Annual Technology Baseline 2018

National Renewable Energy Laboratory

Recommended Citation:

NREL (National Renewable Energy Laboratory). 2018. 2018 Annual Technology Baseline. Golden, CO: National Renewable Energy Laboratory. http://atb.nrel.gov/.

Please consult Guidelines for Using ATB Data:

https://atb.nrel.gov/electricity/user-guidance.html

Offshore Wind

Representative Technology

In 2016, the first offshore wind plant commenced commercial operation in the United States near Block Island (Rhode Island). This demonstration project is 30 MW in capacity; in the ATB, cost and performance estimates are made for commercial-scale projects 600 MW in capacity. The ATB Base Year offshore wind plant technology reflects a machine rating of 3.4 MW with a rotor diameter of 115 m and hub height of 85 m, which is typical of European projects installed in 2015-2016.

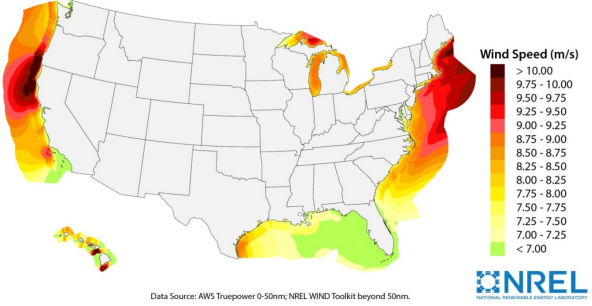

Resource Potential

Wind resource is prevalent throughout major U.S. coastal areas, including the Great Lakes. The resource potential exceeds 2,000 GW (Musial et al. (2016)), excluding Alaska. Prior estimates of offshore wind resource potential (Schwartz et al. (2010)) were updated in 2016 to extend domain boundaries from 50 nautical miles (nm) to 200 nm, consider turbine hub heights of 100 m (previously 90 m), and assume a capacity array power density of 3 MW/km2 (Musial et al. (2016)). A range of technology exclusions were applied based on maximum water depth for deployment, minimum wind speed, and limits to floating technology in freshwater surface ice. Resource potential was represented by over 7,000 areas for offshore wind plant deployment after accounting for competing use and environmental exclusions, such as marine protected areas, shipping lanes, pipelines, and others.

Source: Musial et al. 2016

Renewable energy technical potential, as defined by Lopez et al. 2012, represents the achievable energy generation of a particular technology given system performance, topographic limitations, and environmental and land-use constraints. The primary benefit of assessing technical potential is that it establishes an upper-boundary estimate of development potential. It is important to understand that there are multiple types of potential-resource, technical, economic, and market (Lopez at al. 2012; NREL, "Renewable Energy Technical Potential").

Base Year and Future Year Projections Overview

Based on the Musial et al. (2016) resource assessment, LCOE was estimated at more than 7,000 areas (with a total capacity of approximately 2,000 GW) in Beiter et al. (2016), taking into consideration a variety of spatial parameters, such as wind speeds, water depth, distance from shore, distance to ports, and wave height. CAPEX, O&M, and capacity factor are calculated for each geographic location using engineering models, hourly wind resource profiles, and representative sea states. The spatial LCOE assessment served as the basis for estimating the ATB baseline LCOE in the Base Year 2016, weighted by the available capacity, for fixed-bottom and floating offshore wind technology.

The Base Year LCOE assumes a 3.4-MW turbine size and long-term average hourly wind profiles and it reflects the least-cost choice among three substructure types (Beiter et al. (2016)):

- Monopile (fixed-bottom)

- Jacket (fixed-bottom)

- Semi-submersible (floating).

The representative offshore wind plant size is assumed to be 600 MW (Beiter et al. (2016)). For illustration in the ATB, the full resource potential, represented by 7,000 areas, was divided into 15 techno-resource groups (TRGs), of which TRGs 1-5 are representative of fixed-bottom wind technology and TRGs 6-15 are representative of floating offshore wind technology. The capacity-weighted average CAPEX, O&M, and capacity factor for each group is presented in the ATB.

Future year projections are derived from estimated cost reduction potential for offshore wind technologies based partially on elicitation of over 160 wind industry experts (Wiser et al. (2016)). Estimates for 2016-2050 were adjusted from the 2016 ATB for inflation (2015$ to $2016$). The specific scenarios are:

- Constant Technology Cost Scenario: no change in CAPEX, O&M, or capacity factor from 2015 to 2050; consistent across all renewable energy technologies in the ATB

- Mid Technology Cost Scenario: LCOE percentage reduction from the Base Year equivalent to that corresponding to the Median Scenario (50% probability) in expert survey (Wiser et al. (2016))

- Low Technology Cost Scenario: LCOE percentage reduction from the Base Year equivalent to that corresponding to the Low scenario (10% probability) in the expert survey (Wiser et al. (2016)).

CAPital EXpenditures (CAPEX): Historical Trends, Current Estimates, and Future Projections

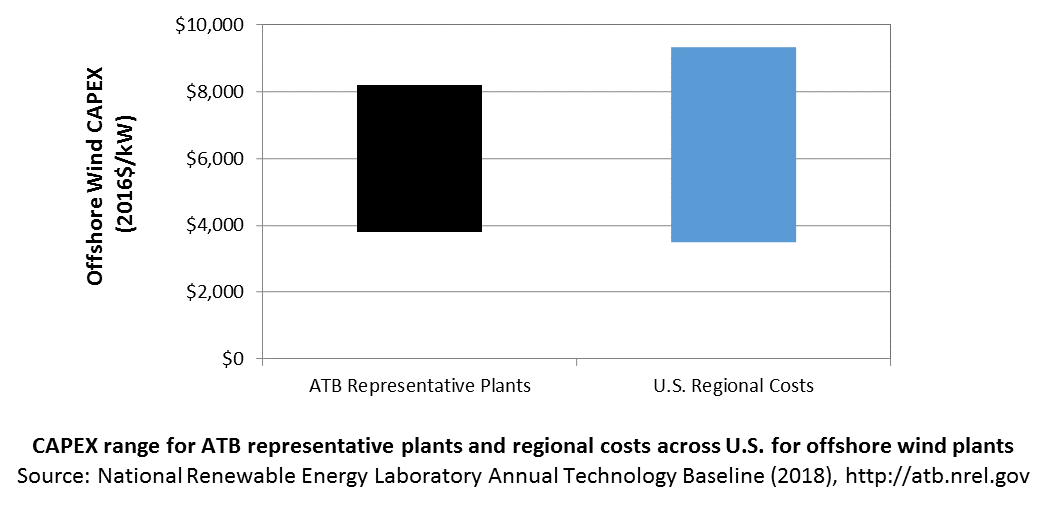

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year. These expenditures include the wind turbine, the balance of system (e.g., site preparation, installation, and electrical infrastructure), and financial costs (e.g., development costs, onsite electrical equipment, and interest during construction) and are detailed in CAPEX Definition. In the ATB, CAPEX reflects typical plants and does not include differences in regional costs associated with labor, materials, taxes, or system requirements. The related Standard Scenarios product uses regional CAPEX adjustments. The range of CAPEX demonstrates variation with wind resource in the contiguous United States.

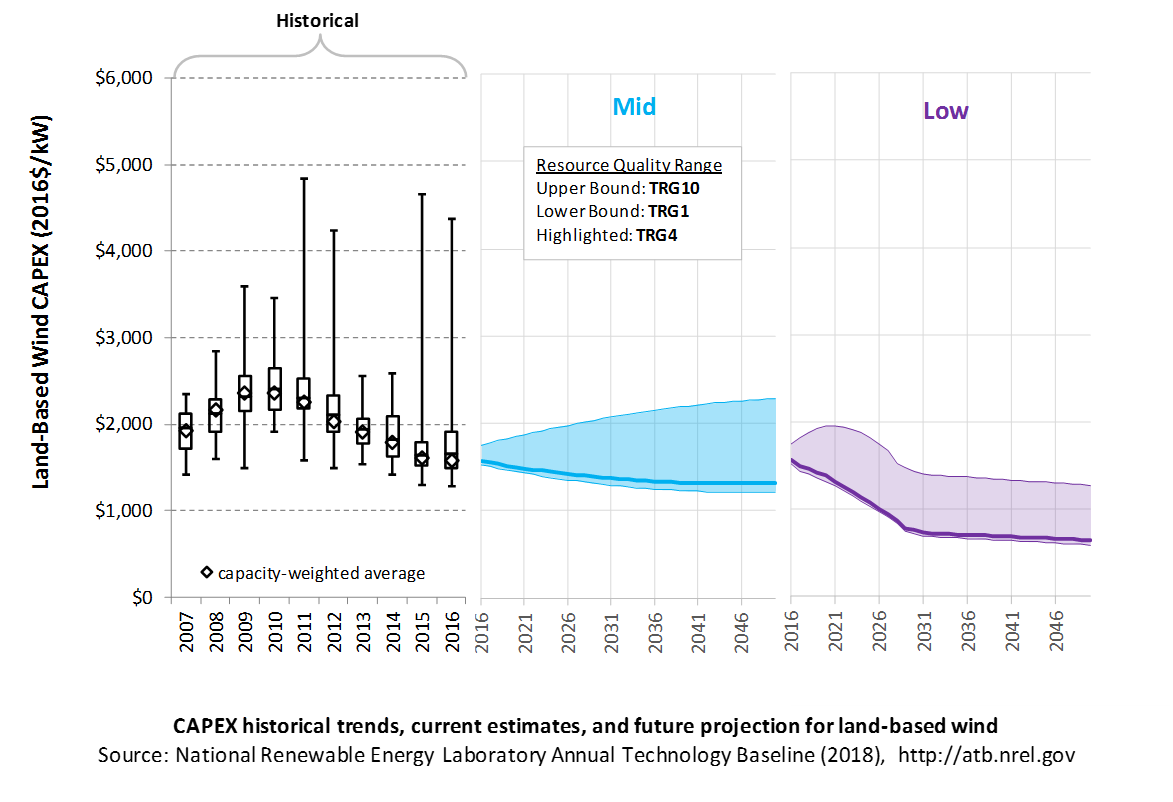

The following figure shows the Base Year estimate and future year projections for CAPEX costs. Three cost scenarios are represented: Constant, Mid, and Low technology cost cases. Historical data from land-based wind plants installed in the United States are shown for comparison to the ATB Base Year estimates. The estimate for a given year represents CAPEX of a new plant that reaches commercial operation in that year.

CAPEX estimates for 2016 correspond well with market data for plants installed in 2016. Projections reflect a continuation of the downward trend observed in the recent past and are anticipated to continue based on preliminary data for 2017 projects.

In the lower wind resource areas represented by TRGs 6-10, CAPEX is expected to grow as future wind turbine technology transitions to new platforms, including taller towers, larger rotors, and higher machine ratings. In the higher wind resource areas represented by TRGs 1-5, optimization of current wind turbine platforms will lead to lower CAPEX in future years.

Recent Trends

Actual land-based wind plant CAPEX (Wiser and Bolinger (2017)) is shown in box-and-whiskers format for comparison to the ATB current CAPEX estimates and future projections. provide statistical representation of CAPEX for about 65% of wind plants installed in the United States since 2007. CAPEX estimates should tend toward the low end of observed cost because no regional impacts or spur line costs are included. These effects are represented in the market data.

Base Year Estimates

For illustration in the ATB, all potential land-based wind plant areas were represented in 10 TRGs. These were defined by resource potential (GW) and have higher resolution on the highest-quality TRGs, as these are the most likely sites to be deployed, based on their economics.

TRG 1 represents the best 100 GW of wind, as determined by LCOE. TRG 2 represents the next best 200 GW, while TRG 3 represents the next best 400 GW, and TRG 4 represents the next best 800 GW. TRGs 5-9 all represent 1,600 GW of resource potential. TRG 10 represents the remaining 1,148 GW of available potential. This representation is based on the approach described in DOE (2015) and implemented with 2015 market data in Moné et al. (2017).

The following table summarizes the annual average wind speed range for each TRG, capacity-weighted average wind speed, cost and performance parameters for each TRG, and resource potential in terms of capacity and energy for each TRG. Typical land-based wind installations in 2015 and 2016 are associated with TRG4.

TRG Definitions for Land-Based Wind

| Techno-Resource Group (TRG) | Wind Speed Range (m/s) | Weighted Average Wind Speed (m/s) | Weighted Average CAPEX ($/kW) | Weighted Average OPEX ($/kW-yr) | Weighted Average Net CF (%) | Potential Wind Plant Capacity (GW) | Potential Wind Plant Energy (TWh) |

|---|---|---|---|---|---|---|---|

| TRG1 | 8.2-13.5 | 8.7 | 1,573 | 51 | 47.4% | 100 | 414 |

| TRG2 | 8.0-10.9 | 8.4 | 1,592 | 51 | 46.2% | 200 | 810 |

| TRG3 | 7.7-11.1 | 8.2 | 1,599 | 51 | 45.0% | 400 | 1,576 |

| TRG4 | 7.5-13.1 | 7.9 | 1,605 | 51 | 43.5% | 800 | 3,050 |

| TRG5 | 6.9-11.1 | 7.5 | 1,616 | 51 | 40.7% | 1,600 | 5,708 |

| TRG6 | 6.1-9.4 | 6.9 | 1,642 | 51 | 36.4% | 1,600 | 5,098 |

| TRG7 | 5.4-8.3 | 6.2 | 1,678 | 51 | 30.8% | 1,600 | 4,320 |

| TRG8 | 4.7-6.9 | 5.5 | 1,708 | 51 | 24.6% | 1,600 | 3,443 |

| TRG9 | 4.0-6.0 | 4.8 | 1,713 | 51 | 18.3% | 1,600 | 2,558 |

| TRG10 | 1.0-5.3 | 4.0 | 1,713 | 51 | 11.1% | 1,148 | 1,116 |

| Total | 10,648 | 28,092 | |||||

Future Year Projections

Mid: Projections of future LCOE were derived from a survey of wind industry experts (Wiser et al. (2016)) for scenarios that are associated with a 50% probability level in 2030 and 2050. Projections of future land-based wind plant CAPEX were determined based on adjustments to CAPEX, fixed O&M (FOM), and capacity factor in each year to result in a predetermined LCOE value derived from Wiser et al. (2016).

In order to achieve the overall LCOE reduction associated with the median and low projections from the expert survey, CAPEX was used to accommodate all improvement aspects other than O&M and capacity factor survey results. In the lower wind resource areas represented by TRGs 6-10, CAPEX is expected to grow as future wind turbine technology transitions to new platforms, including taller towers, larger rotors, and higher machine ratings. In the higher wind resource areas represented by TRGs 1-5, optimization of current wind turbine platforms will lead to lower CAPEX.

Low: Projections of future LCOE for the Low cost scenario were derived from an accelerated development pathway that included incremental improvements to technology through scaling and learning as well as innovation enabled by the DOE's Atmosphere to Electrons research program and anticipated scientific advances (Dykes et al. (2017)). The reductions in turbine and balance-of-system CAPEX were estimated by a survey of wind industry experts (Wiser et al. (2016)) focusing on detailed line item cost reduction potential. The results of the survey show a reduction in turbine and balance-of-system CAPEX by 2030 through turbine scaling with less material use and use of more efficient manufacturing processes. The accelerated decline in CAPEX is expected for all TRGs through 2030 except TRGs 9 and 10, where CAPEX is expected to slightly increase in the near term and then begin to decline at the same rate as the remaining TRGs. After 2030, the rate of CAPEX reduction is expected to continue but at a slower rate. As stated in Dykes et al. (2017), the wind turbine industry is expected to continue trends in scaling seen over the past several decades while learning processes will keep the per-unit power costs of these turbines at or below current levels. In addition, the turbine size increases will lead to economies of scale for the wind power plant through reductions in plant infrastructure and erection costs while science-enabled R&D pathways in turbine design will push materials and manufacturing costs of per-unit power to levels lower than those observed today.

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

CAPEX Definition

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year.

Based on EIA (2013), Moné et al. (2015), and Beiter et al. (2016), the System Cost Breakdown Structure of the ATB for the wind plant envelope is defined to include:

- Wind turbine supply

- Balance of system (BOS)

- Turbine installation, substructure supply and installation

- Site preparation, port and staging area support for delivery, storage, handling, and installation of underground utilities

- Electrical infrastructure, such as transformers, switchgear, and electrical system connecting turbines to each other (array cable system costs) and to the cable landfall (export cable system costs)

- Development and project management

- Financial costs

- Owners' costs, such as development costs, preliminary feasibility and engineering studies, environmental studies and permitting, legal fees, insurance costs, and property taxes during construction

- Interest during construction estimated based on three-year duration accumulated 40%/40%/20% at half-year intervals and an 8% interest rate (ConFinFactor).

CAPEX can be determined for a plant in a specific geographic location as follows:

Regional cost variations are not included in the ATB (CapRegMult = 1). In the ATB, the input value is overnight capital cost (OCC) and details to calculate interest during construction (ConFinFactor). Because transmission infrastructure between an offshore wind plant and the point at which a grid connection is made onshore is a significant component of the offshore wind plant cost, an offshore spur line cost (OffSpurCost) for each TRG is included in the CAPEX estimate. The offshore spur line cost reflects a capacity-weighted average of all potential wind plant areas within a TRG, similar to OCC.

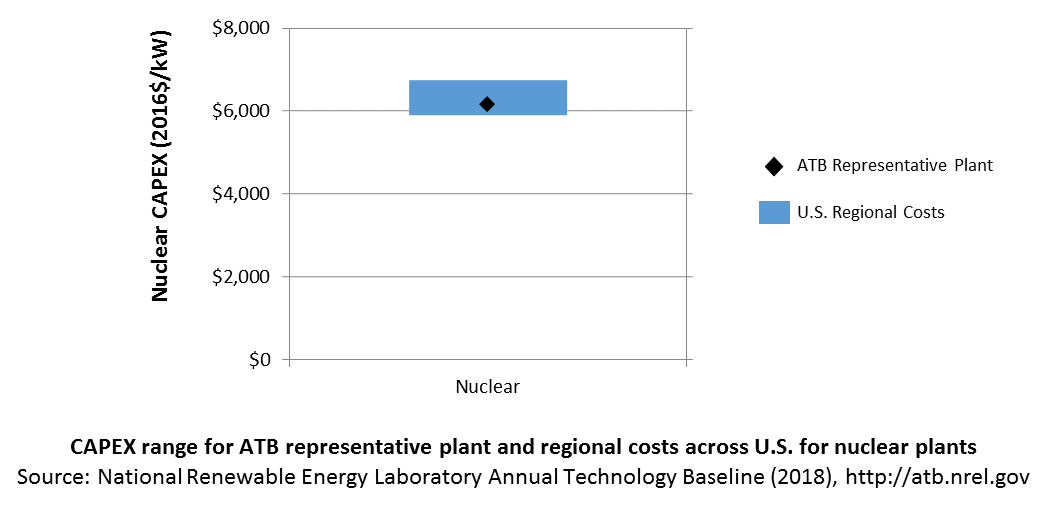

In the ATB, CAPEX represents the capacity-weighted average values of all potential wind plant areas within a TRG and varies with water depth and distance from shore. Regional cost effects associated with labor rates, material costs, and other regional effects as defined by DOE 2015 expand the range of CAPEX. Unique land-based spur line costs for each of the 7,000 areas based on distance and transmission line costs expand the range of CAPEX even further. The following figure illustrates the ATB representative plants relative to the range of CAPEX including regional costs across the contiguous United States. The ATB representative plants are associated with a regional multiplier of 1.0.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

CAPEX in the ATB does not represent regional variants (CapRegMult) associated with labor rates, material costs, etc., but the ReEDS model does include 134 regional multipliers (EIA (2013)).

The ReEDS model determines offshore spur line and land-based spur line (GCC) uniquely for each of the 7,000 areas based on distance and transmission line cost.

Natural Gas Internal Combustion Engine Vehicle

Operations and maintenance (O&M) costs represent the annual fixed expenditures required to operate and maintain a wind plant over its lifetime of 30 years, including:

- Insurance, taxes, land lease payments and other fixed costs (e.g., project management and administration, weather forecasting, and condition monitoring)

- Present value and annualized large component replacement costs over technical life (e.g., blades, gearboxes, and generators)

- Scheduled and unscheduled maintenance of wind plant components, including turbines and transformers, over the technical lifetime of the plant.

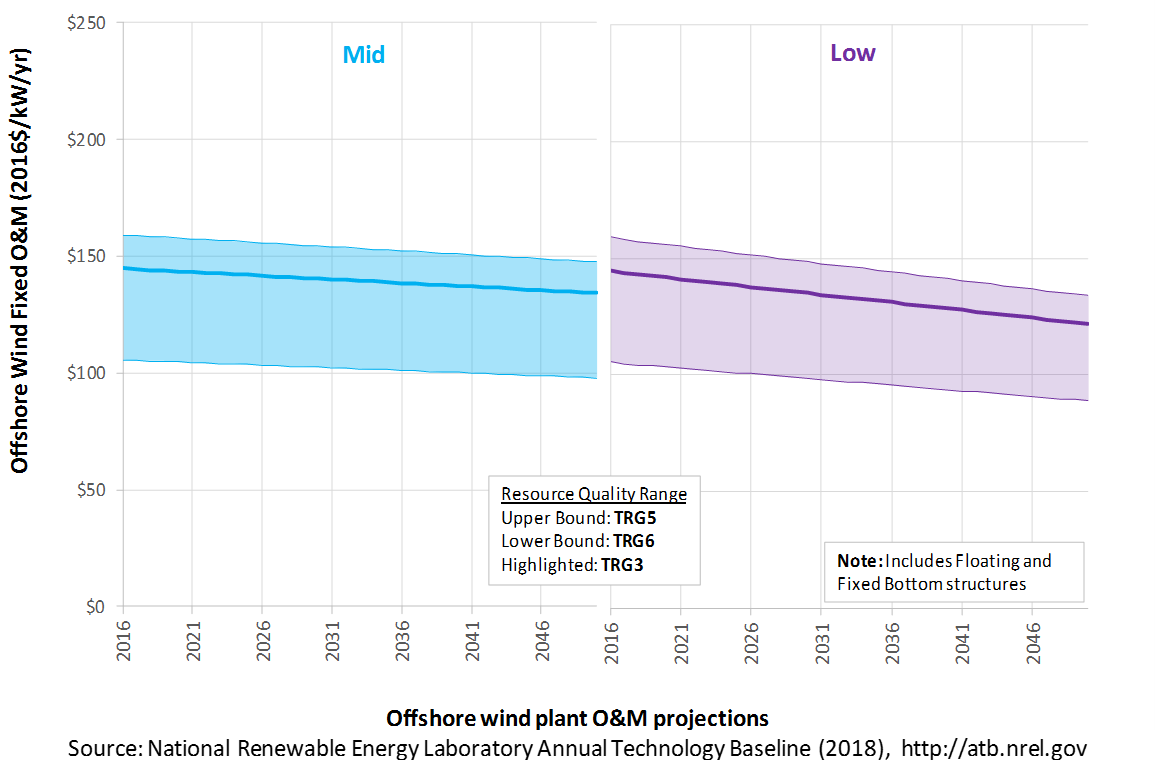

The following figure shows the Base Year estimate and future year projections for fixed O&M (FOM) costs. Three cost scenarios are represented. The estimate for a given year represents annual average FOM costs expected over the technical lifetime of a new plant that reaches commercial operation in that year. The range of Base Year O&M estimates reflects distance from shore and metocean conditions.

Base Year Estimates

FOM costs vary by distance from shore and metocean conditions. As a result, O&M costs vary from $106/kW-year (TRG 6) to $159/kW-year (TRG 5) in 2016. The capacity-weighted average in the ATB for fixed-bottom offshore technology (TRGs 1-5) is $148/kW-year; the corresponding value for floating offshore wind technology (TRGs 6-15) is $127/kW-year.

Future Year Projections

Future fixed-bottom offshore wind technology O&M is assumed to decline 7% by 2050 in the Mid cost case and 16% in the Low cost wind case, based on the expert survey conducted by Wiser et al. (2016).

Future floating offshore wind technology O&M is assumed to decline 7% by 2050 in the Mid cost case and 16% in the Low cost wind case, based on the expert survey conducted by Wiser et al. (2016).

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

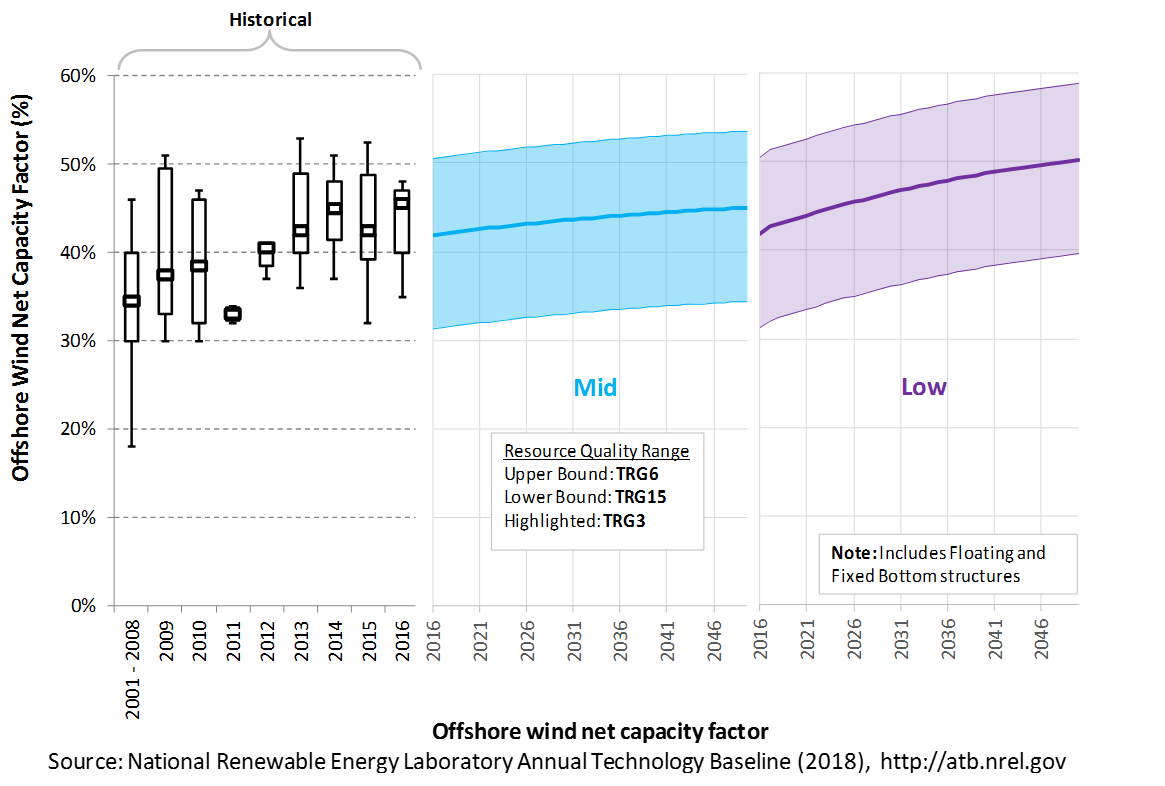

Capacity Factor: Expected Annual Average Energy Production Over Lifetime

The capacity factor represents the expected annual average energy production divided by the annual energy production, assuming the plant operates at rated capacity for every hour of the year. It is intended to represent a long-term average over the lifetime of the plant. It does not represent interannual variation in energy production. Future year estimates represent the estimated annual average capacity factor over the technical lifetime of a new plant installed in a given year.

The capacity factor is influenced by the rotor swept area/generator capacity, hub height, hourly wind profile, expected downtime, and energy losses within the wind plant. It is referenced to 100-m above-water-surface, long-term average hourly wind resource data from Musial et al. (2016).

The following figure shows a range of capacity factors based on variation in the wind resource, water depth, and distance from shore for offshore wind plants in the contiguous United States. Pre-construction estimates for offshore wind plants operating globally in 2015, according to the year in which plants were installed, is shown for comparison to the ATB Base Year estimates. The range of Base Year estimates illustrate the effect of locating an offshore wind plant in a variety of wind resource, water depth, and distance from shore conditions (TRGs 1-5 are fixed-bottom offshore wind plants and TRGs 6-15 are floating offshore wind plants). Future projections are shown for Constant, Mid, and Low technology cost scenarios.

Recent Trends

Pre-construction annual energy estimates from 93% of global operating wind capacity in 2016 (NREL's internal offshore wind database) is shown in a box-and-whiskers format for comparison with the ATB current estimates and future projections. The historical data illustrate pre-construction estimated capacity factors for projects by year of commercial online date. The range of capacity factors defined by the ATB TRGs compared well with the estimated capacity factors for projects installed in 2015.

Base Year Estimates

The capacity factor is determined using a representative power curve for a generic NREL-modeled offshore wind turbine (Beiter et al. (2016)) and includes geospatial estimates of gross capacity factors for the entire resource area (Musial et al. (2016)). The net capacity factor considers spatial variation in wake losses, electrical losses, turbine availability, and other system losses. For illustration in the ATB, all 7,000 wind plant areas are represented in 15 TRGs.

TRG Definitions for Offshore Wind

| TRG | LCOE Range ($/MWh) | Wind Speed Range (m/s) | Weighted Average Wind Speed (m/s) | Weighted Water Depth (m) | Weighted Distance Site to Cable Landfall (km) | Weighted Average CAPEX ($/kW) | Weighted Average OPEX ($/kW/yr) | Weighted Average Net CF (%) | Potential Wind Plant Capacity (GW) | Potential Wind Plant Energy (TWh) |

|---|---|---|---|---|---|---|---|---|---|---|

| Fixed-Bottom | ||||||||||

| TRG 1 | LCOE <= 141 | 8.5–9.0 | 8.6 | 13 | 6 | 3,800 | 137 | 45% | 12 | 49 |

| TRG 2 | LCOE <= 149 | 8.0–8.5 | 8.4 | 16 | 9 | 3,890 | 143 | 43% | 25 | 94 |

| TRG 3 | LCOE <= 157 | 8.0–8.5 | 8.3 | 19 | 15 | 4,027 | 145 | 42% | 50 | 182 |

| TRG 4 | LCOE <= 192 | 8.0–8.5 | 8.3 | 26 | 36 | 4,556 | 152 | 40% | 320 | 1,131 |

| TRG 5 | LCOE <= 306 | 7.5–8.0 | 7.9 | 36 | 72 | 5,333 | 159 | 37% | 320 | 1,023 |

| Floating | ||||||||||

| TRG 6 | LCOE <= 166 | 9.5–10 | 9.7 | 130 | 24 | 5,961 | 105 | 51% | 12 | 55 |

| TRG 7 | LCOE <= 175 | 9.5–10 | 9.7 | 145 | 40 | 6,217 | 108 | 50% | 25 | 108 |

| TRG 8 | LCOE <= 188 | 9.5–10 | 9.5 | 139 | 50 | 6,337 | 111 | 48% | 50 | 212 |

| TRG 9 | LCOE <= 206 | 9.0–9.5 | 9.4 | 136 | 70 | 6,687 | 122 | 47% | 100 | 414 |

| TRG 10 | LCOE <= 229 | 9.0–9.5 | 9.1 | 140 | 94 | 6,931 | 129 | 45% | 200 | 781 |

| TRG 11 | LCOE <= 252 | 8.5–9.0 | 8.7 | 323 | 118 | 7,211 | 134 | 42% | 200 | 727 |

| TRG 12 | LCOE <= 274 | 8.0–8.5 | 8.1 | 404 | 123 | 7,224 | 135 | 37% | 200 | 651 |

| TRG 13 | LCOE <= 299 | 7.5–8.0 | 7.8 | 474 | 138 | 7,411 | 136 | 35% | 200 | 615 |

| TRG 14 | LCOE <= 341 | 7.0–7.5 | 7.4 | 615 | 130 | 7,606 | 131 | 32% | 200 | 566 |

| TRG 15 | LCOE <= 438 | 7.5–8.0 | 7.5 | 797 | 199 | 8,204 | 138 | 31% | 143 | 390 |

| Total | 2,058 | 6,997 | ||||||||

Future Year Projections

Projections of capacity factors for plants installed in future years were determined based on estimates obtained through an expert survey conducted by Wiser et al. (2016) for both fixed-bottom and floating offshore wind technologies. Projections for capacity factors implicitly reflect technology innovations such as larger rotors and taller towers that will increase energy capture at the same geographic location without explicitly specifying tower height and rotor diameter changes.

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

The ReEDS model output capacity factors for offshore wind can be lower than input capacity factors due to endogenously estimated curtailments determined by scenario constraints.

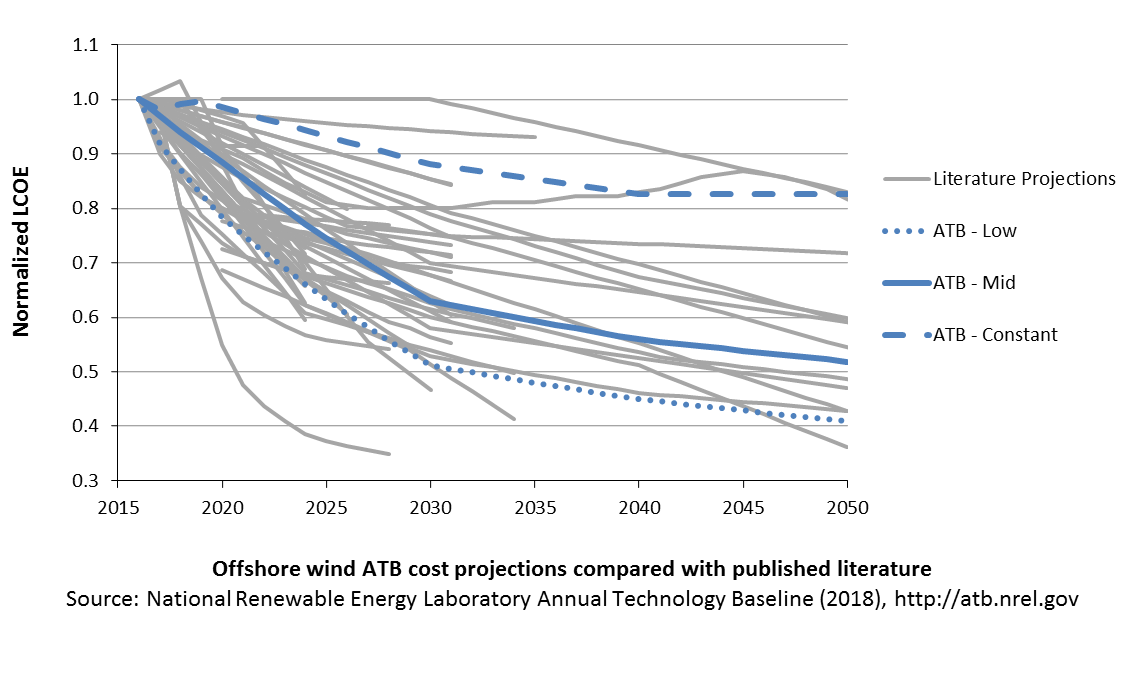

Plant Cost and Performance Projections Methodology

ATB projections were derived from the results of a survey of 163 of the world's wind energy experts Wiser et al. (2016). The survey was conducted to gain insight into the possible future cost reductions, the source of those reductions, and the conditions needed to enable continued innovation and lower costs (Wiser et al. (2016)). The expert survey produced three cost reduction scenarios associated with probability levels of 10%, 50%, and 90% of achieving LCOE reductions by 2030 and 2050. In addition, the scenario results include estimated changes to CAPEX, O&M, capacity factor, project life, and weighted average cost of capital (WACC) by 2030.

For the ATB, three different technology cost scenarios were adapted from the expert survey results for scenario modeling as bounding levels:

- Constant Technology Cost Scenario: no change in CAPEX, O&M, or capacity factor from 2015 to 2050; consistent across all renewable energy technologies in the ATB

- Mid Technology Cost Scenario: LCOE percentage reduction from the Base Year equivalent to that corresponding to the Median Scenario (50% probability) in the expert survey (Wiser et al. (2016))

- Low Technology Cost Scenario: LCOE percentage reduction from the Base Year equivalent to that corresponding to the Low scenario (10% probability) in the expert survey (Wiser et al. (2016)).

Expert survey estimates were normalized to the ATB Base Year starting point in order to focus on projected cost reduction instead of absolute reported costs. The percentage reduction in LCOE by 2020, 2030, and 2050 from the expert survey's Median and Low scenarios are implemented as the ATB Mid and Low cost scenarios. This is accomplished by utilizing survey estimates for changes to capacity factor and O&M costs by 2030 and 2050. The corresponding CAPEX value to achieve the overall LCOE reduction is computed. The percentage reduction in LCOE by 2030 and by 2050 was applied equally across all TRGs. The overall reduction in LCOE by 2050 for the Mid cost scenario is 39% and for the Low cost scenario is 51%.

A broad sample of cost of offshore wind energy projections provides context for the ATB Constant, Mid, and Low technology cost projections. Based on a TRG4 resource classification,[1] the ATB Mid cost projection, which corresponds to the median scenario from the Wiser et al. (2016) expert survey, results in LCOE reductions that are fairly aligned with the median scenarios of external studies (BNEF (2017c); IRENA (2016b); Catapult (2016); Lazard (2017)). EIA (2017b) estimates higher cost levels in the period 2022-2041, while BNEF (2018) estimates lower cost levels for the U.S by the mid-2020s. These external studies were reviewed to validate the baseline estimates and projections derived for the ATB. Generally, while some published studies as well as recent tender awards for European projects to be installed by the mid-2020s suggest significant near-term cost reduction (see e.g., Musial et al. (2017)), it is likely that the United States will lag due to a different development stage of the U.S. supply chain and port infrastructure.

The relative costs of mid-depth water plants and deep water, or floating, offshore wind plants are maintained constant throughout the scenarios for simplicity. Some hypothesize that unique aspects of floating technologies, such as the ability to assemble and commission turbines at the port, could reduce the cost of floating technologies relative to fixed-bottom technologies.

Levelized Cost of Energy (LCOE) Projections

Levelized cost of energy (LCOE) is a simple metric that combines the primary technology cost and performance parameters: CAPEX, O&M, and capacity factor. It is included in the ATB for illustrative purposes. The ATB focuses on defining the primary cost and performance parameters for use in electric sector modeling or other analysis where more sophisticated comparisons among technologies are made. The LCOE accounts for the energy component of electric system planning and operation. The LCOE uses an annual average capacity factor when spreading costs over the anticipated energy generation. This annual capacity factor ignores specific operating behavior such as ramping, start-up, and shutdown that could be relevant for more detailed evaluations of generator cost and value. Electricity generation technologies have different capabilities to provide such services. For example, wind and PV are primarily energy service providers, while the other electricity generation technologies provide capacity and flexibility services in addition to energy. These capacity and flexibility services are difficult to value and depend strongly on the system in which a new generation plant is introduced. These services are represented in electric sector models such as the ReEDS model and corresponding analysis results such as the Standard Scenarios.

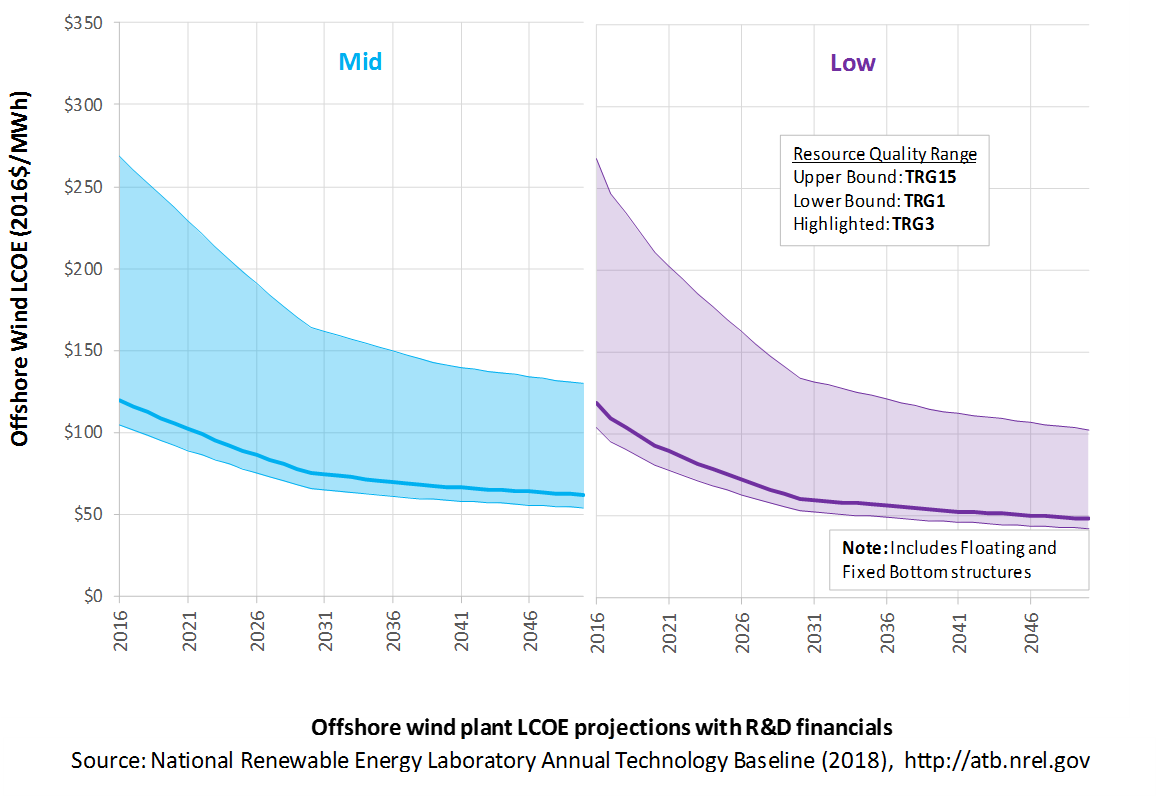

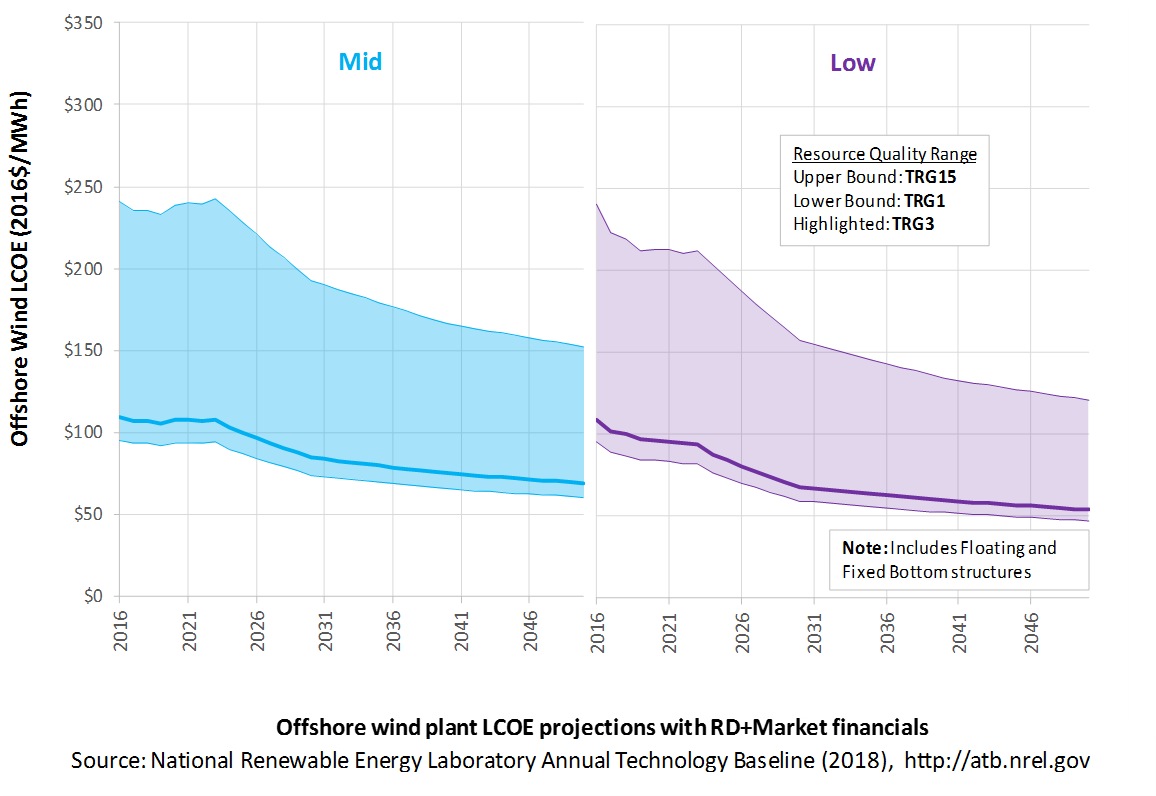

The following three figures illustrate LCOE, which includes the combined impact of CAPEX, O&M, and capacity factor projections for off-shore wind across the range of resources present in the contiguous United States. For the purposes of the ATB, the costs associated with technology and project risk in the U.S. market are represented in the financing costs, not in the upfront capital costs (e.g. developer fees, contingencies). An individual technology may receive more favorable financing terms outside of the U.S., due to less technology and project risk, caused by more project development experience (e.g. offshore wind in Europe), or more government or market guarantees. The R&D Only LCOE sensitivity cases present the range of LCOE based on financial conditions that are held constant over time unless R&D affects them, and they reflect different levels of technology risk. This case excludes effects of tax reform, tax credits, technology-specific tariffs, and changing interest rates over time. The R&D + Market LCOE case adds to these the financial assumptions (1) the changes over time consistent with projections in the Annual Energy Outlook and (2) the effects of tax reform, tax credits, and tariffs. The ATB representative plant characteristics that best align with those of recently installed or anticipated near-term land-based wind plants are associated with TRG 4. Data for all the resource categories can be found in the ATB data spreadsheet.

R&D Only | R&D + Market

The methodology for representing the CAPEX, O&M, and capacity factor assumptions behind each pathway is discussed in Projections Methodology. In general, the degree of adoption of technology innovation distinguishes the Constant, Mid, and Low technology cost scenarios. These projections represent trends that reduce CAPEX and improve performance. Development of these scenarios involves technology-specific application of the following general definitions:

- Constant Technology = Base Year (or near-term estimates of projects under construction) equivalent through 2050 maintains current relative technology cost differences

- Mid Technology Cost Scenario = technology advances through continued industry growth, public and private R&D investments, and market conditions relative to current levels that may be characterized as "likely" or "not surprising"

- Low Technology Cost Scenario = Technology advances that may occur with breakthroughs, increased public and private R&D investments, and/or other market conditions that lead to cost and performance levels that may be characterized as the " limit of surprise" but not necessarily the absolute low bound.

- To estimate LCOE, assumptions about the cost of capital to finance electricity generation projects are required, and the LCOE calculations are sensitive to these financial assumptions. Three project finance structures are used within the ATB:

- R&D Only Financial Assumptions: This sensitivity case allows technology-specific changes to debt interest rates, return on equity rates, and debt fraction to reflect effects of R&D on technological risk perception, but it holds background rates constant at 2016 values from AEO 2018 and excludes effects of tax reform, tax credits, and tariffs.

- R&D Only + Market Financial Assumptions: This sensitivity case retains the technology-specific changes to debt interest, return on equity rates, and debt fraction from the R&D Only case and adds in the variation over time consistent with AEO 2018, as well as effects of tax reform, tax credits, and technology-specific tariffs. For a detailed discussion of these assumptions, see Changes from 2017 ATB to 2018 ATB.

- ReEDS Financial Assumptions: ReEDS uses the R&D Only + Market Financial Assumptions for the "Mid" technology cost scenario.

- A constant cost recovery period -over which the initial capital investment is recovered-is assumed for all technologies throughout this website, and can be varied in the ATB data spreadsheet.

- The equations and variables used to estimate LCOE are defined on the equations and variables page. For illustration of the impact of changing financial structures such as WACC, see Project Finance Impact on LCOE. For LCOE estimates for the Constant, Mid, and Low technology cost scenarios for all technologies, see 2018 ATB Cost and Performance Summary.

- In general, differences among the technology cost cases reflect different levels of adoption of innovations. Reductions in technology costs reflect the cost reduction opportunities that are listed below.

- Continued turbine scaling to larger-megawatt turbines with larger rotors such that swept area/megawatt capacity decreases resulting in higher capacity factors for a given location

- Greater market competition in the production of primary components (e.g., turbines, support structure), and installation services

- Economy-of-scale and productivity improvements in manufacturing, including mass production of substructure component and optimized installation strategies

- Improved plant siting and operation to reduce plant-level energy losses, resulting in higher capacity factors

- More efficient O&M procedures combined with more reliable components to reduce annual average FOM costs

- Adoption of a wide range of innovative control, design, and material concepts that facilitate the high-level trends described above.

Utility-Scale PV

Representative Technology

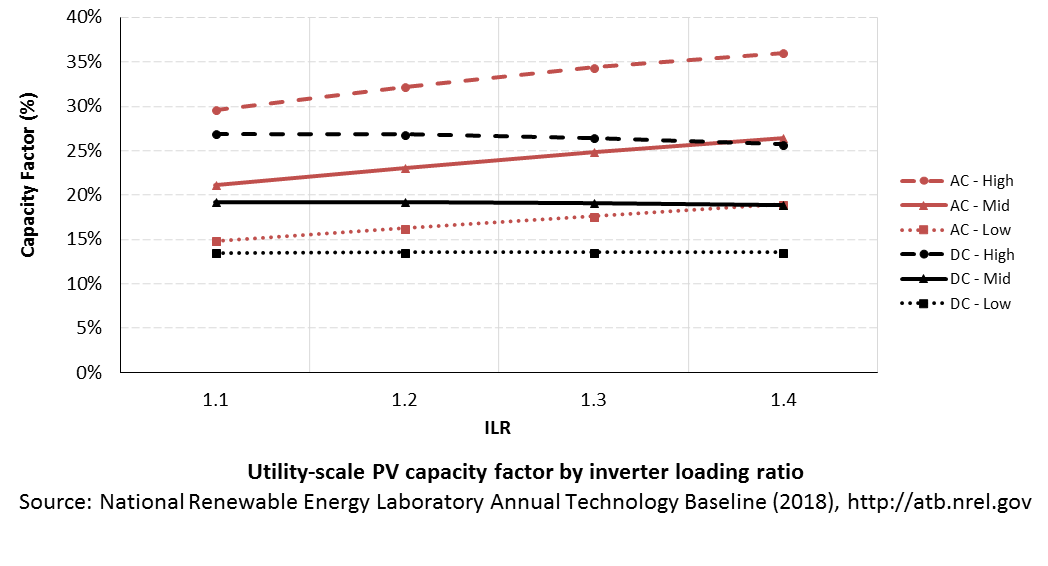

Utility-scale PV systems in the ATB are representative of one-axis tracking systems with performance and pricing characteristics in line with a 1.3 DC-to-AC ratio-or inverter loading ratio (ILR) (Fu et al. (2017)). PV system performance characteristics in previous ATB versions were designed in the ReEDS model at a time when PV system ILRs were lower than they are in current system designs; performance and pricing in the 2018 ATB incorporates more up-to-date system designs and therefore assumes a higher ILR.

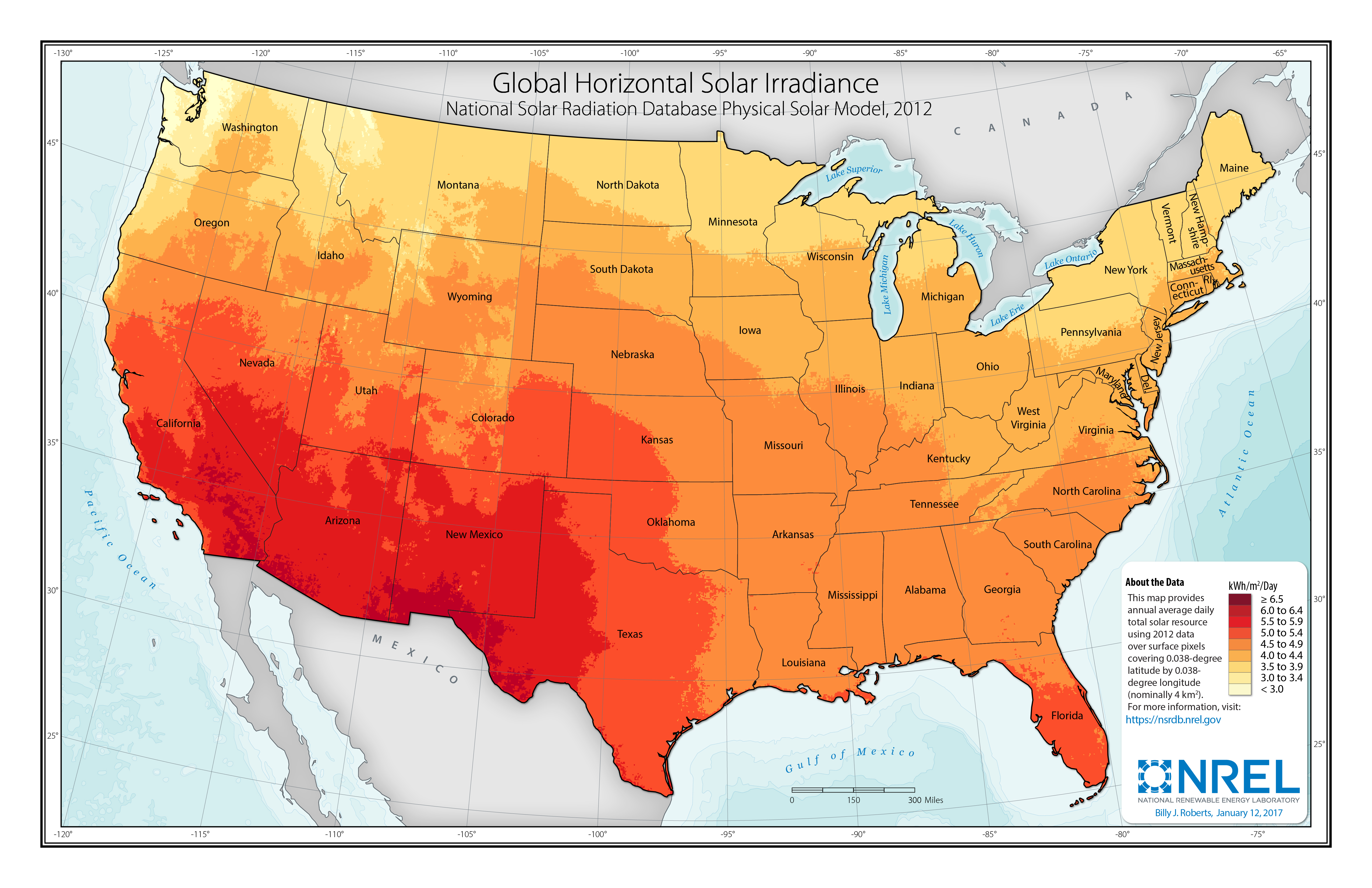

Resource Potential

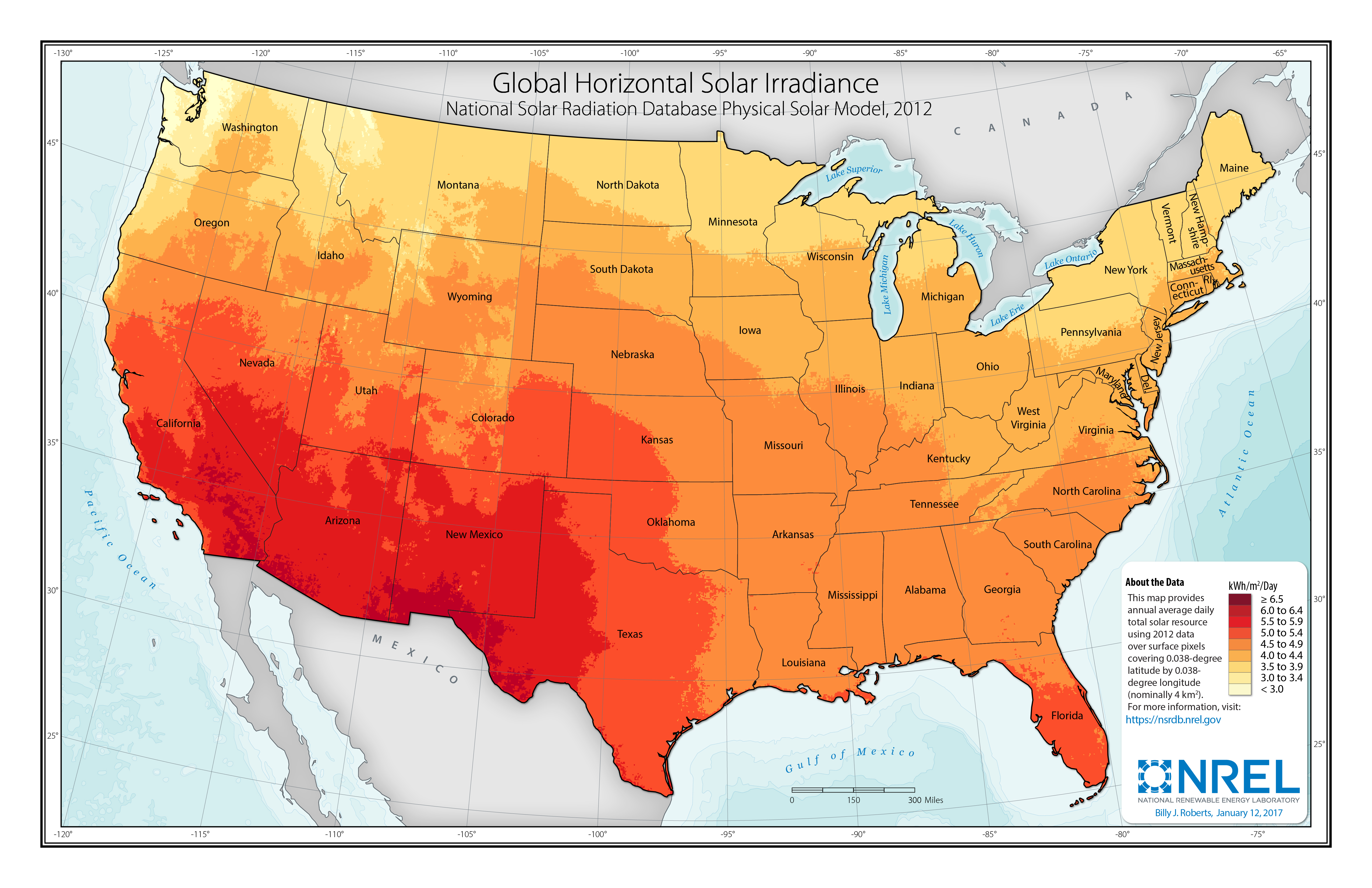

Solar resources across the United States are mostly good to excellent at about 1,000-2,500 kWh/m2/year. The Southwest is at the top of this range, while Alaska and part of Washington are at the low end. The range for the contiguous United States is about 1,350-2,500 kWh/m2/year. Nationwide, solar resource levels vary by about a factor of two.

The total U.S. land area suitable for PV is significant and will not limit PV deployment. One estimate (Denholm and Margolis (2008)) suggests the land area required to supply all end-use electricity in the United States using PV is about 5,500,000 hectares (ha) (13,600,000 acres), which is equivalent to 0.6% of the country's land area or about 22% of the " urban area" footprint (this calculation is based on deployment/land in all 50states).

Renewable energy technical potential, as defined by Lopez et al. 2012, represents the achievable energy generation of a particular technology given system performance, topographic limitations, and environmental and land-use constraints. The primary benefit of assessing technical potential is that it establishes an upper-boundary estimate of development potential. It is important to understand that there are multiple types of potential-resource, technical, economic, and market (Lopez at al. 2012; NREL, "Renewable Energy Technical Potential").

Base Year and Future Year Projections Overview

The Base Year estimates rely on modeled CAPEX and O&M estimates benchmarked with industry and historical data. Capacity factor is estimated based on hours of sunlight at latitude for all geographiclocations in the United States. The ATB presents capacity factor estimates that encompass a range associated with Low, Mid,and Constant technology cost scenarios across the United States.

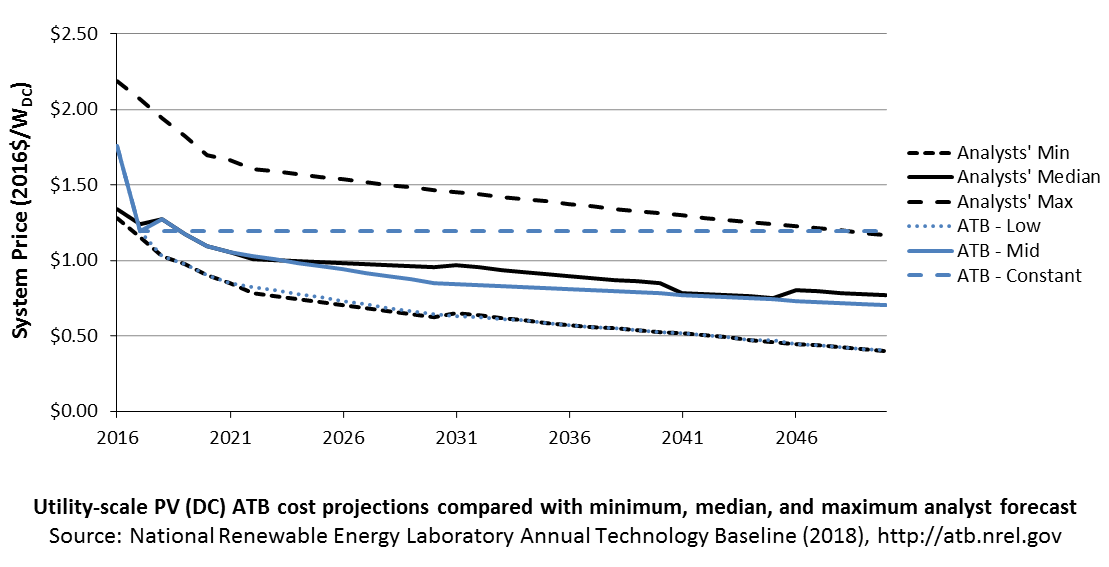

Future year projections are derived from analysis of published projections of PV CAPEX and bottom-up engineering analysis of O&M costs. Three different projections were developed for scenario modeling as bounding levels:

- Constant Technology Cost Scenario: no change in CAPEX, O&M, or capacity factor from 2017 to 2050; consistent across all renewable energy technologies in the ATB

- Mid Technology Cost Scenario: based on the median of literature projections of future CAPEX; O&M technology pathway analysis

- Low Technology Cost Scenario: based on the low bound of literature projections of future CAPEX and O&M technology pathway analysis.

CAPital EXpenditures (CAPEX): Historical Trends, Current Estimates, and Future Projections

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year. These expenditures include the hardware, the balance of system (e.g., site preparation, installation, and electrical infrastructure), and financial costs (e.g., development costs, onsite electrical equipment, and interest during construction) and are detailed in CAPEX Definition. In the ATB, CAPEX reflects typical plants and does not include differences in regional costs associated with labor, materials, taxes, or system requirements. The related Standard Scenarios product uses regional CAPEX adjustments. The range of CAPEX demonstrates variation with resource in the contiguous United States.

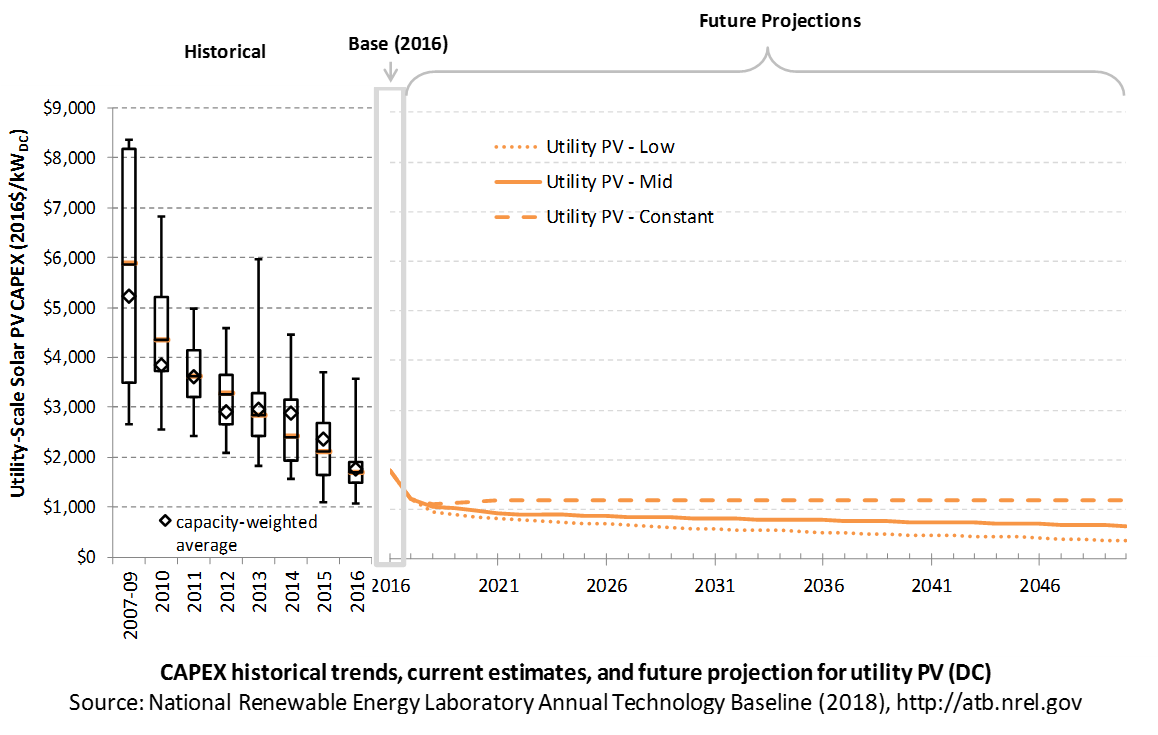

The following figures show the Base Year estimate and future year projections for CAPEX costs in terms of $/kWDC or $/kWAC. Three cost scenarios are represented: Constant, Mid, and Low technology cost. Historical data from utility-scale PV plants installed in the United States are shown for comparison to the ATB Base Year estimates. The estimate for a given year represents CAPEX of a new plant that reaches commercial operation in that year.

The PV industry typically refers to PV CAPEX in terms of $/kWDC based on the aggregated module capacity. The electric utility industry typically refers to PV CAPEX in terms of $/kWAC based on the aggregated inverter capacity. See Solar PV AC-DC Translation for details. The figures illustrate the CAPEX historical trends, current estimates, and future projections in terms of $/kWDC or $/kWAC; current estimates and future projections assume an inverter loading ratio of 1.3 while historical numbers represent reported values.

Recent Trends

Reported historical utility-scale PV plant CAPEX (Bolinger et al. (2017)) is shown in box-and-whiskers format for comparison to the ATB current CAPEX estimates and future projections. Bolinger et al. (2017) provide statistical representation of CAPEX for 88% of all utility-scale PV capacity.

PV pricing and capacities are quoted in kWDC (i.e., module rated capacity) unlike other generation technologies, which are quoted in kWAC. For PV, this would correspond to the combined rated capacity of all inverters. This is done because kWDC is the unit that most of the PV industry uses. Although costs are reported in kWDC, the total CAPEX includes the cost of the inverter, which has a capacity measured in kWAC.

CAPEX estimates for 2016 reflect continued rapid decline supported by analysis of recent power purchase agreement pricing (Bolinger et al. (2017)) for projects that will become operational in 2016 and beyond.

Base Year Estimates

For illustration in the ATB, a representative utility-scale PV plant is shown. Although the PV technologies vary, typical plant costs are represented with a single estimate because the CAPEX does not vary with solar resource.

Although the technology market share may shift over time with new developments, the typical plant cost is represented with the projections above.

A system price of $1.75/WDC in 2016 represents the capacity-weighted average price of a utility-scale PV system installed in 2016 as reported in Bolinger et al. (2017) and adjusted to remove regional cost multipliers based on geographic location of projects installed in 2016. The $1.20/WDC price in 2017 is based on modeled pricing for one-axis tracking systems quoted in Q1 2017 as reported in Fu et al. (2017), adjusted for inflation, and accounting for $0.1/W higher than expected module prices due to tariff concerns in the R&D + Market sensitivity case. These figures are in line with other estimated system prices reported in Feldman et al. (2017).

The Base Year CAPEX estimates should tend toward the low end of reported pricing because no regional impacts, time-lagged system prices, or spur line costs are included. These effects are represented in the historical market data.

For example, in 2014, the reported capacity-weighted average system price was higher than 80% of system prices in 2014 due to very large systems, with multi-year construction schedules, installed in that year. Developers of these large systems negotiated contracts and installed portions of their systems when module and other costs were higher.

Future Year Projections

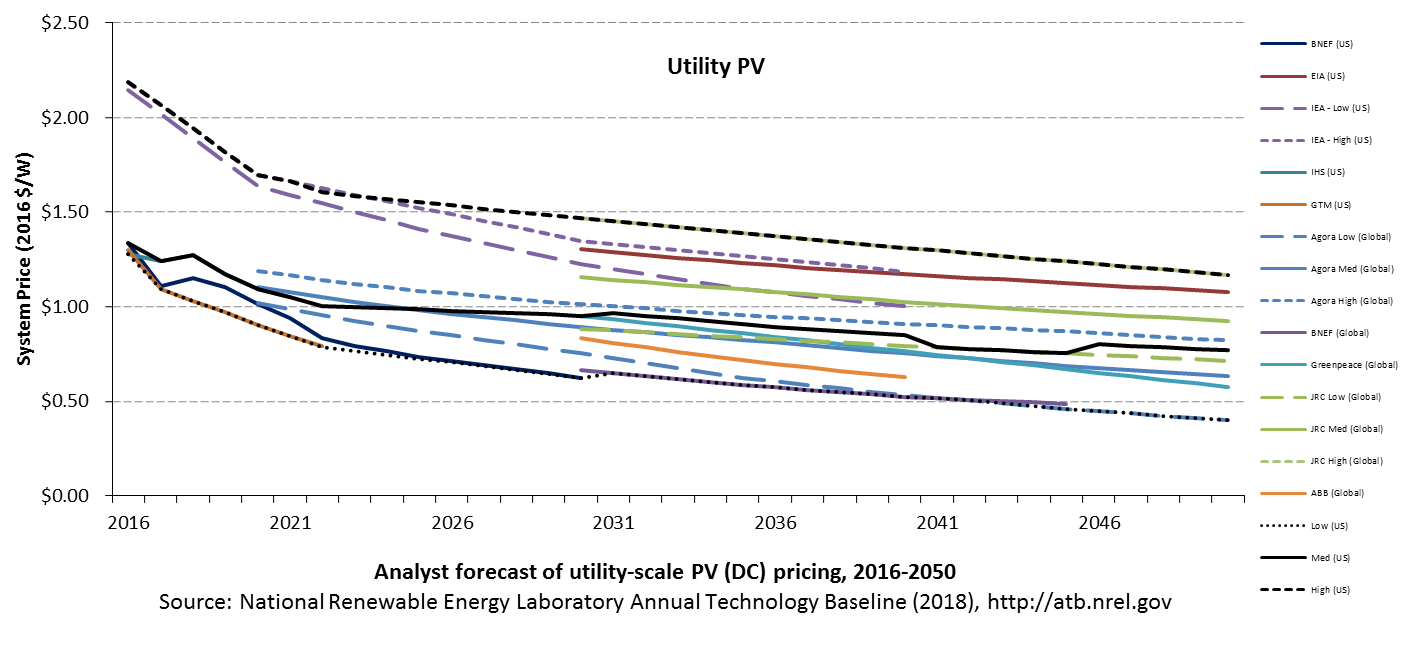

Projections of future utility-scale PV plant CAPEX are based on 15 system price projections from 9 separate institutions with short-term projections (BNEF (2017a); GTM Research (2016); EIA (2017a); EIA (2016a); IHS (2017)) (BNEF (2017a); GTM Research (2016); EIA 2017; IEA (2016); IHS (2017) made in the past year and long-term projections (ABB (2017); BNEF (2017b); Carlsson et al. (2014); Fraunhofer ISE (2015); Teske et al. (2015)) made in the last four years. We adjusted the " min," " median," and " max" projections in a few different ways. All 2016 pricing is based on the capacity-weighted average utility-scale system price as reported in Utility-Scale Solar 2016 (Bolinger et al. (2017)) and adjusted by the ReEDS state-level capital cost multipliers to remove geographic price distortions from 2016 reported pricing. All 2017 pricing is based on the bottom-up benchmark analysis reported in U.S. Solar Photovoltaic System Cost Benchmark Q1 2017 (adjusted for inflation, and accounting for $0.1/W higher than expected module prices due to tariff concerns in the R&D + Market sensitivity case) (Fu et al. (2017)). These figures are in line with other estimated system prices reported in Feldman et al. (2017).

We adjusted the Mid and Low projections for 2018-2050 to remove distortions caused by the combination of forecasts with different time horizons and based on internal judgment of price trends. In addition, because the projections were made before the Section 201 proclamation implementing a tariff on imported PV modules and cells, we adjusted projections to incorporate Section 201 tariff per pricing from internal NREL analysis in the R&D + Market sensitivity case. The Constant cost scenario is kept constant at the 2017 CAPEX value, assuming no improvements beyond2017.

The largest annual reductions in CAPEX for the Mid and Low projections occur from 2016 to 2017, dropping 32%. While reported CAPEX values have not been collected for all systems built in 2017 and 2018, historical CAPEX information has been consistent with utility-scale benchmarks after adjusting for installation data and system size.

Initial reported pricing for utility-scale power purchase agreements (PPAs) placed in service in 2016 fell to approximately $60/MWh, which is consistent in price with PPAs executed in 2013 and 2014, representing a two- to three-year lag from execution to installation. The capacity average executed PPA price in 2016 was approximately $35/MWh. If PPAs executed in 2016 follow a similar two-year lag, we would expect those systems to be installed in 2018-2019; therefore, we could see the capacity-weighted average PPA price for systems installed in the year fall from $60/MWh in 2016 to $35/MWh in 2018, or 41% less. The capacity average executed PPA price in 2016 was 41% lower than the capacity-weighted average PPA price for a system installed in 2016. While PPA pricing and CAPEX are not perfectly correlated, from 2010 to 2016, the capacity-weighted average PPA price and CAPEX for systems installed in that year fell 63% and 54% respectively (Bolinger et al. (2017)).

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future CAPEX costs are summarized in LCOE Projections.

CAPEX Definition

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year.

For the ATB-and based on EIA (2016a) and the NREL Solar PV Cost Model (Fu et al. (2017))-the utility-scale solar PV plant envelope is defined to include:

- Hardware

- Module supply

- Power electronics, including inverters

- Racking

- Foundation

- AC and DC wiring materials and installation

- Electrical infrastructure, such as transformers, switchgear, and electrical system connecting modules to each other and to the control center

- Balance of system (BOS)

- Land acquisition, site preparation, installation of underground utilities, access roads, fencing, and buildings for operations and maintenance

- Project indirect costs, including costs related to engineering, distributable labor and materials, construction management start up and commissioning, and contractor overhead costs, fees, and profit

- Financial Costs

- Owners' costs, such as development costs, preliminary feasibility and engineering studies, environmental studies and permitting, legal fees, insurance costs, and property taxes during construction

- Electrical interconnection, including onsite electrical equipment (e.g., switchyard), a nominal-distance spur line (< 1 mile), and necessary upgrades at a transmission substation; distance-based spur line cost (GCC) not included in the ATB

- Interest during construction estimated based on six-month duration accumulated 100% at half-year intervals and an 8% interest rate (ConFinFactor).

CAPEX can be determined for a plant in a specific geographic location as follows:

Regional cost variations and geographically specific grid connection costs are not included in the ATB (CapRegMult = 1; GCC = 0). In the ATB, the input value is overnight capital cost (OCC) and details to calculate interest during construction (ConFinFactor).

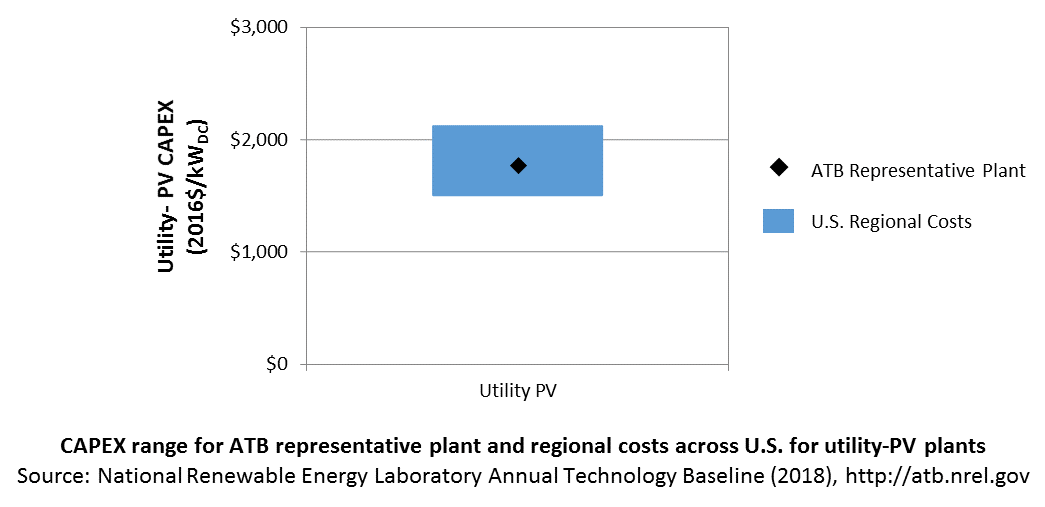

In the ATB, CAPEX represents a typical one-axis utility-scale PV plant and does not vary with resource. The difference in cost between tracking and non-tracking systems has been reduced greatly in the United States. Regional cost effects associated with labor rates, material costs, and other regional effects as defined by EIA 2016a expand the range of CAPEX. Unique land-based spur line costs based on distance and transmission line costs for potential utility-PV plant locations expand the range of CAPEX even further. The following figure illustrates the ATB representative plant relative to the range of CAPEX including regional costs across the contiguous United States. The ATB representative plants are associated with a regional multiplier of 1.0.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

CAPEX in the ATB does not represent regional variants (CapRegMult) associated with labor rates, material costs, etc., but the ReEDS model does include 134 regional multipliers (EIA 2016a).

CAPEX in the ATB does not include a geographically determined spur line (GCC) from plant to transmission grid, but the ReEDS model calculates a unique value for each potential PV plant.

Natural Gas Internal Combustion Engine Vehicle

Operations and maintenance (O&M) costs represent the annual fixed expenditures required to operate and maintain a solar PV plant over its lifetime of 30 years, including:

- Insurance, property taxes, site security, legal and administrative fees, and other fixed costs

- Present value and annualized large component replacement costs over technical life (e.g., inverters at 15 years)

- Scheduled and unscheduled maintenance of solar PV plants, transformers, etc. over the technical lifetime of the plant (e.g., general maintenance, including cleaning and vegetation removal).

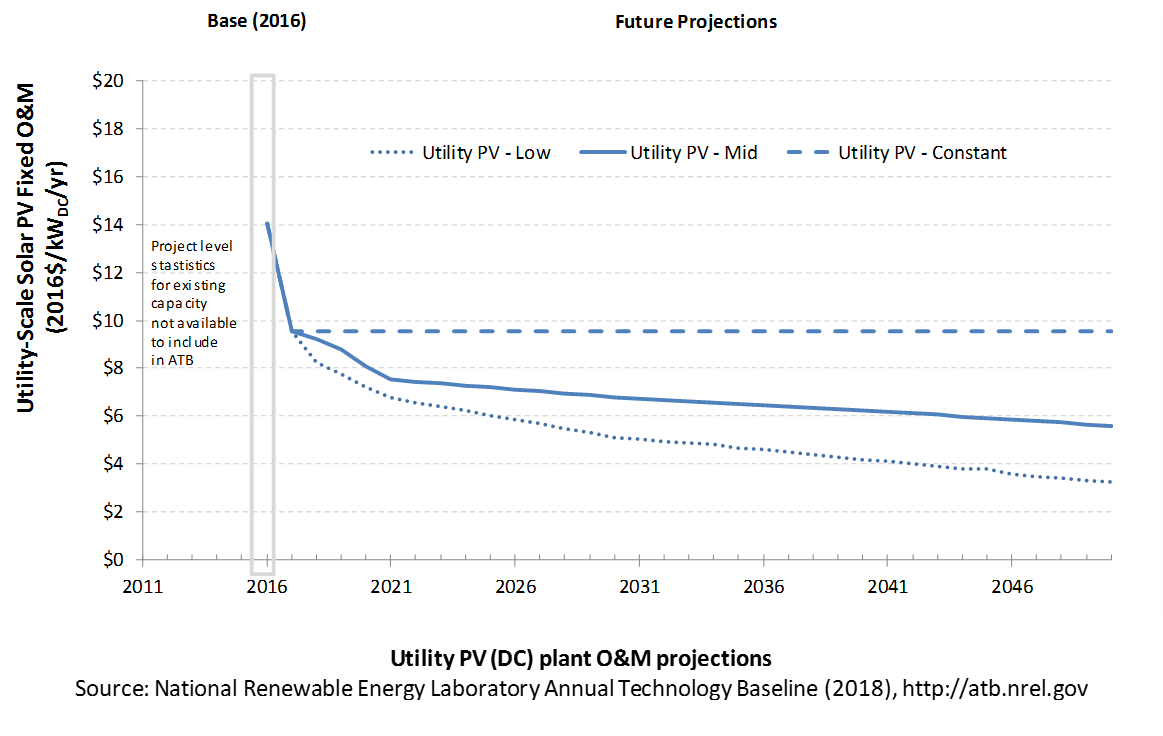

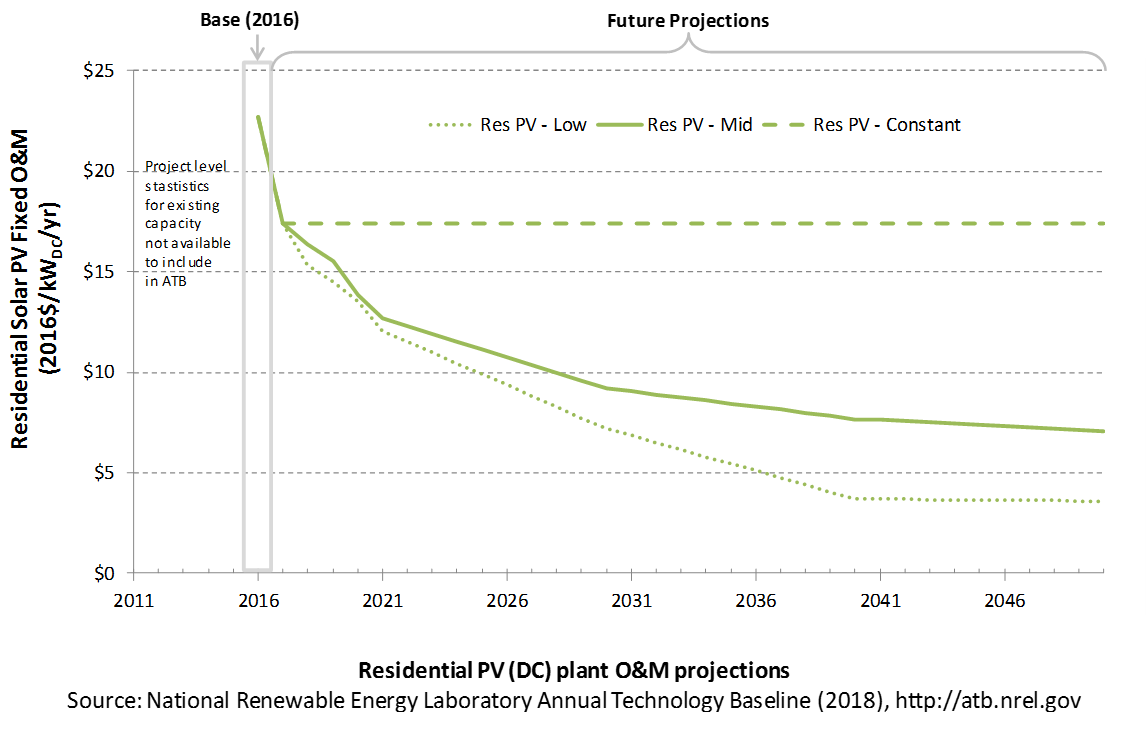

The following figure shows the Base Year estimate and future year projections for fixed O&M (FOM) costs. Three cost scenarios are represented. The estimate for a given year represents annual average FOM costs expected over the technical lifetime of a new plant that reaches commercial operation in that year.

Base Year Estimates

FOM of $14/kWDC - yr is based on the average ratio of O&M costs to CAPEX costs, 0.8%, as reported in Lazard (2017). This ratio is slightly higher than the ratio of O&M costs to historically reported CAPEX costs of 0.6%, which are derived from 2011 to 2016 historical data reported in Bolinger et al. (2017) but are lower than the ratio of O&M costs to CAPEX costs of 1.0%, which are derived from IEA (2016). A wide range in reported prices exists in the market, in part depending on the maintenance practices that exist for a particular system. These cost categories include asset management (including compliance and reporting for incentive payments), different insurance products, site security, cleaning, vegetation removal, and failure of components. Not all these practices are performed for each system; additionally, some factors depend on the quality of the parts and construction. NREL analysts estimate O&M costs can from $0 to $40/kWDC - yr.

Future Year Projections

We derive future FOM based on the same 0.8% ratio of O&M to CAPEX, used to estimate Base Year O&M costs. Historically reported data suggest O&M and CAPEX cost reductions are correlated; from 2011 to 2016, fleetwide average O&M and CAPEX costs fell 43% and 33% respectively, as reported in Bolinger et al. (2017).

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

Capacity Factor: Expected Annual Average Energy Production Over Lifetime

The capacity factor represents the expected annual average energy production divided by the annual energy production, assuming the plant operates at rated capacity for every hour of the year. It is intended to represent a long-term average over the lifetime of the plant. It does not represent interannual variation in energy production. Future year estimates represent the estimated annual average capacity factor over the technical lifetime of a new plant installed in a given year.

Other technologies' capacity factors are represented in exclusively AC units; however, because PV pricing in this ATB documentation is represented in $/kWDC, PV system capacity is a DC rating. The PV capacity factor is the ratio of annual average energy production (kWhAC) to annual energy production assuming the plant operates at rated DC capacity for every hour of the year. For more information, see Solar PV AC-DC Translation.

The capacity factor is influenced by the hourly solar profile, technology (e.g., thin-film versus crystalline silicon), axistype (e.g., none, one, or two), expected downtime, and inverter losses to transform from DC to ACpower. The DC-AC ratio is a design choice that influences the capacity factor. PV plant capacity factor incorporates an assumed degradation rate of 0.75%/year (Fu et al. (2017)) in the annual average calculation. R&D could lower degradation rates of PV plant capacity factor; future projections for Mid and Low cost scenarios reduce degradation rates by 2050, using a straight-line basis, to 0.5%/year and 0.3%/year respectively.

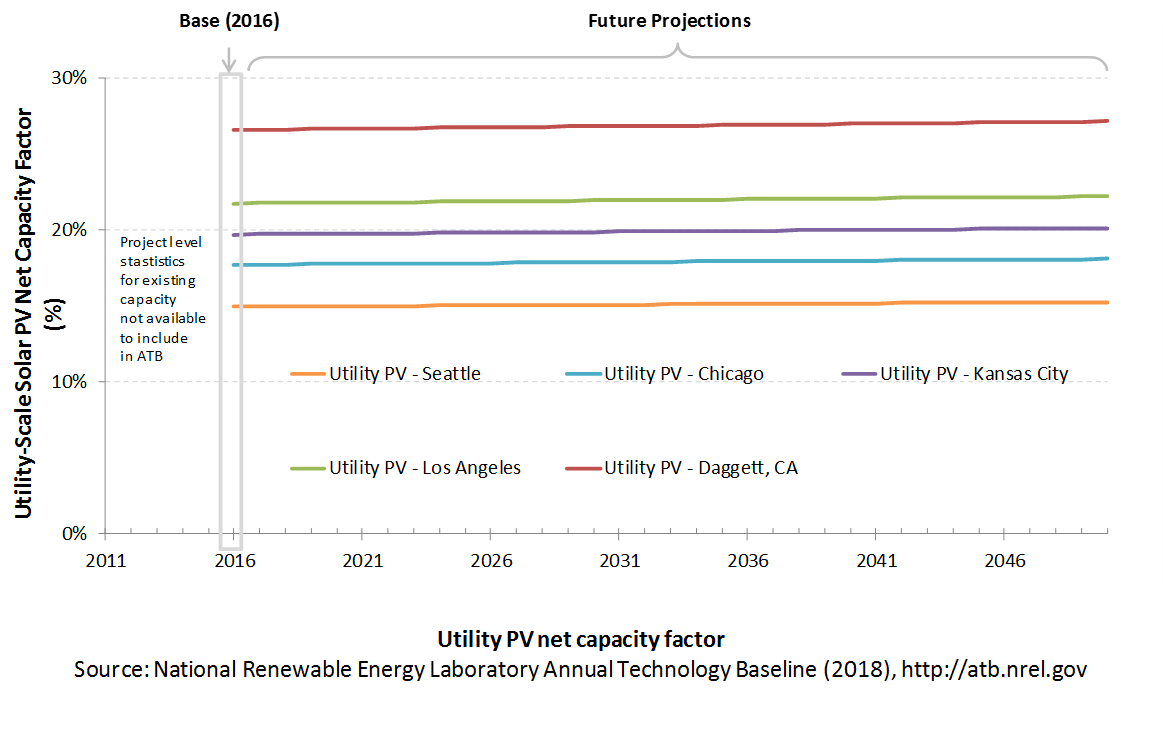

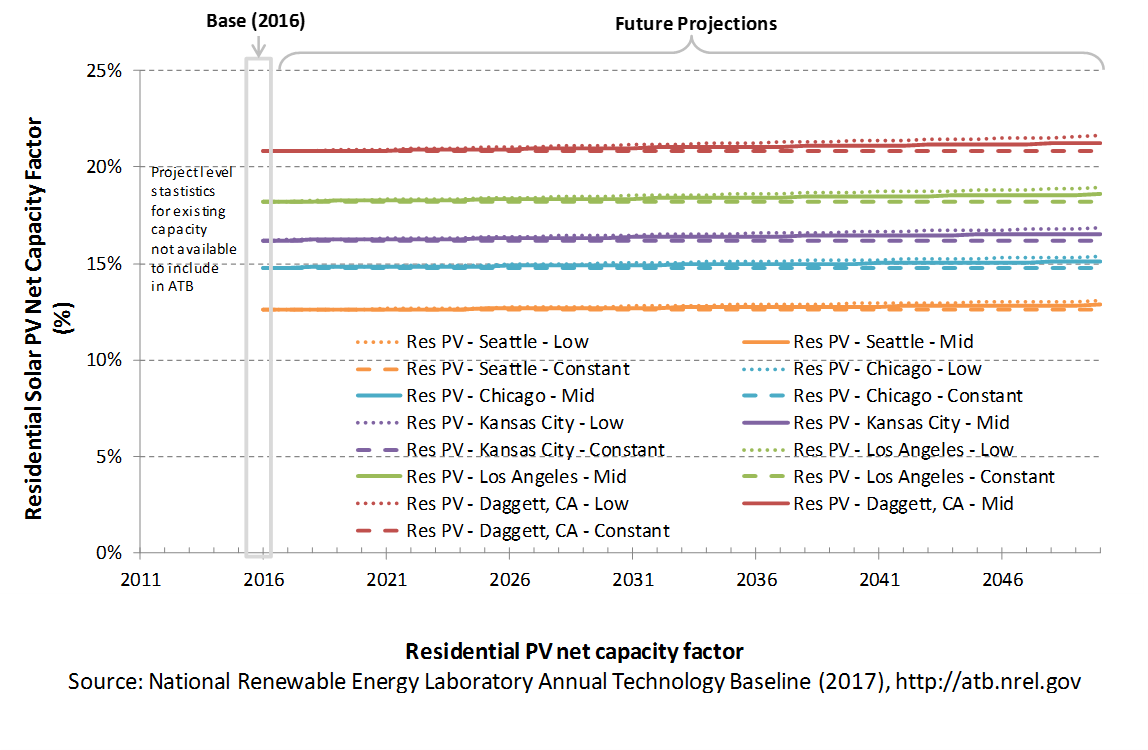

The following figure shows a range of capacity factors based on variation in solar resource in the contiguous United States. The range of the Base Year estimates illustrate the effect of locating a utility-scale PV plant in places with lower or higher solar irradiance. These five values use specific locations as examples of high (Daggett, California), high-mid (Los Angeles, California), mid (Kansas City, Missouri), low-mid (Chicago, Illinois), and low (Seattle, Washington) resource areas in the United States as implemented in the SAM model using PV system characteristics from Fu et al. (2017).

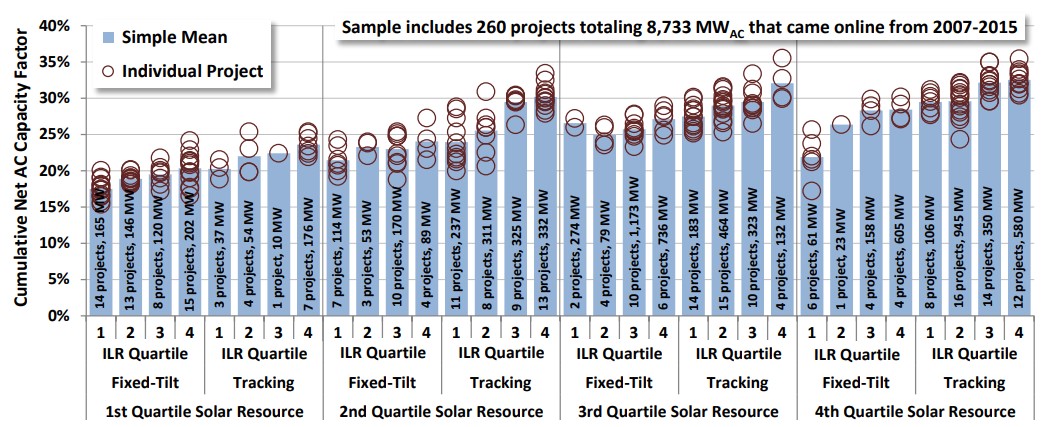

PV system inverters, which convert DC energy/power to AC energy/power, have AC capacity ratings; therefore, the capacity of a PV system is rated in MWAC, or the aggregation of all inverters' rated capacities, or MWDC, or the aggregation of all modules' rated capacities. The capacity factor calculation uses a system's rated capacity, and therefore, capacity factor can be represented using exclusively AC units or using AC units for electricity (the numerator) and DC units for capacity (the denominator). Both capacity factors will result in the same LCOE as long as the other variables use the same capacity rating (e.g., CAPEX in terms of $/kWDC). PV systems' DC ratings are typically higher than their AC ratings; therefore, the capacity factor calculated using a DC capacity rating has a higher denominator. In the ATB, we use capacity factors of 15.9%, 18.9%, 21.0%, 23.2%, and 28.3% for the first year of a PV project and adjust the values to reflect an average capacity factor for the lifetime of a project, calculated with MWDC, assuming 0.75% module capacity degradation per year in the base year and declining to 0.5% and 0.3% module capacity degradation per year by 2050 for the Mid and Low cost scenarios. The adjusted average capacity factor values used in the ATB Base Year are 14.9%, 17.7%, 19.7%, 21.7%, and 26.6%. These numbers would change to approximately 19.4%, 23.0%, 25.6%, 29.3%, and 34.5% if the ATB used MWAC. The following figure illustrates capacity factor-both DC and AC-for a range of inverter loading ratios. The ATB capacity factor assumptions are based on ILR = 1.3.

Recent Trends

At the end of 2016, the capacity-weighted average AC capacity factor for all U.S. projects installed at the time was 27.3% (including fixed-tilt systems), but individual project-level capacity factors exhibited a wide range (15.4%-35.5%).

The capacity-weighted average capacity factor was more closely in line with the higher end of the range because 62% of installed capacity from the data set was placed in service in the past two years of when the data were collected (and therefore have not degraded substantially), and 82% of the installed capacity was in the southwestern United States or California, where the average capacity factor was 29.9% for one-axis systems and 25.5% for fixed-tilt systems (Bolinger et al. (2017)).

Base Year Estimates

For illustration in the ATB, a range of capacity factors associated with the range of latitude in the contiguous United States is shown.

Over time, PV plant output is reduced. This degradation (at 0.75%) is accounted for in ATB estimates of capacity factor. The ATB capacity factor estimates represent estimated annual average energy production over the 30-year lifetime.

These DC capacity factors are for a one-axis tracking system with a DC-to-AC ratio of1.3.

Future Year Projections

Projections of capacity factors for plants installed in future years are unchanged from the Base Year for the Constant cost scenario. Capacity factors for Mid and Low cost scenarios are projected to increase over time, caused by a straight-line reduction in PV plant capacity degradation rates from 0.75%, reaching 0.5%/year and 0.3%/year by 2050 for the Mid and Low cost scenarios respectively. The following table summarizes the difference in average capacity factor in 2050 caused by different degradation rates in the Constant, Mid, and Low cost scenarios.

| Seattle, WA | Chicago, IL | Kansas City, MO | Los Angeles, CA | Daggett, CA | |

|---|---|---|---|---|---|

| Low Cost (0.30% degradation rate) | 15.5% | 18.4% | 20.5% | 22.6% | 27.6% |

| Mid Cost (0.50% degradation rate) | 15.2% | 18.1% | 20.1% | 22.2% | 27.1% |

| Constant Cost (0.75% degradation rate) | 14.9% | 17.7% | 19.7% | 21.7% | 26.6% |

Solar PV plants have very little downtime, inverter efficiency is already optimized, and tracking is already assumed. That said, there is potential for future increases in capacity factors through technological improvements beyond lower degradation rates, such as less panel reflectivity and improved performance in low-light conditions.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

The ReEDS model output capacity factors for wind and solar PV can be lower than input capacity factors due to endogenously estimated curtailments determined by system operation.

Plant Cost and Performance Projections Methodology

Currently, CAPEX-not LCOE-is the most common metric for PV cost. Due to differing assumptions in long-term incentives, system location and production characteristics, and cost of capital, LCOE can be confusing and often incomparable between differing estimates. While CAPEX also has many assumptions and interpretations, it involves fewer variables to manage. Therefore, PV projections in the ATB are driven primarily by CAPEX cost improvements, along with minor improvements in operational cost and cost of capital.

The Constant, Mid, and Low technology cost cases explore the range of possible outcomes of future PV cost improvements:

- Constant: no improvements made beyond today

- Mid: current expectations of price reductions in a " business-as-usual" scenario

- Low: expectations of potential cost reductions given improved R&D funding, favorable financing, and more aggressive global deployment targets.

While CAPEX is one of the drivers to lower costs, R&D efforts continue to focus on other areas to lower the cost of energy from utility-scale PV, such as longer system lifetime and improved performance.

Projections of future utility-scale PV plant CAPEX are based on 15 system price projections from 9 separate institutions. Projections include short-term U.S. price forecasts (BNEF (2017a); GTM Research (2016); EIA 2017; IEA (2016); IHS (2017)) made in the past year and long-term global and U.S. price forecasts (ABB (2017); BNEF (2017b); Carlsson et al. (2014); Fraunhofer ISE (2015); Teske et al. (2015)) made in the past four years. The short-term forecasts were primarily provided by market analysis firms with expertise in the PV industry, through a subscription service with NREL. The long-term forecasts primarily represent the collection of publicly available, unique forecasts with either a long-term perspective of solar trends or through capacity expansion models with assumed learning by doing.

- Short-Term Forecast Institutions: Bloomberg New Energy Finance, GTM Research, IHS Technology, International Energy Agency

- Long-Term Forecast Institutions: ABB, Agora Energiewende, Bloomberg New Energy Finance, European Commission's Joint Research Centre, Greenpeace & Global Wind Energy Council, International Energy Agency, U.S. Energy Information Administration.

To adjust all projections to the ATB's assumption of single-axis tracking systems, $0.08/WDC was added to all price projections that assumed fix-tilt tracking technology, and $0.04/WDC was added for all price projections that did not list whether the technology was fixed-tilt or single-axis tracking. All price projections quoted in $/WAC were converted to $/WDC using a 1.3 ILR. In addition, because the projections were made before the Section 201 proclamation implementing a tariff on imported PV modules and cells, we adjusted projections to incorporate Section 201 tariff per pricing from internal NREL analysis in the R&D + Market sensitivity case. In instances in which literature projections did not include all years, a straight-line change in price was assumed between any two projected values. To generate Constant, Mid, and Low scenarios, we took the " min," " median," and " max" of the data sets; however, we only included short-term U.S. forecasts until 2030 as they focus on near-term pricing trends within the industry. Starting in 2030, we include long-term global and U.S. forecasts in the data set, as they focus more on long-term trends within the industry. It is also assumed that after 2025, U.S. prices will be on par with global averages; the federal tax credit for solar assets reverts down to 10% for all projects placed in service after 2023, which has the potential to lower upfront financing costs and remove any distortions in reported pricing, compared to other global markets. Additionally, a larger portion of the United States will have a more mature PV market, which should result in a narrower price range. Changes in price for the Constant, Mid and Low scenarios between 2020 and 2030 are interpolated on a straight-line basis.

We adjusted the " min," " median," and " max" projections in a few different ways. All 2015 pricing is based on the capacity-weighted average reported utility-scale system price as reported in Utility-Scale Solar 2016 (Bolinger et al. (2017)) and adjusted by the ReEDS state-level capital cost multipliers to remove geographic price distortions from 2016 reported pricing. All 2017 pricing is based on the bottom-up benchmark analysis reported in U.S. Solar Photovoltaic System Cost Benchmark Q1 2017 (adjusted for inflation and accounting for $0.1/W higher than expected module prices due to tariff concerns in the R&D + Market sensitivity case) (Fu et al. (2017)). These figures are in line with other estimated system prices reported in Feldman et al. (2017).

We adjusted the Mid and Low projections for 2018-2050 to remove distortions caused by the combination of forecasts with different time horizons and based on internal judgment of price trends. In addition, because the projections were made before the Section 201 proclamation implementing a tariff on imported PV modules and cells, we adjusted projections to incorporate Section 201 tariff per pricing from internal NREL analysis in the R&D + Market sensitivity case. The Constant technology cost scenario is kept constant at the 2017 CAPEX value, assuming no improvements beyond2017.

All prices quoted in WAC are converted to WDC (1 WAC=1.2 WDC).

We derive future FOM based on the same 0.8% ratio of O&M to CAPEX that we used to estimate Base Year O&M costs. Historically reported data suggest O&M and CAPEX cost reductions are correlated; from 2011 to 2016 fleetwide average O&M and CAPEX costs fell 43% and 33% respectively, as reported in Bolinger et al. (2017).

O&M cost reductions are likely to be achieved over the next decade by a transition from manual and reactive O&M to semi-automated and fully automated O&M where possible. While many of these tasks are very site and region specific, emerging technologies have the potential to reduce the total O&M costs across all systems. For example, automated processes of sensors, monitors, remote-controlled resets, and drones to perform operations have the potential to allow O&M on PV systems to operate more efficiently at lower cost. Not all tasks have a clear path of automation due to complexity, safety, and some policy. This is one reason some level of manual interventions will likely exist for quite some time. Also, as systems age, O&M tasks that rely strictly on manpower are likely to increase in cost over the system lifetime.

Projections of capacity factors for plants installed in future years are unchanged from the Base Year for the Constant cost scenario. Capacity factors for Mid and Low cost scenarios are projected to increase over time, caused by a straight-line reduction in PV plant capacity degradation rates, reaching 0.5%/year and 0.3%/year by 2050 for the Mid and Low cost scenarios respectively.

Levelized Cost of Energy (LCOE) Projections

Levelized cost of energy (LCOE) is a simple metric that combines the primary technology cost and performance parameters: CAPEX, O&M, and capacity factor. It is included in the ATB for illustrative purposes. The ATB focuses on defining the primary cost and performance parameters for use in electric sector modeling or other analysis where more sophisticated comparisons among technologies are made. The LCOE accounts for the energy component of electric system planning and operation. The LCOE uses an annual average capacity factor when spreading costs over the anticipated energy generation. This annual capacity factor ignores specific operating behavior such as ramping, start-up, and shutdown that could be relevant for more detailed evaluations of generator cost and value. Electricity generation technologies have different capabilities to provide such services. For example, wind and PV are primarily energy service providers, while the other electricity generation technologies provide capacity and flexibility services in addition to energy. These capacity and flexibility services are difficult to value and depend strongly on the system in which a new generation plant is introduced. These services are represented in electric sector models such as the ReEDS model and corresponding analysis results such as the Standard Scenarios.

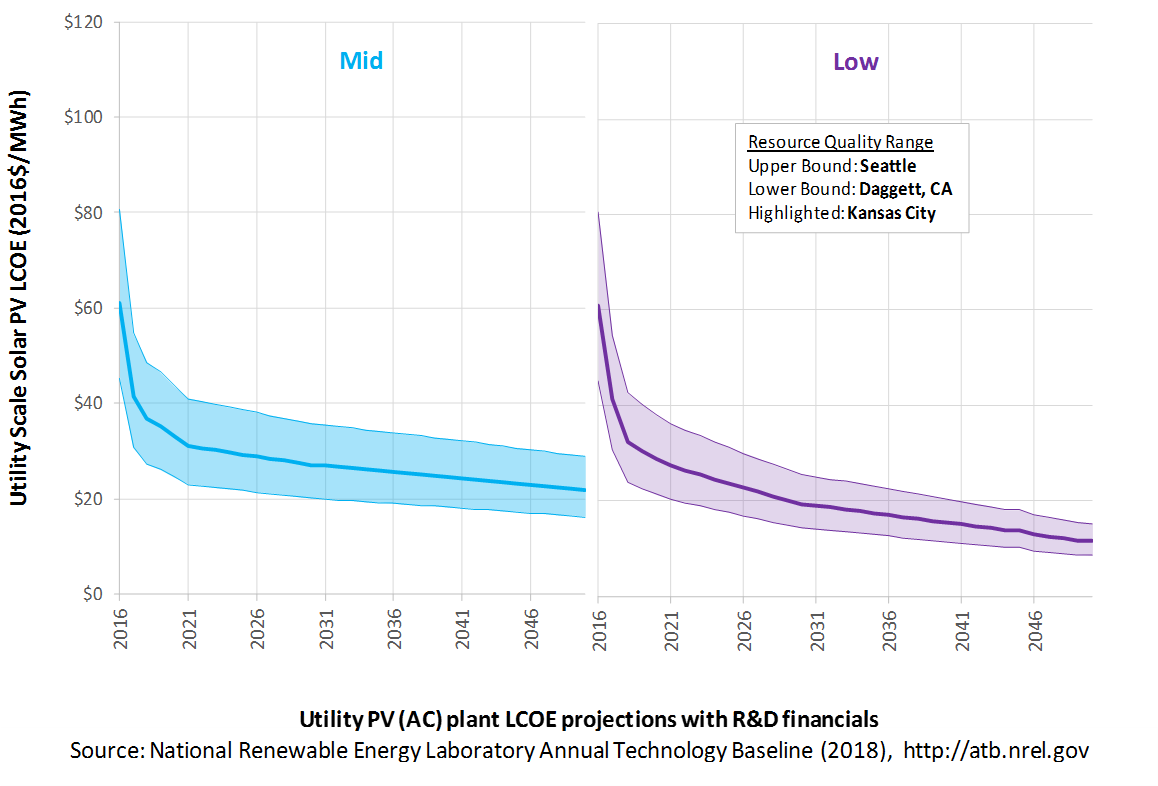

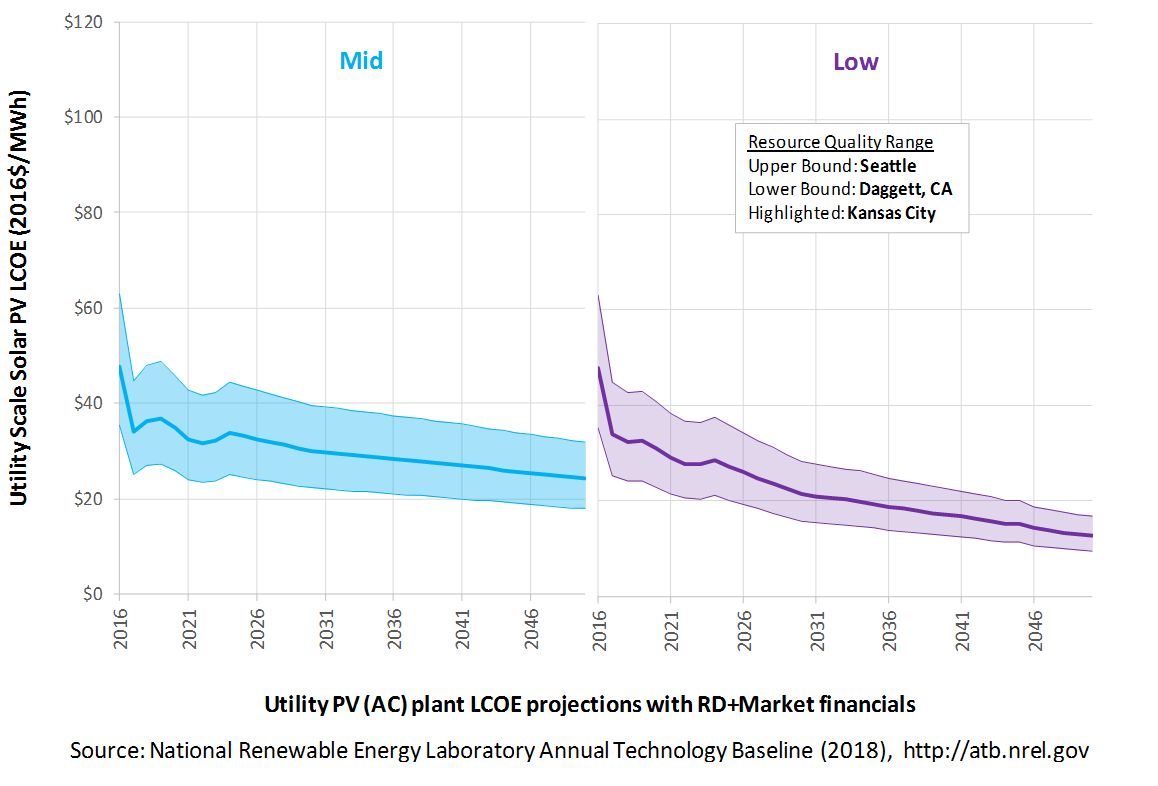

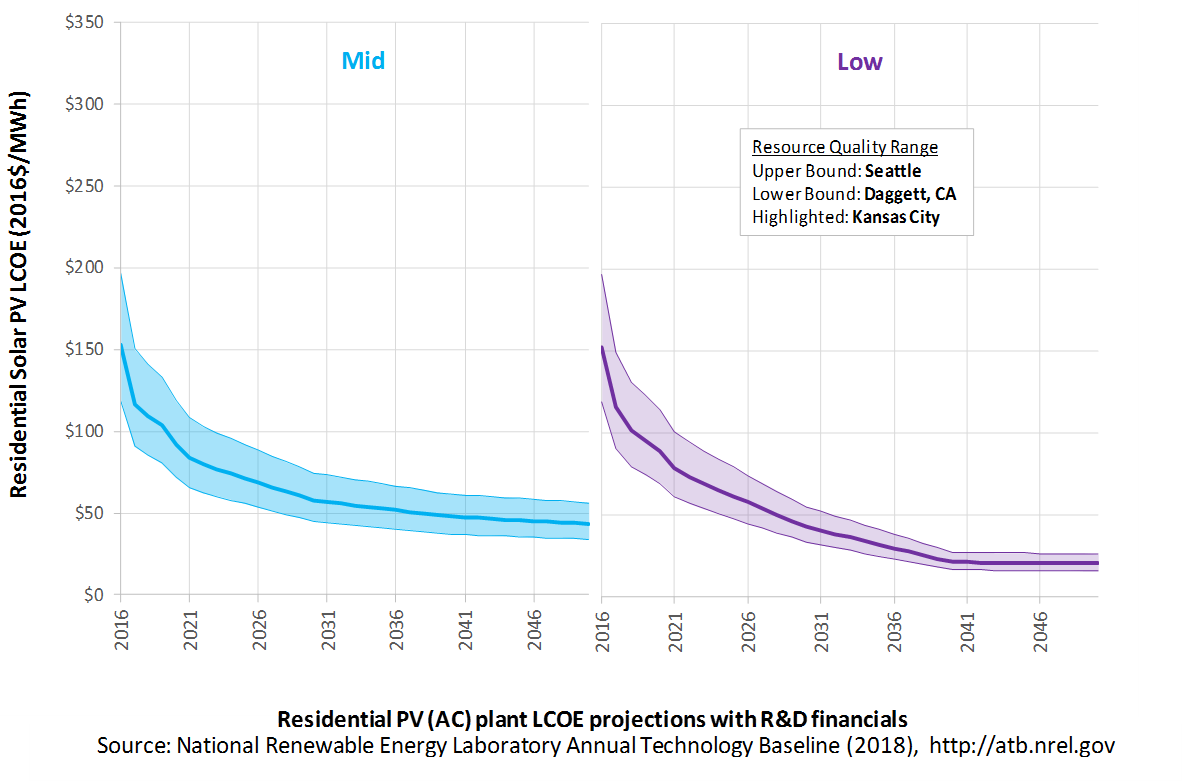

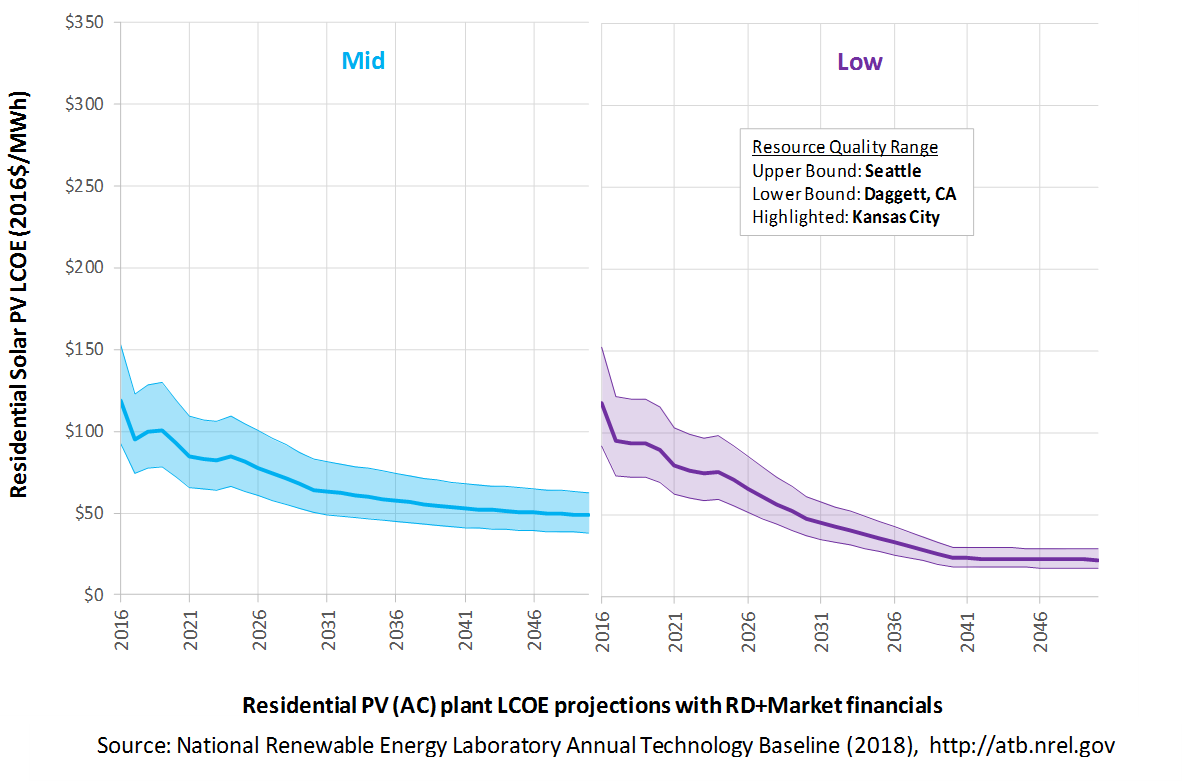

The following three figures illustrate LCOE, which includes the combined impact of CAPEX, O&M, and capacity factor projections for utility-scale PV across the range of resources present in the contiguous United States. For the purposes of the ATB, the costs associated with technology and project risk in the U.S. market are represented in the financing costs, not in the upfront capital costs (e.g. developer fees, contingencies). An individual technology may receive more favorable financing terms outside of the U.S., due to less technology and project risk, caused by more project development experience (e.g. offshore wind in Europe), or more government or market guarantees. The R&D Only LCOE sensitivity cases present the range of LCOE based on financial conditions that are held constant over time unless R&D affects them, and they reflect different levels of technology risk. This case excludes effects of tax reform, tax credits, technology-specific tariffs, and changing interest rates over time. The R&D + Market LCOE case adds to these the financial assumptions (1) the changes over time consistent with projections in the Annual Energy Outlook and (2) the effects of tax reform, tax credits, and tariffs. The ATB representative plant characteristics that best align with those of recently installed or anticipated near-term utility-scale PV plants are associated with Utility PV: Kansas City. Data for all the resource categories can be found in the ATB data spreadsheet.

R&D Only | R&D + Market

The methodology for representing the CAPEX, O&M, and capacity factor assumptions behind each pathway is discussed in Projections Methodology. In general, the degree of adoption of technology innovation distinguishes the Constant, Mid, and Low technology cost scenarios. These projections represent trends that reduce CAPEX and improve performance. Development of these scenarios involves technology-specific application of the following general definitions:

- Constant Technology Cost Scenario = Base Year (or near-term estimates of projects under construction) equivalent through 2050 maintains current relative technology cost differences

- Mid Technology Cost Scenario = technology advances through continued industry growth, public and private R&D investments, and market conditions relative to current levels that may be characterized as "likely" or "not surprising"

- Low Technology Cost Scenario = Technology advances that may occur with breakthroughs, increased public and private R&D investments, and/or other market conditions that lead to cost and performance levels that may be characterized as the " limit of surprise" but not necessarily the absolute low bound.

To estimate LCOE, assumptions about the cost of capital to finance electricity generation projects are required, and the LCOE calculations are sensitive to these financial assumptions. Three project finance structures are used within the ATB:

- R&D Only Financial Assumptions: This sensitivity case allows technology-specific changes to debt interest rates, return on equity rates, and debt fraction to reflect effects of R&D on technological risk perception, but it holds background rates constant at 2016 values from AEO 2018 and excludes effects of tax reform, tax credits, and tariffs.

- R&D Only + Market Financial Assumptions: This sensitivity case retains the technology-specific changes to debt interest, return on equity rates, and debt fraction from the R&D Only case and adds in the variation over time consistent with AEO 2018, as well as effects of tax reform, tax credits, and technology-specific tariffs. For a detailed discussion of these assumptions, see Changes from 2017 ATB to 2018 ATB.

- ReEDS Financial Assumptions: ReEDS uses the R&D Only + Market Financial Assumptions for the "Mid" technology cost scenario.

A constant cost recovery period -over which the initial capital investment is recovered-is assumed for all technologies throughout this website, and can be varied in the ATB data spreadsheet.

- The equations and variables used to estimate LCOE are defined on the equations and variables page. For illustration of the impact of changing financial structures such as WACC, see Project Finance Impact on LCOE. For LCOE estimates for the Constant, Mid, and Low technology cost scenarios for all technologies, see 2018 ATB Cost and Performance Summary.

In general, differences among the technology cost cases reflect different levels of adoption of innovations. Reductions in technology costs reflect the cost reduction opportunities that are listed below.

- Modules

- Increased module efficiencies and increased production-line throughput to decrease CAPEX; overhead costs on a per-kilowatt basis will go down if efficiency and throughput improvement are realized

- Reduced wafer thickness or the thickness of thin-film semiconductor layers

- Development of new semiconductor materials

- Development of larger manufacturing facilities in low-cost regions

- Balance of system (BOS)

- Increased module efficiency, reducing the size of the installation

- Development of racking systems that enhance energy production or require less robust engineering

- Integration of racking or mounting components in modules

- Reduction of supply chain complexity and cost

- Creation of standard packaged system design

- Improvement of supply chains for BOS components in modules

- Improved power electronics

- Improvement of inverter prices and performance, possibly by integrating microinverters

- Decreased installation costs and margins

- Reduction of supply chain margins (e.g., profit and overhead charged by suppliers, manufacturer, distributors, and retailers); this will likely occur naturally as the U.S. PV industry grows and matures

- Streamlining of installation practices through improved workforce development and training and developing standardized PV hardware

- Expansion of access to a range of innovative financing approaches and business models

- Development of best practices for permitting interconnection and PV installation such as subdivision regulations, new construction guidelines, and design requirements.

FOM cost reduction represents optimized O&M strategies, reduced component replacement costs, and lower frequency of component replacement.

Residential PV Systems

Representative Technology

For the ATB, residential PV systems are modeled for a 5.0-kWDC fixed tilt (25°), roof-mounted system. Flat-plate PV can take advantage of direct and indirect insolation, so PV modules need not directly face and track incident radiation. This gives PV systems a broad geographical application, especially for residential PV systems.

Resource Potential

Solar resources across the United States are mostly good to excellent at about 1,000-2,500 kWh/m2/year. The Southwest is at the top of this range, while only Alaska and part of Washington are at the low end. The range for the contiguous United States is about 1,350-2,500 kWh/m2/year. Nationwide, solar resource levels vary by about a factor of two.

Distributed-scale PV is assumed to be configured as a fixed-axis, roof-mounted system. Compared to utility-scale PV, this reduces both the potential capacity factor and amount of land (roof space) that is available for development. A recent study of rooftop PV technical potential (Gagnon et al. (2016)) estimated that as much as 731 GW (926 TWh/yr) of potential exists for small buildings (< 5,000 m2) and 386 GW (506 TWh/yr) of potential exists for medium (5,000-25,000 m2) and large buildings (> 25,000 m2).

Renewable energy technical potential, as defined by Lopez et al. 2012, represents the achievable energy generation of a particular technology given system performance, topographic limitations, and environmental and land-use constraints. The primary benefit of assessing technical potential is that it establishes an upper-boundary estimate of development potential. It is important to understand that there are multiple types of potential-resource, technical, economic, and market (Lopez at al. 2012; NREL, "Renewable Energy Technical Potential").

Base Year and Future Year Projections Overview

The Base Year estimates rely on modeled CAPEX and O&M estimates benchmarked with industry and historical data. Capacity factor is estimated based on hours of sunlight at latitude for three representative geographic locations in the United States.

Future year projections are derived from analysis of published projections of PV CAPEX and bottom-up engineering analysis of O&M costs. Three different technology cost scenarios were developed for scenario modeling as bounding levels:

- Constant Technology Cost Scenario: no change in CAPEX, O&M, or capacity factor from 2016 to 2050; consistent across all renewable energy technologies in the ATB

- Mid Technology Cost Scenario: based on the median of literature projections of future CAPEX; O&M technology pathway analysis

- Low Technology Cost Scenario: based on the low bound of literature projections of future CAPEX and O&M technology pathway analysis.

CAPital EXpenditures (CAPEX): Historical Trends, Current Estimates, and Future Projections

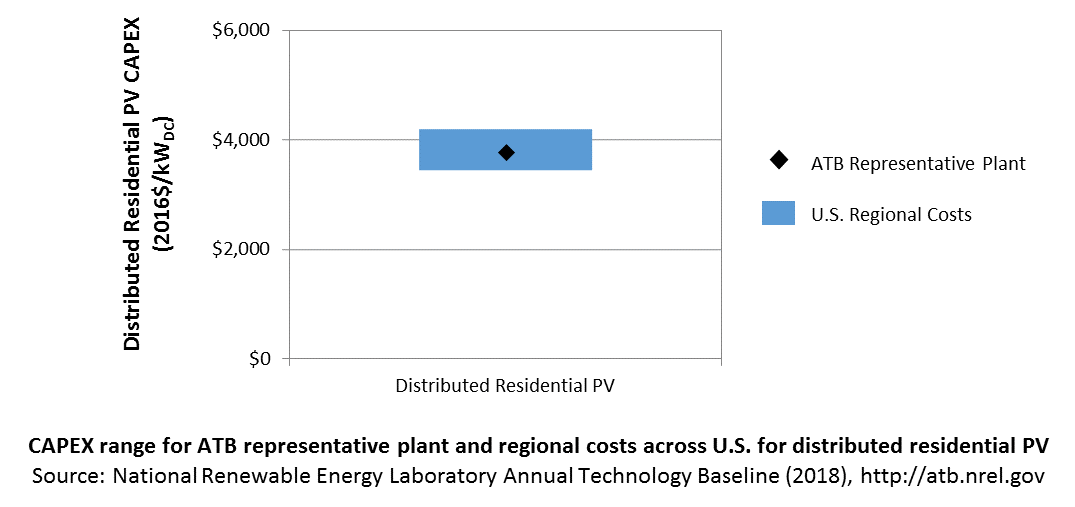

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year. These expenditures include the hardware, the balance of system (e.g., site preparation, installation, and electrical infrastructure), and financial costs (e.g., development costs, onsite electrical equipment, and interest during construction) and are detailed in CAPEX Definition. In the ATB, CAPEX reflects typical plants and does not include differences in regional costs associated with labor, materials, taxes, or system requirements. The related Standard Scenarios product uses regional CAPEX adjustments. The range of CAPEX demonstrates variation with resource in the contiguous United States.

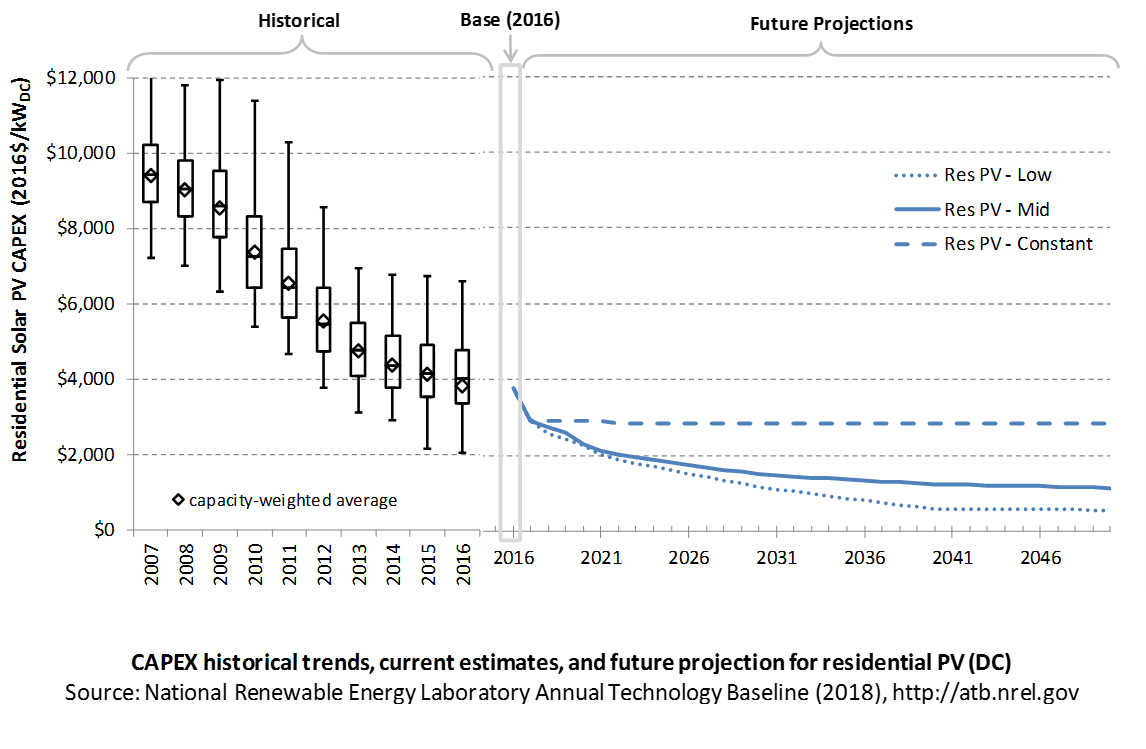

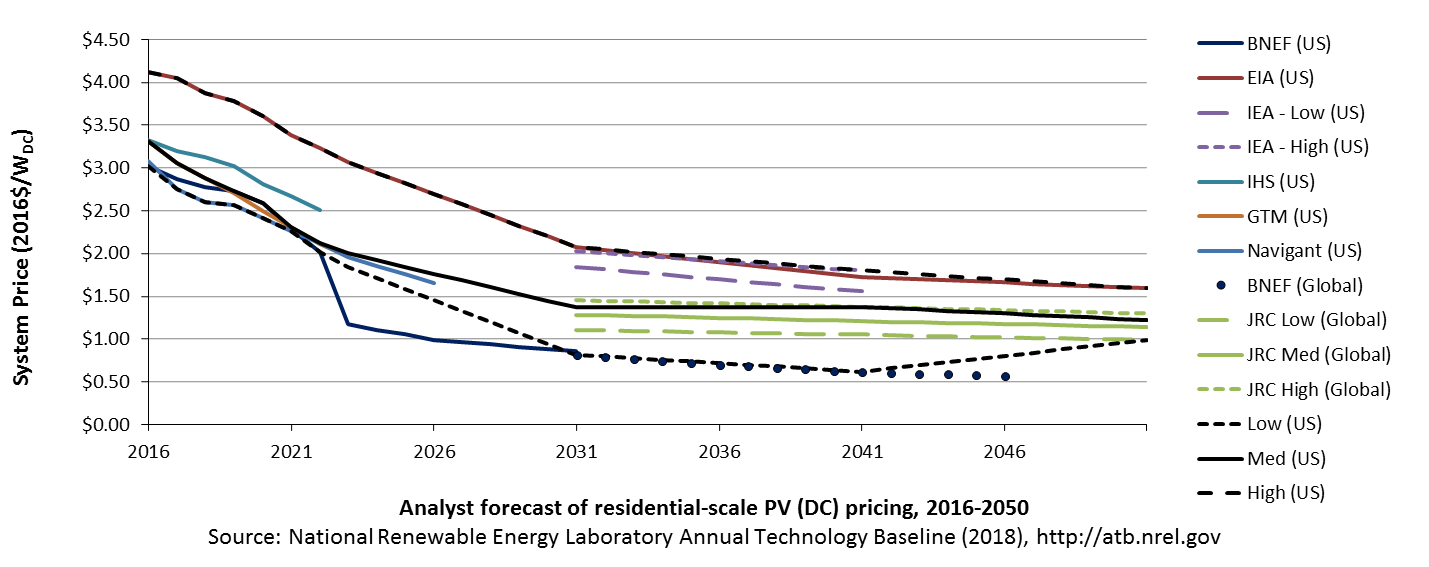

The following figure shows the Base Year estimate and future year projections for CAPEX costs. Three cost scenarios are represented: Constant, Mid, and Low technology cost. Historical data from residential PV installed in the United States are shown for comparison to the ATB Base Year estimates. The estimate for a given year represents CAPEX of a new plant that reaches commercial operation in that year.

Recent Trends

Reported residential PV installation CAPEX (Barbose et al. 2017) is shown in box-and-whiskers format for comparison to the ATB current CAPEX estimates and future projections. The data in Barbose and Dargouth (2017) represent 83% of all U.S. residential and commercial PV capacity installed through 2016 and 76% of capacity installed in 2016. The weighted-average market report numbers are expected to be higher than the national cost number projected here, as many of the historical installations are in states (e.g., California) where installation costs are higher than the national cost number.

PV pricing and capacities are quoted in kWDC (i.e., module rated capacity) unlike other generation technologies, which are quoted in kWAC. For PV, this would correspond to the combined rated capacity of all inverters. This is done because kWDC is the unit that the majority of the PV industry uses. Although costs are reported in kWDC, the total CAPEX includes the cost of the inverter, which has a capacity measured in kWAC.

CAPEX estimates for 2016 reflect a continued rapid decline in pricing supported by analysis of recent system cost and pricing for projects that became operational in 2016 (Feldman et al. (2017)).

Base Year Estimates

For illustration in the ATB, a representative residential-scale PV installation is shown. Although the PV technologies vary, typical installation costs are represented with a single estimate because the CAPEX does not vary with solar resource.

Although the technology market share may shift over time with new developments, the typical installation cost is represented with the projections above.

A system price of $3.78/WDC in 2016 represents the capacity-weighted average reported price of a residential-scale PV system installed in 2016 reported in Tracking the Sun X (Barbose and Dargouth (2017)) and adjusted to remove regional cost multipliers based on geographic location of projects installed in 2015. The $2.90/WDC in 2017 is based on bottom-up benchmark analysis reported in U.S. Solar Photovoltaic System Cost Benchmark Q1 2017 (adjusted for inflation, and accounting for $0.1/W higher than expected module prices due to tariff concerns in the R&D + Market sensitivity case) (Fu et al. (2017)). These figures are in line with other estimated system prices reported in Feldman et al. (2017).

The Base Year CAPEX estimates should tend toward the low end of observed cost because no regional impacts are included. These effects are represented in the historical market data.

Future Year Projections

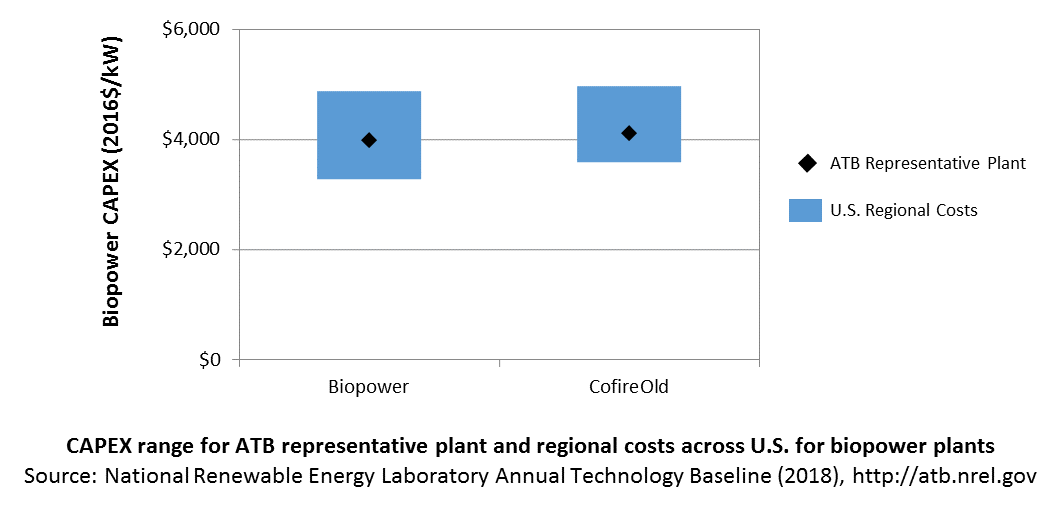

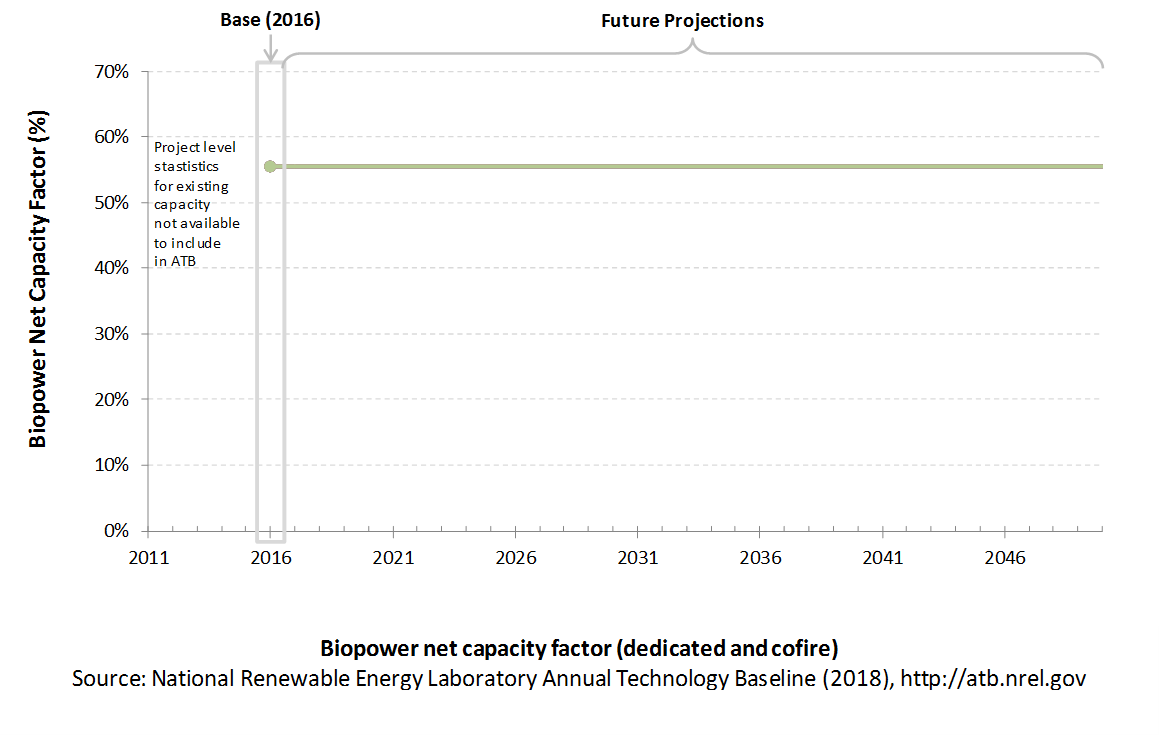

Projections of future residential PV installation CAPEX are based on 11 system price projections from seven separate institutions with short-term projections made in the past year and long-term projections made in the last four years. We adjusted the " min," " median," and " max" projections in a few different ways. All 2016 pricing is based on the capacity-weighted average historically reported residential PV system price reported in Tracking the Sun X (Barbose and Dargouth (2017)). All 2017 pricing is based on the bottom-up benchmark analysis reported in U.S. Solar Photovoltaic System Cost Benchmark Q1 2017 (adjusted for inflation, and accounting for $0.1/W higher than expected module prices due to tariff concerns in the R&D + Market sensitivity case) (Fu et al. (2017)). These figures are in line with other estimated system prices reported in Feldman et al. (2017).