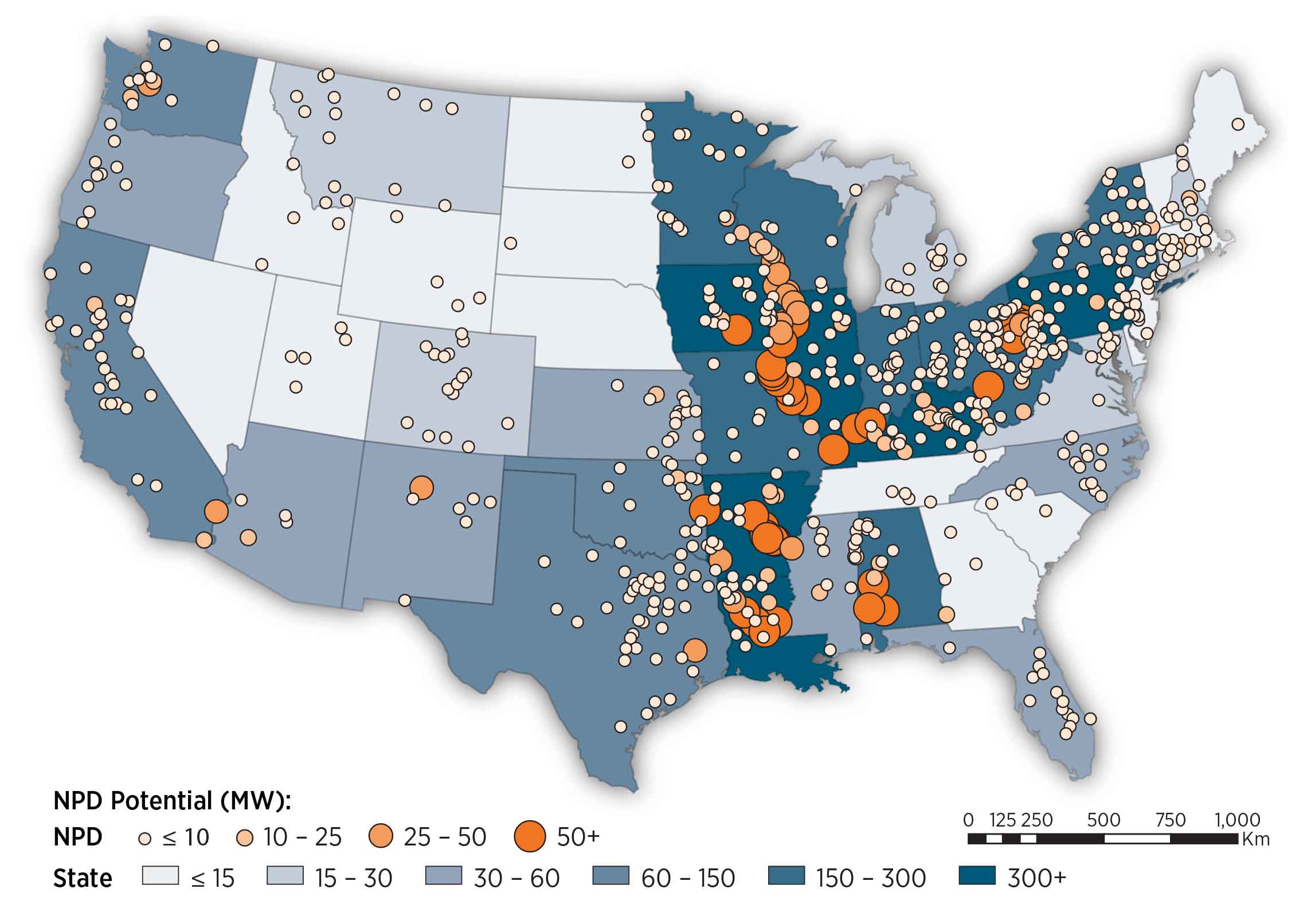

Up to 12 GW of technical potential exists to add power to U.S. NPD. However, based on financial decisions in recent development activity, the economic potential of NPD may be approximately 5.6 GW at more than 54,000 dams in the contiguous United States. Most of this potential (5 GW or 90% of resource capacity) is associated with less than 700 dams. These resource considerations are discussed below:

According to the National

Inventory of Dams, more than 80,000 dams exist that do not produce

power. This data set was filtered to remove dams with erroneous flow

and geographic data and dams whose data could not be resolved to a

satisfactory level of detail

A new methodology for sizing potential hydropower facilities that was developed for the new-stream reach development resource (Kao et al., 2014) was applied to non-powered dams. This resource potential was estimated to be 5.6 GW at more than 54,000 dams. In the development of the Hydropower Vision, the NPD resource available to the ReEDS model was adjusted based on recent development activity and limited to only those projects with power potential of 500 kW or more. As the ATB uses the Hydropower Vision supply curves, this results in a final resource potential of 5 GW/29 TWh from 671 dams.

For each facility, a design capacity, average monthly flow rate over a 30-year period, and a design flow rate exceedance level of 30% are assumed. The exceedance level represents the fraction of time that the design flow is exceeded. This parameter can be varied and results in different capacity and energy generation for a given site. The value of 30% was chosen based on industry rules of thumb. The capacity factor for a given facility is determined by these design criteria.

Design capacity and flow rate dictate capacity and energy generation potential. All facilities are assumed sized for 30% exceedance of flow rate based on long-term, average monthly flow rates.

Base Year and Future Year Projections Overview

Site-specific CAPEX, O&M, and capacity factor estimates are made

for each site in the available resource potential. CAPEX and O&M

estimates are made based on statistical analysis of historical plant

data from 1980 to 2015

Projections developed for the Hydropower Vision study (DOE, 2016) using technological learning assumptions and bottom-up analysis of process and/or technology improvements provide a range of future cost outcomes. Three different projections were developed for scenario modeling as bounding levels:

- Constant Technology Cost Scenario: no change in CAPEX, O&M, or capacity factor from 2017 to 2050; consistent across all renewable energy technologies in the ATB

- Mid Technology Cost Scenario: incremental technology learning, consistent with Reference in Hydropower Vision (DOE, 2016); CAPEX reductions for new stream-reach development (NSD) only

- Low cost: gains that are achievable when pushing to the limits of potential new technologies, such as modularity (in both civil structures and power train design), advanced manufacturing techniques, and materials, consistent with Advanced Technology in Hydropower Vision (DOE, 2016); both CAPEX and O&M cost reductions implemented.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

The ReEDS model includes a sensitivity scenario that restricts the resource potential to sites greater than 500 kW, consistent with the Hydropower Vision, which results in 5 GW/29 TWh at 671 dams.

Representative Technology

Greenfield or new stream-reach development (NSD) sites are defined as new hydropower developments along previously undeveloped waterways and typically exhibit the following characteristics (DOE, 2016) :

- 1 MW to 100 MW

- New diversion/intake structure

- New penstock

- Steel with length being head/terrain dependent

- Various turbine selections

- Impulse/Francis are common for recently completed projects

- New powerhouse (indoor)

- New tailrace

- New transmission line (up to 15 miles for new projects)

- 30% to 80% capacity factor.

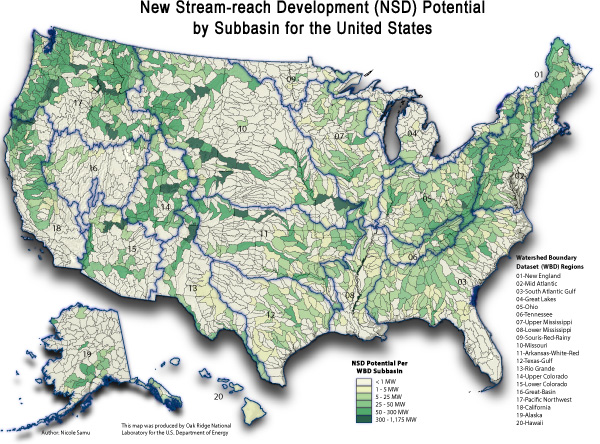

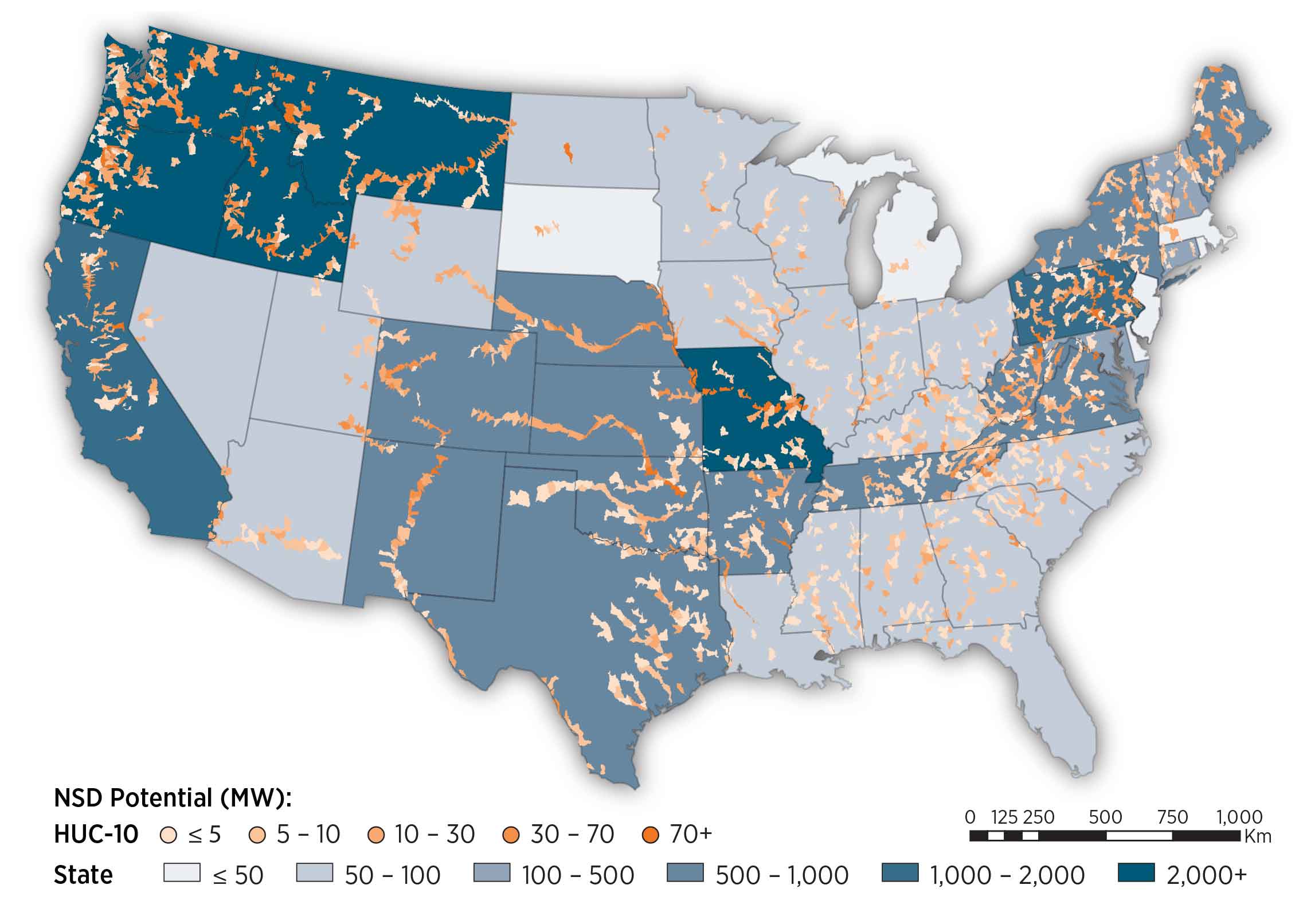

Resource Potential

The resource potential is estimated to be 53.2 GW/301 TWh at nearly 230,000 individual sites (Kao et al., 2014) after accounting for locations statutorily excluded from hydropower development such as national parks, wild and scenic rivers, and wilderness areas.

About 8,500 stream reaches were evaluated to assess resource potential (i.e., capacity) and energy generation potential (i.e., capacity factor). For each stream reach, a design capacity, average monthly flow rate over a 30-year period, and design flow rate exceedance level of 30% are assumed. The exceedance level represents the fraction of time that the design flow is exceeded. This parameter can be varied and results in different capacity and energy generation for a given site. The value of 30% was chosen based on industry rules of thumb. The capacity factor for a given facility is determined by these design criteria. Plant sizes range from kilowatt-scale to multi-megawatt scale (Kao et al., 2014) .

The resource assessment approach is designed to minimize the footprint of a hydropower facility by restricting inundation area to the Federal Emergency Management Agency (FEMA) 100-year floodplain.

New hydropower facilities are assumed to apply run-of-river operation strategies. Run-of-river operation means the flow rate into a reservoir is equal to the flow rate out of the facility. These facilities do not have dispatch capability.

Design capacity and flow rate dictate capacity and energy generation potential. All facilities are assumed sized for 30% exceedance of flow rate based on long-term, average monthly flow rates.

Base Year and Future Year Projections Overview

Site-specific CAPEX, O&M, and capacity factor estimates are made

for each site in the available resource potential. CAPEX and O&M

estimates are made based on statistical analysis of historical plant

data from 1980 to 2015

Projections developed for the Hydropower Vision study (DOE, 2016) using technological learning assumptions and bottom-up analysis of process and/or technology improvements provide a range of future cost outcomes. Three different projections were developed for scenario modeling as bounding levels:

- Constant Technology Cost Scenario: no change in CAPEX, O&M, or capacity factor from 2017 to 2050; consistent across all renewable energy technologies in the ATB

- Mid Technology Cost Scenario: incremental technology learning, consistent with Reference in Hydropower Vision (DOE, 2016); CAPEX reductions for NSD only

- Low Technology Cost Scenario: gains that are achievable

when pushing to the limits of potential new technologies, such as

modularity (in both civil structures and power train design), advanced

manufacturing techniques, and materials, consistent with Advanced

Technology in Hydropower Vision

(DOE, 2016) ; both CAPEX and O&M cost reductions implemented.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

The ReEDS model includes a sensitivity scenario that restricts the resource potential to sites greater than 1 MW, which results in 30.1 GW/176 TWh on nearly 8,000 reaches.

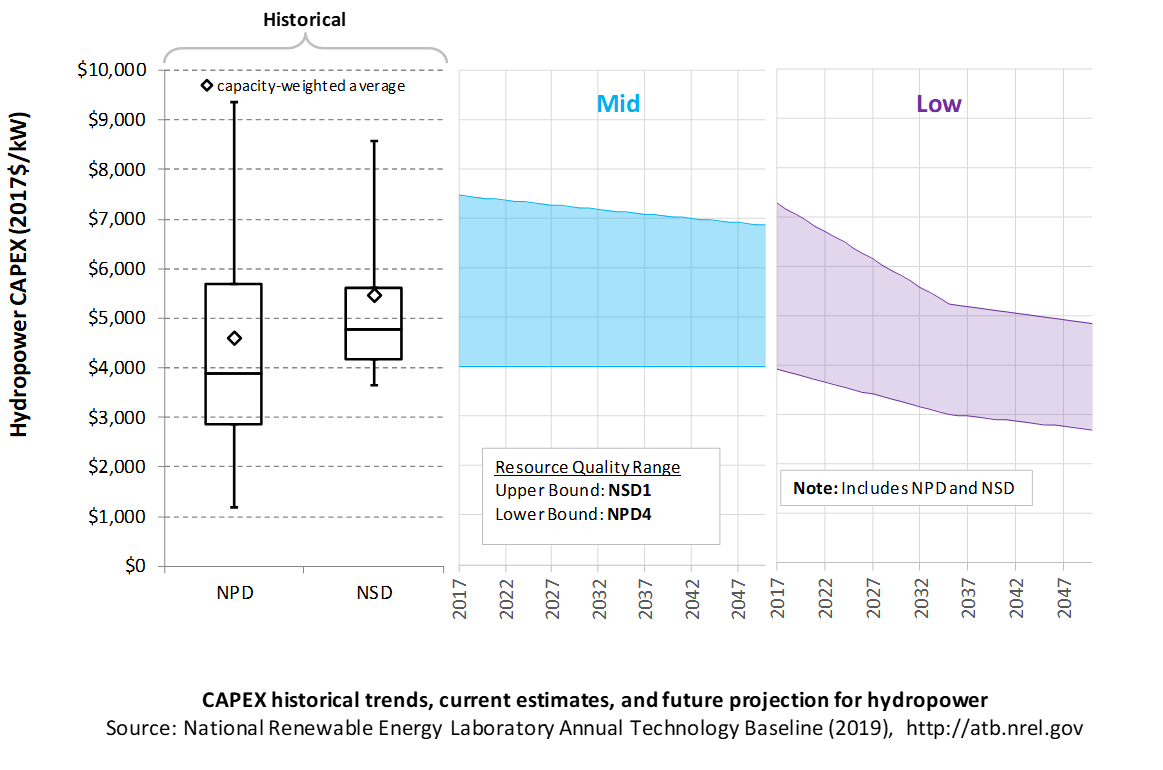

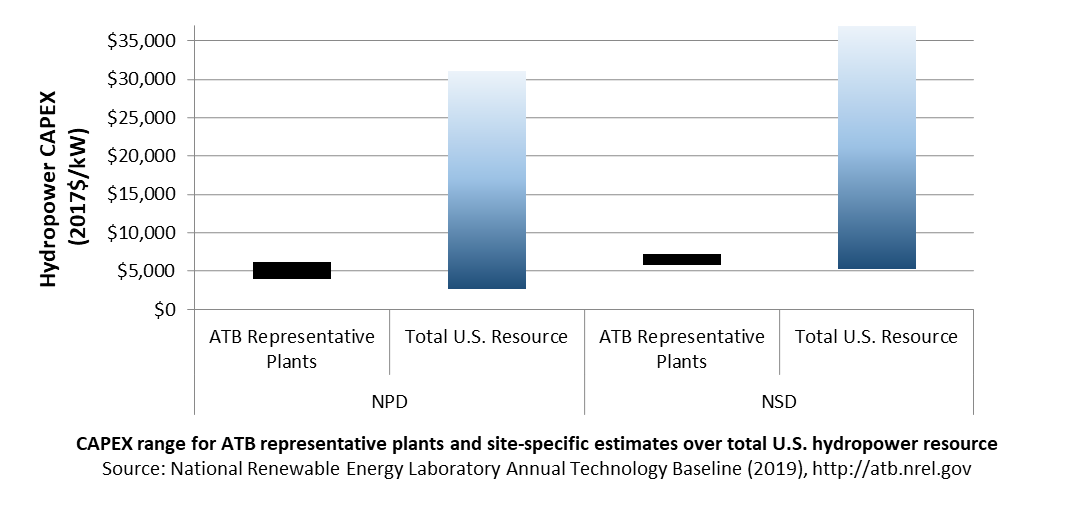

Capital Expenditures (CAPEX): Historical Trends, Current Estimates, and Future Projections

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year. These expenditures include the hydropower generation plant, the balance of system (e.g., site preparation, installation, and electrical infrastructure), and financial costs (e.g., development costs, onsite electrical equipment, and interest during construction) and are detailed in CAPEX Definition. In the ATB, CAPEX reflects typical plants and does not include differences in regional costs associated with labor, materials, taxes, or system requirements. The related Standard Scenarios product uses regional CAPEX adjustments. The range of CAPEX demonstrates variation with resource in the contiguous United States.

The following figure shows the Base Year estimate and future year projections for CAPEX costs. Mid and Low technology cost scenarios are shown. Historical data from actual and proposed non-powered dam (NPD) and new stream-reach development (NSD) plants installed in the United States from 1981 to 2014 are shown for comparison to the ATB Base Year. The estimate for a given year represents CAPEX of a new plant that reaches commercial operation in that year.

Recent Trends

Actual and proposed NPD and NSD CAPEX from 1981 to 2014

The higher-cost ATB sites generally reflect small-capacity, low head sites that are not comparable to the historical data sample's generally larger-capacity and higher head facilities. These characteristics lead to higher ATB Base Year CAPEX estimates than past data suggest. For example, the NSD projects that became commercially operational in this period are dominated by a few high head projects in the mountains of the Pacific Northwest or Alaska.

The Base Year estimates of CAPEX for NPDs in the ATB range from $3,800/kW to $6,000/kW. These estimates reflect facilities with 3 feet of head to more than 60 feet of head and from 0.5 MW to more than 30 MW of capacity. In general, the higher-cost sites reflect much smaller-capacity (< 10 MW), lower head (< 30 ft.) sites that have fewer analogues in the historical data, but these characteristics result in higher CAPEX.

The Base Year estimates of CAPEX for NSD range from $5,500/kW to $7,900/kW. The estimates reflect potential sites with 3 feet of head to more than 60 feet head and from 1 MW to more than 30 MW of capacity. In general, NSD potential represents smaller-capacity facilities with lower head than most historical data represent. These characteristics lead to higher CAPEX estimates than past data suggest, as many of the larger, higher head sites in the United States have been previously developed.

Base Year Estimates

For illustration in the ATB, all potential NPD and NSD sites were first binned by both head and capacity. Analysis of these bins provided groupings that represent the most realistic conditions for future hydropower deployment. The design values of these four reference NPD and four reference NSD plants are shown below. The full range of resource and design characteristics is summarized in the ATB data spreadsheet.

Representative Hydropower Plants

| Resource Characteristics Ranges | Weighted Average Values | Calculated Plant Values | |||||

| Plants | Head (feet) | Capacity (MW) | Head (feet) | Capacity (MW) | Capacity Factor | ICC (2014$/kW) | O&M (2014$/kW) |

| NPD 1 | 3-30 | 0.5-10 | 15.4 | 4.8 | 0.62 | 5,969.33 | 111.73 |

| NPD 2 | 3-30 | 10+ | 15.9 | 82.2 | 0.64 | 5,433.24 | 30.74 |

| NPD 3 | 30+ | 0.5-10 | 89.6 | 4.2 | 0.60 | 3,997.79 | 118.67 |

| NPD 4 | 30+ | 10+ | 81.3 | 44.7 | 0.60 | 3,769.22 | 40.54 |

| NSD 1 | 3-30 | 1-10 | 15.7 | 3.7 | 0.66 | 7,034.81 | 125.01 |

| NSD 2 | 3-30 | 10+ | 19.6 | 44.1 | 0.66 | 6,280.15 | 40.76 |

| NSD 3 | 30+ | 1-10 | 46.8 | 4.3 | 0.62 | 6,151.05 | 117.61 |

| NSD 4 | 30+ | 10+ | 45.3 | 94.0 | 0.66 | 5,537.34 | 28.93 |

The reference plants shown above were developed using the average characteristics (weighted by capacity) of the resource plants within each set of ranges. For example, NPD 1 is constructed from the capacity-weighted average values of NPD sites with 3-30 feet of head and 0.5-10 MW of capacity.

The weighted-average values were used as input to the cost formulas

CAPEX for each plant is based on statistical analysis of historical

plant data from 1980 to 2015 as a function of key design parameters,

plant capacity, and hydraulic head

and

Where P is capacity in megawatts, and H is head in feet. The first term represents the initial capital costs, while the second represents licensing.

Future Projections

Projections developed for the Hydropower Vision study (DOE, 2016) using technological learning assumptions and bottom-up analysis of process and/or technology improvements provide a range of future cost outcomes. Three different CAPEX projections were developed for scenario modeling as bounding levels:

- Constant Technology Cost Scenario:

- NPD and NSD CAPEX unchanged from the Base Year; consistent across all renewable energy technologies in the ATB

- Mid Technology Cost Scenario: consistent with the Reference case in Hydropower Vision:

- NSD CAPEX reduced 5% in 2035 and 8.6% in 2050

- NPD CAPEX unchanged from the Base Year

- Low Technology Cost Scenario: consistent with the Advanced Technology case in Hydropower Vision:

- Low head NPD/All NSD CAPEX reduced 30% in 2035 and 35.3% in 2050. Low Head NPD is NPD-1 and NPD-2

- High head NPD CAPEX reduced 25% in 2035 and 32.7% in 2050; High Head NPD is NPD-3 and NPD-4

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

The ReEDS model uses resource/cost supply curves representing estimates at each individual facility (~700 NPD and ~8,000 NSD).

The ReEDS model represents cost and performance for NPD and NSD potential in 5 bins for each of 134 geographic regions, which results in CAPEX ranges of $2,750/kW-$9,000/kW for NPD resource and $5,200/kW-$15,600/kW for NSD.

CAPEX Definition

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year.

For the ATB, and based on (EIA, 2016) and the System Cost Breakdown Structure described by (O'Connor, Zhang, DeNeale, Chalise, & Centurion, 2015), the hydropower plant envelope is defined to include:

- Hydropower generation plant

- Civil works, such as site preparation, dams and reservoirs, water conveyances, and powerhouse structures

- Equipment, such as the powertrain and ancillary plant electrical and mechanical systems

- Balance of system (BOS)

- Installation and O&M infrastructure

- Electrical infrastructure, such as transformers, switchgear, and electrical system connecting turbines to each other and to the control center

- Project indirect costs, including costs related to environmental mitigation and regulatory compliance, engineering, distributable labor and materials, construction management start up and commissioning, and contractor overhead costs, fees, and profit

- Financial costs

- Owners' costs, such as development costs, preliminary feasibility and engineering studies, environmental studies and permitting, legal fees, insurance costs, and property taxes during construction

- Electrical interconnection and onsite electrical equipment (e.g., switchyard), a nominal-distance spur line (< 1 mile), and necessary upgrades at a transmission substation; distance-based spur line cost (GCC) not included in the ATB

- Interest during construction estimated based on three-year duration accumulated 10%/10%/80% at half-year intervals and an 8% interest rate (ConFinFactor).

CAPEX can be determined for a plant in a specific geographic location as follows:

Regional cost variations and geographically specific grid connection costs are not included in the ATB (CapRegMult = 1; GCC = 0). In the ATB, the input value is overnight capital cost (OCC) and details to calculate interest during construction (ConFinFactor).

In the ATB, CAPEX is shown for four representative non-powered dam plants and four representative new stream-reach development plants. CAPEX estimates for all identified hydropower potential (~700 NPD and ~8,000 NSD) results in a CAPEX range that is much broader than that shown in the ATB. It is unlikely that all the resource potential will be developed due to the very high costs for some sites. Regional cost effects and distance-based spur line costs are not estimated.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

CAPEX in the ATB does not represent regional variants (CapRegMult) associated with labor rates, material costs, etc., and neither does the ReEDS model.

CAPEX in the ATB does not include geographically determined spur line (GCC) from plant to transmission grid, and neither does the ReEDS model.

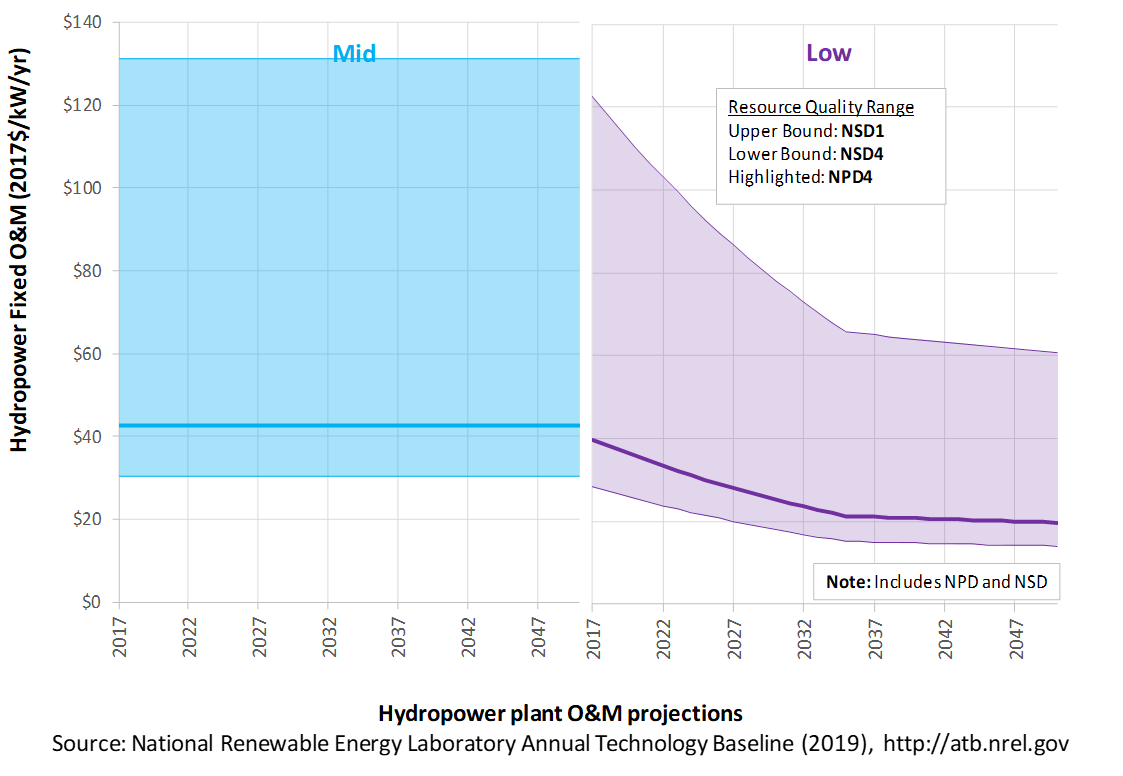

Operation and Maintenance (O&M) Costs

Operations and maintenance (O&M) costs represent average annual fixed expenditures (and depend on rated capacity) required to operate and maintain a hydropower plant over its lifetime, including:

- Insurance, taxes, land lease payments, and other fixed costs

- Present value and annualized large component overhaul or replacement costs over technical life (e.g., rewind stator, patch cavitation damage, and replace bearings)

- Scheduled and unscheduled maintenance of hydropower plant components, including turbines, generators, etc. over the technical lifetime of the plant.

The following figure shows the Base Year estimate and future year projections for fixed O&M (FOM) costs. Mid and Low technology cost scenarios are shown. The estimate for a given year represents annual average FOM costs expected over the technical lifetime of a new plant that reaches commercial operation in that year.

Base Year Estimates

A statistical analysis of long-term plant operation costs from Federal Energy Regulatory Commission Form-1 resulted in a relationship between annual, FOM costs, and plant capacity. Values were updated to 2017$.

Future Year Projections

Projections developed for the Hydropower Vision study (DOE, 2016) using technological learning assumptions and bottom-up analysis of process and/or technology improvements provide a range of future cost outcomes. Three different O&M projections were developed for scenario modeling as bounding levels:

- Constant Technology Cost Scenario: FOM costs unchanged from the Base Year to 2050; consistent with all ATB technologies

- Mid Technology Cost Scenario: FOM costs for both NPD and NSD plants are unchanged from 2017 to 2050; consistent with the Reference case in Hydropower Vision

- Low Technology Cost Scenario: FOM costs for both NPD and NSD plants are reduced by 50% in 2035 and 54% in 2050, consistent with the Advanced Technology case in Hydropower Vision.

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

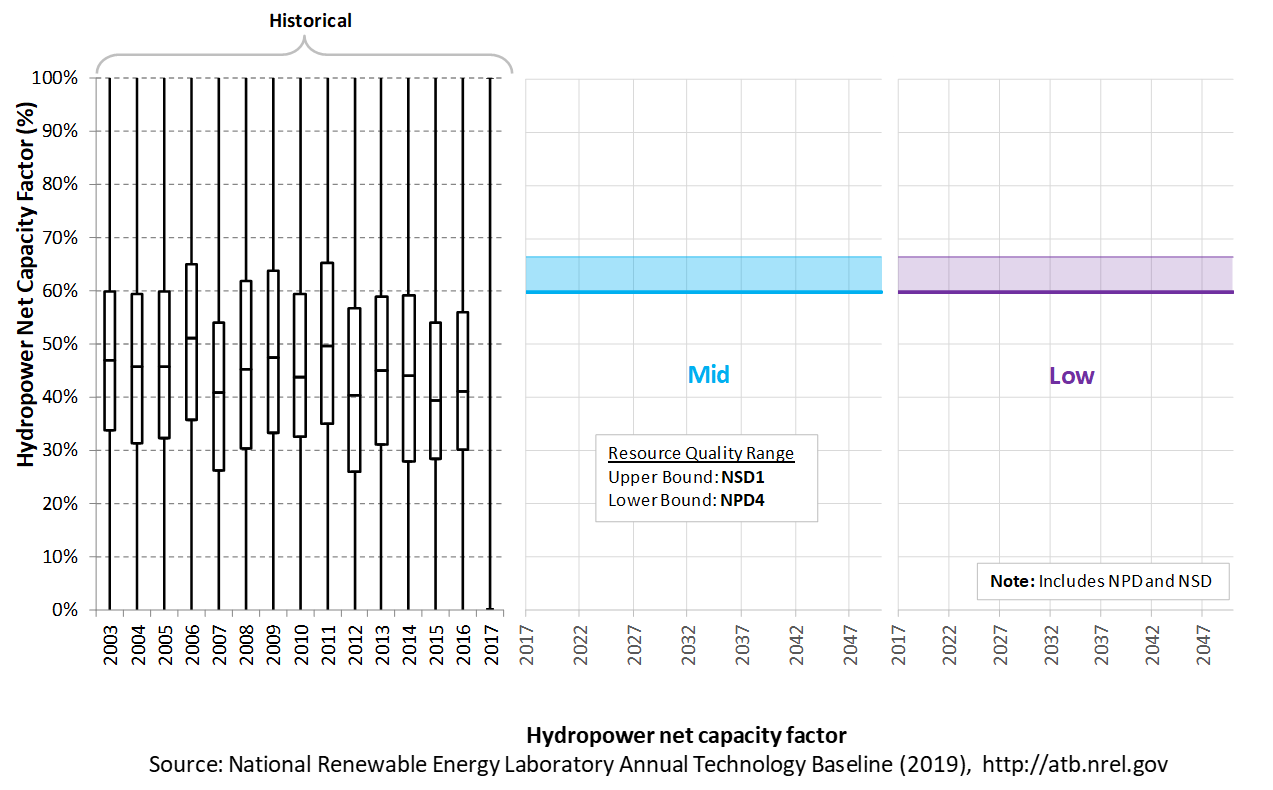

Capacity Factor: Expected Annual Average Energy Production Over Lifetime

The capacity factor represents the expected annual average energy production divided by the annual energy production, assuming the plant operates at rated capacity for every hour of the year. It is intended to represent a long-term average over the lifetime of the plant. It does not represent interannual variation in energy production. Future year estimates represent the estimated annual average capacity factor over the technical lifetime of a new plant installed in a given year.

The capacity factor is influenced by site hydrology, design factors (e.g., exceedance level), and operation characteristics (e.g., dispatch or run-of-river). Capacity factors for all potential NPD sites and NSDs are estimated based on design criteria, long-term monthly flow rate records, and run-of-river operation.

The following figure shows a range of capacity factors based on variation in the resource for hydropower plants in the contiguous United States. Historical data from run-of-river hydropower plants operating in the United States from 2003 through 2012 are shown for comparison with the Base Year estimates. The range of the Base Year estimates illustrates the effect of resource variation. Future projections for the Constant, Mid, and Low technology cost scenarios are unchanged from the Base Year. Technology improvements are focused on CAPEX and O&M cost elements.

Recent Trends

Actual energy production from about 200 run-of-river plants operating in the United States from 2003 to 2012 (EIA, 2016) is shown in box-and-whiskers format for comparison with current estimates and future projections. This sample includes some very old plants that may have lower availability and efficiency. It also includes plants that have been relicensed and may no longer be optimally designed for current operating regime (e.g., a peaking unit now operating as run-of-river). This contributes to the broad range, particularly on the low end.

Interannual variation of hydropower plant output for run-of-river plants may be significant due to hydrological changes such as drought. This impact may be exacerbated by climate change over the long term.

Current and future estimates for new hydropower plants are within the range of observed plant performance. These potential hydropower plants would be designed for specific site conditions, which would indicate operation toward the high end of the range.

Base Year Estimates

For illustration in the ATB, all potential NPD and NSD sites are represented with four reference plants, each as described below.

Representative Hydropower Plants

| Resource Characteristics Ranges | Weighted Average Values | Calculated Plant Values | |||||

| Plants | Head (feet) | Capacity (MW) | Head (feet) | Capacity (MW) | Capacity Factor | ICC (2014$/kW) | O&M (2014$/kW) |

| NPD 1 | 3-30 | 0.5-10 | 15.4 | 4.8 | 0.62 | 5,969.33 | 111.73 |

| NPD 2 | 3-30 | 10 + | 15.9 | 82.2 | 0.64 | 5,433.24 | 30.74 |

| NPD 3 | 30 + | 0.5-10 | 89.6 | 4.2 | 0.60 | 3,997.79 | 118.67 |

| NPD 4 | 30 + | 10 + | 81.3 | 44.7 | 0.60 | 3,769.22 | 40.54 |

| NSD 1 | 3-30 | 1-10 | 15.7 | 3.7 | 0.66 | 7,034.81 | 125.01 |

| NSD 2 | 3-30 | 10 + | 19.6 | 44.1 | 0.66 | 6,280.15 | 40.76 |

| NSD 3 | 30 + | 1-10 | 46.8 | 4.3 | 0.62 | 6,151.05 | 117.61 |

| NSD 4 | 30 + | 10 + | 45.3 | 94.0 | 0.66 | 5,537.34 | 28.93 |

Future Year Projections

The capacity factor remains unchanged from the Base Year through 2050. Technology improvements are focused on CAPEX and O&M costs.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

The ReEDS model uses resource/cost supply curves representing estimates at each individual facility (~700 NPD and ~8,000 NSD).

The ReEDS model represents cost and performance for NPD and NSD potential in 5 bins for each of 134 geographic regions, which results in capacity factor ranges of 38%-80% for the NPD resources and 53%-81% for NSD.

Existing hydropower facilities in the ReEDS model provide dispatch capability such that their annual energy production is determined by the electric system needs by dispatching generators to accommodate diurnal and seasonal load variations and output from variable generation sources (e.g., wind and solar PV).

Plant Cost and Performance Projections Methodology

Projections developed for the Hydropower Vision study (DOE, 2016) using technological learning assumptions and bottom-up analysis of process and/or technology improvements provide a range of future cost outcomes. Three different projections were developed for scenario modeling as bounding levels:

- Constant Technology Cost Scenario: no change in CAPEX or OPEX from 2017 to 2050; consistent across all renewable energy technologies in the ATB

- Mid Technology Cost Scenario: incremental learning, consistent with Reference in the Hydropower Vision study (DOE, 2016); CAPEX reductions for NSD only

- Low Technology Cost Scenario: gains that are achievable when pushing to the limits of potential new technologies, such as modularity (in both civil structures and power train design), advanced manufacturing techniques, and materials, consistent with Advanced Technology in Hydropower Vision (DOE, 2016); both CAPEX and O&M cost reductions implemented.

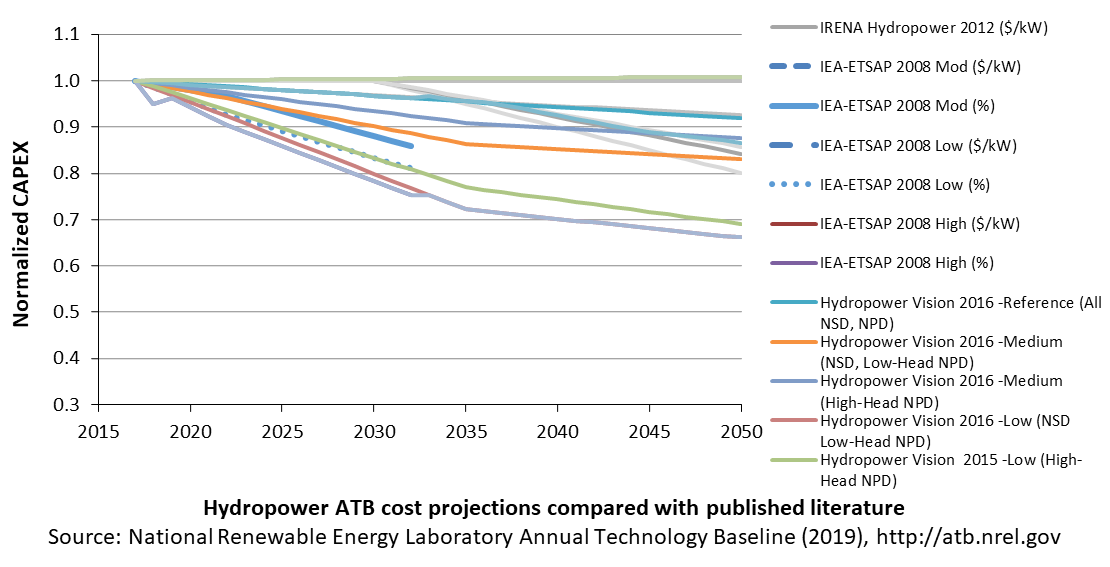

A range of literature projections is shown for comparison. The Mid and Low cost cases use a mix of inputs based on EIA technological learning assumptions, input from a technical team of Oak Ridge National Laboratory researchers, and the experience of expert hydropower consultants. Estimated 2035 cost levels are intended to provide order-of-magnitude cost reductions deemed to be at least conceptually possible, and they are meant to stimulate a broader discussion with the hydropower industry and its stakeholders that will be necessary to the future of cost reduction in the industry. Cost projections were derived independently for NPD and NSD technologies.

For context, ATB cost projections are compared to the literature, which represents 7 independent published studies and 11 cost projection scenarios within these studies. Cost reduction literature for hydropower is limited with several studies projecting no change through 2050. It is unclear whether (1) this represents a deliberate estimate of no future change in cost or (2) no estimate has been made.

Hydropower investment costs are very site specific and vary with type of technology. Literature was reviewed to attempt to isolate perceived CAPEX reduction for resources of similar characteristics over time (e.g., estimated cost to develop the same site in 2015, 2030, and 2050 based on different technology, installation, and other technical aspects). Some studies reflect increasing CAPEX over time. These studies were excluded from the ATB based on the interpretation that rising costs reflect a transition to less attractive sites as the better sites are used earlier.

Literature estimates generally reflect hydropower facilities of sizes similar to those represented in U.S. resource potential (i.e., they exclude estimates for very large facilities). Due to limited sample size, all projections are analyzed together without distinction between types of technology. Note that although declines are shown on a percentage basis, the reduction is likely to vary with initial capital cost. Large reductions for moderately expensive sites may not scale to more expensive sites or to less expensive sites. Projections derived for the Hydropower Vision study for different technologies (Low Head NPD, High Head NPD, and NSD) address this simplification somewhat.

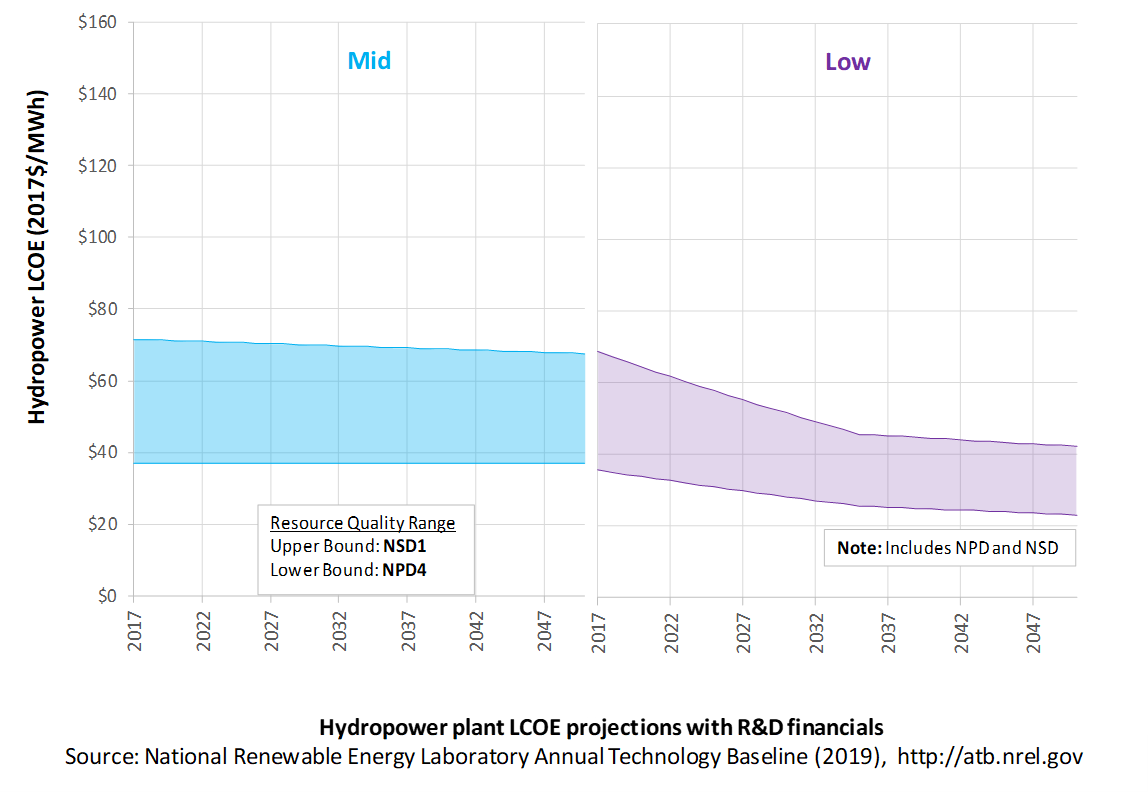

Levelized Cost of Energy (LCOE) Projections

Levelized cost of energy (LCOE) is a summary metric that combines the primary technology cost and performance parameters: CAPEX, O&M, and capacity factor. It is included in the ATB for illustrative purposes. The ATB focuses on defining the primary cost and performance parameters for use in electric sector modeling or other analysis where more sophisticated comparisons among technologies are made. The LCOE accounts for the energy component of electric system planning and operation. The LCOE uses an annual average capacity factor when spreading costs over the anticipated energy generation. This annual capacity factor ignores specific operating behavior such as ramping, start-up, and shutdown that could be relevant for more detailed evaluations of generator cost and value. Electricity generation technologies have different capabilities to provide such services. For example, wind and PV are primarily energy service providers, while the other electricity generation technologies such as hydropower can provide capacity and flexibility services in addition to energy. These capacity and flexibility services are difficult to value and depend strongly on the system in which a new generation plant is introduced. These services are represented in electric sector models such as the ReEDS model and corresponding analysis results such as the Standard Scenarios.

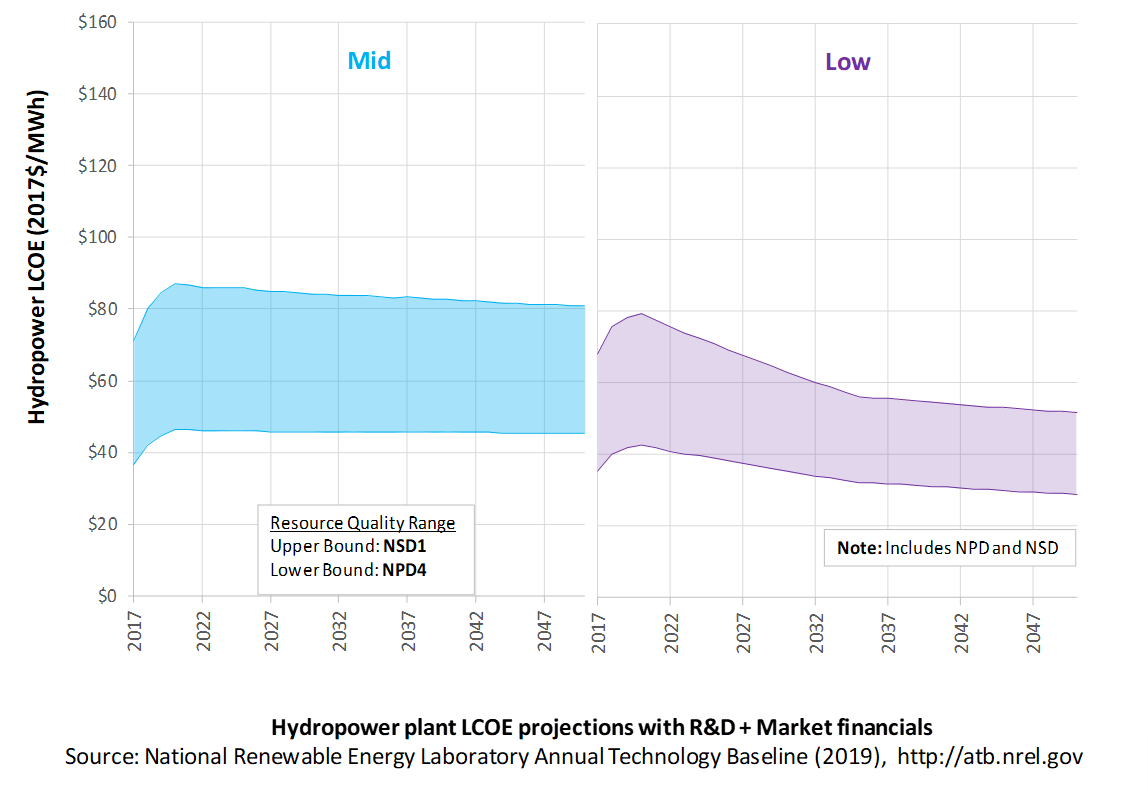

The following three figures illustrate LCOE, which includes the combined impact of CAPEX, O&M, and capacity factor projections for hydropower across the range of resources present in the contiguous United States. For the purposes of the ATB, the costs associated with technology and project risk in the U.S. market are represented in the financing costs but not in the upfront capital costs (e.g., developer fees and contingencies). An individual technology may receive more favorable financing terms outside the United States, due to less technology and project risk, caused by more project development experience (e.g., offshore wind in Europe) or more government or market guarantees. The R&D Only LCOE sensitivity cases present the range of LCOE based on financial conditions that are held constant over time unless R&D affects them, and they reflect different levels of technology risk. This case excludes effects of tax reform, tax credits, and changing interest rates over time. The R&D + Market LCOE case adds to these financial assumptions: (1) the changes over time consistent with projections in the Annual Energy Outlook and (2) the effects of tax reform and tax credits. The representative plant characteristics in the ATB that best align with those of recently installed or anticipated near-term hydropower plants are associated with NPD 4. Data for all the resource categories can be found in the ATB Data spreadsheet; for simplicity, not all resource categories are shown in the figures.

R&D Only | R&D + Market

The methodology for representing the CAPEX, O&M, and capacity factor assumptions behind each pathway is discussed in Projections Methodology. In general, the degree of adoption of technology innovation distinguishes the Constant, Mid, and Low technology cost scenarios. These projections represent trends that reduce CAPEX and improve performance. Development of these scenarios involves technology-specific application of the following general definitions:

- Constant Technology: Base Year (or near-term estimates of projects under construction) equivalent through 2050 maintains current relative technology cost differences

- Mid Technology Cost Scenario: Technology advances through continued industry growth, public and private R&D investments, and market conditions relative to current levels that may be characterized as "likely" or "not surprising"

- Low Technology Cost Scenario: Technology advances that may occur with breakthroughs, increased public and private R&D investments, and/or other market conditions that lead to cost and performance levels that may be characterized as the " limit of surprise" but not necessarily the absolute low bound.

To estimate LCOE, assumptions about the cost of capital to finance electricity generation projects are required, and the LCOE calculations are sensitive to these financial assumptions. Two project finance structures are used within the ATB:

- R&D Only Financial Assumptions: This sensitivity case allows technology-specific changes to debt interest rates, return on equity rates, and debt fraction to reflect effects of R&D on technological risk perception, but it holds background rates constant at 2017 values from AEO2019 (EIA, 2019) and excludes effects of tax reform and tax credits.

- R&D Only + Market Financial Assumptions: This sensitivity case retains the technology-specific changes to debt interest, return on equity rates, and debt fraction from the R&D Only case and adds in the variation over time consistent with AEO2019 (EIA, 2019), as well as effects of tax reform and tax credits. For a detailed discussion of these assumptions, see Project Finance Impact on LCOE.

A constant cost recovery period – over which the initial capital investment is recovered – of 30 years is assumed for all technologies throughout this website, and can be varied in the ATB data spreadsheet.

The equations and variables used to estimate LCOE are defined on the Equations and Variables page. For illustration of the impact of changing financial structures such as WACC, see Project Finance Impact on LCOE. For LCOE estimates for the Constant, Mid, and Low technology cost scenarios for all technologies, see 2019 ATB Cost and Performance Summary.

In general, differences among the technology cost cases reflect different levels of adoption of innovations. Reductions in technology costs reflect the cost reduction opportunities that are listed below.

- Widespread implementation of value engineering and design/construction best practices

- Modular "drop-in" systems that minimize civil works and maximize ease of manufacture reduce both capital investment and O&M expenditures

- Use of alternative materials in place of steel for water diversion (e.g., penstocks)

- Implementation of standardized "smart" automation and remote monitoring systems to optimize scheduling of maintenance

- Research and development on environmentally enhanced turbines to improve performance of the existing hydropower fleet

- Efficient, certain, permitting, licensing, and approval procedures.

The Hydropower Vision study (DOE, 2016) includes road map actions that result in lower-cost technology.

Coal

The ATB includes three coal power plant types: coal-new, coal-IGCC, and coal-CCS. The cost and performance characteristics of these plants are adapted from EIA data rather than derived from original analysis.

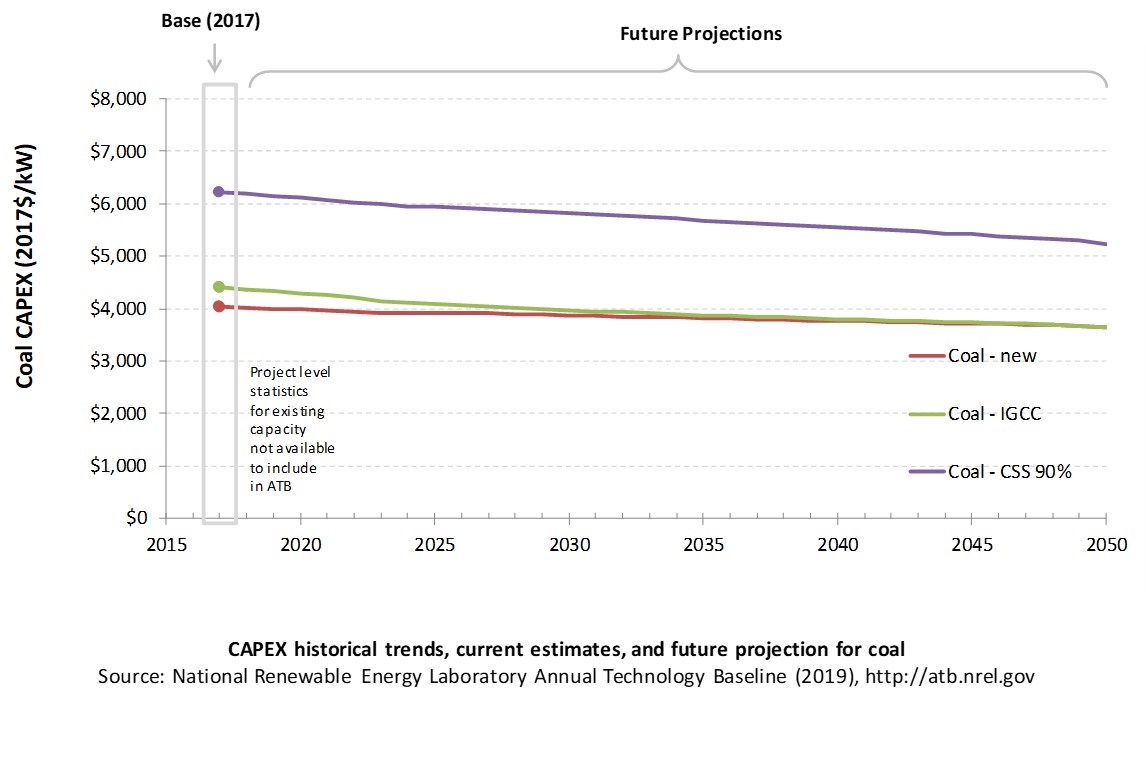

Capital Expenditures (CAPEX): Historical Trends, Current Estimates, and Future Projections

Coal power plant CAPEX is taken from the AEO2019 Reference Scenario (EIA, 2019a) with the adjustments discussed in the CAPEX definition section. The ATB includes only a single CAPEX projection for each type of coal plant.

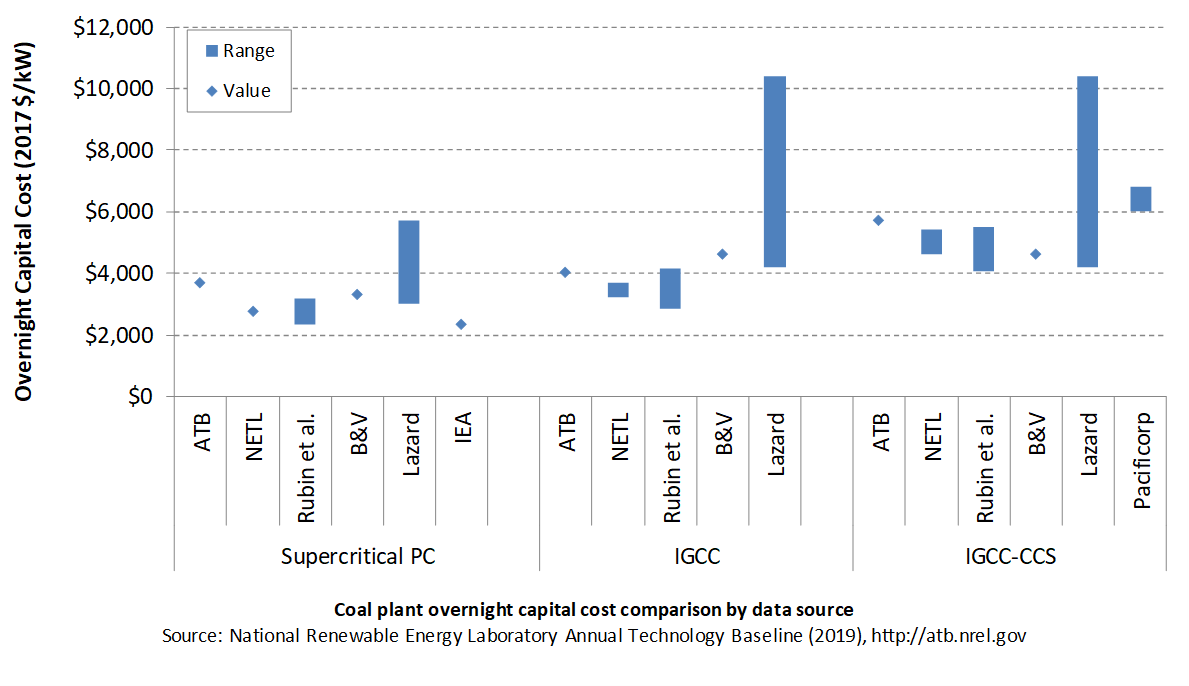

Comparison with Other Sources

Lazard (2016) does not explicitly define its ranges with and without CCS; thus, the high end of their pulverized coal and IGCC ranges and the low end of their IGCC-CCS range are assumed to be the middle of the full reported range. All sources have been normalized to the same dollar year. Costs vary due to differences in system design (e.g., coal rank), methodology, and plant cost definitions. The coal capital costs include environmental controls to meet current federal regulations.

CAPEX Definition

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year.

For coal power plants, CAPEX equals interest during construction (ConFinFactor) times the overnight capital cost (OCC).

Overnight capital costs are modified from AEO2019 (EIA, 2019a). The EIA projections were adjusted by removing the material price index. The material price index accounts for projected changes in the price index for metals and metals products, and it is independent of the learning-based cost reductions applied in the EIA projections.

For the ATB, coal-CCS technology is ultra-supercritical pulverized coal technology fitted with CCS. Both 30% capture and 90% capture options are included for the coal-CCS technology. The CCS plant configuration includes only the cost of capturing and compressing the CO2. It does not include CO2 delivery and storage.

| Overnight Capital Cost ($/kW) | Construction Financing Factor (ConFinFactor) | CAPEX ($/kW) | |

| Coal-new: Ultra-supercritical pulverized coal with SO2 and NOx controls | $3,711 | 1.087 | $4,036 |

| Coal-IGCC: Integrated gasification combined cycle (IGCC) | $4,055 | 1.087 | $4,409 |

| Coal-CCS: Ultra-supercritical pulverized coal with carbon capture and sequestration (CCS) options (30% / 90% capture) | $5,180 / $5,728 | 1.087 | $5,633 / $6,229 |

CAPEX can be determined for a plant in a specific geographic location as follows:

Regional cost variations and geographically specific grid connection costs are not included in the ATB (CapRegMult = 1; GCC = 0). In the ATB, the input value is overnight capital cost (OCC) and details to calculate interest during construction (ConFinFactor).

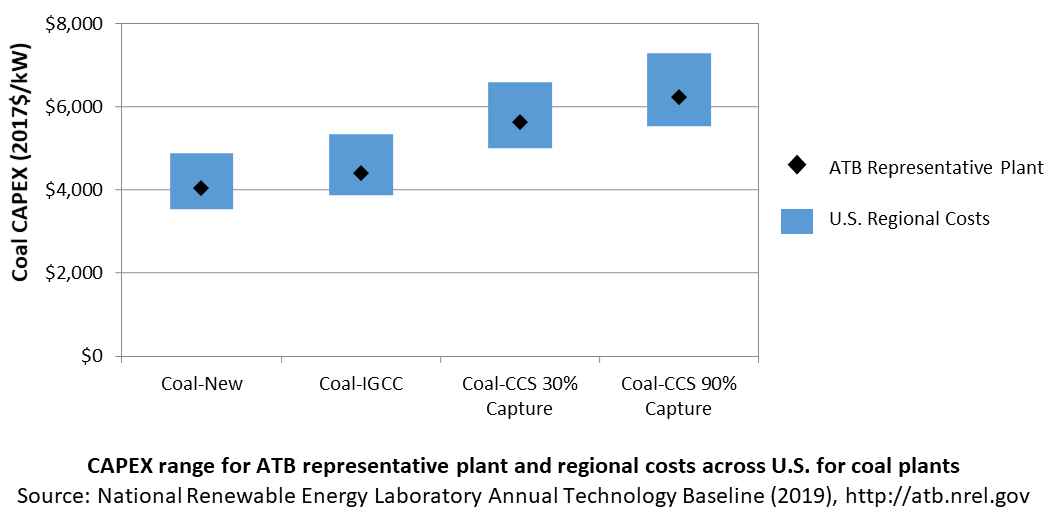

In the ATB, CAPEX represents each type of coal plant with a unique value. Regional cost effects associated with labor rates, material costs, and other regional effects as defined by (EIA, 2016) expand the range of CAPEX. Unique land-based spur line costs based on distance and transmission line costs are not estimated. The following figure illustrates the ATB representative plant relative to the range of CAPEX including regional costs across the contiguous United States. The ATB representative plants are associated with a regional multiplier of 1.0.

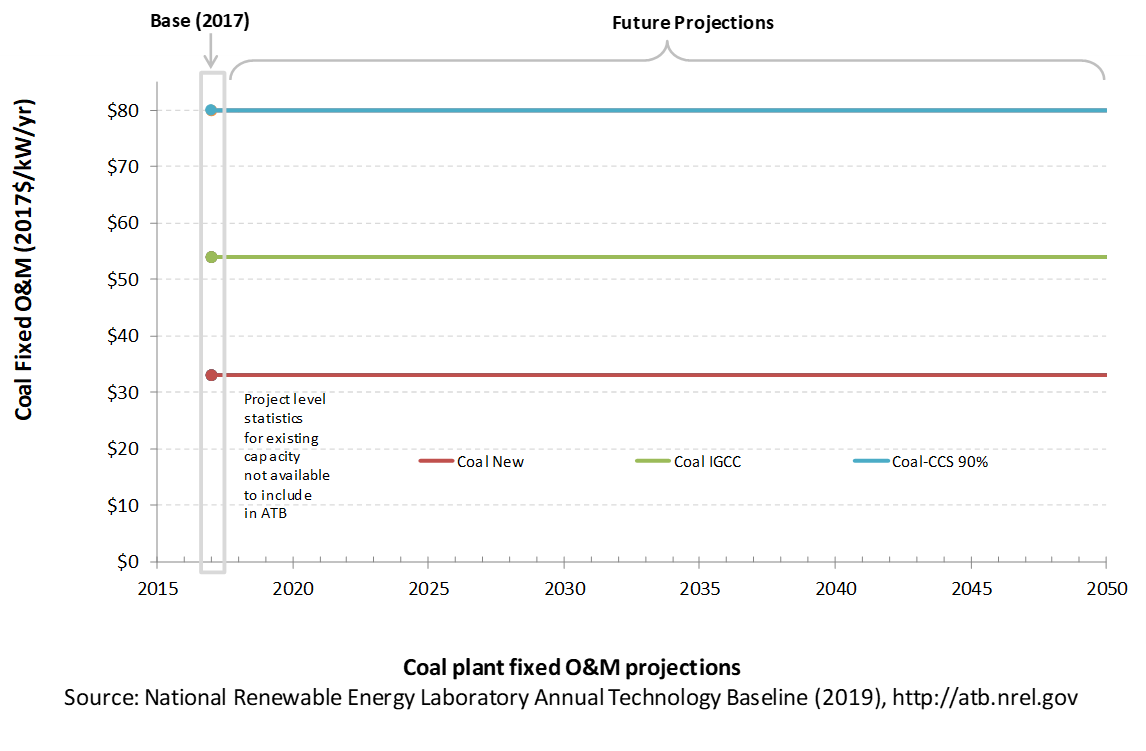

Operation and Maintenance (O&M) Costs

Coal power plant fixed and variable O&M costs are taken from table 8.2 of the AEO2019, and they are assumed to be constant over time.

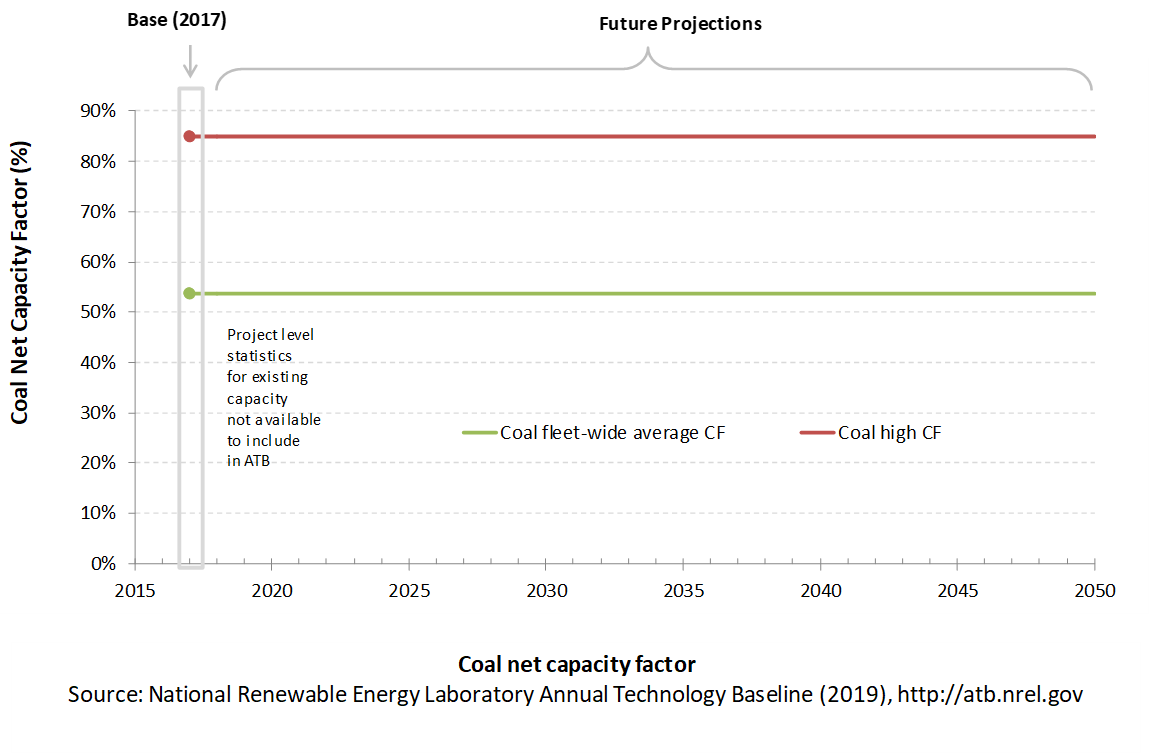

Capacity Factor: Expected Annual Average Energy Production Over Lifetime

The capacity factor represents the assumed annual energy production divided by the total possible annual energy production, assuming the plant operates at rated capacity for every hour of the year. For coal plants, the capacity factors are typically lower than their availability factors. Coal plant availability factors have a wide range depending on system design and maintenance schedules.

The capacity factor of dispatchable units is typically a function of the unit's marginal costs and local grid needs (e.g., need for voltage support or limits due to transmission congestion).

Coal power plants have typically been operated as baseload units, although that has changed in many locations due to low natural gas prices and increased penetration of variable renewable technologies. The average capacity factor used in the ATB is the fleet-wide average reported by EIA for 2017. The high capacity factor represents a new plant that would operate as a baseload unit. New coal plants would likely be more efficient than existing coal plants, and therefore would be more likely to be dispatched more often, resulting in capacity factors closer to the "high" level than the "average" level, but actual capacity factors will vary based on local grid conditions and needs.

Even though IGCC and coal with CCS have experienced limited deployment in the United States, it is expected that their performance characteristics would be similar to new coal power plants.

Levelized Cost of Energy (LCOE) Projections

Levelized cost of energy (LCOE) is a summary metric that combines the primary technology cost and performance parameters: CAPEX, O&M, and capacity factor. It is included in the ATB for illustrative purposes. The ATB focuses on defining the primary cost and performance parameters for use in electric sector modeling or other analysis where more sophisticated comparisons among technologies are made. The LCOE accounts for the energy component of electric system planning and operation. The LCOE uses an annual average capacity factor when spreading costs over the anticipated energy generation. This annual capacity factor ignores specific operating behavior such as ramping, start-up, and shutdown that could be relevant for more detailed evaluations of generator cost and value. Electricity generation technologies have different capabilities to provide such services. For example, wind and PV are primarily energy service providers, while the other electricity generation technologies provide capacity and flexibility services in addition to energy. These capacity and flexibility services are difficult to value and depend strongly on the system in which a new generation plant is introduced. These services are represented in electric sector models such as the ReEDS model and corresponding analysis results such as the Standard Scenarios.

References

The following references are specific to this page; for all references in this ATB, see References.Beiter, P., Musial, W., Smith, A., Kilcher, L., Damiani, R., Maness, M., … Scott, G. (2016). A Spatial-Economic Cost-Reduction Pathway Analysis for U.S. Offshore Wind Energy Development from 2015-2030 (Technical Report No. NREL/TP-6A20-66579). https://doi.org/10.2172/1324526

Black & Veatch. (2012). Cost and Performance Data for Power Generation Technologies. Retrieved from Black & Veatch Corporation website: https://www.bv.com/docs/reports-studies/nrel-cost-report.pdf

DOE, & NREL. (2015). Wind Vision: A New Era for Wind Power in the United States (Technical Report No. DOE/GO-102015-4557). Retrieved from U.S. Department of Energy website: https://www.nrel.gov/docs/fy15osti/63197-2.pdf

DOE. (2016). Hydropower Vision: A New Chapter for America's Renewable Electricity Source (No. DOE/GO-102016-4869). Retrieved from U.S. Department of Energy website: https://www.energy.gov/sites/prod/files/2018/02/f49/Hydropower-Vision-021518.pdf

EIA. (2013). Updated Capital Cost Estimates for Utility Scale Electricity Generating Plants. Retrieved from U.S. Energy Information Administration website: https://www.eia.gov/analysis/studies/powerplants/capitalcost/archive/2013/pdf/updated_capcost.pdf

EIA. (2016b). Capital Cost Estimates for Utility Scale Electricity Generating Plants. Retrieved from U.S. Energy Information Administration website: https://www.eia.gov/analysis/studies/powerplants/capitalcost/pdf/capcost_assumption.pdf

EIA. (2019a). Annual Energy Outlook 2019 with Projections to 2050. Retrieved from U.S. Energy Information Administration website: https://www.eia.gov/outlooks/aeo/pdf/AEO2019.pdf

Hundleby, G., Freeman, K., Logan, A., & Frost, C. (2017). Floating Offshore: 55 Technology Innovations that will have greater impact on reducing the cost of electricity from European floating offshore wind farms. Retrieved from KiC InnoEnergy and BVG Associates website.