Annual Technology Baseline 2018

National Renewable Energy Laboratory

Recommended Citation:

NREL (National Renewable Energy Laboratory). 2018. 2018 Annual Technology Baseline. Golden, CO: National Renewable Energy Laboratory. http://atb.nrel.gov/.

Please consult Guidelines for Using ATB Data:

https://atb.nrel.gov/electricity/user-guidance.html

Offshore Wind

Representative Technology

In 2016, the first offshore wind plant commenced commercial operation in the United States near Block Island (Rhode Island). This demonstration project is 30 MW in capacity; in the ATB, cost and performance estimates are made for commercial-scale projects 600 MW in capacity. The ATB Base Year offshore wind plant technology reflects a machine rating of 3.4 MW with a rotor diameter of 115 m and hub height of 85 m, which is typical of European projects installed in 2015-2016.

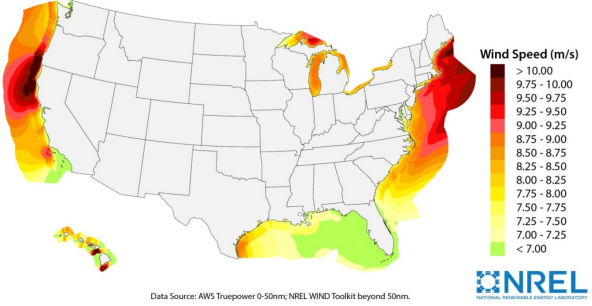

Resource Potential

Wind resource is prevalent throughout major U.S. coastal areas, including the Great Lakes. The resource potential exceeds 2,000 GW (Musial et al. (2016)), excluding Alaska. Prior estimates of offshore wind resource potential (Schwartz et al. (2010)) were updated in 2016 to extend domain boundaries from 50 nautical miles (nm) to 200 nm, consider turbine hub heights of 100 m (previously 90 m), and assume a capacity array power density of 3 MW/km2 (Musial et al. (2016)). A range of technology exclusions were applied based on maximum water depth for deployment, minimum wind speed, and limits to floating technology in freshwater surface ice. Resource potential was represented by over 7,000 areas for offshore wind plant deployment after accounting for competing use and environmental exclusions, such as marine protected areas, shipping lanes, pipelines, and others.

Source: Musial et al. 2016

Renewable energy technical potential, as defined by Lopez et al. 2012, represents the achievable energy generation of a particular technology given system performance, topographic limitations, and environmental and land-use constraints. The primary benefit of assessing technical potential is that it establishes an upper-boundary estimate of development potential. It is important to understand that there are multiple types of potential-resource, technical, economic, and market (Lopez at al. 2012; NREL, "Renewable Energy Technical Potential").

Base Year and Future Year Projections Overview

Based on the Musial et al. (2016) resource assessment, LCOE was estimated at more than 7,000 areas (with a total capacity of approximately 2,000 GW) in Beiter et al. (2016), taking into consideration a variety of spatial parameters, such as wind speeds, water depth, distance from shore, distance to ports, and wave height. CAPEX, O&M, and capacity factor are calculated for each geographic location using engineering models, hourly wind resource profiles, and representative sea states. The spatial LCOE assessment served as the basis for estimating the ATB baseline LCOE in the Base Year 2016, weighted by the available capacity, for fixed-bottom and floating offshore wind technology.

The Base Year LCOE assumes a 3.4-MW turbine size and long-term average hourly wind profiles and it reflects the least-cost choice among three substructure types (Beiter et al. (2016)):

- Monopile (fixed-bottom)

- Jacket (fixed-bottom)

- Semi-submersible (floating).

The representative offshore wind plant size is assumed to be 600 MW (Beiter et al. (2016)). For illustration in the ATB, the full resource potential, represented by 7,000 areas, was divided into 15 techno-resource groups (TRGs), of which TRGs 1-5 are representative of fixed-bottom wind technology and TRGs 6-15 are representative of floating offshore wind technology. The capacity-weighted average CAPEX, O&M, and capacity factor for each group is presented in the ATB.

Future year projections are derived from estimated cost reduction potential for offshore wind technologies based partially on elicitation of over 160 wind industry experts (Wiser et al. (2016)). Estimates for 2016-2050 were adjusted from the 2016 ATB for inflation (2015$ to $2016$). The specific scenarios are:

- Constant Technology Cost Scenario: no change in CAPEX, O&M, or capacity factor from 2015 to 2050; consistent across all renewable energy technologies in the ATB

- Mid Technology Cost Scenario: LCOE percentage reduction from the Base Year equivalent to that corresponding to the Median Scenario (50% probability) in expert survey (Wiser et al. (2016))

- Low Technology Cost Scenario: LCOE percentage reduction from the Base Year equivalent to that corresponding to the Low scenario (10% probability) in the expert survey (Wiser et al. (2016)).

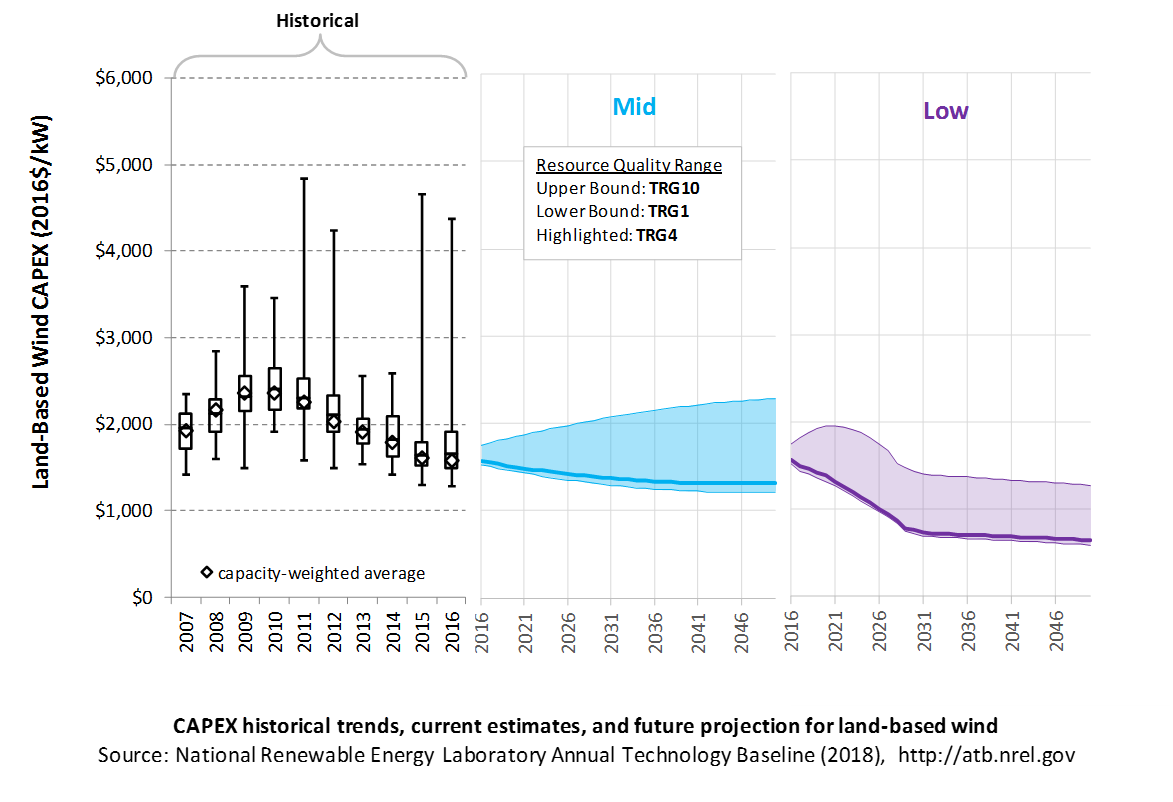

CAPital EXpenditures (CAPEX): Historical Trends, Current Estimates, and Future Projections

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year. These expenditures include the wind turbine, the balance of system (e.g., site preparation, installation, and electrical infrastructure), and financial costs (e.g., development costs, onsite electrical equipment, and interest during construction) and are detailed in CAPEX Definition. In the ATB, CAPEX reflects typical plants and does not include differences in regional costs associated with labor, materials, taxes, or system requirements. The related Standard Scenarios product uses regional CAPEX adjustments. The range of CAPEX demonstrates variation with wind resource in the contiguous United States.

The following figure shows the Base Year estimate and future year projections for CAPEX costs. Three cost scenarios are represented: Constant, Mid, and Low technology cost cases. Historical data from land-based wind plants installed in the United States are shown for comparison to the ATB Base Year estimates. The estimate for a given year represents CAPEX of a new plant that reaches commercial operation in that year.

CAPEX estimates for 2016 correspond well with market data for plants installed in 2016. Projections reflect a continuation of the downward trend observed in the recent past and are anticipated to continue based on preliminary data for 2017 projects.

In the lower wind resource areas represented by TRGs 6-10, CAPEX is expected to grow as future wind turbine technology transitions to new platforms, including taller towers, larger rotors, and higher machine ratings. In the higher wind resource areas represented by TRGs 1-5, optimization of current wind turbine platforms will lead to lower CAPEX in future years.

Recent Trends

Actual land-based wind plant CAPEX (Wiser and Bolinger (2017)) is shown in box-and-whiskers format for comparison to the ATB current CAPEX estimates and future projections. provide statistical representation of CAPEX for about 65% of wind plants installed in the United States since 2007. CAPEX estimates should tend toward the low end of observed cost because no regional impacts or spur line costs are included. These effects are represented in the market data.

Base Year Estimates

For illustration in the ATB, all potential land-based wind plant areas were represented in 10 TRGs. These were defined by resource potential (GW) and have higher resolution on the highest-quality TRGs, as these are the most likely sites to be deployed, based on their economics.

TRG 1 represents the best 100 GW of wind, as determined by LCOE. TRG 2 represents the next best 200 GW, while TRG 3 represents the next best 400 GW, and TRG 4 represents the next best 800 GW. TRGs 5-9 all represent 1,600 GW of resource potential. TRG 10 represents the remaining 1,148 GW of available potential. This representation is based on the approach described in DOE (2015) and implemented with 2015 market data in Moné et al. (2017).

The following table summarizes the annual average wind speed range for each TRG, capacity-weighted average wind speed, cost and performance parameters for each TRG, and resource potential in terms of capacity and energy for each TRG. Typical land-based wind installations in 2015 and 2016 are associated with TRG4.

TRG Definitions for Land-Based Wind

| Techno-Resource Group (TRG) | Wind Speed Range (m/s) | Weighted Average Wind Speed (m/s) | Weighted Average CAPEX ($/kW) | Weighted Average OPEX ($/kW-yr) | Weighted Average Net CF (%) | Potential Wind Plant Capacity (GW) | Potential Wind Plant Energy (TWh) |

|---|---|---|---|---|---|---|---|

| TRG1 | 8.2-13.5 | 8.7 | 1,573 | 51 | 47.4% | 100 | 414 |

| TRG2 | 8.0-10.9 | 8.4 | 1,592 | 51 | 46.2% | 200 | 810 |

| TRG3 | 7.7-11.1 | 8.2 | 1,599 | 51 | 45.0% | 400 | 1,576 |

| TRG4 | 7.5-13.1 | 7.9 | 1,605 | 51 | 43.5% | 800 | 3,050 |

| TRG5 | 6.9-11.1 | 7.5 | 1,616 | 51 | 40.7% | 1,600 | 5,708 |

| TRG6 | 6.1-9.4 | 6.9 | 1,642 | 51 | 36.4% | 1,600 | 5,098 |

| TRG7 | 5.4-8.3 | 6.2 | 1,678 | 51 | 30.8% | 1,600 | 4,320 |

| TRG8 | 4.7-6.9 | 5.5 | 1,708 | 51 | 24.6% | 1,600 | 3,443 |

| TRG9 | 4.0-6.0 | 4.8 | 1,713 | 51 | 18.3% | 1,600 | 2,558 |

| TRG10 | 1.0-5.3 | 4.0 | 1,713 | 51 | 11.1% | 1,148 | 1,116 |

| Total | 10,648 | 28,092 | |||||

Future Year Projections

Mid: Projections of future LCOE were derived from a survey of wind industry experts (Wiser et al. (2016)) for scenarios that are associated with a 50% probability level in 2030 and 2050. Projections of future land-based wind plant CAPEX were determined based on adjustments to CAPEX, fixed O&M (FOM), and capacity factor in each year to result in a predetermined LCOE value derived from Wiser et al. (2016).

In order to achieve the overall LCOE reduction associated with the median and low projections from the expert survey, CAPEX was used to accommodate all improvement aspects other than O&M and capacity factor survey results. In the lower wind resource areas represented by TRGs 6-10, CAPEX is expected to grow as future wind turbine technology transitions to new platforms, including taller towers, larger rotors, and higher machine ratings. In the higher wind resource areas represented by TRGs 1-5, optimization of current wind turbine platforms will lead to lower CAPEX.

Low: Projections of future LCOE for the Low cost scenario were derived from an accelerated development pathway that included incremental improvements to technology through scaling and learning as well as innovation enabled by the DOE's Atmosphere to Electrons research program and anticipated scientific advances (Dykes et al. (2017)). The reductions in turbine and balance-of-system CAPEX were estimated by a survey of wind industry experts (Wiser et al. (2016)) focusing on detailed line item cost reduction potential. The results of the survey show a reduction in turbine and balance-of-system CAPEX by 2030 through turbine scaling with less material use and use of more efficient manufacturing processes. The accelerated decline in CAPEX is expected for all TRGs through 2030 except TRGs 9 and 10, where CAPEX is expected to slightly increase in the near term and then begin to decline at the same rate as the remaining TRGs. After 2030, the rate of CAPEX reduction is expected to continue but at a slower rate. As stated in Dykes et al. (2017), the wind turbine industry is expected to continue trends in scaling seen over the past several decades while learning processes will keep the per-unit power costs of these turbines at or below current levels. In addition, the turbine size increases will lead to economies of scale for the wind power plant through reductions in plant infrastructure and erection costs while science-enabled R&D pathways in turbine design will push materials and manufacturing costs of per-unit power to levels lower than those observed today.

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

CAPEX Definition

Capital expenditures (CAPEX) are expenditures required to achieve commercial operation in a given year.

Based on EIA (2013), Moné et al. (2015), and Beiter et al. (2016), the System Cost Breakdown Structure of the ATB for the wind plant envelope is defined to include:

- Wind turbine supply

- Balance of system (BOS)

- Turbine installation, substructure supply and installation

- Site preparation, port and staging area support for delivery, storage, handling, and installation of underground utilities

- Electrical infrastructure, such as transformers, switchgear, and electrical system connecting turbines to each other (array cable system costs) and to the cable landfall (export cable system costs)

- Development and project management

- Financial costs

- Owners' costs, such as development costs, preliminary feasibility and engineering studies, environmental studies and permitting, legal fees, insurance costs, and property taxes during construction

- Interest during construction estimated based on three-year duration accumulated 40%/40%/20% at half-year intervals and an 8% interest rate (ConFinFactor).

CAPEX can be determined for a plant in a specific geographic location as follows:

Regional cost variations are not included in the ATB (CapRegMult = 1). In the ATB, the input value is overnight capital cost (OCC) and details to calculate interest during construction (ConFinFactor). Because transmission infrastructure between an offshore wind plant and the point at which a grid connection is made onshore is a significant component of the offshore wind plant cost, an offshore spur line cost (OffSpurCost) for each TRG is included in the CAPEX estimate. The offshore spur line cost reflects a capacity-weighted average of all potential wind plant areas within a TRG, similar to OCC.

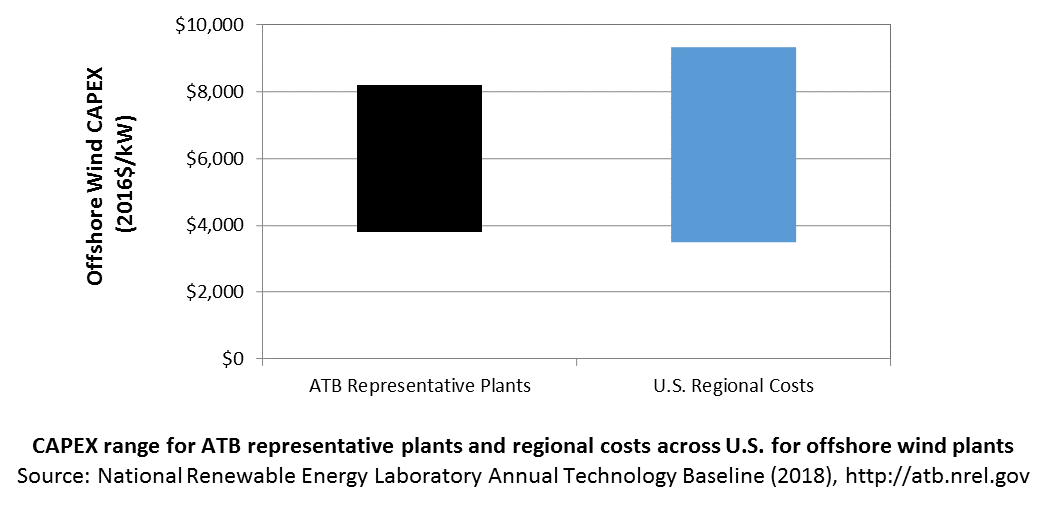

In the ATB, CAPEX represents the capacity-weighted average values of all potential wind plant areas within a TRG and varies with water depth and distance from shore. Regional cost effects associated with labor rates, material costs, and other regional effects as defined by DOE 2015 expand the range of CAPEX. Unique land-based spur line costs for each of the 7,000 areas based on distance and transmission line costs expand the range of CAPEX even further. The following figure illustrates the ATB representative plants relative to the range of CAPEX including regional costs across the contiguous United States. The ATB representative plants are associated with a regional multiplier of 1.0.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

CAPEX in the ATB does not represent regional variants (CapRegMult) associated with labor rates, material costs, etc., but the ReEDS model does include 134 regional multipliers (EIA (2013)).

The ReEDS model determines offshore spur line and land-based spur line (GCC) uniquely for each of the 7,000 areas based on distance and transmission line cost.

Natural Gas Internal Combustion Engine Vehicle

Operations and maintenance (O&M) costs represent the annual fixed expenditures required to operate and maintain a wind plant over its lifetime of 30 years, including:

- Insurance, taxes, land lease payments and other fixed costs (e.g., project management and administration, weather forecasting, and condition monitoring)

- Present value and annualized large component replacement costs over technical life (e.g., blades, gearboxes, and generators)

- Scheduled and unscheduled maintenance of wind plant components, including turbines and transformers, over the technical lifetime of the plant.

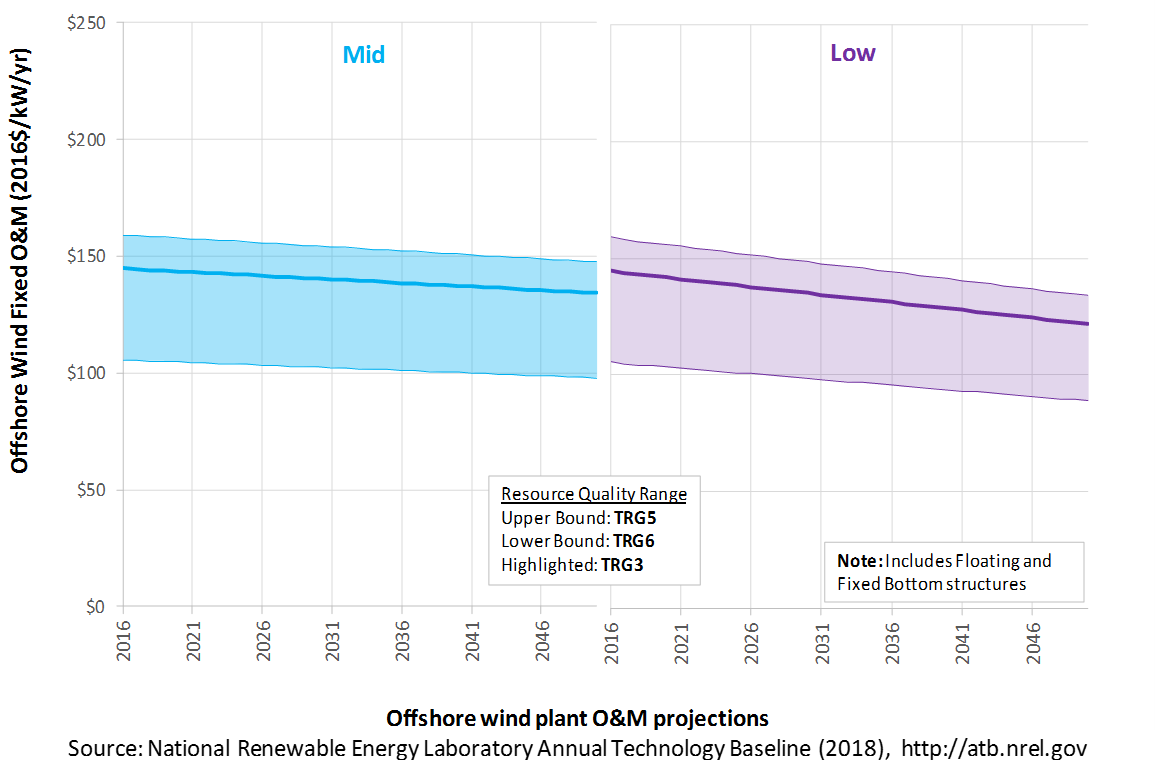

The following figure shows the Base Year estimate and future year projections for fixed O&M (FOM) costs. Three cost scenarios are represented. The estimate for a given year represents annual average FOM costs expected over the technical lifetime of a new plant that reaches commercial operation in that year. The range of Base Year O&M estimates reflects distance from shore and metocean conditions.

Base Year Estimates

FOM costs vary by distance from shore and metocean conditions. As a result, O&M costs vary from $106/kW-year (TRG 6) to $159/kW-year (TRG 5) in 2016. The capacity-weighted average in the ATB for fixed-bottom offshore technology (TRGs 1-5) is $148/kW-year; the corresponding value for floating offshore wind technology (TRGs 6-15) is $127/kW-year.

Future Year Projections

Future fixed-bottom offshore wind technology O&M is assumed to decline 7% by 2050 in the Mid cost case and 16% in the Low cost wind case, based on the expert survey conducted by Wiser et al. (2016).

Future floating offshore wind technology O&M is assumed to decline 7% by 2050 in the Mid cost case and 16% in the Low cost wind case, based on the expert survey conducted by Wiser et al. (2016).

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

Capacity Factor: Expected Annual Average Energy Production Over Lifetime

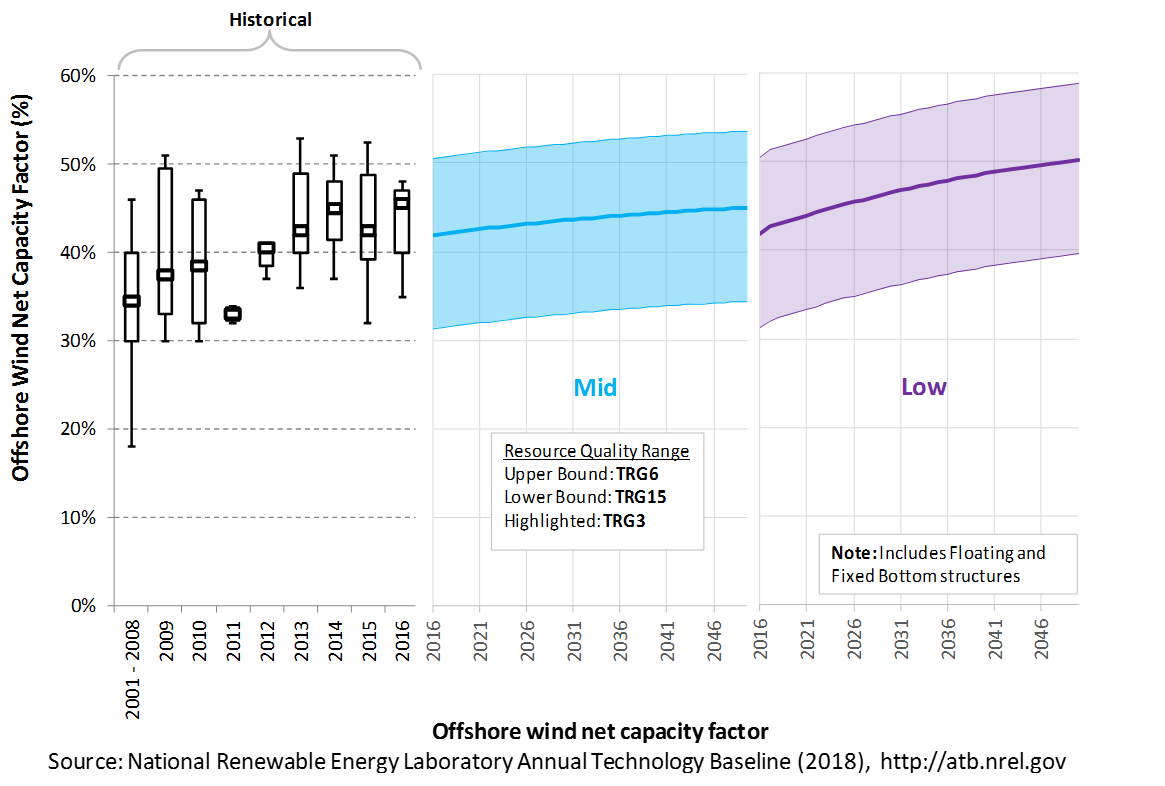

The capacity factor represents the expected annual average energy production divided by the annual energy production, assuming the plant operates at rated capacity for every hour of the year. It is intended to represent a long-term average over the lifetime of the plant. It does not represent interannual variation in energy production. Future year estimates represent the estimated annual average capacity factor over the technical lifetime of a new plant installed in a given year.

The capacity factor is influenced by the rotor swept area/generator capacity, hub height, hourly wind profile, expected downtime, and energy losses within the wind plant. It is referenced to 100-m above-water-surface, long-term average hourly wind resource data from Musial et al. (2016).

The following figure shows a range of capacity factors based on variation in the wind resource, water depth, and distance from shore for offshore wind plants in the contiguous United States. Pre-construction estimates for offshore wind plants operating globally in 2015, according to the year in which plants were installed, is shown for comparison to the ATB Base Year estimates. The range of Base Year estimates illustrate the effect of locating an offshore wind plant in a variety of wind resource, water depth, and distance from shore conditions (TRGs 1-5 are fixed-bottom offshore wind plants and TRGs 6-15 are floating offshore wind plants). Future projections are shown for Constant, Mid, and Low technology cost scenarios.

Recent Trends

Pre-construction annual energy estimates from 93% of global operating wind capacity in 2016 (NREL's internal offshore wind database) is shown in a box-and-whiskers format for comparison with the ATB current estimates and future projections. The historical data illustrate pre-construction estimated capacity factors for projects by year of commercial online date. The range of capacity factors defined by the ATB TRGs compared well with the estimated capacity factors for projects installed in 2015.

Base Year Estimates

The capacity factor is determined using a representative power curve for a generic NREL-modeled offshore wind turbine (Beiter et al. (2016)) and includes geospatial estimates of gross capacity factors for the entire resource area (Musial et al. (2016)). The net capacity factor considers spatial variation in wake losses, electrical losses, turbine availability, and other system losses. For illustration in the ATB, all 7,000 wind plant areas are represented in 15 TRGs.

TRG Definitions for Offshore Wind

| TRG | LCOE Range ($/MWh) | Wind Speed Range (m/s) | Weighted Average Wind Speed (m/s) | Weighted Water Depth (m) | Weighted Distance Site to Cable Landfall (km) | Weighted Average CAPEX ($/kW) | Weighted Average OPEX ($/kW/yr) | Weighted Average Net CF (%) | Potential Wind Plant Capacity (GW) | Potential Wind Plant Energy (TWh) |

|---|---|---|---|---|---|---|---|---|---|---|

| Fixed-Bottom | ||||||||||

| TRG 1 | LCOE <= 141 | 8.5–9.0 | 8.6 | 13 | 6 | 3,800 | 137 | 45% | 12 | 49 |

| TRG 2 | LCOE <= 149 | 8.0–8.5 | 8.4 | 16 | 9 | 3,890 | 143 | 43% | 25 | 94 |

| TRG 3 | LCOE <= 157 | 8.0–8.5 | 8.3 | 19 | 15 | 4,027 | 145 | 42% | 50 | 182 |

| TRG 4 | LCOE <= 192 | 8.0–8.5 | 8.3 | 26 | 36 | 4,556 | 152 | 40% | 320 | 1,131 |

| TRG 5 | LCOE <= 306 | 7.5–8.0 | 7.9 | 36 | 72 | 5,333 | 159 | 37% | 320 | 1,023 |

| Floating | ||||||||||

| TRG 6 | LCOE <= 166 | 9.5–10 | 9.7 | 130 | 24 | 5,961 | 105 | 51% | 12 | 55 |

| TRG 7 | LCOE <= 175 | 9.5–10 | 9.7 | 145 | 40 | 6,217 | 108 | 50% | 25 | 108 |

| TRG 8 | LCOE <= 188 | 9.5–10 | 9.5 | 139 | 50 | 6,337 | 111 | 48% | 50 | 212 |

| TRG 9 | LCOE <= 206 | 9.0–9.5 | 9.4 | 136 | 70 | 6,687 | 122 | 47% | 100 | 414 |

| TRG 10 | LCOE <= 229 | 9.0–9.5 | 9.1 | 140 | 94 | 6,931 | 129 | 45% | 200 | 781 |

| TRG 11 | LCOE <= 252 | 8.5–9.0 | 8.7 | 323 | 118 | 7,211 | 134 | 42% | 200 | 727 |

| TRG 12 | LCOE <= 274 | 8.0–8.5 | 8.1 | 404 | 123 | 7,224 | 135 | 37% | 200 | 651 |

| TRG 13 | LCOE <= 299 | 7.5–8.0 | 7.8 | 474 | 138 | 7,411 | 136 | 35% | 200 | 615 |

| TRG 14 | LCOE <= 341 | 7.0–7.5 | 7.4 | 615 | 130 | 7,606 | 131 | 32% | 200 | 566 |

| TRG 15 | LCOE <= 438 | 7.5–8.0 | 7.5 | 797 | 199 | 8,204 | 138 | 31% | 143 | 390 |

| Total | 2,058 | 6,997 | ||||||||

Future Year Projections

Projections of capacity factors for plants installed in future years were determined based on estimates obtained through an expert survey conducted by Wiser et al. (2016) for both fixed-bottom and floating offshore wind technologies. Projections for capacity factors implicitly reflect technology innovations such as larger rotors and taller towers that will increase energy capture at the same geographic location without explicitly specifying tower height and rotor diameter changes.

A detailed description of the methodology for developing future year projections is found in Projections Methodology.

Technology innovations that could impact future O&M costs are summarized in LCOE Projections.

Standard Scenarios Model Results

ATB CAPEX, O&M, and capacity factor assumptions for the Base Year and future projections through 2050 for Constant, Mid, and Low technology cost scenarios are used to develop the NREL Standard Scenarios using the ReEDS model. See ATB and Standard Scenarios.

The ReEDS model output capacity factors for offshore wind can be lower than input capacity factors due to endogenously estimated curtailments determined by scenario constraints.

Plant Cost and Performance Projections Methodology

ATB projections were derived from the results of a survey of 163 of the world's wind energy experts Wiser et al. (2016). The survey was conducted to gain insight into the possible future cost reductions, the source of those reductions, and the conditions needed to enable continued innovation and lower costs (Wiser et al. (2016)). The expert survey produced three cost reduction scenarios associated with probability levels of 10%, 50%, and 90% of achieving LCOE reductions by 2030 and 2050. In addition, the scenario results include estimated changes to CAPEX, O&M, capacity factor, project life, and weighted average cost of capital (WACC) by 2030.

For the ATB, three different technology cost scenarios were adapted from the expert survey results for scenario modeling as bounding levels:

- Constant Technology Cost Scenario: no change in CAPEX, O&M, or capacity factor from 2015 to 2050; consistent across all renewable energy technologies in the ATB

- Mid Technology Cost Scenario: LCOE percentage reduction from the Base Year equivalent to that corresponding to the Median Scenario (50% probability) in the expert survey (Wiser et al. (2016))

- Low Technology Cost Scenario: LCOE percentage reduction from the Base Year equivalent to that corresponding to the Low scenario (10% probability) in the expert survey (Wiser et al. (2016)).

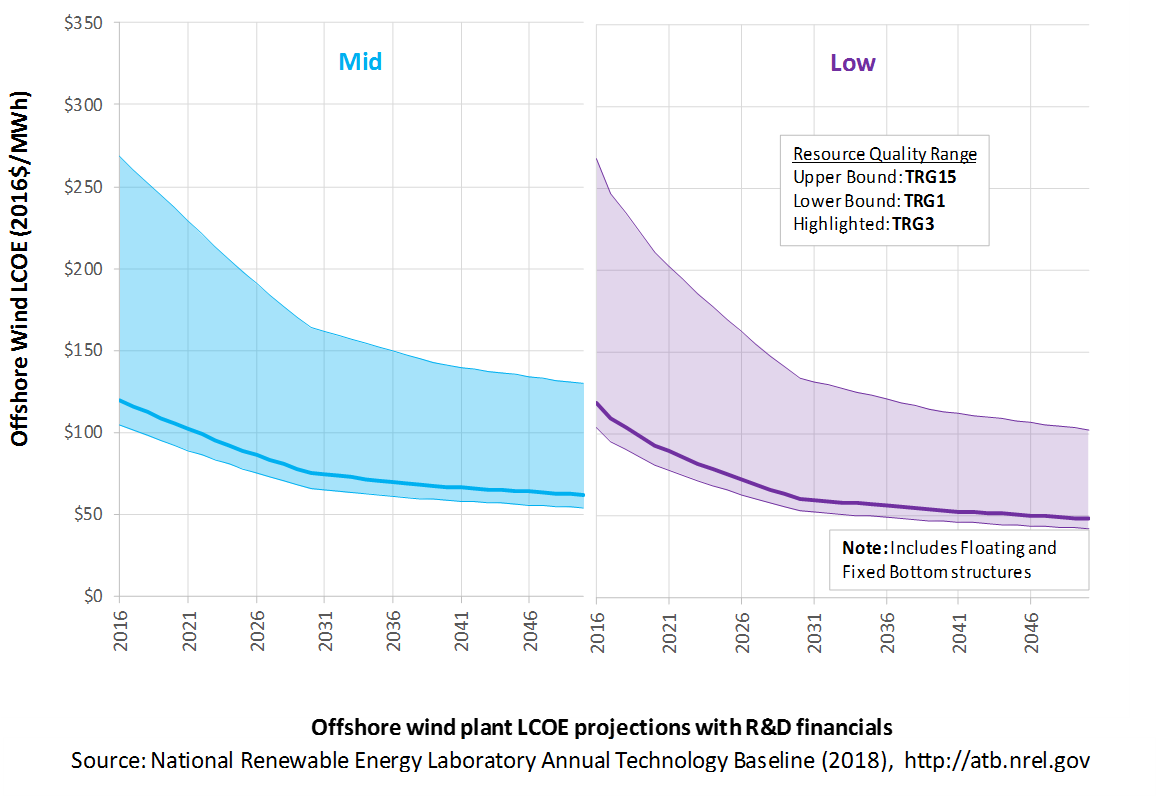

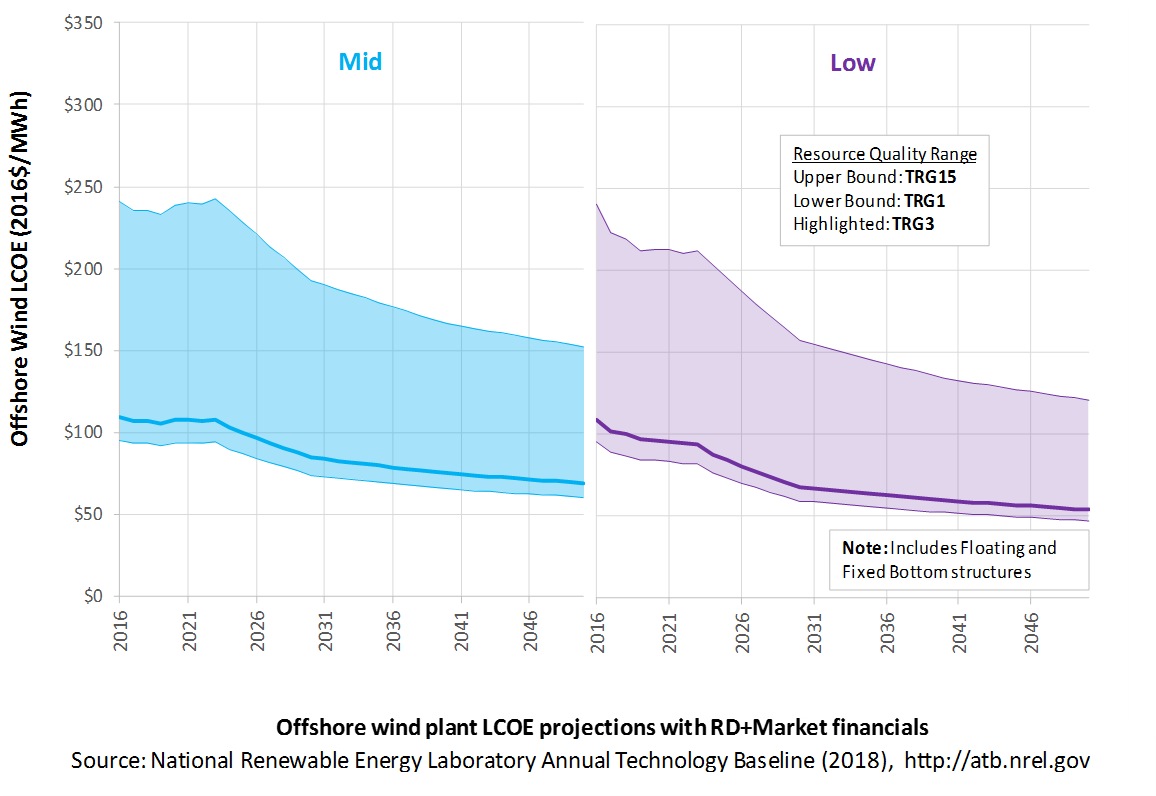

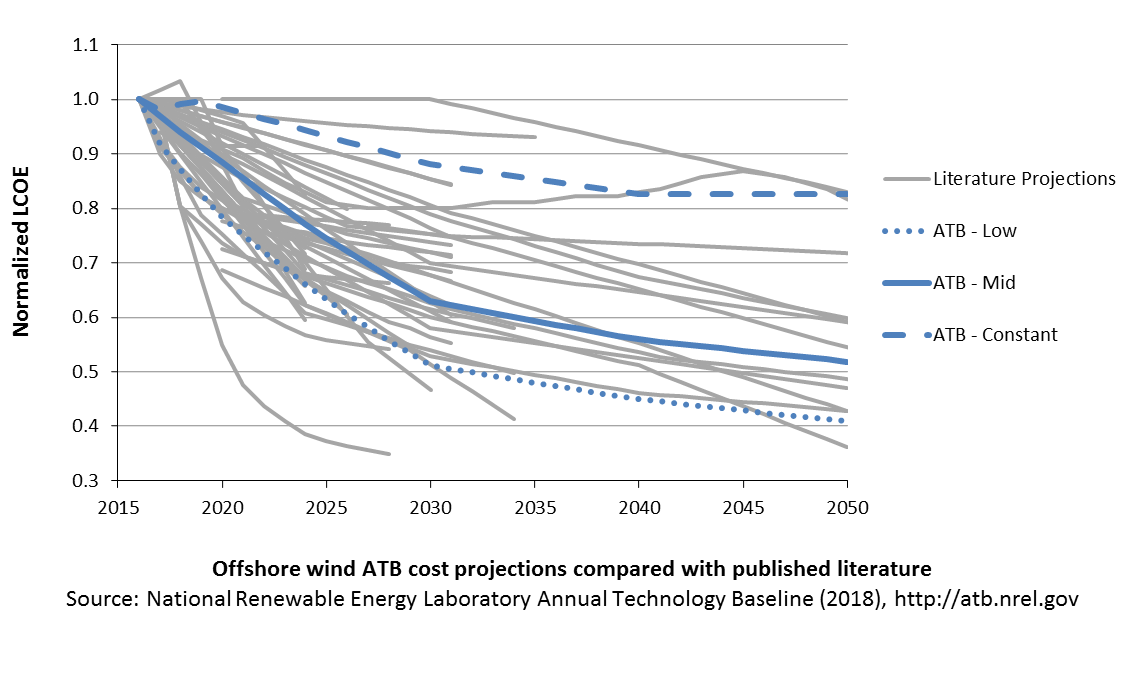

Expert survey estimates were normalized to the ATB Base Year starting point in order to focus on projected cost reduction instead of absolute reported costs. The percentage reduction in LCOE by 2020, 2030, and 2050 from the expert survey's Median and Low scenarios are implemented as the ATB Mid and Low cost scenarios. This is accomplished by utilizing survey estimates for changes to capacity factor and O&M costs by 2030 and 2050. The corresponding CAPEX value to achieve the overall LCOE reduction is computed. The percentage reduction in LCOE by 2030 and by 2050 was applied equally across all TRGs. The overall reduction in LCOE by 2050 for the Mid cost scenario is 39% and for the Low cost scenario is 51%.

A broad sample of cost of offshore wind energy projections provides context for the ATB Constant, Mid, and Low technology cost projections. Based on a TRG4 resource classification,[1] the ATB Mid cost projection, which corresponds to the median scenario from the Wiser et al. (2016) expert survey, results in LCOE reductions that are fairly aligned with the median scenarios of external studies (BNEF (2017c); IRENA (2016b); Catapult (2016); Lazard (2017)). EIA (2017b) estimates higher cost levels in the period 2022-2041, while BNEF (2018) estimates lower cost levels for the U.S by the mid-2020s. These external studies were reviewed to validate the baseline estimates and projections derived for the ATB. Generally, while some published studies as well as recent tender awards for European projects to be installed by the mid-2020s suggest significant near-term cost reduction (see e.g., Musial et al. (2017)), it is likely that the United States will lag due to a different development stage of the U.S. supply chain and port infrastructure.

The relative costs of mid-depth water plants and deep water, or floating, offshore wind plants are maintained constant throughout the scenarios for simplicity. Some hypothesize that unique aspects of floating technologies, such as the ability to assemble and commission turbines at the port, could reduce the cost of floating technologies relative to fixed-bottom technologies.

Levelized Cost of Energy (LCOE) Projections

Levelized cost of energy (LCOE) is a simple metric that combines the primary technology cost and performance parameters: CAPEX, O&M, and capacity factor. It is included in the ATB for illustrative purposes. The ATB focuses on defining the primary cost and performance parameters for use in electric sector modeling or other analysis where more sophisticated comparisons among technologies are made. The LCOE accounts for the energy component of electric system planning and operation. The LCOE uses an annual average capacity factor when spreading costs over the anticipated energy generation. This annual capacity factor ignores specific operating behavior such as ramping, start-up, and shutdown that could be relevant for more detailed evaluations of generator cost and value. Electricity generation technologies have different capabilities to provide such services. For example, wind and PV are primarily energy service providers, while the other electricity generation technologies provide capacity and flexibility services in addition to energy. These capacity and flexibility services are difficult to value and depend strongly on the system in which a new generation plant is introduced. These services are represented in electric sector models such as the ReEDS model and corresponding analysis results such as the Standard Scenarios.

The following three figures illustrate LCOE, which includes the combined impact of CAPEX, O&M, and capacity factor projections for off-shore wind across the range of resources present in the contiguous United States. For the purposes of the ATB, the costs associated with technology and project risk in the U.S. market are represented in the financing costs, not in the upfront capital costs (e.g. developer fees, contingencies). An individual technology may receive more favorable financing terms outside of the U.S., due to less technology and project risk, caused by more project development experience (e.g. offshore wind in Europe), or more government or market guarantees. The R&D Only LCOE sensitivity cases present the range of LCOE based on financial conditions that are held constant over time unless R&D affects them, and they reflect different levels of technology risk. This case excludes effects of tax reform, tax credits, technology-specific tariffs, and changing interest rates over time. The R&D + Market LCOE case adds to these the financial assumptions (1) the changes over time consistent with projections in the Annual Energy Outlook and (2) the effects of tax reform, tax credits, and tariffs. The ATB representative plant characteristics that best align with those of recently installed or anticipated near-term land-based wind plants are associated with TRG 4. Data for all the resource categories can be found in the ATB data spreadsheet.

R&D Only | R&D + Market

The methodology for representing the CAPEX, O&M, and capacity factor assumptions behind each pathway is discussed in Projections Methodology. In general, the degree of adoption of technology innovation distinguishes the Constant, Mid, and Low technology cost scenarios. These projections represent trends that reduce CAPEX and improve performance. Development of these scenarios involves technology-specific application of the following general definitions:

- Constant Technology = Base Year (or near-term estimates of projects under construction) equivalent through 2050 maintains current relative technology cost differences

- Mid Technology Cost Scenario = technology advances through continued industry growth, public and private R&D investments, and market conditions relative to current levels that may be characterized as "likely" or "not surprising"

- Low Technology Cost Scenario = Technology advances that may occur with breakthroughs, increased public and private R&D investments, and/or other market conditions that lead to cost and performance levels that may be characterized as the " limit of surprise" but not necessarily the absolute low bound.

- To estimate LCOE, assumptions about the cost of capital to finance electricity generation projects are required, and the LCOE calculations are sensitive to these financial assumptions. Three project finance structures are used within the ATB:

- R&D Only Financial Assumptions: This sensitivity case allows technology-specific changes to debt interest rates, return on equity rates, and debt fraction to reflect effects of R&D on technological risk perception, but it holds background rates constant at 2016 values from AEO 2018 and excludes effects of tax reform, tax credits, and tariffs.

- R&D Only + Market Financial Assumptions: This sensitivity case retains the technology-specific changes to debt interest, return on equity rates, and debt fraction from the R&D Only case and adds in the variation over time consistent with AEO 2018, as well as effects of tax reform, tax credits, and technology-specific tariffs. For a detailed discussion of these assumptions, see Changes from 2017 ATB to 2018 ATB.

- ReEDS Financial Assumptions: ReEDS uses the R&D Only + Market Financial Assumptions for the "Mid" technology cost scenario.

- A constant cost recovery period -over which the initial capital investment is recovered-is assumed for all technologies throughout this website, and can be varied in the ATB data spreadsheet.

- The equations and variables used to estimate LCOE are defined on the equations and variables page. For illustration of the impact of changing financial structures such as WACC, see Project Finance Impact on LCOE. For LCOE estimates for the Constant, Mid, and Low technology cost scenarios for all technologies, see 2018 ATB Cost and Performance Summary.

- In general, differences among the technology cost cases reflect different levels of adoption of innovations. Reductions in technology costs reflect the cost reduction opportunities that are listed below.

- Continued turbine scaling to larger-megawatt turbines with larger rotors such that swept area/megawatt capacity decreases resulting in higher capacity factors for a given location

- Greater market competition in the production of primary components (e.g., turbines, support structure), and installation services

- Economy-of-scale and productivity improvements in manufacturing, including mass production of substructure component and optimized installation strategies

- Improved plant siting and operation to reduce plant-level energy losses, resulting in higher capacity factors

- More efficient O&M procedures combined with more reliable components to reduce annual average FOM costs

- Adoption of a wide range of innovative control, design, and material concepts that facilitate the high-level trends described above.

References

2H 2017 Offshore Wind Market Outlook. Presentation by Tom Harries, accessed through BNEF subscription services.

Innovation Outlook: Off shore Wind. Abu Dhabi: International Renewable Energy Agency.

Lazard's Levelized Cost of Energy Analysis: Version 11.0. November 2017. New York: Lazard. https://www.lazard.com/perspective/levelized-cost-of-energy-2017.

Levelized Cost and Levelized Avoided Cost of New Generation Resources in the Annual Energy Outlook 2017.

U.S. Offshore Wind. Presentation by Tom Harries, accessed through BNEF subscription services.

Beiter, Philipp, Walter Musial, Aaron Smith, Levi Kilcher, Rick Damiani, Michael Maness, Senu Sirnivas, Tyler Stehly, Vahan Gevorgian, Meghan Mooney, and George Scott. 2016. A Spatial-Economic Cost-Reduction Pathway Analysis for U.S. Offshore Wind Energy Development from 2015-2030. Golden, CO: National Renewable Energy Laboratory. NREL/TP-6A20-66579. September 2016. http://www.nrel.gov/docs/fy16osti/66579.pdf.

Catapult. 2016. Cost Reduction Monitoring Framework. Quantitative Assessment Report. 19 December 2016.

DOE (U.S. Department of Energy). 2015. Wind Vision: A New Era for Wind Power in the United States. U.S. Department of Energy. DOE/GO-102015-4557. March 2015. http://energy.gov/sites/prod/files/2015/03/f20/wv_full_report.pdf.

Dykes, K., M. Hand, T. Stehly, P. Veers, M. Robinson, E. Lantz. 2017. Enabling the SMART Wind Power Plant of the Future Through Science-Based Innovation (Technical Report), NREL/TP-5000-68123. National Renewable Energy Laboratory (NREL). Golden, CO (US). https://www.nrel.gov/docs/fy17osti/68123.pdf.

EIA (U.S. Energy Information Administration). 2013. Updated Capital Cost Estimates for Utility Scale Electricity Generating Plants. Washington, D.C.: U.S. Department of Energy, U.S. Energy Information Administration. https://www.eia.gov/outlooks/capitalcost/pdf/updated_capcost.pdf.

EIA (U.S. Energy Information Administration). 2018. Annual Energy Outlook 2018 with Projections to 2050. Washington, D.C.: U.S. Department of Energy. February 6, 2018. https://www.eia.gov/outlooks/aeo/pdf/AEO2018.pdf.

Lopez, Anthony, Billy Roberts, Donna Heimiller, Nate Blair, and Gian Porro. 2012. U.S. Renewable Energy Technical Potentials: A GIS-Based Analysis. National Renewable Energy Laboratory. NREL/TP-6A20-51946. http://www.nrel.gov/docs/fy12osti/51946.pdf.

Moné, C., A. Smith, M. Hand, and B. Maples. 2015. 2013 Cost of Wind Energy Review. Golden, CO: National Renewable Energy Laboratory. http://www.nrel.gov/docs/fy15osti/63267.pdf.

Moné, Christopher, Maureen Hand, Mark Bolinger, Joseph Rand, Donna Heimiller, and Jonathan Ho. 2017. 2015 Cost of Wind Energy Review. Golden, CO: National Renewable Energy Laboratory. NREL/TP-6A20-66861. http://www.nrel.gov/docs/fy17osti/66861.pdf.

Musial, W., P. Beiter, P. Schwabe, T. Tian, T. Stehly, P. Spitsen. 2017. 2016 Offshore Wind Technologies Market Report. U.S. Department of Energy Office of Energy Efficiency and Renewable Energy. DOE/GO-102017-5031. August 2017. https://www.energy.gov/sites/prod/files/2018/08/f35/2016%20Offshore%20Wind%20Technologies%20Market%20Report.pdf

Musial, Walt, Donna Heimiller, Philipp Beiter, George Scott, and Caroline Draxl. 2016. 2016 Offshore Wind Energy Resource Assessment for the United States. Golden, CO: National Renewable Energy Laboratory. NREL/TP-5000-66599. September 2016. http://www.nrel.gov/docs/fy16osti/66599.pdf.

Schwartz, Marc, Donna Heimiller, Steve Haymes, and Walt Musial. 2010. Assessment of Offshore Wind Energy Resources for the United States. Golden, CO: National Renewable Energy Laboratory. NREL/TP-500-45889. June 2010. http://www.nrel.gov/docs/fy10osti/45889.pdf.

Wiser, Ryan, and Mark Bolinger. 2014. 2014 Wind Technologies Market Report. U.S. Department of Energy. DOE/GO-102015-4702. https://energy.gov/sites/prod/files/2015/08/f25/2014-Wind-Technologies-Market-Report-8.7.pdf.

Wiser, Ryan, and Mark Bolinger. 2017. 2016 Wind Technologies Market Report. https://www.energy.gov/sites/prod/files/2017/10/f37/2016_Wind_Technologies_Market_Report_101317.pdf.

Wiser, Ryan, Karen Jenni, Joachim Seel, Erin Baker, Maureen Hand, Eric Lantz, and Aaron Smith. 2016. Forecasting Wind Energy Costs and Cost Drivers: The Views of the World's Leading Experts. Berkeley, CA: Lawrence Berkeley National Laboratory. LBNL-1005717. June 2016. https://emp.lbl.gov/publications/forecasting-wind-energy-costs-and.