Annual Technology Baseline 2017

National Renewable Energy Laboratory

Recommended Citation:

NREL (National Renewable Energy Laboratory). 2017. 2017 Annual Technology Baseline. Golden, CO: National Renewable Energy Laboratory. http://atb.nrel.gov/.

Please consult Guidelines for Using ATB Data:

https://atb.nrel.gov/electricity/user-guidance.html

Offshore Wind Power Plants

Representative Technology

In 2016, the first offshore wind plant commenced commercial operation in the United States near Block Island (Rhode Island). This demonstration project is 30 MW in capacity; in the ATB, cost and performance estimates are made for commercial-scale projects 600 MW in capacity. The ATB Base Year offshore wind plant technology reflects a machine rating of 3.4 MW with a rotor diameter of 115 m and hub height of 85 m, which is typical of European projects installed in 2015.

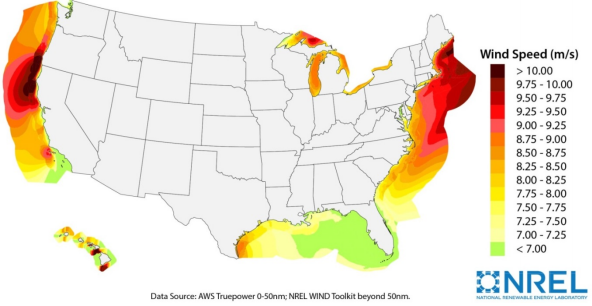

Resource Potential

Wind resource is prevalent throughout major U.S. coastal areas, including the Great Lakes. The resource potential exceeds 2,000 GW (Musial et al. 2016), excluding Alaska. Prior estimates of offshore wind resource potential (Schwartz et al. 2010) were updated in 2016 to extend domain boundaries from 50 nautical miles (nm) to 200 nm, consider turbine hub heights of 100 m (previously 90 m), and assume a capacity array power density of 3 MW/km2 (Musial et al. 2016). A range of technology exclusions were applied based on maximum water depth for deployment, minimum wind speed, and limits to floating technology in freshwater surface ice. Resource potential was represented by over 7,000 areas for offshore wind plant deployment after accounting for competing use and environmental exclusions, such as marine protected areas, shipping lanes, pipelines, and others.

Source: Musial et al. 2016

Renewable energy technical potential, as defined by Lopez et al. (2012), represents the achievable energy generation of a particular technology given system performance, topographic limitations, and environmental and land-use constraints. The primary benefit of assessing technical potential is that it establishes an upper-boundary estimate of development potential. It is important to understand that there are multiple types of potential - resource, technical, economic, and market (Lopez at al. 2012; NREL, "Renewable Energy Technical Potential").

Base Year and Future Year Projections Overview

Based on the Musial et al. (2016) resource assessment, LCOE was estimated at more than 7,000 areas (with a total capacity of approximately 2,000 GW) in Beiter et al. (2016), taking into consideration a variety of spatial parameters, such as wind speeds, water depth, distance from shore, distance to ports, and wave height. CAPEX, O&M, and capacity factor are calculated for each geographic location using engineering models, hourly wind resource profiles, and representative sea states. The spatial LCOE assessment served as the basis for estimating the ATB baseline LCOE in the Base Year 2015, weighted by the available capacity, for fixed-bottom and floating offshore wind technology.

The Base Year LCOE assumes a 3.4-MW turbine size and long-term average hourly wind profiles and it reflects the least-cost choice among three sub-structure types (Beiter et al. 2016):

- Monopile (fixed-bottom)

- Jacket (fixed-bottom)

- Semi-submersible (floating)

The representative offshore wind plant size is assumed to be 600 MW (Beiter et al. 2016). For illustration in the ATB, the full resource potential, represented by 7,000 areas, was divided into 15 techno-resource groups (TRGs). The capacity-weighted average CAPEX, O&M, and capacity factor for each group is presented in the ATB.

Future year projections are derived from estimated cost reduction potential for offshore wind technologies based on elicitation of over 160 wind industry experts (Wiser et al. 2016). This study produced three different cost reduction pathways, and the median and low estimates are used for ATB Mid and ATB Low cost scenarios. Three different projections were developed for scenario modeling as bounding levels:

- High cost: no change in CAPEX, O&M, or capacity factor from 2015 to 2050; consistent across all renewable energy technologies in the ATB

- Mid cost: LCOE percent reduction from the Base Year equivalent to that corresponding to the Median Scenario (50% probability) in expert survey (Wiser et al. 2016)

- Low Cost: LCOE percent reduction from the Base Year equivalent to that corresponding to the Low Scenario (10% probability) in expert survey (Wiser et al. 2016).

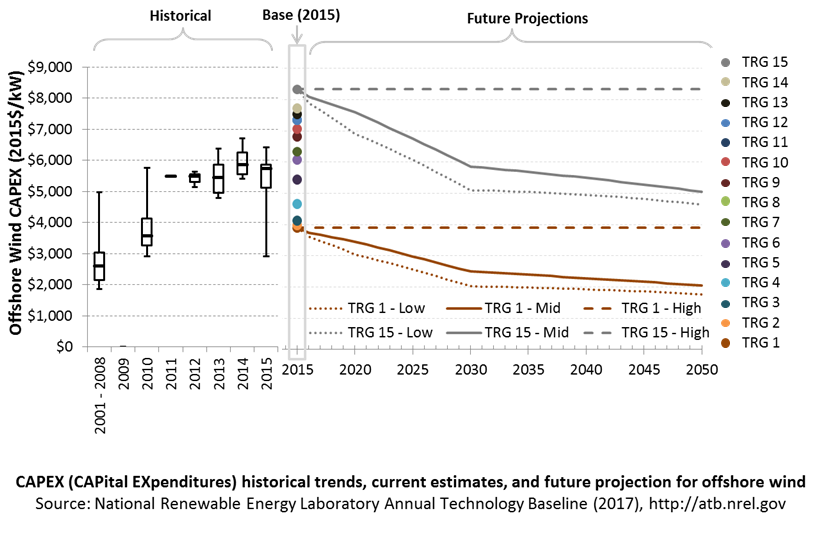

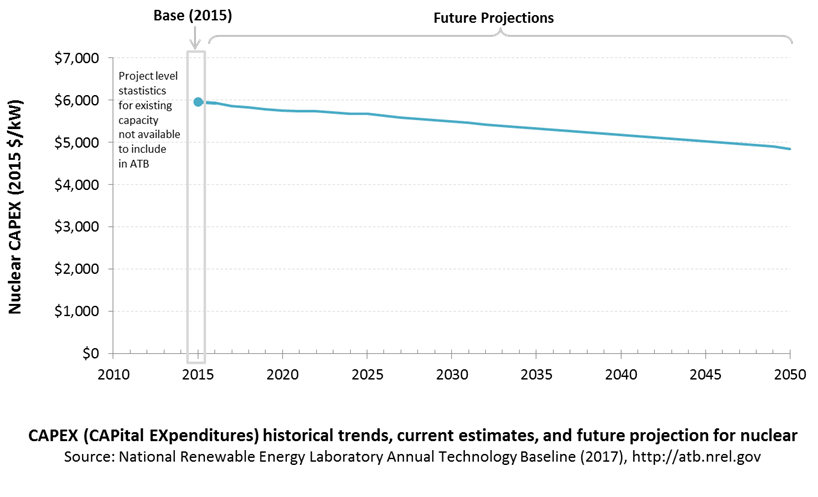

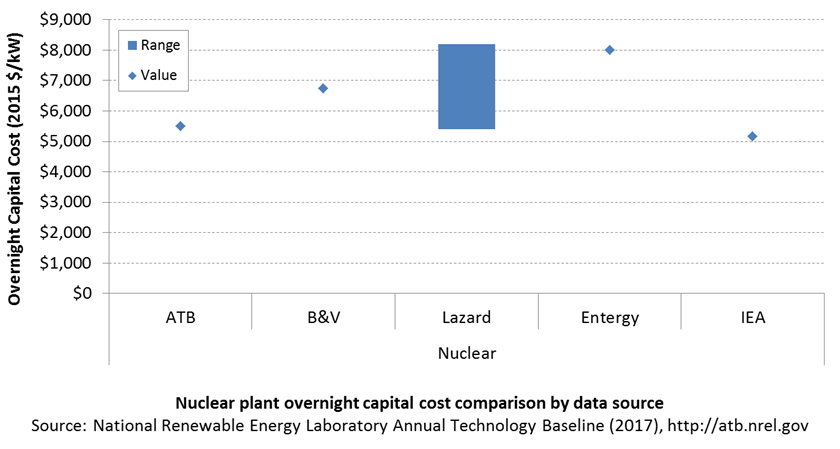

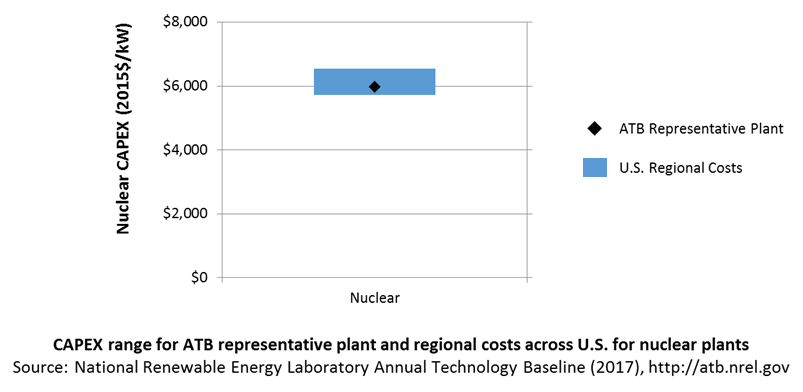

CAPital EXpenditures (CAPEX): Historical Trends, Current Estimates, and Future Projections

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year. These expenditures include the wind turbine, the balance of system (e.g., site preparation, installation, and electrical infrastructure), and financial costs (e.g., development costs, onsite electrical equipment, and interest during construction) and are detailed in CAPEX Definition. In the ATB, CAPEX reflects typical plants and does not include differences in regional costs associated with labor or materials. The range of CAPEX demonstrates variation with water depth and distance from shore in the contiguous United States.

The following figure shows the Base Year estimate and future year projections for CAPEX costs. Three cost reduction scenarios are represented: High, Mid, and Low. Historical data from offshore wind plants installed globally are shown for comparison to the ATB Base Year estimates (TRG 1–5 reflects fixed-bottom offshore wind plants and TRG 6–15 reflect floating offshore wind plants). The estimate for a given year represents CAPEX of a new plant that reaches commercial operation in that year.

Recent Trends

Actual wind plant CAPEX for European projects installed through 2015 are shown for comparison to the ATB Base Year CAPEX estimates and future projections. NREL's internal offshore wind database provides statistical representation of CAPEX for about 91% of offshore wind plants >100 MW commissioned in Europe and Asia from 2001 to 2015, based on installed capacity. All commercial-scale offshore wind plants installed to date have fixed-bottom substructures.

CAPEX estimates for the Base Year 2015 for TRGs 1–5, fixed-bottom technologies, tend to be lower than CAPEX for projects installed in 2015. The recent project installations represent characteristics in terms of water depth and distance from shore that generally align with those of TRG5. Floating technologies (TRGs 6–15) are not yet commercially deployed and are estimated to be higher cost than today's fixed-bottom project installations.

Base Year Estimates

For illustration in the ATB, offshore wind capacity was represented in 15 techno-resource groups (TRGs). Based on the share of capacity between fixed-bottom and floating technology estimated in Beiter et al. (2016), 5 TRGs were allocated to fixed-bottom technology (TRGs 1–5) (total capacity of 727 GW) and 10 TRGs to floating technology (TRGs 6–15) (total capacity of 1,330 GW). Available capacity for fixed-bottom and floating offshore wind technology was determined based on the least-cost choice between fixed-bottom and floating substructure types at more than 7,000 U.S. coastal areas in Beiter et al. (2016). Offshore wind locations were ranked by the LCOE estimated in Beiter et al. (2016) and binned into TRGs. The table below shows the capacity that was allocated by TRG. TRGs 1–3 (fixed-bottom) and 6–8 (floating) include less capacity than TRGs 4 and 5 (fixed bottom) and TRGs 9–15 to provide higher resolution at low levels of LCOE. The table also includes capacity-weighted average wind speed, water depth, distance from shore, cost and performance parameters, and resource potential in terms of capacity and energy for each TRG. Spatial conditions typically found in existing Bureau of Ocean Energy Management lease areas in the Northeast range from 10 m to 95 m in water depth (average of 32 m) and 3 km to 90 km in distance from shore (average of 22 km), corresponding to the average conditions in TRGs 3–5. Wind speeds found across existing Bureau of Ocean Energy Management lease areas in the Northeast generally tend to be more aligned with TRGs 1 and 2.

| TRG | LCOE Range ($/MWh) | Wind Speed Range (m/s) | Weighted Average Wind Speed (m/s) | Weighted Water Depth (m) | Weighted Distance Site to Cable Landfall (km) | Weighted Average CAPEX ($/kW) | Weighted Average OPEX ($/kW/yr) | Weighted Average Net CF (%) | Potential Wind Plant Capacity (GW) | Potential Wind Plant Energy (TWh) |

|---|---|---|---|---|---|---|---|---|---|---|

| Fixed-Bottom | ||||||||||

| TRG 1 | LCOE <= 141 | 8.5–9.0 | 8.6 | 13 | 6 | 3,891 | 136 | 45% | 12 | 49 |

| TRG 2 | LCOE <= 149 | 8.0–8.5 | 8.4 | 16 | 9 | 3,982 | 141 | 43% | 25 | 94 |

| TRG 3 | LCOE <= 157 | 8.0–8.5 | 8.3 | 19 | 15 | 4,121 | 143 | 42% | 50 | 182 |

| TRG 4 | LCOE <= 192 | 8.0–8.5 | 8.3 | 26 | 36 | 4,657 | 150 | 40% | 320 | 1,131 |

| TRG 5 | LCOE <= 306 | 7.5–8.0 | 7.9 | 36 | 72 | 5,442 | 157 | 37% | 320 | 1,023 |

| Floating | ||||||||||

| TRG 6 | LCOE <= 166 | 9.5–10 | 9.7 | 130 | 24 | 6,078 | 105 | 50% | 12 | 55 |

| TRG 7 | LCOE <= 175 | 9.5–10 | 9.7 | 145 | 40 | 6,338 | 106 | 50% | 25 | 108 |

| TRG 8 | LCOE <= 188 | 9.5–10 | 9.5 | 139 | 50 | 6,501 | 110 | 48% | 50 | 212 |

| TRG 9 | LCOE <= 206 | 9.0–9.5 | 9.4 | 136 | 70 | 6,816 | 121 | 47% | 100 | 414 |

| TRG 10 | LCOE <= 229 | 9.0–9.5 | 9.1 | 140 | 94 | 7,066 | 128 | 45% | 200 | 781 |

| TRG 11 | LCOE <= 252 | 8.5–9.0 | 8.7 | 323 | 118 | 7,345 | 132 | 42% | 200 | 727 |

| TRG 12 | LCOE <= 274 | 8.0–8.5 | 8.1 | 404 | 123 | 7,351 | 134 | 37% | 200 | 651 |

| TRG 13 | LCOE <= 299 | 7.5–8.0 | 7.8 | 474 | 138 | 7,538 | 135 | 35% | 200 | 615 |

| TRG 14 | LCOE <= 341 | 7.0–7.5 | 7.4 | 615 | 130 | 7,728 | 130 | 32% | 200 | 566 |

| TRG 15 | LCOE <= 438 | 7.5–8.0 | 7.5 | 797 | 199 | 8,331 | 137 | 31% | 143 | 390 |

| Total | 2,058 | 6,997 | ||||||||

Future Year Projections

Projections of future LCOE were derived from a survey of wind industry experts (Wiser et al. 2016) for scenarios that are associated with 50% and 10% probability levels in 2030 and 2050. Projections of future offshore wind plant CAPEX was determined based on adjustments to CAPEX, FOM, and capacity factor in each year to result in a predetermined LCOE value based on an expert survey conducted by Wiser et al. (2016).

In order to achieve the overall LCOE reduction associated with the median and low projections from the expert survey, CAPEX was used to accommodate all improvement aspects other than O&M and capacity factor survey results. Future fixed-bottom offshore wind technology CAPEX is assumed to decline 54% by 2050 in the Mid cost case and 62% in the Low cost wind case. Future floating offshore wind technology CAPEX is assumed to decline 49% by 2050 in the Mid cost case and 58% in the Low cost wind case.

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future CAPEX costs are summarized in LCOE Projections.

CAPEX Definition

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year.

Based on EIA (2013), Moné et al. (2013 ), and Beiter et al. (2016 ), the System Cost Breakdown Structure of the ATB for the wind plant envelope is defined to include:

- Wind turbine supply

- Balance of system

- Turbine installation, substructure supply and installation

- Site preparation, port and staging area support for delivery, storage, handling, installation of underground utilities

- Electrical infrastructure, such as transformers, switchgear, and electrical system connecting turbines to each other (array cable system costs) and to the cable landfall (export cable system costs)

- Development and project management

- Financial costs

- Owner's costs, such as development costs, preliminary feasibility and engineering studies, environmental studies and permitting, legal fees, insurance costs, and property taxes during construction

- Interest during construction estimated based on three-year duration accumulated 40%/40%/20% at half year intervals and an 8% interest rate (ConFinFactor).

CAPEX can be determined for a plant in a specific geographic location as follows:

CAPEX = ConFinFactor*(OCC*CapRegMult+GCC), where GCC = OnSpurCost + OffSpurCost.

(See the Financial Definitions tab in the ATB data spreadsheet.)

Regional cost variations are not included in the ATB (CapRegMult = 1). In the ATB, the input value is overnight capital cost (OCC) and details to calculate interest during construction (ConFinFactor). Because transmission infrastructure between an offshore wind plant and the point at which a grid connection is made onshore is a significant component of the offshore wind plant cost, an offshore spur line cost (OffSpurCost) for each TRG is included in the CAPEX estimate. The offshore spur line cost reflects a capacity-weighted average of all potential wind plant areas within a TRG, similar to OCC.

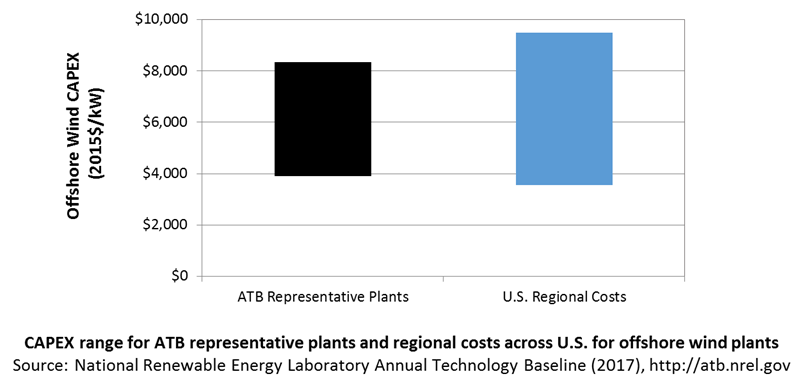

In the ATB, CAPEX represents the capacity-weighted average values of all potential wind plant areas within a TRG and varies with water depth and distance from shore. Regional cost effects associated with labor rates, material costs, and other regional effects as defined by EIA (2013) expand the range of CAPEX. Unique land-based spur line costs for each of the 7,000 areas based on distance and transmission line costs expand the range of CAPEX even further. The following figure illustrates the ATB representative plants relative to the range of CAPEX including regional costs across the contiguous United States. The ATB representative plants are associated with a regional multiplier of 1.0.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for High, Mid, and Low projections are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

CAPEX in the ATB does not represent regional variants (CapRegMult) associated with labor rates, material costs, etc., but the ReEDS model does include 134 regional multipliers (EIA 2013).

The ReEDS model determines offshore spur line and land-based spur line (GCC) uniquely for each of the 7,000 areas based on distance and transmission line cost.

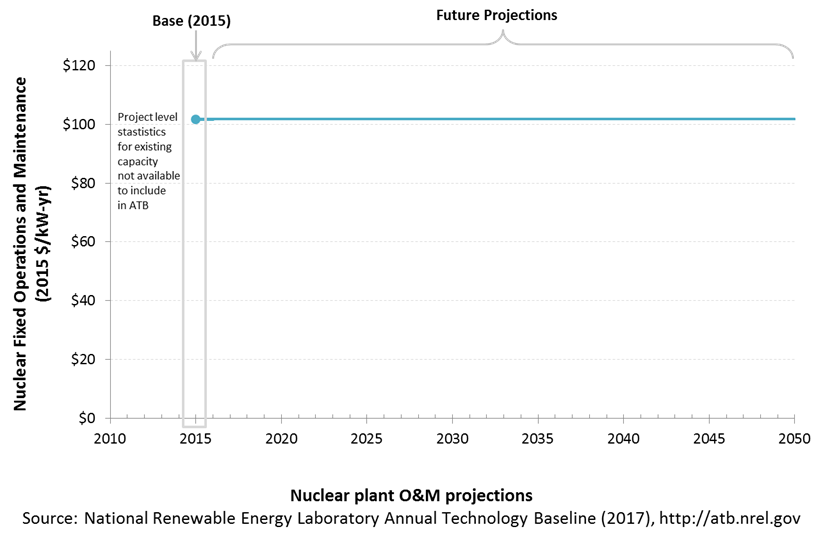

Operation and Maintenance (O&M) Costs

Operations and maintenance (O&M) costs represent the annual fixed expenditures required to operate and maintain a wind plant over its technical lifetime of 25 years (the distinction between economic life and technical life is described here), including:

- Insurance, taxes, land lease payments and other fixed costs (e.g., project management and administration, weather forecasting, and condition monitoring)

- Present value and annualized large component replacement costs over technical life (e.g., blades, gearboxes, and generators)

- Scheduled and unscheduled maintenance of wind plant components, including turbines and transformers, over the technical lifetime of the plant.

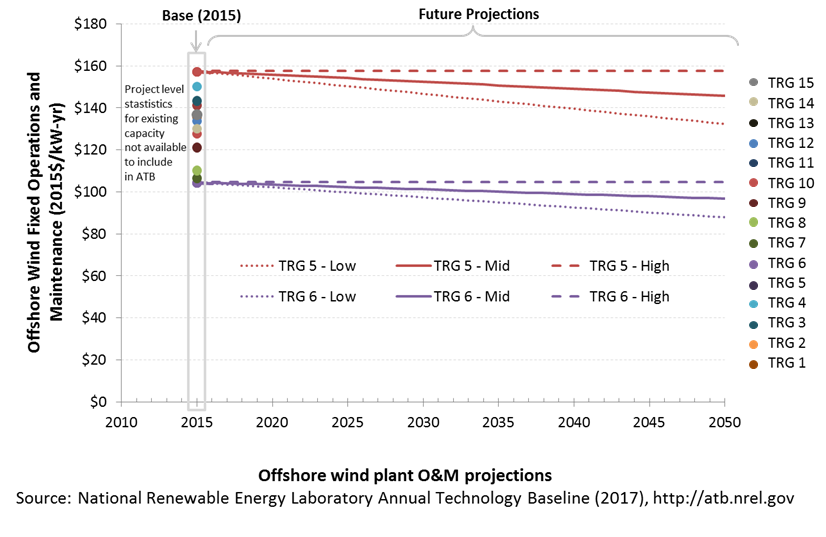

The following figure shows the Base Year estimate and future year projections for fixed O&M (FOM) costs. Three cost reduction scenarios are represented. The estimate for a given year represents annual average FOM costs expected over the technical lifetime of a new plant that reaches commercial operation in that year. The range of Base Year O&M estimates reflects distance from shore and metocean conditions.

Base Year Estimates

FOM costs vary by distance from shore and metocean conditions. As a result, O&M costs vary from $105/kW-year (TRG 6) to $157/kW-year (TRG 5) in 2015. The capacity-weighted average in the ATB for fixed-bottom offshore technology (TRGs 1-5) is $146/kW-year; the corresponding value for floating offshore wind technology (TRGs 6-15) is $125/kW-year.

Future Year Projections

Future fixed-bottom offshore wind technology O&M is assumed to decline 7.5% by 2050 in the Mid cost case and 16% in the Low cost wind case, based on the expert survey conducted by Wiser et al. (2016).

Future floating offshore wind technology O&M is assumed to decline 7.5% by 2050 in the Mid cost case and 16% in the Low cost wind case, based on the expert survey conducted by Wiser et al. (2016).

A detailed description of the methodology for developing Future Year Projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

Capacity Factor: Expected Annual Average Energy Production Over Lifetime

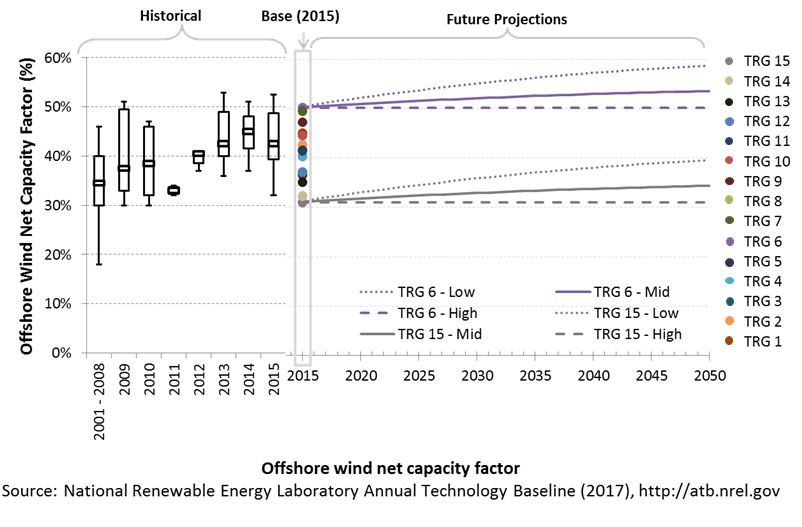

The capacity factor represents the expected annual average energy production divided by the annual energy production, assuming the plant operates at rated capacity for every hour of the year. It is intended to represent a long-term average over the technical lifetime of the plant (the distinction between economic life and technical life is described here). It does not represent interannual variation in energy production. Future year estimates represent the estimated annual average capacity factor over the technical lifetime of a new plant installed in a given year.

The capacity factor is influenced by the rotor swept area/generator capacity, hub height, hourly wind profile, expected downtime, and energy losses within the wind plant. It is referenced to 100-m above-water-surface, long-term average hourly wind resource data from Musial et al. (2016 ).

The following figure shows a range of capacity factors based on variation in the wind resource, water depth, and distance from shore for offshore wind plants in the contiguous United States. Pre-construction estimates for offshore wind plants operating globally in 2015, according to the year in which plants were installed, is shown for comparison to the ATB Base Year estimates. The range of Base Year estimates illustrate the effect of locating an offshore wind plant in a variety of wind resource, water depth, and distance from shore conditions (TRGs 1-5 are fixed-bottom offshore wind plants and TRGs 6-15 are floating offshore wind plants). Future projections are shown for High, Mid, and Low cost scenarios.

Recent Trends

Pre-construction annual energy estimates from 93% of global operating wind capacity in 2015 (NREL's internal offshore wind database) is shown in a box-and-whiskers format for comparison with the ATB current estimates and future projections. The historical data illustrate pre-construction estimated capacity factors for projects by year of commercial online date. The range of capacity factors defined by the ATB TRGs compared well with the estimated capacity factors for projects installed in 2015.

Base Year Estimates

The capacity factor is determined using a representative power curve for a generic NREL-modeled offshore wind turbine (Beiter et al. 2016) and includes geospatial estimates of gross capacity factors for the entire resource area (Musial et al. 2016). The net capacity factor considers spatial variation in wake losses, electrical losses, turbine availability, and other system losses. For illustration in the ATB, all 7,000 wind plant areas are represented in 15 TRGs (see table).

Future Year Projections

Projections of capacity factors for plants installed in future years were determined based on estimates obtained through an expert survey conducted by Wiser et al. (2016) for both fixed-bottom and floating offshore wind technologies. Projections for capacity factors implicitly reflect technology innovations such as larger rotors and taller towers that will increase energy capture at the same geographic location without explicitly specifying tower height and rotor diameter changes.

A detailed description of the methodology for developing Future Year Projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

Standard Scenarios Model Results

ATB CAPEX, O&M, and CF assumptions for Base Year and future projections through 2050 for Low, Mid, and High projections are used to develop Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

ReEDS output capacity factors for offshore wind can be lower than input capacity factors due to endogenously estimated curtailments determined by scenario constraints.

Plant Cost and Performance Projections Methodology

ATB projections were derived from the results of a survey of 163 of the world's wind energy experts (Wiser et al. 2016). The survey was conducted to gain insight into the possible future cost reductions, the source of those reductions, and the conditions needed to enable continued innovation and lower costs (Wiser et al. 2016). The expert survey produced three cost reduction scenarios associated with probability levels of 10%, 50%, and 90% of achieving LCOE reductions by 2030 and 2050. In addition, the scenario results include estimated changes to CAPEX, O&M, capacity factor, project life, and weighted average cost of capital (WACC) by 2030.

For the ATB, three different projections were adapted from the expert survey results for scenario modeling as bounding levels:

- High cost: no change in CAPEX, O&M, or capacity factor from 2015 to 2050; consistent across all renewable energy technologies in the ATB

- Mid cost: LCOE percent reduction from the Base Year equivalent to that corresponding to the Median Scenario (50% probability) in the expert survey (Wiser et al. 2016)

- Low Cost: LCOE percent reduction from the Base Year equivalent to that corresponding to the Low Scenario (10% probability) in the expert survey (Wiser et al. 2016).

Expert survey estimates were normalized to the ATB Base Year starting point in order to focus on projected cost reduction instead of absolute reported costs. The percent reduction in LCOE by 2020, 2030, and 2050 from the expert survey's Median and Low scenarios are implemented as the ATB Mid and Low cost scenarios. This is accomplished by utilizing survey estimates for changes to capacity factor and O&M costs by 2030 and 2050. The corresponding CAPEX value to achieve the overall LCOE reduction is computed. The percent reduction in LCOE by 2030 and by 2050 was applied equally across all TRGs. The overall reduction in LCOE by 2050 for the Mid cost scenario is 39% and for the Low cost scenario is 51%.

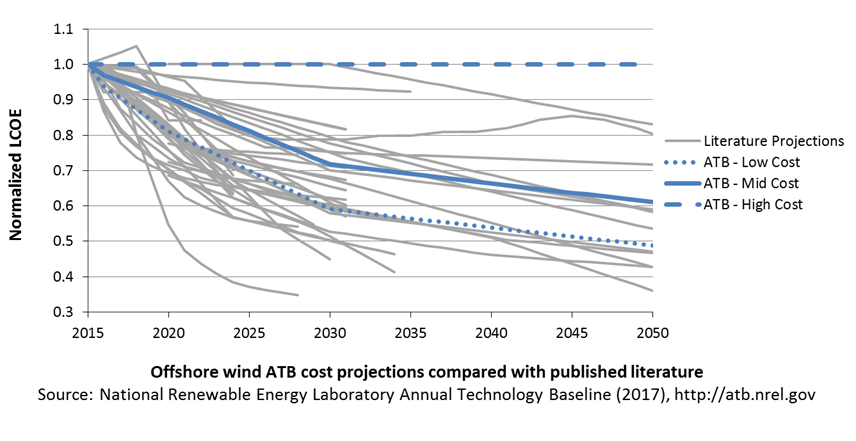

A broad sample of cost of wind energy projections are shown to provide context for the ATB High, Mid, and Low cost projections. In general, the ATB Mid cost projection reflects median values of the full population of literature; the ATB Low cost projection is similar to the low bound of the literature in the later years. While some published studies as well as recent project announcements for European projects to be installed by 2020 suggest significant near-term cost reduction, it is likely that the United States will lag due to a lack of industry infrastructure. Because the expert survey provided LCOE Projections that are related to each other in terms of probability, these scenarios are used in the ATB to represent two distinct levels of technology improvement pathways.

The relative costs of mid-depth water plants and deep water, or floating, offshore wind plants are maintained constant throughout the scenarios for simplicity. Some hypothesize that unique aspects of floating technologies, such as the ability to assemble and commission turbines at the port, could reduce the cost of floating technologies relative to fixed-bottom technologies.

Levelized Cost of Energy (LCOE) Projections

Levelized cost of energy (LCOE) is a simple metric that combines the primary technology cost and performance parameters, CAPEX, O&M, and capacity factor. It is included in the ATB for illustrative purposes. The focus of the ATB is to define the primary cost and performance parameters for use in electric sector modeling or other analysis where more sophisticated comparisons among technologies are made. LCOE captures the energy component of electric system planning and operation, but the electric system also requires capacity and flexibility services to operate reliably. Electricity generation technologies have different capabilities to provide such services. For example, wind and PV are primarily energy service providers, while the other electricity generation technologies provide capacity and flexibility services in addition to energy. These capacity and flexibility services are difficult to value and depend strongly on the system in which a new generation plant is introduced. These services are represented in electric sector models such as the ReEDS model and corresponding analysis results such as the Standard Scenarios.

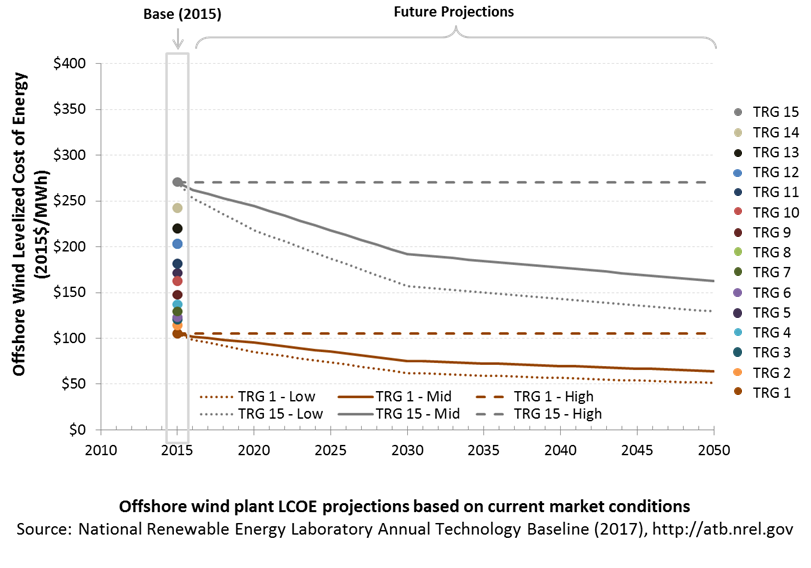

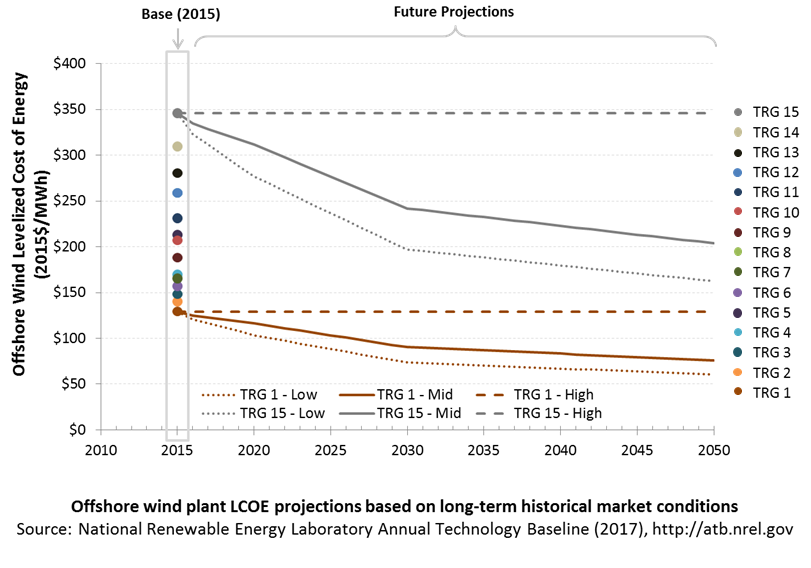

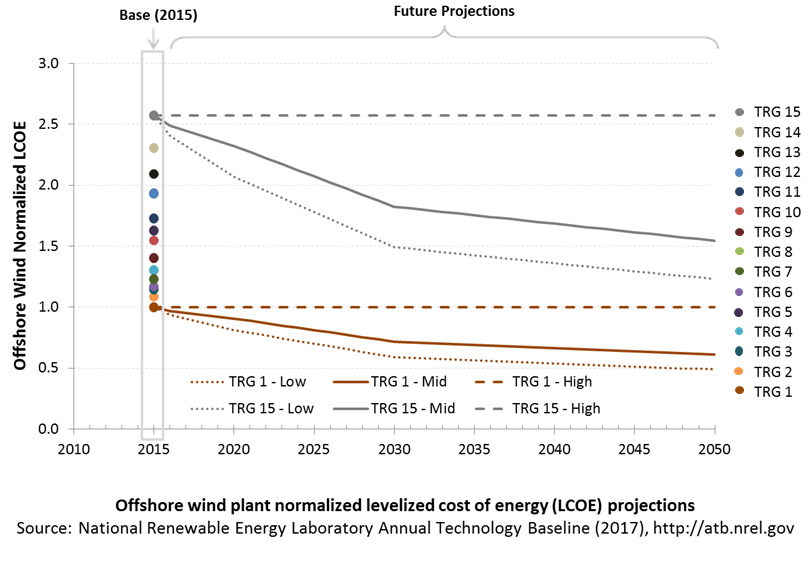

The following three figures illustrate the combined impact of CAPEX, O&M, and capacity factor projections across the range of resources present in the contiguous United States. The Current Market Conditions LCOE demonstrates the range of LCOE based on macroeconomic conditions similar to the present. The Historical Market Conditions LCOE presents the range of LCOE based on macroeconomic conditions consistent with prior ATB editions and Standard Scenarios model results. The Normalized LCOE (all LCOE estimates are normalized with the lowest Base Year LCOE value) emphasizes the effect of resource quality and the relative differences in the three future pathways independent of project finance assumptions. The ATB representative plant characteristics that best align with recently installed or anticipated near-term offshore wind plants are associated with TRGs 3-5. Data for all the resource categories can be found in the ATB data spreadsheet.

The methodology for representing the CAPEX, O&M, and capacity factor assumptions behind each pathway is discussed in Projections Methodology. The three pathways are generally defined as:

- High = Base Year (or near-term estimates of projects under construction) equivalent through 2050 maintains current relative technology cost differences

- Mid = technology advances through continued industry growth, public and private R&D investments, and market conditions relative to current levels that may be characterized as "likely" or "not surprising"

- Low = Technology advances that may occur with breakthroughs, increased public and private R&D investments, and/or other market conditions that lead to cost and performance levels that may be characterized as the "limit of surprise" but not necessarily the absolute low bound.

To estimate LCOE, assumptions about the cost of capital to finance electricity generation projects are required. For comparison in the ATB, two project finance structures are represented.

- Current Market Conditions: The values of the production tax credit (PTC) and investment tax credit (ITC) are ramping down by 2020, at which time wind and solar projects may be financed with debt fractions similar to other technologies. This scenario reflects debt interest (4.4% nominal, 1.9% real) and return on equity rates (9.5% nominal, 6.8% real) to represent 2017 market conditions (AEO 2017) and a debt fraction of 60% for all electricity generation technologies. An economic life, or period over which the initial capital investment is recovered, of 20 years is assumed for all technologies. These assumptions are one of the project finance options in the ATB spreadsheet.

- Long-Term Historical Market Conditions: Historically, debt interest and return on equity were represented with higher values. This scenario reflects debt interest (8% nominal, 5.4% real) and return on equity rates (13% nominal, 10.2% real) implemented in the ReEDS model and reflected in prior versions of the ATB and Standard Scenarios model results. A debt fraction of 60% for all electricity generation technologies is assumed. An economic life, or period over which the initial capital investment is recovered, of 20 years is assumed for all technologies. These assumptions are one of the project finance options in the ATB spreadsheet.

These parameters are held constant for estimates representing the Base Year through 2050. No incentives such as the PTC or ITC are included. The equations and variables used to estimate LCOE are defined on the equations and variables page. For illustration of the impact of changing financial structures such as WACC and economic life, see Project Finance Impact on LCOE. For LCOE estimates for High, Mid, and Low scenarios for all technologies, see 2017 ATB Cost and Performance Summary.

In general, the degree of adoption of a range of technology innovations distinguishes the High, Mid and Low cost cases. These projections represent the following trends to reduce CAPEX and FOM, and increase O&M.

- Continued turbine scaling to larger-megawatt turbines with larger rotors such that the swept area/megawatt capacity decreases, resulting in higher capacity factors for a given location

- Continued diversity of turbine technology whereby the largest rotor diameter turbines tend to be located in lower wind speed sites, but the number of turbine options for higher wind speed sites increases

- Taller towers that result in higher capacity factors for a given site due to the wind speed increase with elevation above ground level

- Improved plant siting and operation to reduce plant-level energy losses, resulting in higher capacity factors

- More efficient O&M procedures combined with more reliable components to reduce annual average FOM costs

- Continued manufacturing and design efficiencies such that capital cost/kilowatt decreases with larger turbine components

- Adoption of a wide range of innovative control, design, and material concepts that facilitate the above high-level trends.

Utility-Scale PV Power Plants

Representative Technology

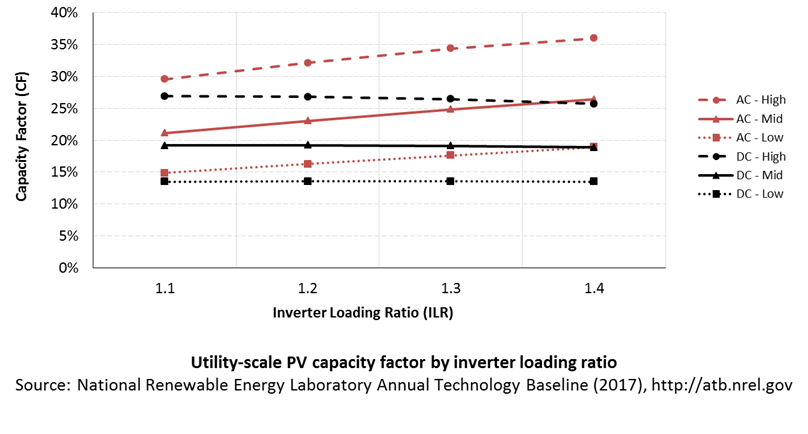

Utility-scale PV systems in the ATB are representative of one-axis tracking systems with performance characteristics in line with a 1.1 DC-to-AC ratio - or inverter loading ratio (ILR) - and pricing characteristics in line with a 1.2 DC-to-AC ratio (Fu et al. 2016). PV system performance characteristics were designed in the ReEDS model at a time when PV system ILRs were lower than they are in current system designs; pricing in the 2017 ATB incorporates more up-to-date system designs and therefore assumes a higher ILR.

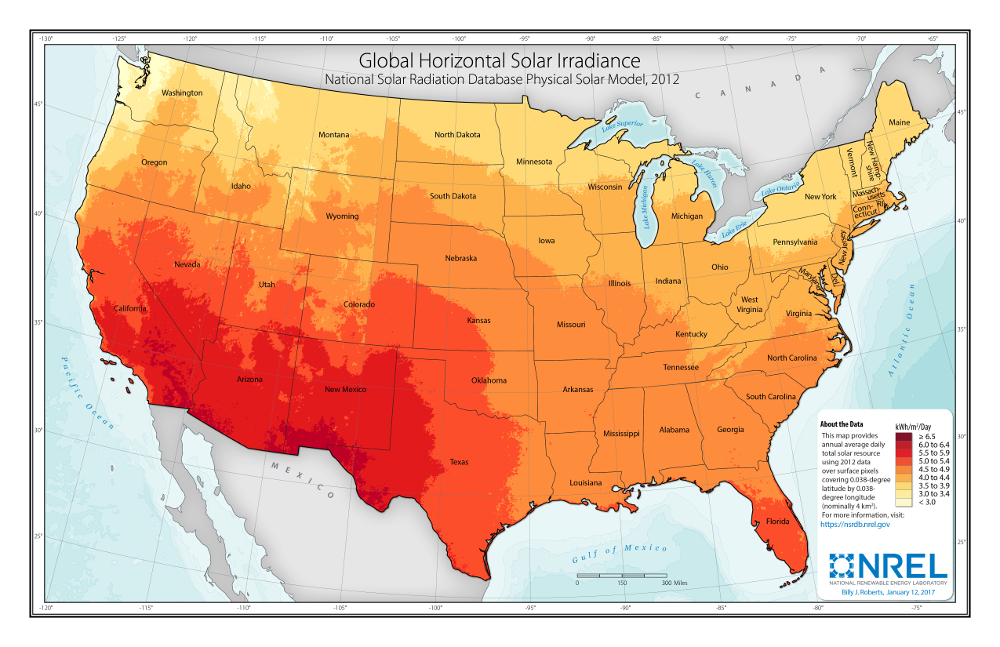

Resource Potential

Solar resources across the United States are mostly good to excellent at about 1,000-2,500 kWh/m2/year. The Southwest is at the top of this range, while Alaska and part of Washington are at the low end. The range for the contiguous United States is about 1,350-2,500 kWh/m2/year. Nationwide, solar resource levels vary by about a factor of two.

The total U.S. land area suitable for PV is significant and will not limit PV deployment. One estimate (Denholm and Margolis 2008) suggests the land area required to supply all end-use electricity in the United States using PV is about 5,500,000 hectares (ha) (13,600,000 acres), which is equivalent to 0.6% of the country's land area or about 22% of the "urban area" footprint (this calculation is based on deployment/land in all 50 states).

Renewable energy technical potential, as defined by Lopez et al. (2012), represents the achievable energy generation of a particular technology given system performance, topographic limitations, and environmental and land-use constraints. The primary benefit of assessing technical potential is that it establishes an upper-boundary estimate of development potential. It is important to understand that there are multiple types of potential - resource, technical, economic, and market (Lopez et al. 2012; NREL, "Renewable Energy Technical Potential").

Base Year and Future Year Projections Overview

The Base Year estimates rely on modeled CAPEX and O&M estimates benchmarked with industry and historical data. Capacity factor is estimated based on hours of sunlight at latitude for all geographic locations in the United States. The ATB presents capacity factor estimates that encompass a range associated with low, mid, and high levels across the United States.

Future year projections are derived from analysis of published projections of PV CAPEX and bottom-up engineering analysis of O&M costs. Three different projections were developed for scenario modeling as bounding levels:

- High cost: no change in CAPEX, O&M, or capacity factor from 2016 to 2050; consistent across all renewable energy technologies in the ATB

- Mid cost: based on the median of literature projections of future CAPEX; O&M technology pathway analysis

- Low Cost: based on low bound of literature projections of future CAPEX; O&M technology pathway analysis.

CAPital EXpenditures (CAPEX): Historical Trends, Current Estimates, and Future Projections

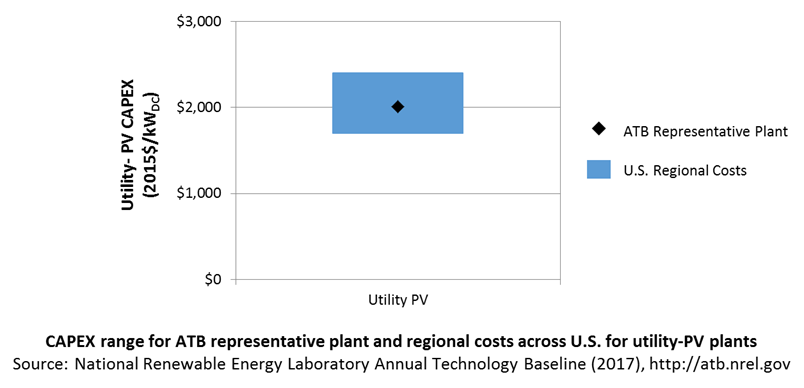

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year. These expenditures include the hardware, the balance of system (e.g., site preparation, installation, and electrical infrastructure), and financial costs (e.g., development costs, onsite electrical equipment, and interest during construction) and are detailed in CAPEX Definition. In the ATB, CAPEX reflects typical plants and does not include differences in regional costs associated with labor or materials. The range of CAPEX demonstrates variation with resource in the contiguous United States.

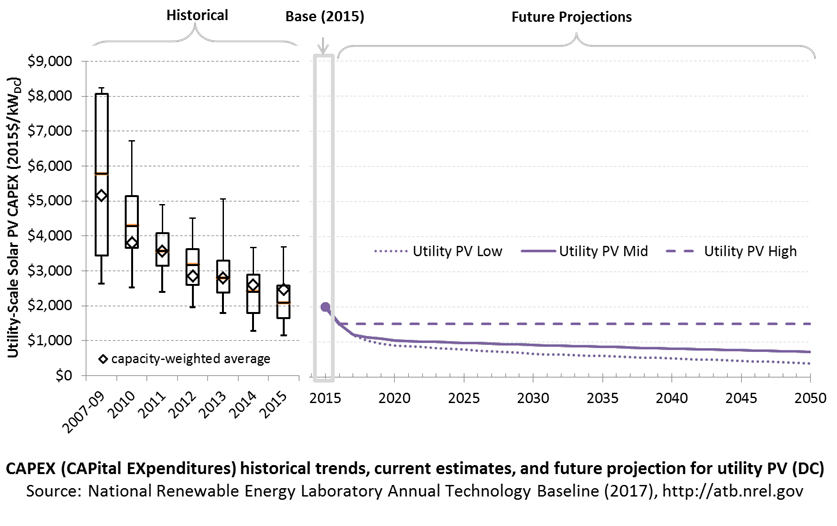

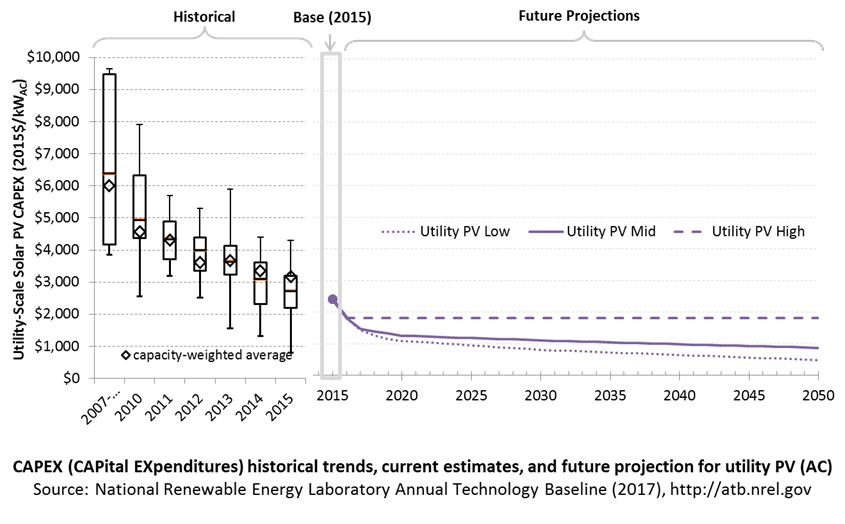

The following figures show the Base Year estimate and future year projections for CAPEX costs in terms of $/kWDC or $/kWAC. Three cost reduction scenarios are represented: High, Mid, and Low. Historical data from utility-scale PV plants installed in the United States are shown for comparison to the ATB Base Year estimates. The estimate for a given year represents CAPEX of a new plant that reaches commercial operation in that year.

The PV industry typically refers to PV CAPEX in terms of $/kWDC based on the aggregated module capacity. The electric utility industry typically refers to PV CAPEX in terms of $/kWAC based on the aggregated inverter capacity. See Solar PV AC-DC Translation for details. The figures illustrate the CAPEX historical trends, current estimates, and future projections in terms of $/kWDC or $/kWAC assuming an inverter loading ratio of 1.2.

Recent Trends

Reported historical utility-scale PV plant CAPEX (Bolinger and Seel 2016) is shown in box-and-whiskers format for comparison to the ATB current CAPEX estimates and future projections. Bolinger and Seel (2016) provide statistical representation of CAPEX for 89% of all utility-scale PV capacity.

PV pricing and capacities are quoted in kWDC (i.e., module rated capacity) unlike other generation technologies, which are quoted in kWAC. For PV, this would correspond to the combined rated capacity of all inverters. This is done because kWDC is the unit that the majority of the PV industry uses. Although costs are reported in kWDC, the total CAPEX includes the cost of the inverter, which has a capacity measured in kWAC.

CAPEX estimates for 2015 reflect continued rapid decline supported by analysis of recent power purchase agreement pricing (Bolinger and Seel 2016) for projects that will become operational in 2015 and beyond.

Base Year Estimates

For illustration in the ATB, a representative utility-scale PV plant is shown. Although the PV technologies vary, typical plant costs are represented with a single estimate because the CAPEX does not vary with solar resource.

Although the technology market share may shift over time with new developments, the typical plant cost is represented with the projections above.

A system price of $2.01/WDC in 2015 represents the median price of a utility-scale PV system installed in 2015 as reported in Bolinger and Seel (2016) and adjusted to remove regional cost multipliers based on geographic location of projects installed in 2015. The $1.51/WDC price in 2016 is based on modeled pricing for one-axis tracking systems quoted in Q1 2016 as reported in Fu et al. (2016) and adjusted for inflation. These figures are in line with other estimated system prices reported in Feldman et al. (2016).

The Base Year CAPEX estimates should tend toward the low end of reported pricing because no regional impacts, time-lagged system prices, or spur line costs are included. These effects are represented in the historical market data.

For example, in 2014, the reported capacity-weighted average system price was higher than 80% of system prices in 2014 due to very large systems, with multi-year construction schedules, installed in that year. Developers of these large systems negotiated contracts and installed portions of their systems when module and other costs were higher.

Future Year Projections

Projections of future utility-scale PV plant CAPEX are based on 14 system price projections from 8 separate institutions with short-term projections made in the past six months and long-term projections made in the last three years. We adjusted the "min," "median," and "max" analyst forecasts in a few different ways. All 2015 pricing is based on the median utility-scale system price as reported in Utility-Scale Solar 2015 (Bolinger and Seel 2016) and adjusted by the ReEDS state-level capital cost multipliers to remove geographic price distortions from 2015 reported pricing. All 2016 pricing is based on the bottom-up benchmark analysis reported in U.S. Solar Photovoltaic System Cost Benchmark Q1 2016 (adjusted for inflation) (Fu et al. 2016). These figures are in line with other estimated system prices reported in Feldman et al. (2016).

We adjusted the Mid and Low projections for 2017-2050 to remove distortions caused by the combination of forecasts with different time horizons and based on internal judgment of price trends. The High projection case is kept constant at the 2016 CAPEX value, assuming no improvements beyond 2016.

The largest annual reductions in CAPEX for the Mid and Low projections occur from 2015 to 2017, dropping 25% from 2015 to 2016 and another 19%-22% from 2016 to 2017. While reported CAPEX values have not been collected for all systems built in 2016 and 2017, CAPEX information collected from Annual Reports of Major Electric Utilities from the Federal Regulatory Commission (FERC Form 1) from nine major utilities found a 22% reduction in CAPEX from 2015 to 2016, falling to $1.32/W, which is well below reported CAPEX in the ATB. (FERC Form 1 collected from the FERC Online elibrary for the following utilities: Arizona Public Service, Florida Power & Light, Duke Energy Progressive, Georgia Power, Indiana Michigan Power Company, Kentucky Utilities, Pacific Gas & Electric, Public Service of New Mexico, and Southern California Edison.) The ATB values in 2017 are based on analysts' forecasts. Additionally, initially reported pricing for utility-scale power purchase agreements (PPAs) for utility-scale systems placed in service in that year fell 33% from 2015 to 2016; the ATB LCOE reduction over the same period is 23%.

Detailed description of the methodology for developing Future Year Projections is found in Projections Methodology.

Technology innovations that could impact future CAPEX costs are summarized in LCOE Projections.

CAPEX Definition

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year.

For the ATB—and based on EIA (2016a) and the NREL Solar PV Cost Model (Fu et al. 2016) - the utility-scale solar PV plant envelope is defined to include:

- Hardware

- Module supply

- Power electronics, including inverters

- Racking

- Foundation

- AC and DC wiring materials and installation

- Electrical infrastructure, such as transformers, switchgear, and electrical system connecting modules to each other and to the control center

- Balance of system

- Land acquisition, site preparation, installation of underground utilities, access roads, fencing, and buildings for operations and maintenance

- Project indirect costs, including costs related to engineering, distributable labor and materials, construction management start up and commissioning, and contractor overhead costs, fees, and profit.

- Financial Costs

- Owner's costs, such as development costs, preliminary feasibility and engineering studies, environmental studies and permitting, legal fees, insurance costs, and property taxes during construction.

- Electrical interconnection, including onsite electrical equipment (e.g., switchyard), a nominal-distance spur line (<1 mile), and necessary upgrades at a transmission substation; distance-based spur line cost (GCC) not included in the ATB

- Interest during construction estimated based on six-month duration accumulated 100% at half-year intervals and an 8% interest rate (ConFinFactor).

CAPEX can be determined for a plant in a specific geographic location as follows:

CAPEX = ConFinFactor*(OCC*CapRegMult+GCC).

(See the Financial Definitions tab in the ATB data spreadsheet.)

Regional cost variations and geographically specific grid connection costs are not included in the ATB (CapRegMult = 1; GCC = 0). In the ATB, the input value is overnight capital cost (OCC) and details to calculate interest during construction (ConFinFactor).

In the ATB, CAPEX represents a typical one-axis utility-scale PV plant and does not vary with resource. The difference in cost between tracking and non-tracking systems has been reduced greatly in the United States. Regional cost effects associated with labor rates, material costs, and other regional effects as defined by EIA (2016a) expand the range of CAPEX. Unique land-based spur line costs based on distance and transmission line costs for potential utility-PV plant locations expand the range of CAPEX even further. The following figure illustrates the ATB representative plant relative to the range of CAPEX including regional costs across the contiguous United States. The ATB representative plants are associated with a regional multiplier of 1.0.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for Base Year and future projections through 2050 for High, Mid, and Low projections are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and ATB and Standard Scenarios.

CAPEX in the ATB does not represent regional variants (CapRegMult) associated with labor rates, material costs, etc., but the ReEDS model does include 134 regional multipliers (EIA 2016a).

CAPEX in the ATB does not include a geographically determined spur line (GCC) from plant to transmission grid, but the ReEDS model calculates a unique value for each potential PV plant.

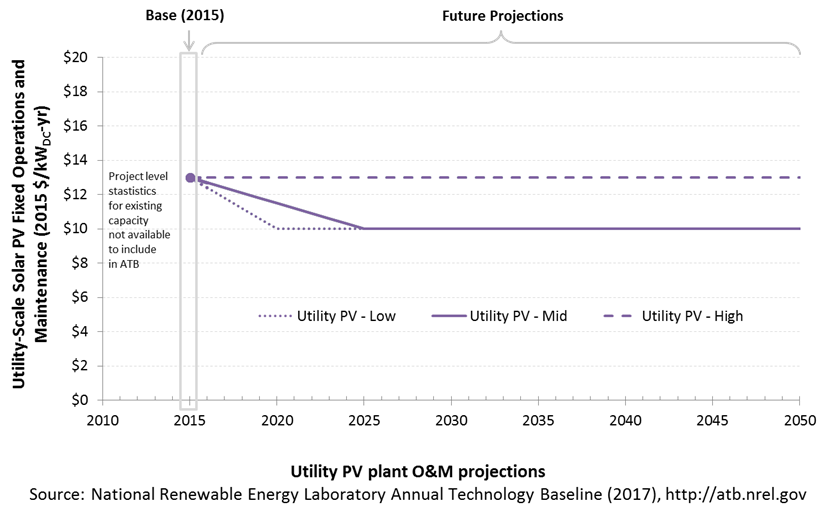

Operation and Maintenance (O&M) Costs

Operations and maintenance (O&M) costs represent the annual fixed expenditures required to operate and maintain a solar PV plant over its technical lifetime of 30 years (the distinction between economic life and technical life is described here), including:

- Insurance, property taxes, site security, legal and administrative fees, and other fixed costs

- Present value, annualized large component replacement costs over technical life (e.g., inverters at 15 years)

- Scheduled and unscheduled maintenance of solar PV plants, transformers, etc. over the technical lifetime of the plant (e.g., general maintenance, including cleaning and vegetation removal)

The following figure shows the Base Year estimate and future year projections for fixed O&M (FOM) costs. Three cost reduction scenarios are represented. The estimate for a given year represents annual average FOM costs expected over the technical lifetime of a new plant that reaches commercial operation in that year.

Base Year Estimates

FOM of $13/kWDC-yr is based on Bolinger and Seel (2016 ), who state that "average O&M costs for the cumulative set of PV plants within this sample have steadily declined from about $31/kWAC-yr (or $19/MWh) in 2011 to about $16/kWAC-yr ($7/MWh) in 2015." AC was converted into DC by dividing by 1.2. A wide range in reported prices exists in the market, in part depending on the maintenance practices that exist for a particular system. These cost categories include asset management (including compliance and reporting for incentive payments), different insurance products, site security, cleaning, vegetation removal, and failure of components. Not all these practices are performed for each system; additionally, some factors are dependent on the quality of the parts and construction. NREL analysts estimate O&M costs can range between $0 and $40/kWDC-yr.

Future Year Projections

Future FOM is assumed to decline to $10/kWDC-yr by 2020 in the Low cost case and by 2025 in the Mid cost case through improvements in system operation and more durable, better performing capital equipment, as per Woodhouse et al. 2016.

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

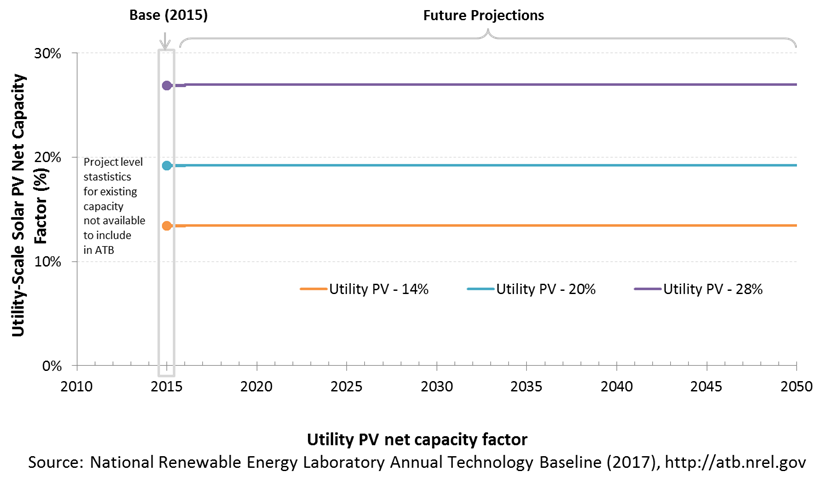

Capacity Factor: Expected Annual Average Energy Production Over Lifetime

The capacity factor represents the expected annual average energy production divided by the annual energy production, assuming the plant operates at rated capacity for every hour of the year. It is intended to represent a long-term average over the technical lifetime of the plant (the distinction between economic life and technical life is described here). It does not represent interannual variation in energy production. Future year estimates represent the estimated annual average capacity factor over the technical lifetime of a new plant installed in a given year.

Other technologies' capacity factors are represented in exclusively AC units; however, because PV pricing in this ATB documentation is represented in $/kWDC, PV system capacity is a DC rating. The PV capacity factor is the ratio of annual average energy production (kWhAC) to annual energy production assuming the plant operates at rated DC capacity for every hour of the year. For more information, see Solar PV AC-DC Translation.

The capacity factor is influenced by the hourly solar profile, technology (e.g., thin-film versus crystalline silicon), axis type (e.g., none, one, or two), expected downtime, and inverter losses to transform from DC to AC power. The DC-AC ratio is a design choice that influences the capacity factor. PV plant capacity factor incorporates an assumed degradation rate of 0.5%/year (Jordan and Kurtz 2013) in the annual average calculation.

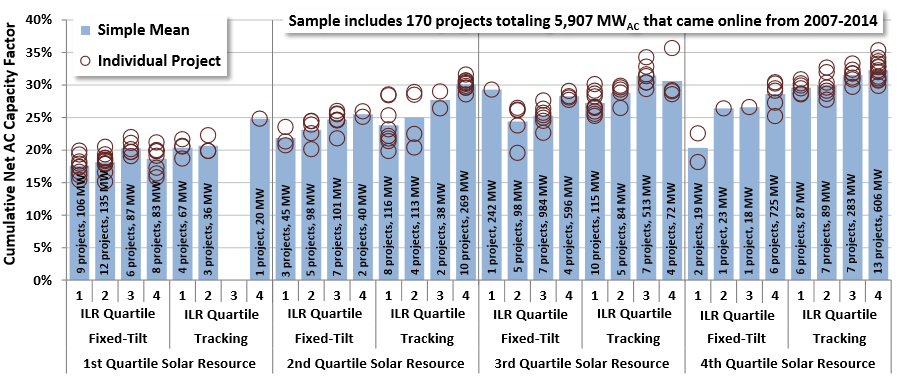

The following figure shows a range of capacity factors based on variation in solar resource in the contiguous United States. The range of the Base Year estimates illustrate the effect of locating a utility-scale PV plant in places with lower or higher solar irradiance. These values are the maximum, median, and minimum values for all geographic locations in the United States as implemented in the ReEDS model (Eurek et al. 2017 ). Future projections for High, Mid, and Low cost scenarios are unchanged from the Base Year. Technology improvements are focused on CAPEX and O&M cost elements.

PV system inverters, which convert DC energy/power to AC energy/power, have AC capacity ratings; therefore, the capacity of a PV system is rated in MWAC, or the aggregation of all inverters' rated capacities, or MWDC, or the aggregation of all modules' rated capacities. The capacity factor calculation uses a system's rated capacity, and therefore, capacity factor can be represented using exclusively AC units or using AC units for electricity (the numerator) and DC units for capacity (the denominator). Both capacity factors will result in the same LCOE as long as the other variables use the same capacity rating (e.g., CAPEX in terms of $/kWDC). PV systems' DC ratings are typically higher than their AC ratings; therefore, the capacity factor calculated using a DC capacity rating has a higher denominator. In the ATB, we use capacity factors of 14%, 20%, and 28% for the first year of a PV project and adjust the values to reflect an average capacity factor for the lifetime of a project, calculated with MWDC, assuming 0.5% module capacity degradation per year. The adjusted average capacity factor values used in the ATB are 13.5%, 19.2%, and 26.9%. These numbers would change to approximately 14.8%, 21.2%, and 29.6% if the ATB used MWAC. The following figure illustrates capacity factor - both DC and AC - for a range of inverter loading ratios. The ATB capacity factor assumptions are based on ILR = 1.1.

Recent Trends

At the end of 2015, the capacity-weighted average AC capacity factor for all U.S. projects installed at the time was 27.6% (including fixed-tilt systems), but individual project-level capacity factors exhibited a wide range (15.1%–35.7%).

The capacity-weighted average capacity factor was more closely in line with the higher end of the range because 88% of the installed capacity was in the southwestern United States or California, where the average capacity factor was 30.2% for one-axis systems and 25.6% for fixed-tilt systems (Bolinger and Seel 2016). The upper and lower capacity factor values in the ATB are conservative due to the lower DC-to-AC ratio.

Base Year Estimates

For illustration in the ATB, a range of capacity factors associated with the range of latitude in the contiguous United States is shown.

Over time, PV plant output is reduced. This degradation (at 0.5%) is accounted for in ATB estimates of capacity factor. The ATB capacity factor estimates represent estimated annual average energy production over the 20-year economic life of the plant (the distinction between economic life and technical life is described here).

Given the historical reported capacity factors by systems installed in the United States and the potential for technological improvements that can improve the solar PV plant capacity factors (e.g., less reflectivity and improved low-light performance), these values likely represent a conservative estimate of system production. Part of this is due to differences in inverter loading ratios (also called DC-to-AC ratio), which can increase production but also increases cost ($/WDC). In 2015, the cumulative PV capacity factors for low-, mid-, and high-insolation regions, for tracking systems with a mid-level inverter loading ratio (1.19:1.25) were 20.7%, 26.7%, and 30.0% respectively (in WAC) (Bolinger and Seel 2016), which is comparable to or significantly higher than the 14.8%, 21.2%, and 29.6% (in WAC) used in the ATB (13.5%, 19.2%, and 26.9% in WDC). Currently reported capacity factors for deployed systems are, on average, reflective of capacity factors for relatively new plants.

These capacity factors are for a one-axis tracking system with a DC-to-AC ratio of 1.1.

Future Year Projections

Projections of capacity factors for plants installed in future years are unchanged from the Base Year. Solar PV plants have very little downtime, inverter efficiency is already optimized, and tracking is already assumed. That said, there is potential for future increases in capacity factors through technological improvements such as less panel reflectivity, lower degradation rates, and improved performance in low-light conditions.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for High, Mid, and Low projections are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

The ReEDS model output capacity factors for wind and solar PV can be lower than input capacity factors due to endogenously estimated curtailments determined by system operation.

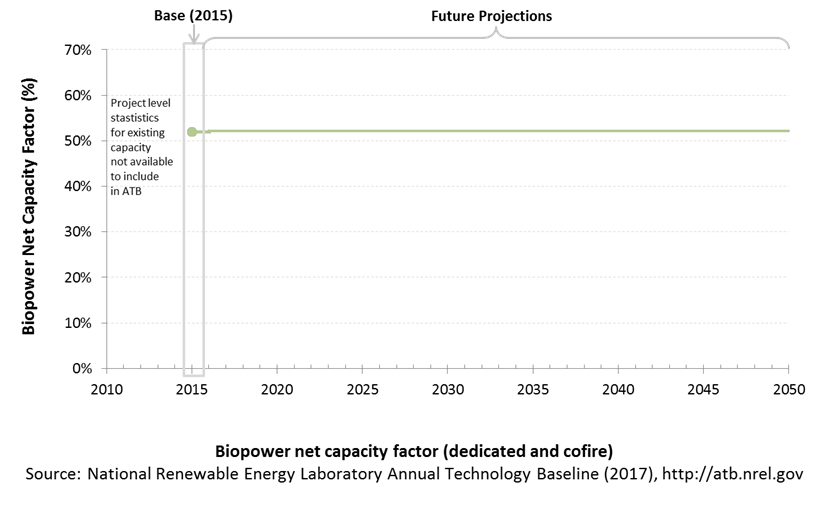

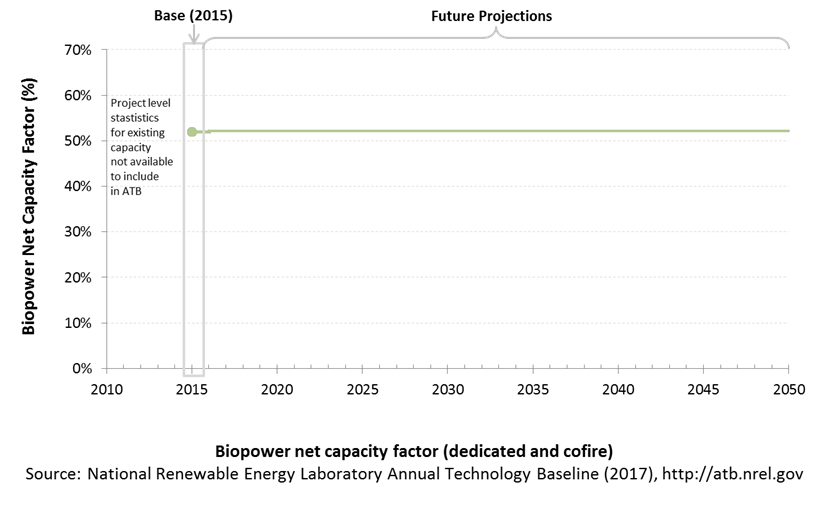

Plant Cost and Performance Projections Methodology

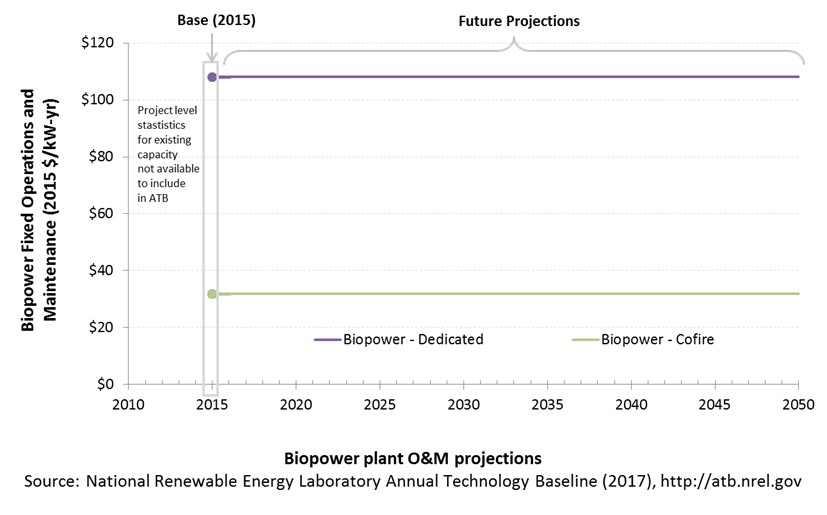

The capacity factor represents the assumed annual energy production divided by the total possible annual energy production, assuming the plant operates at rated capacity for every hour of the year. For biopower plants, the capacity factors are typically lower than their availability factors. Biopower plant availability factors have a wide range depending on system design, fuel type and availability, and maintenance schedules.

Biopower plants are typically baseload plants with steady capacity factors. For the ATB, the biopower capacity factor is taken as the average capacity factor for biomass plants for 2015, as reported by EIA.

Biopower capacity factors are influenced by technology and feedstock supply, expected downtime, and energy losses.

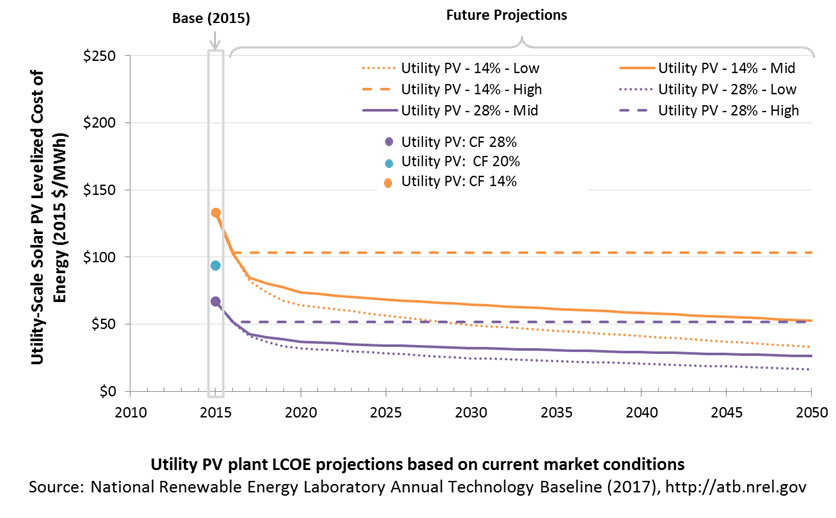

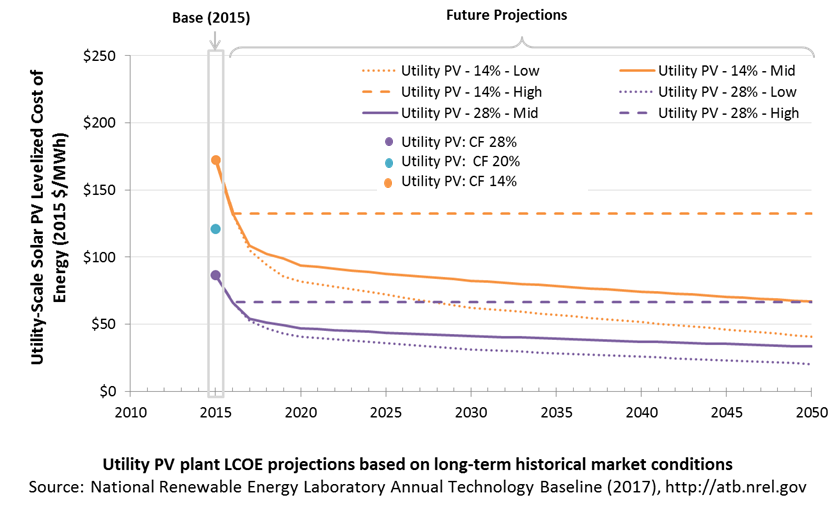

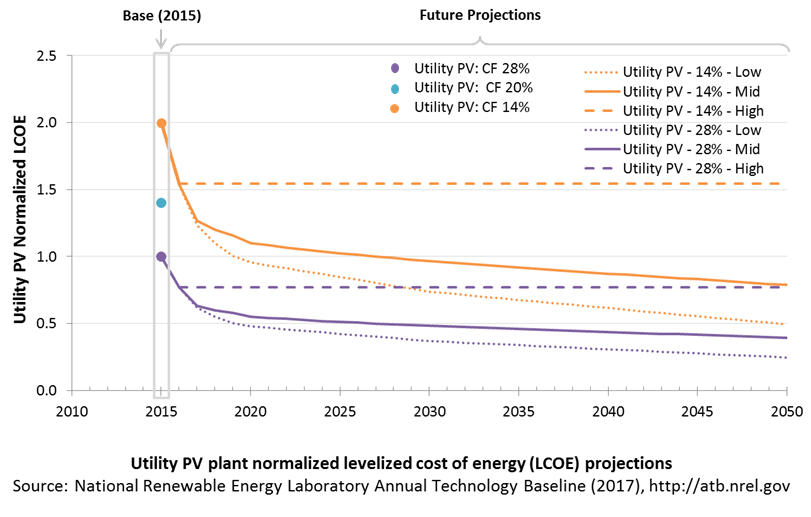

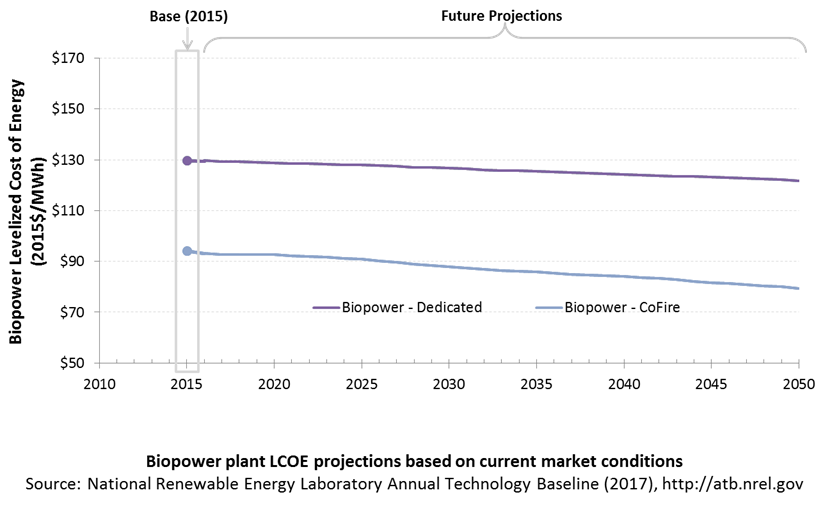

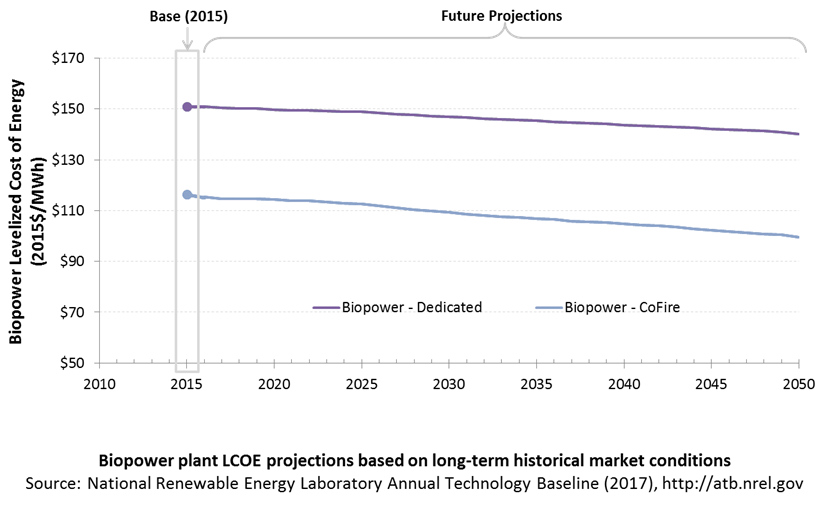

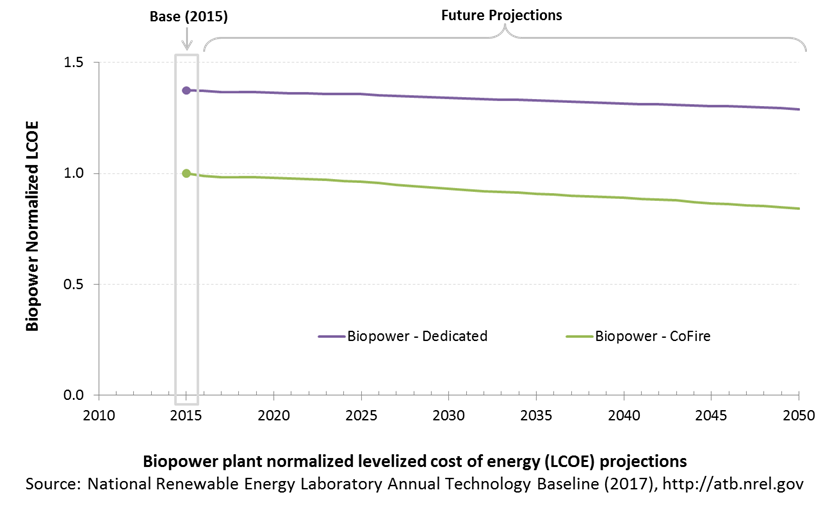

Levelized Cost of Energy (LCOE) Projections

Levelized cost of energy (LCOE) is a simple metric that combines the primary technology cost and performance parameters, CAPEX, O&M, and capacity factor. It is included in the ATB for illustrative purposes. The focus of the ATB is to define the primary cost and performance parameters for use in electric sector modeling or other analysis where more sophisticated comparisons among technologies are made. LCOE captures the energy component of electric system planning and operation, but the electric system also requires capacity and flexibility services to operate reliably. Electricity generation technologies have different capabilities to provide such services. For example, wind and PV are primarily energy service providers, while the other electricity generation technologies provide capacity and flexibility services in addition to energy. These capacity and flexibility services are difficult to value and depend strongly on the system in which a new generation plant is introduced. These services are represented in electric sector models such as the ReEDS model and corresponding analysis results such as the Standard Scenarios.

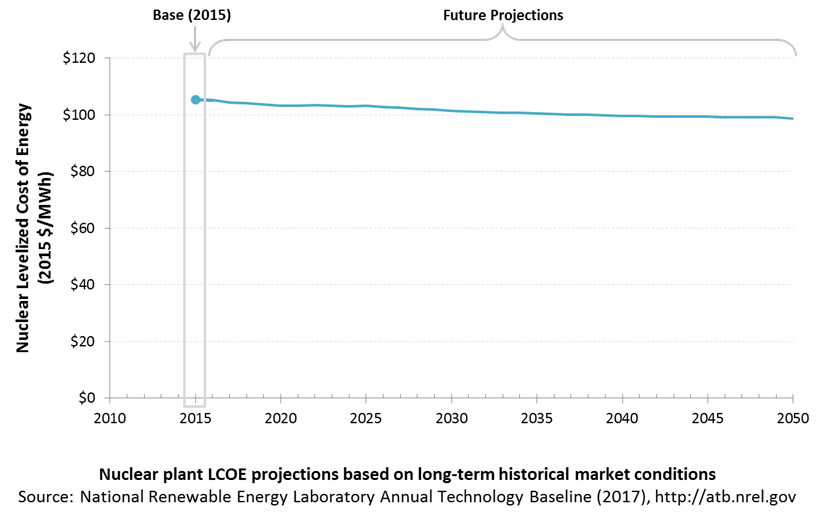

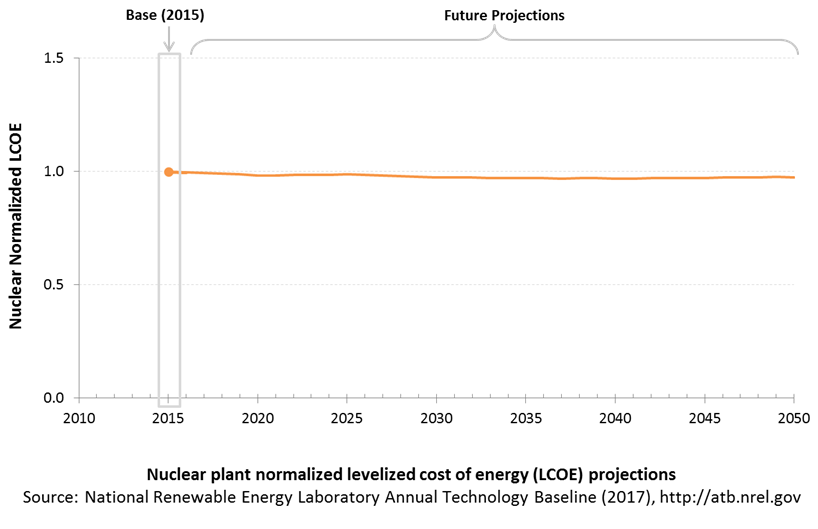

The following three figures illustrate the combined impact of CAPEX, O&M, and capacity factor projections across the range of resources present in the contiguous United States. The Current Market Conditions LCOE demonstrates the range of LCOE based on macroeconomic conditions similar to the present. The Historical Market Conditions LCOE presents the range of LCOE based on macroeconomic conditions consistent with prior ATB editions and Standard Scenarios model results. The Normalized LCOE (all LCOE estimates are normalized with the lowest Base Year LCOE value) emphasizes the effect of resource quality and the relative differences in the three future pathways independent of project finance assumptions. The ATB representative plant characteristics that best align with recently installed or anticipated near-term utility-scale PV plants are associated with Utility PV: CF 20%. Data for all the resource categories can be found in the ATB data spreadsheet.

The methodology for representing the CAPEX, O&M, and capacity factor assumptions behind each pathway is discussed in Projections Methodology. The three pathways are generally defined as:

- High = Base Year (or near-term estimates of projects under construction) equivalent through 2050 maintains current relative technology cost differences

- Mid = technology advances through continued industry growth, public and private R&D investments, and market conditions relative to current levels that may be characterized as "likely" or "not surprising"

- Low = Technology advances that may occur with breakthroughs, increased public and private R&D investments, and/or other market conditions that lead to cost and performance levels that may be characterized as the "limit of surprise" but not necessarily the absolute low bound.

To estimate LCOE, assumptions about the cost of capital to finance electricity generation projects are required. For comparison in the ATB, two project finance structures are represented.

- Current Market Conditions: The values of the production tax credit (PTC) and investment tax credit (ITC) are ramping down by 2020, at which time wind and solar projects may be financed with debt fractions similar to other technologies. This scenario reflects debt interest (4.4% nominal, 1.9% real) and return on equity rates (9.5% nominal, 6.8% real) to represent 2017 market conditions (AEO 2017) and a debt fraction of 60% for all electricity generation technologies. An economic life, or period over which the initial capital investment is recovered, of 20 years is assumed for all technologies. These assumptions are one of the project finance options in the ATB spreadsheet.

- Long-Term Historical Market Conditions: Historically, debt interest and return on equity were represented with higher values. This scenario reflects debt interest (8% nominal, 5.4% real) and return on equity rates (13% nominal, 10.2% real) implemented in the ReEDS model and reflected in prior versions of the ATB and Standard Scenarios model results. A debt fraction of 60% for all electricity generation technologies is assumed. An economic life, or period over which the initial capital investment is recovered, of 20 years is assumed for all technologies. These assumptions are one of the project finance options in the ATB spreadsheet.

These parameters are held constant for estimates representing the Base Year through 2050. No incentives such as the PTC or ITC are included. The equations and variables used to estimate LCOE are defined on the equations and variables page. For illustration of the impact of changing financial structures such as WACC and economic life, see Project Finance Impact on LCOE. For LCOE estimates for High, Mid, and Low scenarios for all technologies, see 2017 ATB Cost and Performance Summary.

In general, the degree of adoption of a range of technology innovations distinguishes the High, Mid and Low cost cases. These projections represent the following trends to reduce CAPEX and FOM.

- Modules

- Increased module efficiencies and increased production-line throughput to decrease CAPEX; overhead costs on a per-kilowatt will go down if efficiency and throughput improvement are realized.

- Reduced wafer thickness or the thickness of thin-film semiconductor layers

- Development of new semiconductor materials

- Development of larger manufacturing facilities in low-cost regions

- Balance of system (BOS)

- Increased module efficiency, reducing the size of the installation

- Development of racking systems that enhance energy production or require less robust engineering

- Integration of racking or mounting components in modules

- Reduction of supply chain complexity and cost

- Creation of standard packages system design

- Improvement supply chains for BOS components in modules

- Improved power electronics

- Improvement of inverter prices and performance, possibly by integrating micro-inverters

- Decreased installation costs and margins

- Reduction of supply chain margins (e.g., profit and overhead charged by suppliers, manufacturer, distributors, and retailers); this will likely occur naturally as the U.S. PV industry grows and matures.

- Streamlining of installation practices through improved workforce development and training, and developing standardized PV hardware

- Expansion of access to a range of innovative financing approaches and business models

- Development of best practices for permitting interconnection, and PV installation such as subdivision regulations, new construction guidelines, and design requirements.

FOM cost reduction represents optimized O&M strategies, reduced component replacement costs, and lower frequency of component replacement.

Geothermal

Hydrothermal Geothermal

Representative Technology

The typical geothermal plant size for hydrothermal resource sites is represented by a range of 30–40 MW, depending on the technology type (e.g., binary or flash) (Mines 2013).

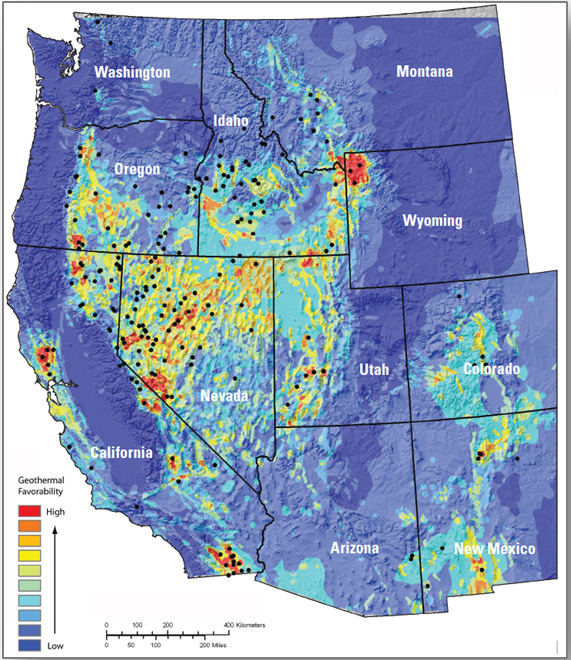

Resource Potential

The hydrothermal geothermal resource is concentrated in the western United States. The total potential is 45,370 MW: 7,833 MW identified and 37,537 MW undiscovered (Williams et al. 2008). The U.S. Geological Survey (Williams et al. 2008) identified resource potential at each site is based on available reservoir thermal energy information from studies conducted at the site. The undiscovered hydrothermal technical potential estimate is based on a series of GIS statistical models for the spatial correlation of geological factors that facilitate the formation of geothermal systems.

The U.S. Geological Survey resource potential estimates for hydrothermal were used with the following modifications:

- Installed capacity of about 3 GW in 2014 is excluded from the resource potential

- Technical potential estimates increased 20%–30% to reflect impact of in-field enhanced geothermal system (EGS) technologies to increase (1) productivity of dry wells and (2) recovery of heat in place from hydrothermal reservoirs.

Renewable energy technical potential, as defined by Lopez et al. (2012), represents the achievable energy generation of a particular technology given system performance, topographic limitations, and environmental and land-use constraints. The primary benefit of assessing technical potential is that it establishes an upper-boundary estimate of development potential. It is important to understand that there are multiple types of potential-resource, technical, economic, and market (Lopez et al. 2012; NREL, "Renewable Energy Technical Potential").

Base Year and Future Year Projections Overview

The Base Year cost and performance estimates are calculated using Geothermal Electricity Technology Evaluation Model (GETEM), a bottom-up cost analysis tool that accounts for each phase of development of a geothermal plant (DOE "Geothermal Electricity Technology Evaluation Model").

- Cost and performance data for hydrothermal generation plants are estimated for each potential site using GETEM. Model results are based on resource attributes (e.g., estimated reservoir temperature, depth, and potential) of each site.

- Site attribute values are from Williams et al. (2008) for identified resource potential and from capacity-weighted averages of site attribute values of nearby identified resources for undiscovered resource potential.

- GETEM is used to estimate CAPEX, O&M, and parasitic plant losses that affect net energy production.

Projections of CAPEX for plants installed in future years are derived from minimum learning estimates (IEA 2017). Capacity factor and O&M costs for plants installed in future years are unchanged from the Base Year. Projections for hydrothermal and EGS technologies are equivalent.

- High cost: no change in CAPEX, O&M, or capacity factor from 2015 to 2050; consistent across all renewable energy technologies in the ATB

- Mid cost: CAPEX cost reduction based on half of assumed minimum learning

- Low cost: CAPEX cost reduction based on assumed minimum learning.

Enhanced Geothermal System (EGS) Technology

Representative Technology

The typical geothermal plant size for EGS plants is represented by a range of 20-25 MW for binary or flash technologies (Mines 2013).

Resource Potential

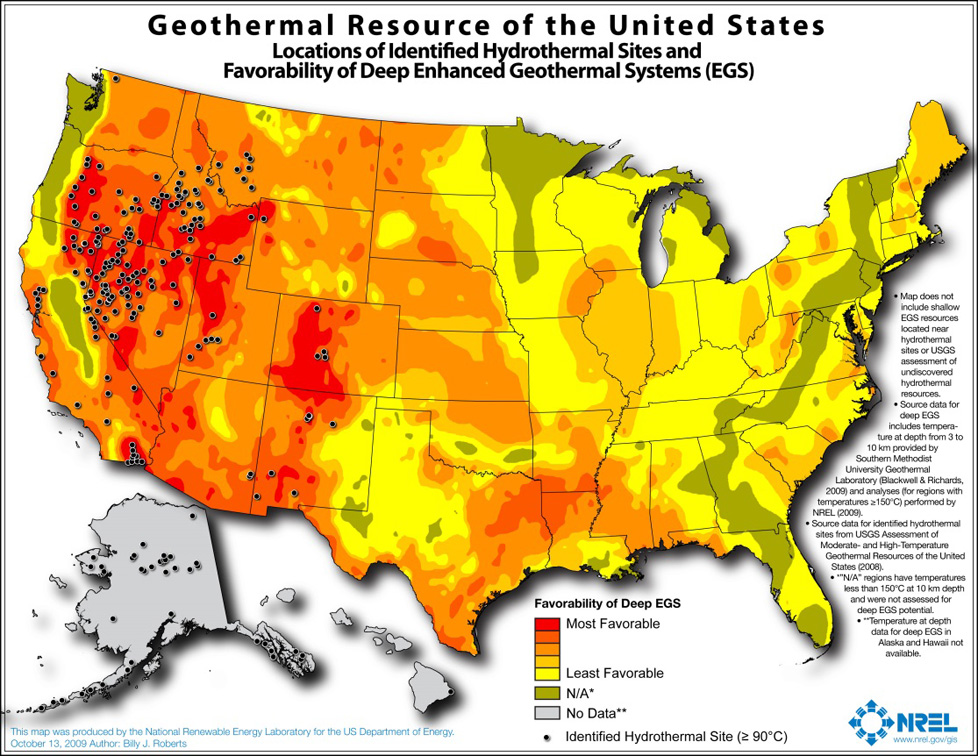

The enhanced geothermal system (EGS) resource is concentrated in the western United States. The total potential is greater than 100,000 MW: 1,493 MW of near-hydrothermal field EGS (NF-EGS) and the remaining potential comes from deep EGS.

- The NF-EGS resource potential is based on data from USGS for EGS potential on the periphery of select studied and identified hydrothermal sites.

- The deep EGS resource potential (Augustine 2011) is based on Southern Methodist University Geothermal Laboratory temp-at-depth maps and the methodology is from MIT (2006).

- The EGS resource is thousands of GW (16,000 GW) but many locations are likely not commercially feasible.

Renewable energy technical potential as defined by Lopez et al., (2012) represents the achievable energy generation of a particular technology given system performance, topographic limitations, environmental, and land-use constraints. The primary benefit of assessing technical potential is that it establishes an upper-boundary estimate of development potential. It is important to understand that there are multiple types of potential-resource, technical, economic, and market (Lopez et al. 2012; NREL, "Renewable Energy Technical Potential").

Base Year and Future Projections Overview

The Base Year cost and performance estimates are calculated using the Geothermal Electricity Technology Evaluation Model (GETEM), a bottom-up cost analysis tool that accounts for each phase of development of a geothermal plant (DOE "Geothermal Electricity Technology Evaluation Model").

- Cost and performance data for EGS generation plants are estimated for each potential site using GETEM. Model results based on resource attributes (e.g., estimated reservoir temperature, depth, and potential) of each site.

- Approaches to restrict resource potential to about 500 GW based on USGS analysis may be implemented in the future.

- GETEM is used to estimate CAPEX and O&M. and parasitic plant losses that affect net energy production.

Projections of CAPEX for plants installed in future years are derived from minimum learning estimates (IEA 2017). Capacity factor and O&M costs for plants installed in future years are unchanged from the Base Year. Projections for hydrothermal and enhanced geothermal system technologies are equivalent.

- High Cost: no change in CAPEX, O&M, or capacity factor from 2015 to 2050, consistent across all renewable energy technologies in the ATB

- Mid Cost: CAPEX cost reduction based on half of assumed minimum learning

- Low cost: CAPEX cost reduction based on assumed minimum learning.

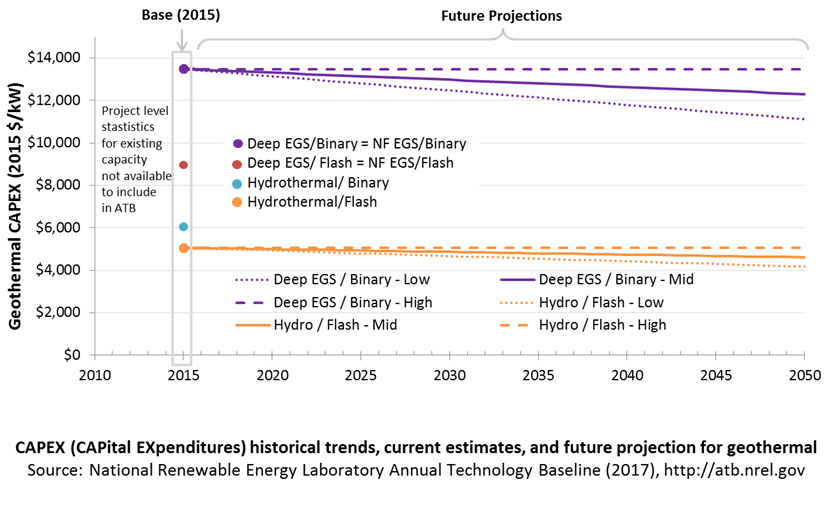

CAPital EXpenditures (CAPEX): Historical Trends, Current Estimates, and Future Projections

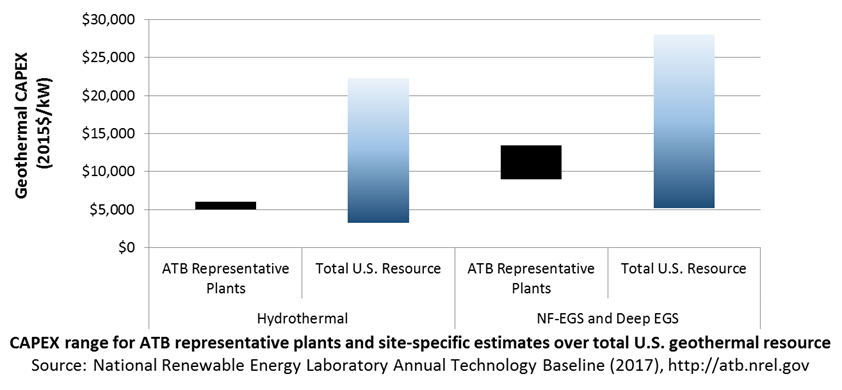

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year. These expenditures include the geothermal generation plant, the balance of system (e.g., site preparation, installation, and electrical infrastructure), and financial costs (e.g., development costs, onsite electrical equipment, and interest during construction) and are detailed in CAPEX Definition. In the ATB, CAPEX reflects typical plants and does not include differences in regional costs associated with labor or materials. The range of CAPEX demonstrates variation with resource in the contiguous United States.

The following figure shows the Base Year estimate and future year projections for CAPEX costs. Three cost reduction scenarios are represented: High, Mid, and Low. The estimate for a given year represents CAPEX of a new plant that reaches commercial operation in that year.

Base Year Estimates

For illustration in the ATB, six representative geothermal plants are shown. Two energy conversion processes are common: binary organic Rankine cycle and flash.

- Binary plants use a heat exchanger to transfer geothermal energy to an organic Rankine cycle. This technology generally applies to lower-temperature systems. These systems have higher CAPEX than flash systems because of the increased number of components, their lower-temperature operation, and a general requirement that a number of wells be drilled for a given power output.

- Flash plants create steam directly from the thermal fluid through a pressure change. This technology generally applies to higher-temperature systems. Due to the reduced number of components and higher-temperature operation, these systems generally produce more power per well, thus reducing drilling costs. These systems generally have lower CAPEX than binary systems.

Examples using each of these plant types in each of the three resource types (hydrothermal, NF-EGS, and deep EGS) are shown in the ATB.

Costs are for new or "greenfield" hydrothermal projects, not for re-drilling or additional development/capacity additions at an existing site.

Characteristics for the six example plants representing current technology were developed based on discussion with industry stakeholders. The CAPEX estimates were generated using GETEM. CAPEX for NF-EGS and EGS are equivalent.

The table below shows the range of OCC associated with the resource characteristics for potential sites throughout the United States.

| Temp (°C) | |||||

|---|---|---|---|---|---|

| >=200C | 150–200 | 135–150 | <135 | ||

| Hydrothermal | |||||

| Number of identified sites | 21 | 23 | 17 | 59 | |

| Total capacity (MW) | 22,718 | 5,560 | 1,173 | 9,697 | |

| Avgerage OCC ($/kW) | 4,047 | 6,801 | 8,611 | 15,367 | |

| Min. OCC ($/kW) | 3,000 | 3,909 | 6,786 | 10,596 | |

| Max. OCC ($/kW) | 5,906 | 15,314 | 11,885 | 20,612 | |

| Example plant OCC ($/kW) | 4,567 | 5,465 | |||

| NF-EGS | Number of sites | 12 | 20 | ||

| Total capacity (MW) | 787 | 707 | |||

| Avgerage OCC ($/kW) | 5,928 | 8,820 | |||

| Min. OCC ($/kW) | 4,871 | 6,757 | |||

| Max. OCC ($/kW) | 7,216 | 11,486 | |||

| Example plant OCC ($/kW) | 8,100 | 12,179 | |||

| Deep EGS (3–6 km) | Number of sites | n/a | n/a | ||

| Total capacity (MW) | 100,000+ | ||||

| Average OCC ($/kW) | 10,061 | 20,840 | |||

| Min.OCC ($/kW) | 4,782 | 15,951 | |||

| Max. OCC ($/kW) | 18,292 | 25,933 | |||

| Example plant OCC ($/kW) | 8,100 | 12,179 | |||

Future Year Projections

Projection of future geothermal plant CAPEX for the Low case is based on minimum learning rates as implemented in AEO (EIA 2015): 10% by 2035. This corresponds to a 0.5% annual improvement in CAPEX, which is assumed to continue on through 2050. The Mid case is also considered with a 0.25% annual improvement in CAPEX through 2050.

A detailed description of the methodology for developing Future Year Projections is found in Projections Methodology.

Technology innovations that could impact future CAPEX costs are summarized in LCOE Projections.

CAPEX Definition

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year.

For the ATB - and based on EIA (2016a) and GETEM component cost calculations - the geothermal plant envelope is defined to include:

- Geothermal generation plant

- Exploration, confirmation drilling, well field development, reservoir stimulation (EGS), plant equipment, and plant construction

- Power plant equipment, well-field equipment, and components for wells (including dry/non-commercial wells)

- Balance of system (BOS)

- Installation and electrical infrastructure, such as transformers, switchgear, and electrical system connecting turbines to each other and to the control center

- Project indirect costs, including costs related to engineering, distributable labor and materials, construction management start up and commissioning, and contractor overhead costs, fees, and profit

- Financial costs

- Owner's costs, such as development costs, preliminary feasibility and engineering studies, environmental studies and permitting, legal fees, insurance costs, and property taxes during construction

- Electrical interconnection and onsite electrical equipment (e.g., switchyard), a nominal-distance spur line (<1 mile), and necessary upgrades at a transmission substation; distance-based spur line cost (GCC) not included in the ATB

- Interest during construction estimated based on four-year duration accumulated 10%/20%/30%/40% at half-year intervals and an 8% interest rate (ConFinFactor).

CAPEX can be determined for a plant in a specific geographic location as follows:

CAPEX = ConFinFactor*(OCC*CapRegMult+GCC).

(See the Financial Definitions tab in the ATB data spreadsheet.)

Regional cost variations and geographically specific grid connection costs are not included in the ATB (CapRegMult = 1; GCC = 0). In the ATB, the input value is overnight capital cost (OCC) and details to calculate interest during construction (ConFinFactor).

In the ATB, CAPEX is shown for six representative plants. Example CAPEX for binary organic Rankine cycle and flash energy conversion processes in each of three geothermal resource types are presented. CAPEX estimates for all hydrothermal NF-EGS potential results in a CAPEX range that is much broader than that shown in the ATB. It is unlikely that all of the resource potential will be developed due to the very high costs for some sites. Regional cost effects and distance-based spur line costs are not estimated.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for High, Mid, and Low projections are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

The ReEDS model represents cost and performance for hydrothermal, NF-EGS, and EGS potential in 5 bins for each of 134 geographic regions, resulting in a greater CAPEX range in the reference supply curve than what is shown in examples in the ATB.

CAPEX in the ATB does not represent regional variants (CapRegMult) associated with labor rates, material costs, etc., and neither does the ReEDS model.

CAPEX in the ATB does not include geographically determined spur line (GCC) from plant to transmission grid, and neither does the ReEDS model.

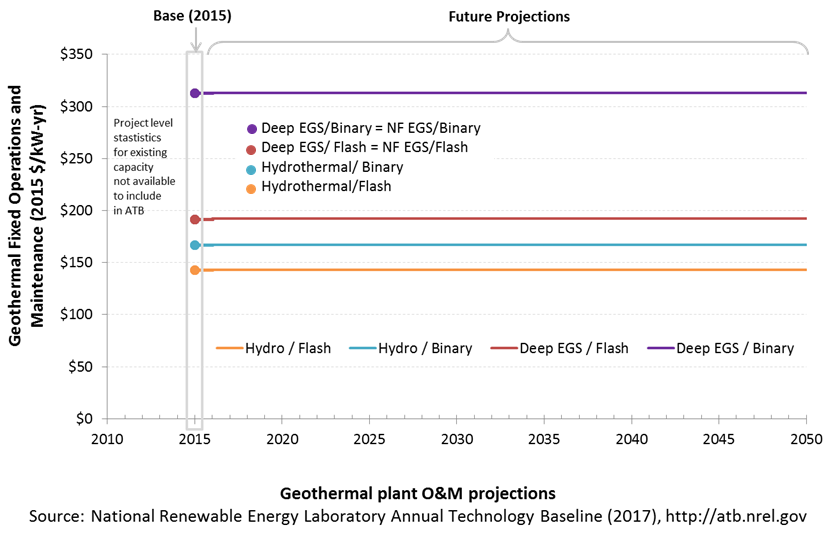

Operation and Maintenance (O&M) Costs

Operations and maintenance (O&M) costs represent average annual fixed expenditures (and depend on rated capacity) required to operate and maintain a hydrothermal plant over its technical lifetime of 30 years (plant and reservoir) (the distinction between economic life and technical life is described here), including:

- Insurance, taxes, land lease payments, and other fixed costs

- Present value and annualized large component overhaul or replacement costs over technical life (e.g., downhole pumps)

- Scheduled and unscheduled maintenance of geothermal plant components and well field components over the technical lifetime of the plant and reservoir.

The following figure shows the Base Year estimate and future year projections for fixed O&M (FOM) costs. Three cost reduction scenarios are represented. The estimate for a given year represents annual average FOM costs expected over the technical lifetime of a new plant that reaches commercial operation in that year.

Base Year Estimates

FOM is estimated for each example plant based on technical characteristics.

GETEM is used to estimate FOM for each of the six representative plants. FOM for NF-EGS and EGS are equivalent.

Future Year Projections

No future FOM cost reduction is assumed in this edition of the ATB.

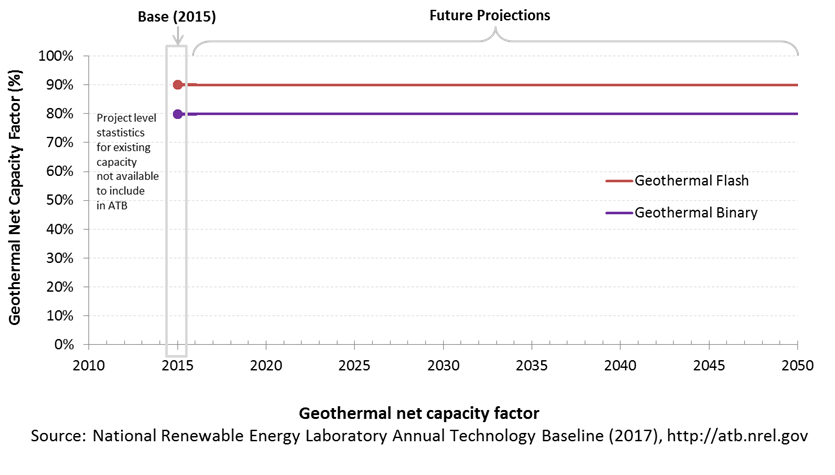

Capacity Factor: Expected Annual Average Energy Production Over Lifetime

The capacity factor represents the expected annual average energy production divided by the annual energy production, assuming the plant operates at rated capacity for every hour of the year. It is intended to represent a long-term average over the technical lifetime of the plant (the distinction between economic life and technical life is described here). It does not represent interannual variation in energy production. Future year estimates represent the estimated annual average capacity factor over the technical lifetime of a new plant installed in a given year.

Geothermal plant capacity factor is influenced by diurnal and seasonal air temperature variation (for air-cooled plants), technology (e.g., binary or flash), downtime, and internal plant energy losses.

The following figure shows a range of capacity factors based on variation in the resource for plants in the contiguous United States. The range of the Base Year estimates illustrates Binary or Flash geothermal plants. Future year projections for High, Mid, and Low cost scenarios are unchanged from the Base Year. Technology improvements are focused on CAPEX cost elements.

Base Year Estimate

The capacity factor estimates are developed using GETEM at typical design air temperature and based on design plant capacity net losses. An additional reduction is applied to approximate potential variability due to seasonal temperature effects.

Some geothermal plants have experienced year-on-year reductions in energy production, but this is not consistent across all plants. No approximation of long-term degradation of energy output is assumed.

Ongoing work at NREL and the Idaho National Laboratory is helping improve capacity factor estimates for geothermal plants. As this work progresses, it will be incorporated into future versions of the ATB.

Future Year Projections

Capacity factors remain unchanged from the Base Year through 2050. Technology improvements are focused on CAPEX costs. Estimates of capacity factor for geothermal plants in the ATB represent typical operation. The dispatch characteristics of these systems are valuable to the electric system to manage changes in net electricity demand. Actual capacity factors will be influenced by the degree to which system operators call on geothermal plants to manage grid services.

Plant Cost and Performance Projections Methodology

The site-specific nature of geothermal plant cost, the relative maturity of hydrothermal plant technology, and the very early stage development of EGS technologies make cost projections difficult. No thorough literature reviews have been conducted for cost reduction of hydrothermal geothermal technologies or EGS technologies. However, the Geothermal Vision Study, which is sponsored by the DOE Geothermal Technologies Office, is currently underway and is likely to lead to industry-developed cost reduction estimates that could be included in a future ATB..

Projection of future geothermal plant CAPEX for the Low cost case is based on minimum learning rates as implemented in AEO (EIA 2015): 10% by 2035. This corresponds to a 0.5% annual improvement in CAPEX, which is assumed to continue on through 2050. The Mid cost case assumes a 0.25% annual improvement in CAPEX through 2050. The High cost case retains all cost and performance assumptions equivalent to the Base Year through 2050.

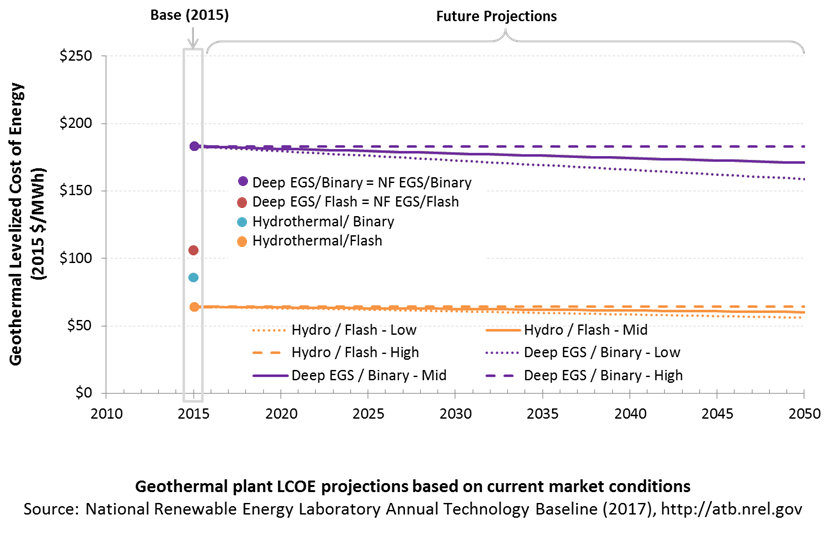

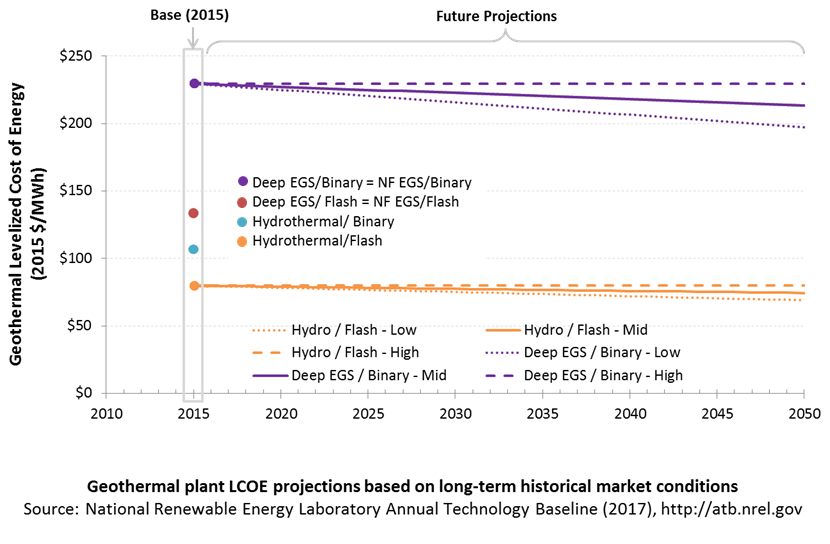

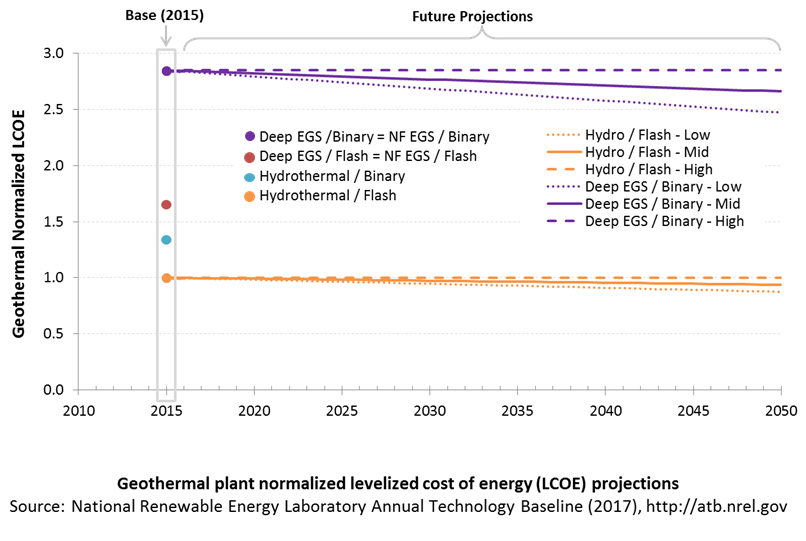

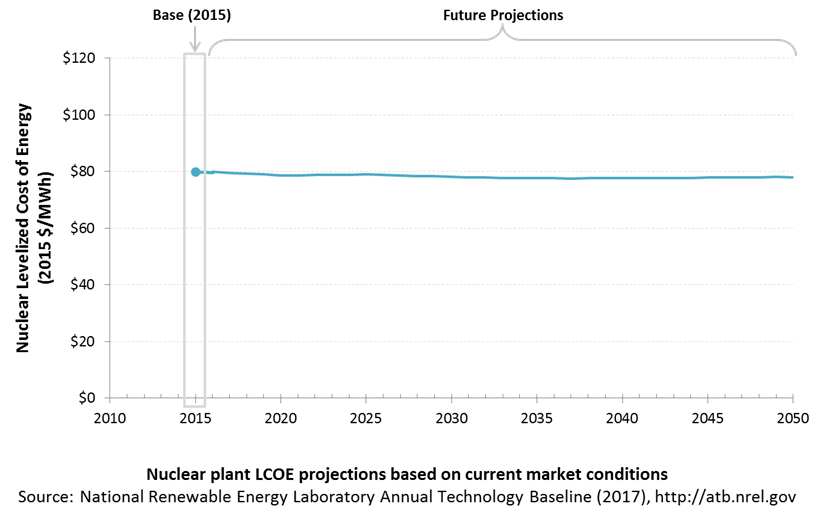

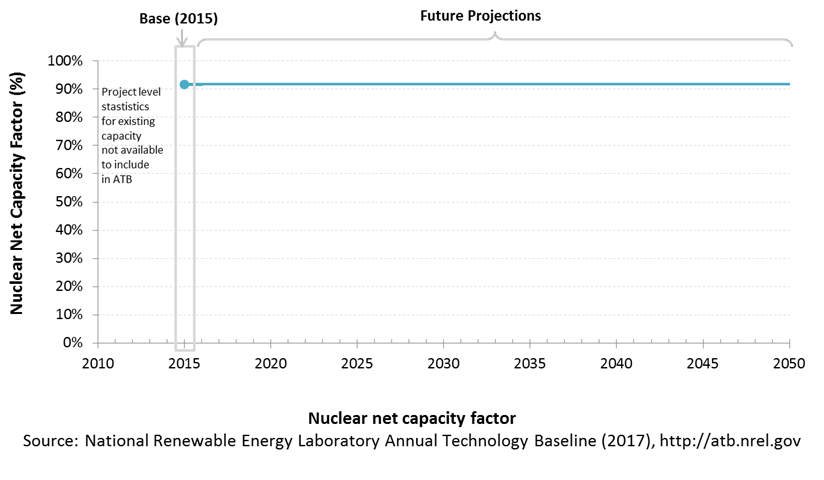

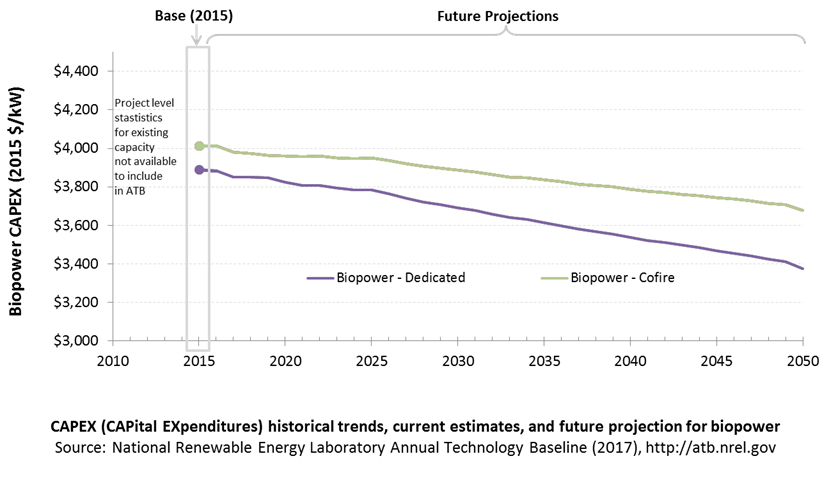

Levelized Cost of Energy (LCOE) Projections